A well-defined billing workflow ensures that every transaction is captured accurately, invoices are generated on time, payments are tracked properly, and records remain compliant and audit-ready. This guide explains what a billing workflow is, why it matters, how it works, and how businesses can streamline it using digital tools.

What Is Billing Workflow?

A billing workflow is the complete process a business uses to manage transactions, from recording sales and creating invoices to collecting payments and keeping financial records. Unlike invoicing, which only involves sending bills, a billing workflow covers the entire process from sale to payment and reporting.

It’s different from accounting, which focuses on financial statements. A clear billing workflow ensures consistency, reduces errors, and gives a complete view of sales and payments. This process is important for many types of businesses, including retail, wholesalers, distributors, and service providers.

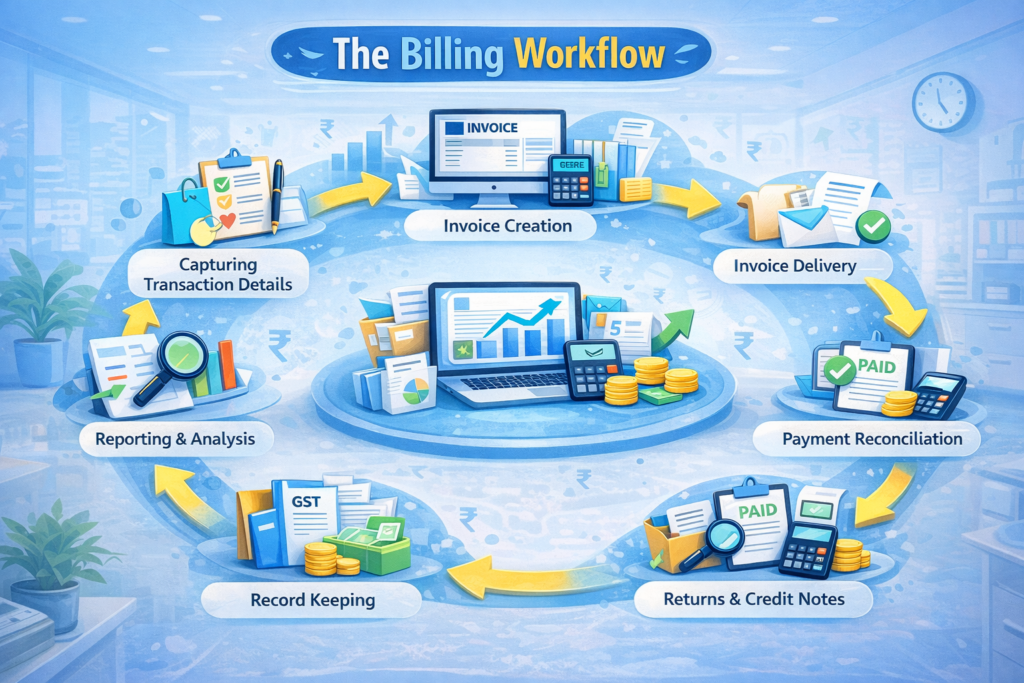

Key Stages of the Billing Workflow

A complete billing workflow typically includes the following stages. Each stage plays a critical role in ensuring accuracy, efficiency, and control.

Capturing TransactionDetails

The billing workflow begins when a sale is made or a service is delivered. This stage involves capturing product or service details, quantities, prices, discounts, and customer information. Errors at this stage often propagate throughout the workflow, making accuracy essential.

Invoice Creation

Once transaction details are captured, an invoice is generated. This may be a tax invoice, a bill of supply, or a proforma invoice, depending on the business and compliance requirements. This stage includes calculating taxes, applying discounts, and formatting the invoice correctly.

Invoice Validation and Internal Checks

In some businesses, invoices undergo internal validation before being sent to customers. This helps catch errors early, especially in high-value or credit transactions. Clear workflows reduce dependency on repeated manual reviews.

Invoice Delivery to Customers

Invoices are then shared with customers—either as printed copies or digital invoices via email or messaging platforms. Timely delivery is critical, as delays directly affect payment timelines.

Payment Collection

This stage involves receiving payments through cash, UPI, cards, bank transfers, or credit arrangements. Clear payment terms and due dates are essential to avoid confusion and delays.

Payment Reconciliation

After payments are received, they must be matched against invoices. This ensures that partial or advance payments, as well as mismatches, are identified early. Without proper reconciliation, outstanding balances become unclear.

Returns, Adjustments, and Credit Notes

Returns, cancellations, and discounts after billing require adjustments. Proper issuance of credit notes and inventory updates ensures accurate financial and tax records.

Record Keeping and Compliance

All billing data is stored in sales registers, tax records, and audit documentation. Clean record-keeping simplifies compliance and reporting.

Reporting and Analysis

The final stage of the billing workflow involves generating reports on sales, payments, outstanding dues, and trends. These insights help businesses make informed decisions and plan growth.

How a Digital Billing Workflow Improves Business Efficiency

Manual billing processes often face challenges with speed, accuracy, and visibility. In contrast, a digital billing workflow enhances efficiency by automating repetitive tasks and consolidating all stages into one system.

Automation minimises errors from manual calculations and duplicate entries, while real-time invoice generation keeps sales data up to date. Business owners gain greater visibility, allowing them to monitor sales, payments, and dues in real time rather than waiting for summaries.

Payment follow-ups become proactive with clear due lists and statuses, reducing the need for reminders. A digital billing workflow also scales easily, efficiently managing growing transaction volumes without disruption.

How the Right Billing Software Streamlines the Entire Billing Workflow

- Automates invoice creation and calculations, ensuring accurate pricing, discounts, and tax application across every transaction without manual intervention.

- Enables real-time billing and invoice sharing, allowing businesses to generate and send invoices instantly at the point of sale or service completion.

- Simplifies GST and tax compliance by automatically applying the correct tax rules and capturing mandatory details, such as HSN and SAC codes.

- Centralises payment tracking and due management, giving businesses real-time visibility into pending, partial, and completed payments.

- Integrates billing with inventory management, automatically updating stock levels with every sale, return, or cancellation.

- Supports multiple payment modes seamlessly, recording cash, UPI, card, and bank transfer payments against individual invoices for easy reconciliation.

- Handles returns, cancellations, and credit notes systematically, ensuring accurate inventory adjustments and compliant tax reporting.

- Provides real-time reports and business insights to help owners track sales trends, collections, and outstanding dues.

- Scales with business growth, offering multi-user access, centralised data, and cloud-based visibility as transaction volumes and locations increase.

Frequently Asked Questions

A billing workflow typically includes capturing transaction details, creating invoices, delivering invoices, collecting payments, reconciling, making adjustments, maintaining records, and reporting.

A structured billing workflow ensures timely invoicing, clear payment tracking, and systematic follow-ups, thereby improving cash flow and reducing outstanding dues.

Yes. Even small businesses benefit from a defined billing workflow, as it reduces errors, improves professionalism, and prepares the business to scale without later system changes.

Billing workflow focuses on transaction-level processes such as invoicing and payments, while accounting focuses on financial statements, compliance, and overall financial reporting.