Blogs

Featured

Delivery Challan

All About Delivery Challan

Businesses with multiple outlets or operations at different locations might be well aware of a delivery challan. However, issuing a delivery challan might be confusing for those who are just starting out i...

Featured

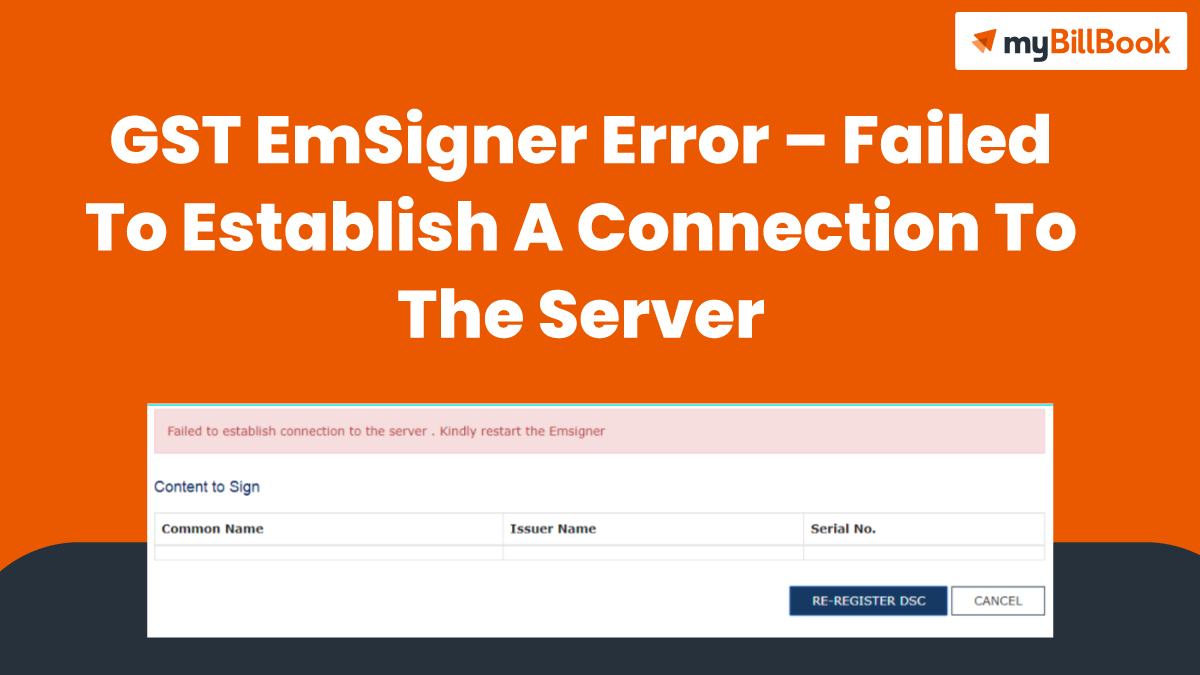

GST EmSigner Error – https://127.0.0.1:1585 – Failed to establish a connection to the server

“Failed to establish a connection to the server. Kindly restart the EmSigner.” You must have encountered this error on the GST portal while filing your GST return or during DSC registration. It is called an emSigner error. Gov...

Billing

How to Print Your Company Logo on Thermal Bills

Ready to add your business logo to your thermal bills? Well, myBillBook has come up with this exciting feature, which allows you to print your company logo on thermal bills,...

Thermal Printer Bill Template

A thermal printer bill is prepared using thermal printers. These printers can be used for printing receipts, invoices and other official documentation. There are different models, ...

Difference between a debit note and a credit note

What are the Difference between a Debit Note and Credit Note BASISDEBIT NOTECREDIT NOTEDefinitionA Debit Note is a detailed document that indicates a debit to the other party’...

GST

Streamlining GST Compliance for SMEs with Digital Tools

Small and medium enterprises (SMEs) contribute to more than 45% of manufacturing output in India. Besides, more than 40% of the total workforce in India is employed in this sector....

e Way Bill Guide 2025: Rules, Process, Validity, and Updates

An e Way Bill is a document essential for transporting goods worth more than ₹50,000 in India under the Goods and Services Tax (GST) framework. Introduced to streamline logistics a...

