All About Delivery Challan

Businesses with multiple outlets or operations at different locations might be well aware of a delivery challan. However, issuing a delivery challan might be confusing for those who are just starting out in a business.

A delivery challan is issued when goods are transported from one place to another but not necessarily because of a sale. Goods are being delivered, but no purchase has been made! Little confusing, right? Let’s dig deeper to understand what a delivery challan is, when a delivery challan is issued, which businesses need to issue a delivery challan and other such information in detail.

What is a Delivery Challan?| Delivery Challan Meaning & Requirements Under GST

A delivery challan is a document created for transporting goods from one place to another, which may or may not result in sales. Hence, no GST applies to such supply.

If a factory sends goods from one warehouse to another, it issues a delivery challan. If a bakery sends raw material from the head branch to its sub-branch, it creates a delivery challan. A delivery challan typically helps track and verify the goods of a shipment.

A delivery challan is also called a dispatch challan or a delivery slip. It is sent along with the goods shipped for delivery and contains the details of the goods being transported.

Three copies of the delivery challan must be created and should be marked as follows:

| Copies of Delivery Challan | Used By |

| Original – ORIGINAL FOR CONSIGNEE | Buyer |

| Duplicate – DUPLICATE FOR TRANSPORTER | Transporter |

| Triplicate – TRIPLICATE FOR CONSIGNER | Seller |

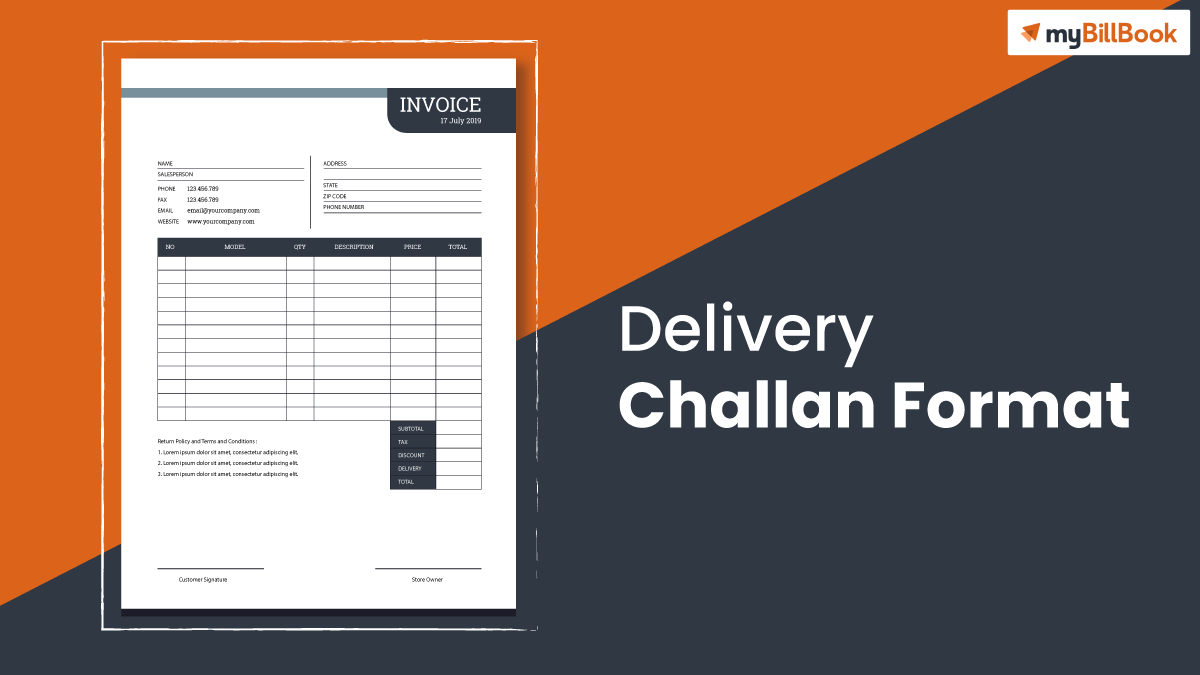

Sample Delivery Challan Format

Mandatory Components of a Delivery Challan

The GST regime mandates that the delivery challan must contain the following details.

