A thermal printer bill is prepared using thermal printers. These printers can be used for printing receipts, invoices and other official documentation. There are different models, and it is pretty common to find them in offices and business places. However, the need for a thermal printer has increased in the last few years with the surge of internet usage among businesses. There are numerous advantages of using a thermal printer, and therefore businesses all over are using this device which is very useful in saving time and money.

One can connect the thermal printer with a computer using a USB cable or through wireless mediums to print invoices. The quality of the paper for this printer depends on the amount of information that has to be printed. Usually, there is an option to change the paper quality of these printers.

Read this blog to know about the thermal printer bill template, its advantages and the must-haves of a thermal printer bill.

Advantages of a thermal printer invoice

Bundling

The print groupings option can be used to make an entire inventory list. It enables the user to print all the different items together on a sheet rather than record it manually. For example, a set of tyres, brakes, and other spare parts can be printed as bundled items rather than individual items. This feature helps businesses save time & reduce errors.

E-storage of invoices

Instead of generating different invoices for multiple products, business owners can get relief from the bureaucracy of manual journaling with thermal printing. Using this printer, one can generate an e-journal of invoices similar to the paper journal, except in a “cleaner” format. With the elimination of entirely manual journaling, business owners can easily keep a record of invoices and maintain their sales ledger.

Faster transactions

In a world full of options for customers, Business owners should aim to decrease transaction time and wait times for their customers. They can do it by using thermal printers in their self-checkout counter setup. These printers help businesses speed up transactions and decrease manual labour costs, making the business perform more efficiently.

A thermal printer is a great tool to process professional invoice formats because it can print at a speed of 20 mm/second. This is nearly seven times the speed of standard receipt printers. Also, these printers do not require ink or ribbons.

Low maintenance

Another fascinating aspect of thermal printing is its low maintenance costs as compared to other printers. Traditional thermal printers come in a variety of degrees of integration, and it is directly proportional to the overall service life. These degrees are generally broken down into three broad categories, each more integrated than the next. The more integrated, the longer the expected service life. The less integrated, the shorter the expected service life.

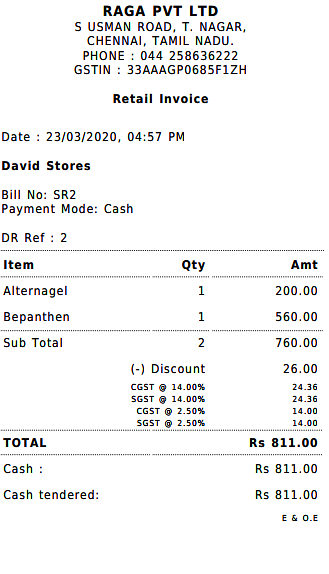

Thermal printer bill’s format

Key elements in a thermal printer bill/invoice

1) The name, address, and contact details of the seller or the company issuing the invoice should be mentioned

2)The customer name, mobile number, etc.

3)The date and time of the transaction for tax-related purposes

4)The invoice should contain the details of the goods or services sold. In the case of goods, it should mention the name of the product, the number of products sold and the GST numbers of the products sold.

5)A clear price distribution should be mentioned. It should have a list price, the tax levied, and discount, if any

6) The source of payment should be mentioned (cash, debit card, credit card, UPI, and more)