Eway Bill For Job Work

The coming of e-way bills has standardised compliance documents while transporting goods across states. However, issuing e-way bills during transport is not just limited to a trans...

Accounting

Intangible Assets

What Are Intangible Assets?

Intangible assets refer to non-physical assets that provide long-term value to a business. These assets can include intellectual property, brand recogni...

Capital Expenditure

What is Capital Expenditure?

Capital Expenditure (CapEx) refers to funds used by a company to acquire, upgrade, and maintain physical assets such as property, equipment, or technol...

Bookkeeping

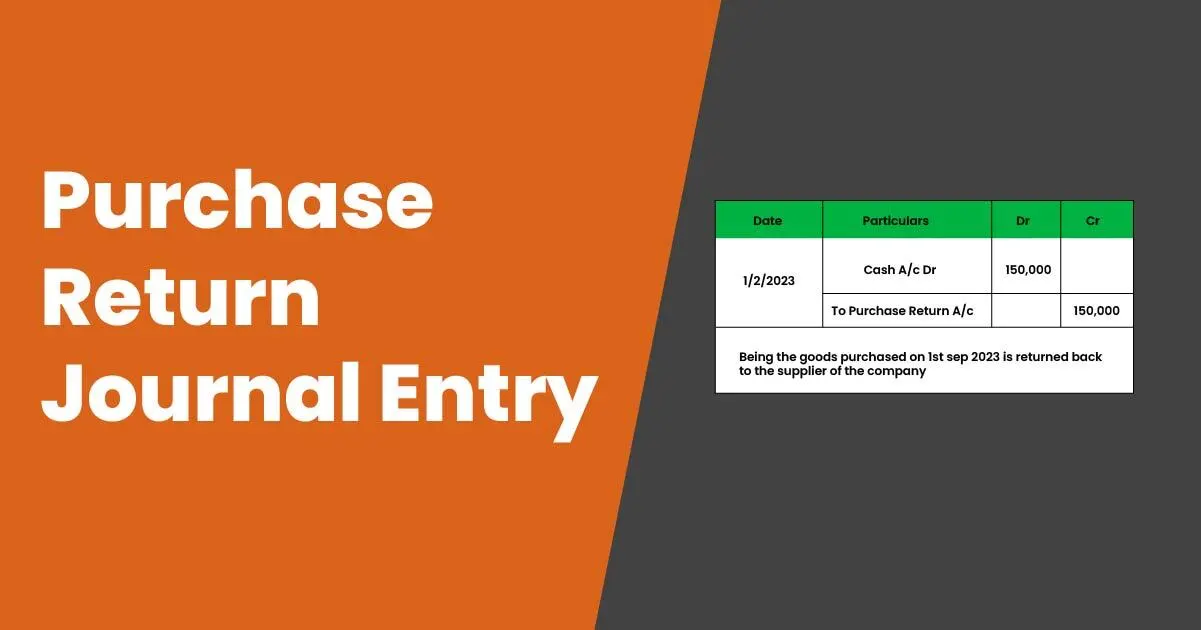

Purchase Return Journal Entry

When a company purchases goods or services, there may come a time when they need to return them due to various reasons such as damage, wrong item delivered, or overstocking. This p...

Bills Payable in Balance Sheet

Bills payable are short-term debts that a company owes to creditors. A company’s balance sheet is a financial statement that provides a snapshot of a company’s financia...

How to Calculate Accounts Receivable Turnover Ratio

Debtors Turnover Ratio Formula No business can afford to conduct all transactions in cash; thus, making credit available to clients is a requirement. But collecting book debts quic...

Banking

Credit Limit

What is Credit Limit? The credit limit of a credit card refers to the maximum amount of credit a bank or other lender will extend to a customer. The credit limit varies depending o...