- Serial number in one or multiple series – Not exceeding 16 characters

- Date and challan number

- The name, address, and the GSTIN of the consignor

- The name, address, GSTIN, or UIN of the registered consignee. If the consignee is unregistered, you should mention the place of supply instead of the GSTIN or UIN

- HSN code of the goods being transported

- Description of the goods

- The exact or provisional quantity of goods being transported

- The taxable amount of the supply

- The applicable GST rate, broken down into IGST, CGST, SGST, and cess

- The place of supply of the goods if the transportation is being done between two states

- Signature of the supplier or designated authority of the supplier

When to Issue a Delivery Challan as per CGST act?

Section 55(1) of the CGST Rules specifies when suppliers can issue a delivery challan instead of an invoice.

- During the supply of liquid gas, when the quantity of the gas is unknown

- When goods are transported for job work.

- If the principal is sending goods to a job worker

- If one job worker is transporting goods to another job worker

- If the job worker is sending goods back to the principal

- When the goods are being transported before they are supplied. For example, moving goods from the factory to the warehouse or from one warehouse to another.

Occasionally, issuing this challan in an acceptable format is needed for transporting goods. Such cases are as follows –

- When transporting goods on an approval basis

If you are transporting the goods (inter or intra-state) on a sale or return basis, and then they are removed before the supply happens, you would need a challan.

- When transporting “art” to galleries

If works of art are transported to galleries for exhibition, such transport can be done with these challans.

- Transporting goods abroad for promotion or exhibition

As per the CBIC Circular No. 108/27/2019-GST issued on 18th July 2019, if goods are sent outside India for exhibition or promotional activities, such transportation cannot be treated as ‘supply’ or ‘export’. Thus, such transportation should be done under this challan.

- Transporting goods in multiple shipments

If goods are transported using different modes of shipment in a partial or full non-assembled state, the supplier must issue a tax invoice when transporting the first consignment. Then, a challan should be issued for every subsequent consignment, for which you should provide the invoice reference.

- When issuing tax invoice is not possible when removing the goods

As per Rule 55(4) of CGST and SGST Rules, 2017, if the goods being transported are meant for sale or supply. Still, it is impossible to issue the tax invoice, and the supplier can issue a delivery challan and transport the goods. The tax invoice would then be issued after the delivery of the goods.

- When an e-way bill is not needed

According to Rule 55A of the CGST Rules with effect from 23rd January 2018, if the e-way bill is not needed and when the tax invoice or Bill of Supply is not needed, the goods should be transported using delivery challan.

Businesses that Issue Delivery Challan

- Businesses that are involved in the trading of goods, i.e. trading businesses

- Businesses with multiple warehouses where goods are usually transported between different warehouses or godowns

- Suppliers of goods

- Wholesalers of goods

- Manufacturers of goods

Difference Between Delivery Challan & Invoice

A GST invoice is issued when the supply of goods or services is made or when the supplier has received payment.

In contrast, a delivery challan is given for the transportation of goods.

A delivery challan may or may not include the value of goods, but it never states the tax charged on the goods. But an invoice always shows the taxes charged on goods sold. Reflecting on what invoicing truly means can help in understanding this difference.

Sometimes, both delivery challan and invoice are merged and called “Tax invoice cum delivery challan”

