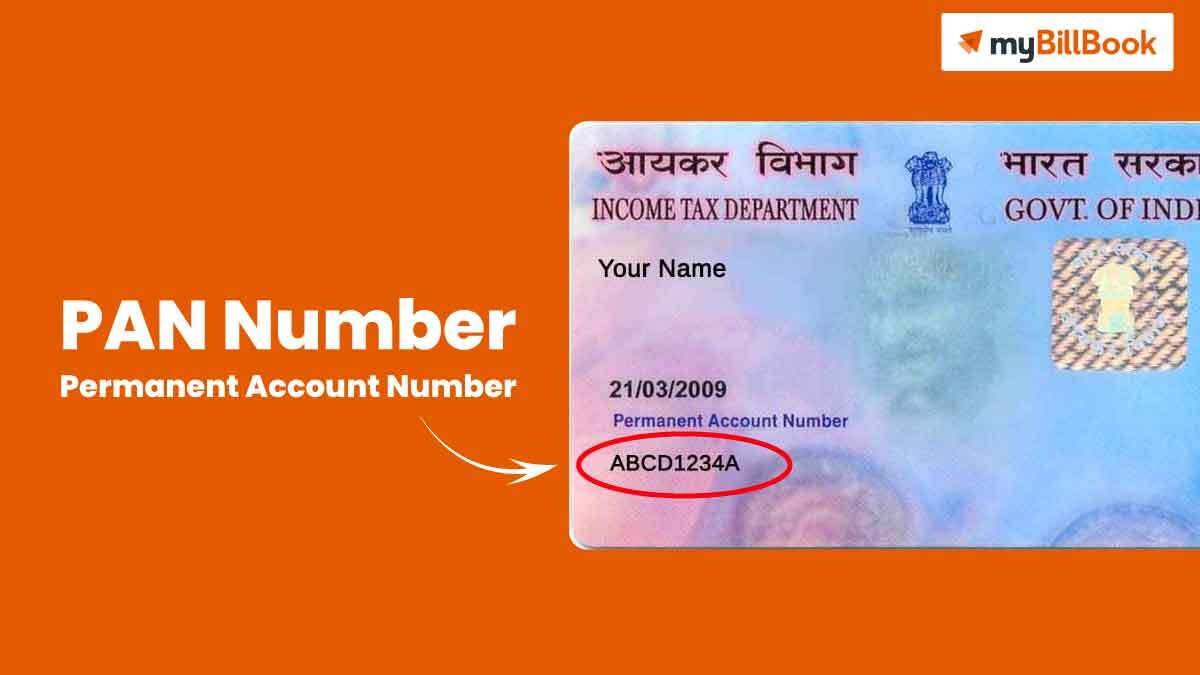

What is PAN Card & PAN Number?

Full-form of PAN : Permanent Account Number

PAN Number is a 10-digit alphanumeric Permanent Account Number provided to all Indian taxpayers. It is issued in the form of a laminated PAN Card. The Indian Income Tax Department issues it under the Indian Income Tax Act, 1961. The Central Board approves the PAN for Direct Taxes (CBDT).

PAN cards are computerised systems that record all of the tax-related data of a person or organisation against that particular PAN number. This information can be recorded against a person’s or corporation’s PAN number. Two taxpaying entities cannot possess the same PAN Card. A PAN card is required for any major financial transaction, such as opening a bank account or purchasing or selling assets. This is why the PAN card offers the account holder’s information uniquely.

What kind of information is on a PAN Card?

Details in PAN card includes

- Name of the cardholder (individual or business)

- Father’s name of the cardholder – Required for individual cardholders

- Date of birth – The date of birth of the cardholder, if an individual, or the date of registration, if a company or firm.

- The Individual’s Signature on the Card — The Personal Identification Number (PAN) card contains the individual’s signature, which is necessary for all financial transactions.

- Individual’s Photo – PAN card serves as a photo ID. There are no photographs on the card in the case of corporations and businesses.

No photos or father’s name will be included on a PAN card issued for business purposes. In addition, the cardholder’s date of birth is changed to reflect the date the company was registered, and the recipient’s name is changed to reflect the name of the company.

Sample of PAN Card

General Uses Of PAN Card

- A PAN card can be used as proof of identity anywhere in the country because it has your name, age, and picture.

- The PAN is the most effective way to trace your tax payments. Otherwise, you may be obliged to pay it many times due to the inability to verify your tax payment.

- Since each PAN is unique, its misuse for tax avoidance or other fraudulent activities is nearly impossible.

- Utility connections, including those for electricity, telephone, liquid petroleum gas (LPG), and the internet, can be secured using a PAN card.

Who needs a PAN number?

According to the Income Tax department, people who get a salary, even if they don’t pay income tax, and business owners whose sales total more than Rs 5 lakh must get a PAN number.

Why do you need a PAN number?

The department of Income Tax has made the Permanent Account Number (PAN) mandatory for all transactions. PAN number is also required to open a bank account, obtain a loan, travel abroad, and engage in stock market operations. Numerous other financial operations, including confirming bank accounts, the receipt of numerous financial credits, the purchase of luxury consumer goods, international travel, the sale of real estate, the trading securities, etc. A PAN card is a widely accepted form of picture identification by public and private sector organisations in India.

What are the PAN Card eligibility requirements?

U/S139A of the Income Tax Act provides a list of eligible organisations for a PAN card under Section 139A.