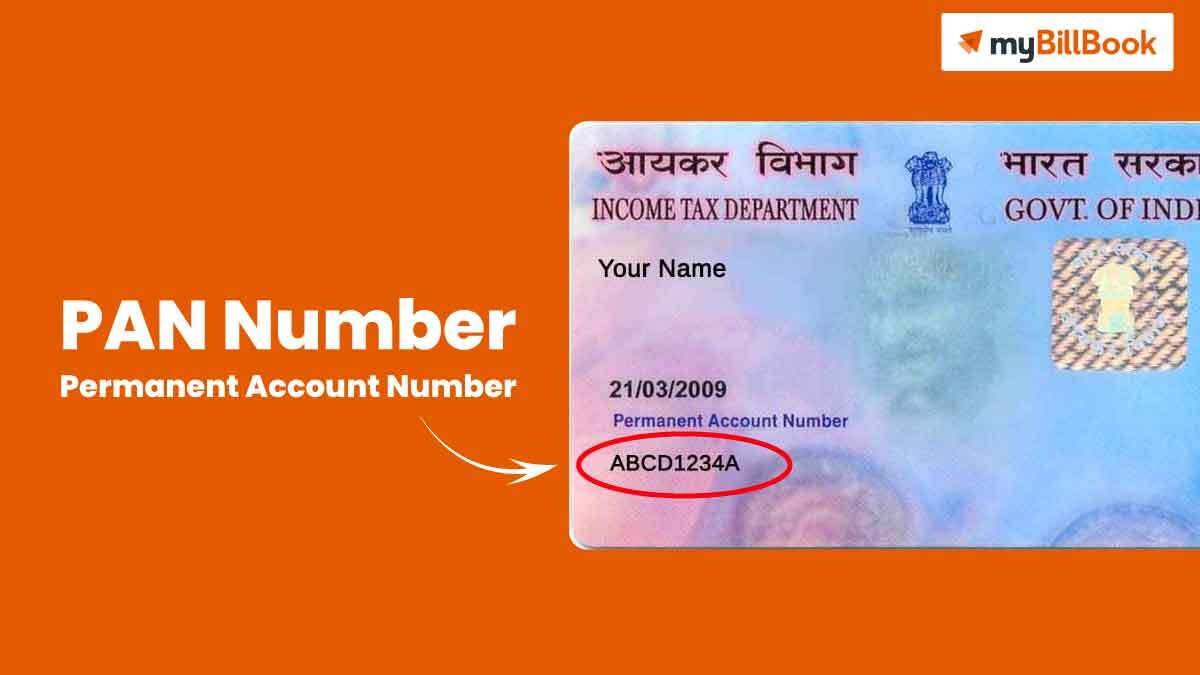

PAN Number – Permanent Account Number

What is PAN Card & PAN Number? Full-form of PAN : Permanent Account NumberPAN Number is a 10-digit alphanumeric Permanent Account Number provided to all Indian taxpayers. It is...