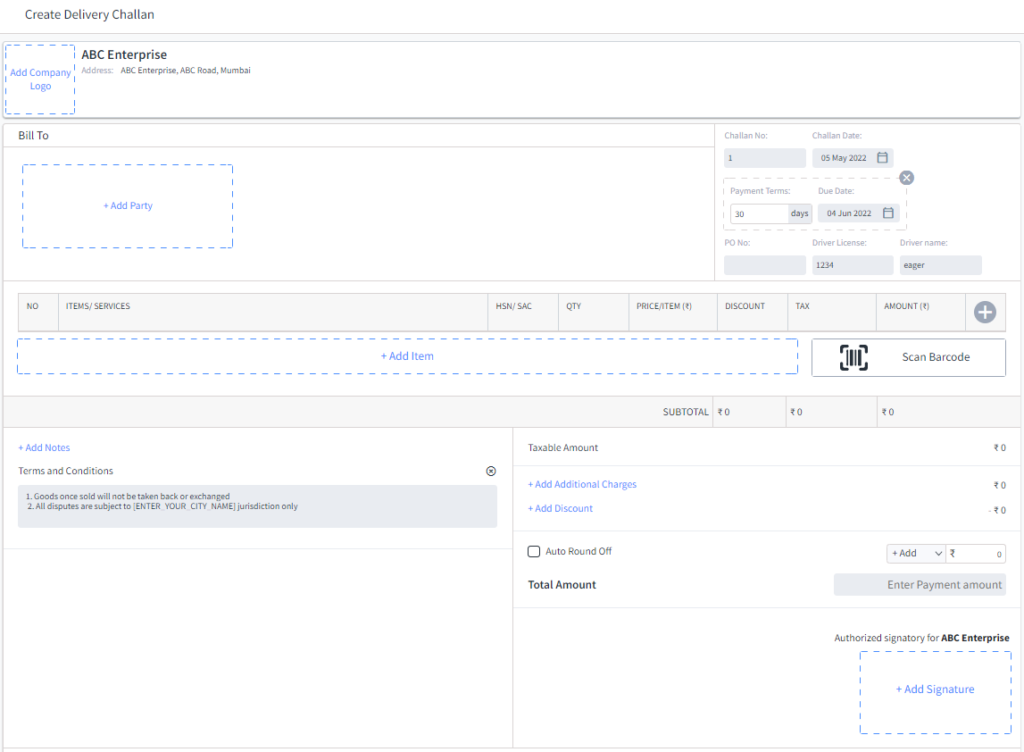

How to Create Delivery Challan Using myBillBook

myBillBook is a billing and accounting software that helps businesses generate various kinds of invoice formats, including delivery challan. Using software to generate delivery challan makes your job easy as all the mandatory fields are already present in the template, and all you need to do is enter the required details. myBillBook stores all the generated delivery challans securely, making it easy for future reference. Here is a step-by-step guide to generating delivery challan using myBillBook billing software.

- Login to myBillBook mobile or desktop application.

- From the left side navigation menu, find the ‘Create Sales Invoice’ button

- Click on the drop-down next to it to find the ‘Delivery Challan’ option

- Click on ‘Delivery Challan’ to find the ‘Create Delivery Challan’ page on the right

- Start by adding the consignee or recipient’s information by clicking on ‘Add Party’ option

- You can add the recipient’s name, contact number, address, shipping details, etc., in this field

- Add a unique number in the ‘Challan Number’ field

- Add date under ‘Challan Date’

- Add ‘Vehicle number’

- Under the ‘Add Item’ column, you can include the details of the goods that are being shipped and their total value.

- Add signature in the ‘Authorised Signatory’ field.

Double-check all the details before clicking on the ‘Save’ option at the top. Once it is saved, you can share it through Whatsapp or SMS, download it and take a printout.

FAQs on Delivery Challan

Why is a delivery challan required?

A delivery challan is a mandatory document under GST for the movement of goods, such as during job work, sales returns, or stock transfers. It helps track the transportation of goods and prevents tax evasion.

What is the rule 45 challan in GST?

Rule 45 challan in GST is about moving goods for job work. Under this rule, the manufacturer must issue a delivery challan while sending goods to a job worker and make a record of all such transfers.

Who signs the delivery challan?

The delivery challan must be signed by the person/entity sending the goods. This signature validates the document and confirms the details of the goods being transported.

How many types of delivery challan are there?

There are generally three main types of delivery challans:

- Job Work Challan: Used when goods are sent to a job worker for processing or manufacturing.

- Sales Return Challan: Issued when goods are returned by the buyer to the seller.

- Stock Transfer Challan: Used for transferring goods between different branches or locations of the same organisation.

Is an e-way bill required for a delivery challan?

Yes, an e-way bill is required for a delivery challan if the value of the goods exceeds Rs.50,000.

Is an e-invoice required for a delivery challan?

No, an e-invoice is not required for a delivery challan.

Is GST applicable on delivery challan?

No, GST is not directly applicable to a delivery challan itself.

What is the rule for issuing a delivery challan?

As per Rule 55 (2) of CGST Rules, a delivery challan must be issued in triplicate. The original one is meant for the consignee (recipient of goods), the duplicate copy is for the transporter of goods, and the triplicate copy is meant for the consignor (supplier of goods).

Does the delivery challan format contain the details of the mode of transport?

Yes, the challan should have the mode of transportation being used to transport the goods.

Can I use a delivery challan if I transport the goods from a warehouse in one state to another warehouse in another state?

Yes, a delivery challan can be used for the inter-state movement of goods from one warehouse to another. Therefore, you should ensure that the format contains the details of the warehouses too.

What is the delivery challan for job work in GST?

A delivery challan issued for the following is termed as delivery challan for job work in GST

- Sending goods by the principal to a job worker

- One job worker to another job worker

- Return of goods after job work to the principal.

Can we generate an e-way bill for the delivery challan?

Yes, you can generate an e-way bill for a delivery challan if the value of the goods being transported exceeds Rs. 50,000.