Billing is the first step in getting paid. No matter how good the sale is or how reliable the customer is, payment can proceed only when billing is done correctly. When billing is accurate and clear, payments move forward smoothly. When billing is slow, unclear, or incorrect, the entire payment process slows down.

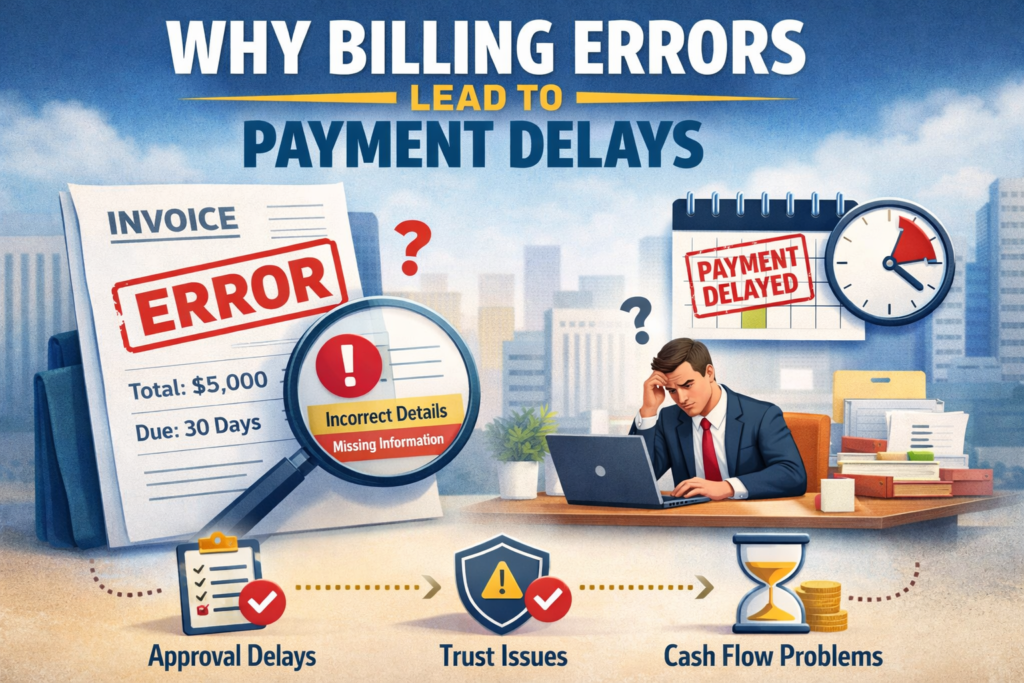

Billing errors are one of the most common reasons payments get delayed. Even small mistakes in an invoice can interrupt approvals, reduce urgency, and force customers to pause payments until issues are clarified. What looks like a minor billing issue often turns into days or weeks of payment delay.

This is why payment delays are often a billing problem before they become a collection problem. By reducing billing errors at the source, businesses can prevent delays, speed up payments, and build stronger trust with customers.

What Billing Errors Really Mean in Business Transactions

Billing errors can greatly disrupt business transactions, causing delays and complicating the payment process. These errors aren’t just limited to miscalculations; they can include incorrect details, missing references, unclear tax information, and inconsistencies between documentation. When an invoice raises questions, it shifts from a simple payable item to a verification task, requiring customers to pause to resolve the discrepancies.

This verification process can significantly prolong payment cycles, impacting cash flow and potentially straining business relationships. Therefore, it is essential for companies to prioritise accuracy and clarity in their invoicing practices. By doing so, they can ensure smoother transactions and foster trust with their clients, ultimately enhancing overall business efficiency.

How Billing Errors Disrupt Customer Payment Workflows

- Billing errors cause invoices to be flagged immediately instead of moving through the normal payment approval flow.

- Once flagged, invoices are put on hold in the customer’s accounting or ERP system until the issue is clarified.

- Corrected invoices usually do not resume at the same stage and often require restarting the entire approval process.

- Restarted approvals may miss scheduled payment cycles, pushing payments to the next cycle or later.

- Internal teams may need to re-verify contracts, purchase orders, or delivery records before approving payment.

- During this period, invoices are prioritised less, as finance teams focus on clean, error-free bills first.

- Even willing customers cannot release payments until all checks are completed.

Why Billing Errors Create Delays Even When Customers Want to Pay

Errors Trigger Caution, Not Rejection

When customers spot a billing error, their first reaction is rarely to refuse payment. Instead, they slow down. Errors introduce doubt, and doubt forces customers to be cautious before approving any payment.

Internal Controls Override Intent

Even if a customer wants to pay, internal finance controls don’t allow payments to move forward when invoices contain inaccuracies. Approval systems are designed to block anything that looks incorrect until it is verified.

Verification Takes Time

Once an error is detected, customers often cross-check invoices against purchase orders, delivery notes, or contracts. This verification process involves multiple teams and naturally extends the payment timeline.

Urgency Disappears

An invoice with errors loses its priority. What was once a routine payment becomes a task to address later, causing payments to slip past due dates without deliberate intent to delay.

The Long-Term Impact of Billing Errors on Payment Timelines

Over time, repeated billing errors change customer behaviour.

- Invoices are reviewed more slowly

- Payments are deprioritised

- Vendors with frequent errors are paid last

Even correct invoices begin to move more slowly because trust has already been weakened. This stretches payment cycles, increases outstanding receivables, and makes cash flow unpredictable.

Billing errors don’t just delay one payment — they condition customers to delay all future payments.

What Error-Free Billing Looks Like in Practice

Invoices Are Clear at First Look

An error-free invoice doesn’t require explanation. Customers can understand the charges, taxes, and terms immediately without needing clarification or follow-up communication.

All Required Details Are Included Upfront

When invoices contain complete references, tax breakups, and payment terms, customers don’t need to pause payments for verification or internal confirmation steps.

Consistency Builds Familiarity

Using the same invoice format and structure every time makes processing faster for customer finance teams and significantly reduces review effort.

Invoices Move Without Interruptions

Accurate and complete invoices flow through approval systems smoothly, without being flagged or put on hold at any stage.

Trust Shortens Payment Timelines

When customers consistently receive error-free invoices, trust increases—and trusted invoices get paid faster with minimal internal resistance.

Conclusion

Billing errors may look small, but their impact on payment timelines is significant. Each mistake slows down approvals, reduces urgency, and creates hesitation on the customer’s side. Over time, these delays become habitual, stretching payment cycles and affecting cash flow predictability. Fixing billing errors is not just about accuracy—it’s about restoring trust, keeping payments moving smoothly, and ensuring money reaches the business when it should.