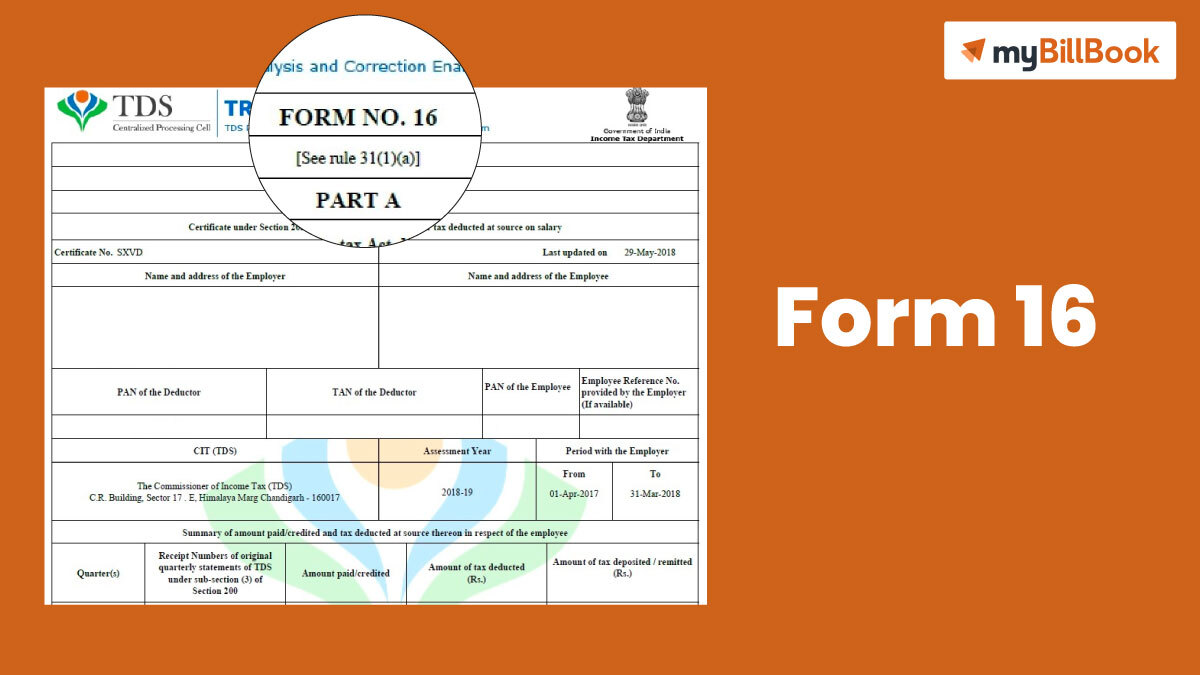

Tax

QRMP Scheme

The Indian government has introduced the QRMP plan to make it easier for small business taxpayers to file taxes. What is the QRMP scheme? The Quarterly Reports Monthly Paymen...

Different Types of ITNS Challan

In earlier times, tax-paying used to be a manual job. An individual or a company had to pay their taxes at their respective banks, and then the Income Tax Department would collect ...

Business Ideas

All You Need to Know About Drug License in India

Every individual has the right to access medicines and drugs for their physical and mental well-being. The store that manages the distribution and sale of these drugs is called a d...

FMCG Products Distributorship Opportunities in India

Consumer products that are sold quickly at a relatively lesser price are categorised as fast-moving consumer goods which in short is known as FMCGs. If managed properly, FMCG prese...

How to Use POS Systems in Retail Business

Upgrading a cash register to a point-of-sale (POS) system is likely to be a difficult task. However, due to the POS system’s increased operational efficiency, you may anticip...

Finance

Tax Incentives Under the Startup India Action Plan

“Are you a small business owner in India looking for ways to reduce your tax burden and invest in your company’s growth? Have you heard about the tax incentives provide...

Profit Maximization vs Wealth Maximization

Profit maximisation and wealth maximisation are two different approaches to business. The main focus for any business is profit maximisation, but many people need to realise that w...

Financial Reporting

Financial reporting gives you an insight into the financial performance of a business during a certain period. Tracking business metrics allows you to stay up-to-date with your bus...

Inventory

Building a Barcode Inventory System for Your Business

For a layperson, a barcode may be just a set of black lines on a white surface. But in reality, entire inventory systems run on the barcode system. It is one of the oldest and most...

Inventory Management Formulas for a Successful Business

Inventory management is a complete task in its own right. From keeping track of the stock to ordering and purchasing new items, it is necessary to follow a routine to maintain the ...

Inventory Turnover Ratio

What is Inventory Turnover? It is the rate at which a company orders and replaces its stock depleted by sales. It includes all the items in a company’s stock that will be sold. It ...

Loan

Udyogini Scheme

What is Udyogini Scheme? The Women Development Corporation’s Udyogini Scheme provides subsidised loans to budding women entrepreneurs from rural and impoverished areas. Udyog...

Mahila Samridhi Yojana and How to Apply

What is Mahila Samridhi Yojana The Indian government introduced the Mahila Samridhi Yojana (MSY) as a programme to give women working in the unorganised sector financial and social...

SME Loan Guide: Definition, Features, and Benefits

What is an SME Loan? An SME loan is specifically designed for small and medium-sized enterprises (SMEs). These loans help businesses expand, invest in new equipment or machinery, o...