- Any individual whose annual income exceeds the threshold for tax-exempt income.

- A business owner whose annual revenue exceeds Rs.5 lakh

- Each Hindu Undivided Family (HUF) where the Karta or head of the family is the signatory.

- Any organisation, including single proprietorships, LLPs, AOP/BOIs, etc.

- Any charity group, trust, or organisation.

A PAN card must also be obtained for any minor who may become a future taxpayer. This shows that there are no barriers to applying. Almost all Indian nationals and non-resident Indians must obtain this document.

With so many distinct types of PAN card holders, however, authorities have developed a variety of classifications to classify PAN card types.

What are the different kinds of PAN Cards?

Different types of taxpaying entities have different PAN cards. The 4th character of each PAN can be used to identify this category, which differs for different entities. Here is a brief analysis of the various alphabets and their respective meanings.

G: Government Institution

J: Artificial Juridical People

P: Individual

C: Corporation

A: Association of Persons (AOP)

E: Limited Liability Partnership (LLP)

B: Body of Individuals (BOI)

F: Partnership Business

T: Trust

H: Hindu Undivided Family (HUF)

L: Local Authority

How can I submit my application for a PAN Card?

The following is a detailed overview of the steps involved in submitting an online application for a PAN card.

Step 1: Visit the official UTIITSL or NSDL website.

Step 2: Go to the menu “Apply online” and click it.

Step 3: Select Form 49A or 49AA from “Application Type.” First is for Indian applicants, second for foreigners.

Step 4: Choose your identity type from the list.

Step 5: After completing the remaining required fields, click the “Submit” button after entering the verification code.

Step 6: Click “Continue with PAN Application Form”

Step 7: You will be redirected to your chosen application form. Fill this out with correct information.

Step 8: Upload documents and click “Submit.”

Step 9: Pay for the PAN card processing fees and download the receipt. Then, click “Continue.”

Step 10: After authenticating your Aadhaar number, you’ll receive an OTP.

Step 11: Complete your application by entering the OTP.

After following the steps, you’ll receive a PDF acknowledgement slip. Don’t be worried if it asks for a password to unlock because your birthday is in the DD/MM/YY format.

Documents needed to get a PAN Card:

When filing for this key document, different types of taxpaying organisations have different requirements for the mandatory documents submitted. Use the table below to find the documents you need for your category.

| Taxpaying organisation | Required documentation |

| Individual | Proof of Identity and Address Proof for verification |

| Companies | Company Registrar’s Registration Certificate |

| AOP | Registration Certificate Number / Copy of Agreement Issued by the Charity Authority or Registrar of Co-operative Society |

| LLP | Companies’ registration certificate, partnership deed given by the Registrars of Companies |

| Trusts | The Charity Commissioner’s Registration Certificate Number. |

| HUF | A Karta-issued affidavit listing the details of all coparcener. |

| Foreign candidate’s | ID proof such as OCI, PIO, passport copy, etc., and Address proof. |

A PAN card application can’t be changed once you’ve collected all the necessary paperwork and understand the application process.

However, once the application has been submitted successfully, you may prefer to keep track of the status instead of waiting.

Advantages of PAN Card:

A PAN card is required to ensure that the transactions go through smoothly and legally when selling or purchasing assets worth more than five lakh rupees.

- Both private and government banks need a PAN card to open an account in a bank.

- Phone connection requires a PAN card.

- A PAN card is necessary to apply for a new gas connection.

- Hotels and restaurants require PAN cards for one-time payments of over 25,000 rupees.

- A PAN card is essential to pay more than 25,000 rupees in cash while travelling abroad.

Having a PAN card could prevent fraudulent transactions from being processed. In addition, it eliminates tax avoidance and increases buyer-seller transparency.

Conclusion

Obtaining a PAN card is required if you are a resident of India and make financial contributions to the country’s economy. A PAN card represents a Permanent Account Number. If you want to file your taxes, you’ll need to have this document on hand. Remember that accuracy is vital while filling out and submitting forms for your PAN card. Keep this guide available to avoid making any mistakes.

FAQs on PAN Card:

How is the Aadhaar number linked to the PAN?

Aadhaar can be linked to a PAN number in either of two ways:

1. Using the SMS service

2. Using the features on the e-Filing portal (www.incometax.gov.in/iec/foportal)

Should a married woman share her father's name for PAN?

An applicant's full name should include the father's name; hence, a married woman should provide her father's name and not her husband's.

After obtaining a PAN, does one have an obligation to submit a return of income?

You must file a return of income only if you are required to do so under section 139. After having PAN, income tax returns aren't required.

What is the PAN's validity?

Once received, a PAN is valid for the person's lifetime across India. Hence, it is unaffected by a change in residence or Assessing Officer, etc. Nevertheless, any changes in the PAN database (i.e., details submitted at the time of getting PAN) must be notified to the Tax Authority by completing the "Request for New PAN Card or Correction in PAN Data" form.

What exactly is E-PAN?

E-PAN is a PAN issued in PDF format instead of a physical card. The E-PAN card will be sent to the email address you put on the PAN application form in PDF format. It is the responsibility of the PAN applicant to specify, at the time of application, whether or not a physical PAN Card would be required. If they provide a valid email address, e-PAN cards are issued to the PAN applicant's email address. In such instances, you will not receive a physical PAN Card. The fees associated with an electronic PAN card are distinct from those associated with a physical card.

Read more: