Many companies assume that cash-flow issues stem from low sales. However, a significant number of profitable businesses face cash flow challenges due to late payments.

The hidden issue often lies in manual billing processes. When manual invoices are sent via paper, Excel spreadsheets, WhatsApp PDFs, or disparate systems, delays occur at multiple stages. Each of these delays postpones payments, tying up cash that the business has already earned. Manual billing doesn’t fail in an obvious way; instead, it silently elongates the time between making a sale and receiving payment.

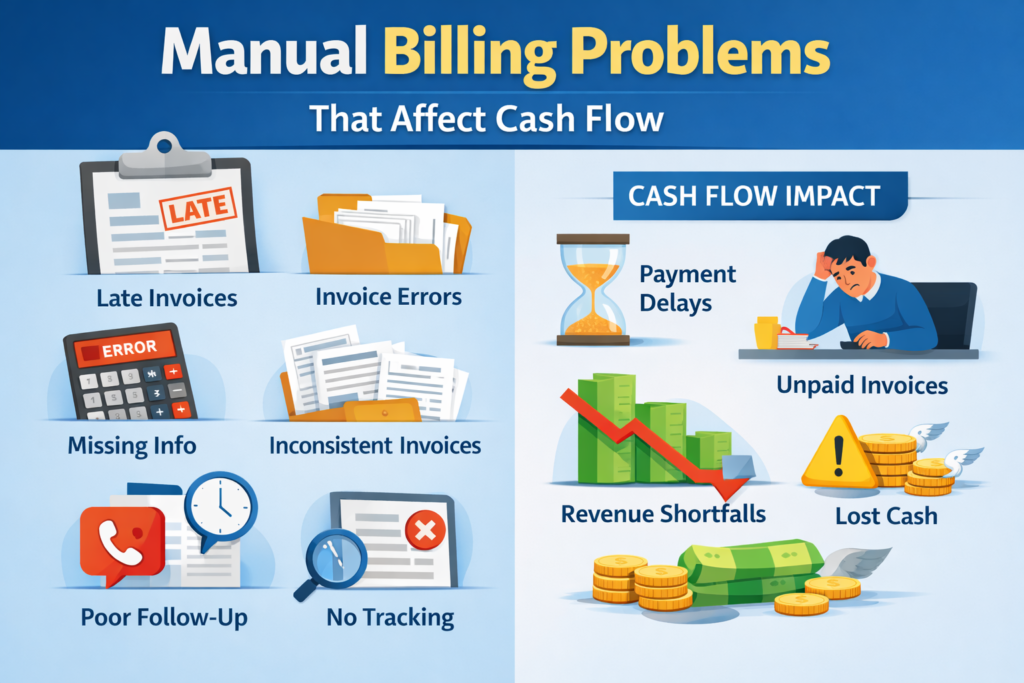

This article explores common problems associated with manual billing and shows how they negatively affect cash flow.

Understanding the Link Between Billing and Cash Flow

Cash flow is fundamentally about timing, not just revenue. The billing process is critical to the invoice-to-cash cycle, which begins with a sale and proceeds through invoice creation, approval, payment, and, finally, cash receipt by the bank. However, manual billing can slow down nearly every step of this cycle.

Even a delay of just one or two days in invoicing can result in weeks of postponed payments. When these delays recur, businesses may face a cash-shortage despite steady sales.

What Counts as Manual Billing Today

Manual billing isn’t limited to handwritten bills. It includes any process in which billing depends heavily on people rather than systems.

Common examples:

- Paper invoices or bill books

- Excel or Google Sheets invoices

- PDFs created manually and sent on WhatsApp

- Separate tools for sales, billing, and accounting

- Manual payment tracking and follow-ups

Even businesses using “software” may still be operating with manual billing if processes aren’t connected or automated.

Core Manual Billing Problems That Hurt Cash Flow

Invoices Are Created and Sent Late

Manual billing slows down invoice creation, often pushing it to the end of the day or week. Since payment timelines typically begin on the invoice date, each delay extends the time it takes for funds to reach the business.

Human Errors in Invoices

Manual invoices are prone to mistakes in pricing, quantities, taxes, or customer details. Even small errors can pause payments, trigger corrections, and restart approval cycles, delaying cash inflow.

Missing or Incomplete Invoice Details

Invoices missing key details such as tax breakdowns, PO references, or payment terms often get stuck in customer approval systems. Until the information is corrected, payments remain on hold.

Lack of Standard Billing Processes

Inconsistent invoice formats and terms confuse customers and slow approvals. When invoices don’t follow a standard structure, they are more likely to be questioned or delayed.

No Structured Payment Follow-ups

Without a system, payment follow-ups rely on memory and ad hoc reminders. Customers delay payments simply because there is no timely or consistent follow-up.

Poor Visibility on Outstanding Receivables

Manual billing makes it difficult to track who owes money and which invoices are overdue. This lack of clarity leads to poor prioritisation and unpredictable cash flow.

Slow Internal and Customer Approvals

Manual handoffs between teams and customers create waiting periods. Invoices often sit unattended, delaying payment even when there is no dispute.

Payment Friction for Customers

When invoices don’t offer clear or easy payment options, customers postpone payment. Inconvenience alone is enough to delay cash inflow.

Disconnected Sales, Billing, and Accounting Data

When sales, billing, and accounts aren’t synced, mismatches occur. These discrepancies lead to disputes and payment delays.

Compliance and Tax Errors

Manual billing increases the risk of tax and compliance mistakes. Fixing these issues drains time and money, indirectly impacting cash flow.

Early Warning Signs of Cash-Flow Leakage

Businesses often notice:

- Rising overdue invoices

- Frequent payment excuses from customers

- Difficulty predicting cash inflows

- Stress around monthly expenses despite good sales

These are not sales problems. They are billing and collection problems.

What an Efficient Billing Process Looks Like

Fast Invoice Creation

Invoices are generated immediately after a sale or delivery, not batched or delayed. Faster invoicing shortens the payment cycle from day one.

Accurate and Complete Invoices

All required details like pricing, taxes, customer information, and references are correct and included upfront, reducing disputes and rework.

Standard Invoice Format

A consistent invoice format structure makes it easier for customers to review, approve, and process payments without confusion.

Clear Receivables Visibility

Outstanding invoices, overdue amounts, and expected inflows are visible at a glance, helping businesses prioritise collections effectively.

Simple and Convenient Payments

Clear payment instructions and convenient payment options reduce friction and encourage on-time payments.

How to Move Away from Manual Billing Without Disruption

Start with Standardisation

Fix one invoice format, mandatory fields, and payment terms to reduce errors, even before changing tools.

Reduce Invoice Turnaround Time

Move toward same-day invoicing to ensure payments aren’t delayed due to late invoice generation.

Bring Structure to Follow-ups

Set a clear reminder and follow-up cadence so collections don’t depend on memory or manual tracking.

Centralise Receivable Tracking

Track all outstanding invoices in one place to improve visibility and focus on high-impact collections.

Gradually Introduce Automation

Automate invoicing, reminders, and reconciliation in a step-by-step approach to reduce manual effort without disrupting operations.

Conclusion

Manual billing is more than a time drain; it extends the invoice-to-cash cycle, delays payments, and strains cash flow. To resolve this issue, businesses don’t necessarily need to boost sales—they need a more efficient, streamlined, and reliable billing process. Improving billing practices leads to an immediate enhancement in cash flow. This is the often-overlooked advantage of transforming manual billing.