What Is HSN Code?

The HSN code full form is “Harmonised System of Nomenclature.” The World Customs Organisation (WCO) created the HS Code, also known as the HSN Code in India, as a standardised system for categorising products globally. This code classifies more than 5000 products in India, uses 4, 6, and 8-digit uniform codes recognised worldwide.

How does the HSN code work?

About 5,000 commodity groups on HSN are organised logically and legally, with each group having a six-digit identifier for identification. To achieve uniform classification, it is backed by precise rules.

Structure of HSN Code

Here’s how the HSN Code is organised:

The 99 chapters that makeup HSN Codes are divided into 21 divisions, each identifying a specific product category.

The HSN Code’s Division is as follows:

Headings, subheadings, and tariff items further split the chapters. The first two digits of an HSN Code’s eight-digit structure determine the Chapter, followed by headings at the four-digit level, subheadings at the six-digit level, and tariff items at the eight-digit level.

Example of HSN Code

Nearly all products in India are categorised using the HSN system. A business must choose a 4, 6, or 8 number identifier for their product based on their turnover and type of transactions.

Let’s understand this with an example:

Situation 1:

Mr X, a domestic trader who sells cement, must determine the HSN code to increase his tax invoices.

His total yearly revenue is INR 4.5 cr.

Mr X needs the four-digit HSN Code for his goods because business turnover is less than Rs. 5 cr.

His investigation leads him to conclude that the HSN Code 2521 – Cement, including cement clinkers, whether or not coloured – is the most relevant HSN Code for his product, and he uses it accordingly in his invoices and GST reports.

Situation 2:

Likewise, Mr X exports cement to the US.

He must record the correct HSN Code when filing his customs paperwork and creating his invoices.

Since this transaction now involves the export of commodities, Mr X must disclose the 8-digit code for his product.

He finds that HSN Code 25233000 is the appropriate 8-digit code for aluminous cement, so he starts putting up his export paperwork.

For more on basic invoicing, check what is invoicing.

Difference between HSN Code and SAC Code

The Harmonised System of Nomenclature (HSN) code categorises items for GST purposes.

The World Customs Organisation(WCO) has released the codes used to categorise products into different parts, chapters, headings, and subheadings of a similar sort.

On the other hand, The Central Board of Excise and Customs(CBEC has released the SAC codes. Services are classified using the Services Accounting Code (SAC Code) for GST purposes. Each service has been given a distinct SAC, so they are utilised to categorise all services.

It greatly streamlines and systematises the GST return filing process in both situations.

HSN in GST

HSN Codes were previously only applicable to Central Excise and Customs; however, since the introduction of GST, businesses are now required to include HSN Codes in their tax invoices and declare them in their GST filings.

Here are the details of HSN codes that must be announced by March 31, 2021:

-

- If the transaction charges are up to 1.5 cr, the of digits of the HSN code is 0

- If the transaction charge is between 1.5 cr to 5 cr, the of digits stands to 2

- If the transaction charges are above 4 cr, no digits stand to 4.

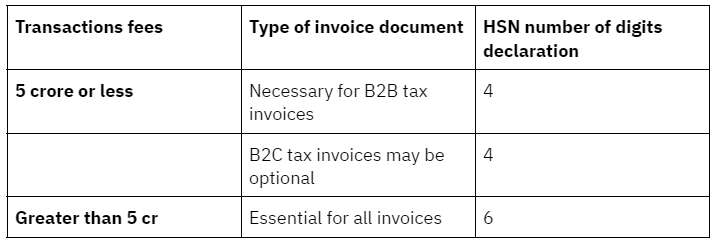

HSN Code for Goods and Services Notification

Below are the GST HSN codes that will be announced beginning on April 1, 2021:

Important point to remember:

-

- For reporting invoices in FY 2021–22, the prior financial year’s annual aggregate turnover, or FY 2020–21, must be used.

-

- Every tax invoice that the taxpayer issues under GST must include these HSN codes.

- In order to export or import goods under the GST, the entire 8-digit HSN code must be provided.

HSN – wise summary of outward supplies

| Sections | Details of HSN code list for |

|---|---|

| Section 1 | Animal Livestock, Animal Products |

| Section 2 | Vegetable-Based Items |

| Section 3 | Animal or vegetable waxes, animal or vegetable fats and oils, and their cleavage products |

| Section 4 | Prepared foods, beverages, beverages, spirits, and vinegar, as well as tobacco and artificial tobacco substitutes |

| Section 5 | Mineral-based products |

| Section 6 | A chemical or associated industry product |

| Section 7 | Rubber and related products, as well as plastics |

| Section 8 | Raw hides and skins, leather, furskins, and their products, saddlery, harness, travel items, handbags, and similar items, and animal gut products ( other than silk-worm gut ) |

| Section 9 | Wood and wood-based products, charred wood, Manufacturers of cork and cork-related products, straw, esparto, and other plaiting materials, Wicker and basketwork |

| Section 10 | Wood or other fibrous cellulosic material pulp, recycled paper or paperboard, as well as paper and paperboard products and publications |

| Section 11 | Textiles and textile-related items |

| Section 12 | Footwear, hats, sun umbrellas, and umbrellas Walking sticks, seat sticks, whips, riding crops, and their component pieces, prepared feathers and items created with them, plastic flowers, human hair products |

| Section 13 | Stone, plaster, cement, asbestos, mica, or similar material articles, ceramic goods, glass, and glassware |

| Section 14 | Natural or cultivated pearls, stones, precious metals, and semi-precious stones. Objects made of metal plated with precious metal replica jewellery, Coins |

| Section 15 | Base Metals and Base Metal-related items |

| Section 16 | Mechanical and electrical equipment, sound recorders and reproducers, television image and sound recorders and reproducers, as well as their parts and accessories |

| Section 17 | Automobiles, aircraft, ships, and related transportation equipment |

| Section 18 | Precision, measuring, checking, medical or surgical equipment, clocks and watches, musical instruments, parts and accessories thereto, optical, photographic, cinematographic, measuring, checking, and other devices. |

| Section 19 | Weapons, ammunition, and related components and equipment. |

| Section 20 | Miscellaneous Products of Manufacturing |

| Section 21 | Objects of art, collectibles, and antiquities |

List of Popular HSN Codes

FAQs on HSN Code

How do I locate my product in the HSN catalogue and its HSN code?

Go to the ministry’s website and open the list for GST Rates for Goods and GST Rates for Services to find the HSN codes for the corresponding goods or services.

What types of companies are exempt from using HSN codes for marketing their products?

Businesses with annual revenue of less than Rs. 1.50 crores in the previous fiscal year are exempt from using the HSN Code in invoices provided for the supply of products undertaken by them.

How many codes do companies have on their invoices?

Businesses with annual sales of more than Rs. 5 Crores in the previous fiscal year must use four-digit HSN Codes for the goods they sell.

Furthermore, dealers with an annual turnover of more than Rs. 1.50 crores but less than Rs. 5 crores must use 2 digit HSN codes in their invoices for products supplied by them.

Finally, companies with annual revenue of less than Rs. 1.50 crores are exempt from using the HSN Code in their invoices for goods sold.

Businesses that import or export products, on the other hand, are expected to have the entire 8-digit HSN Code. This is achieved by international norms and procedures.

Where does the HSN code appear?

Each invoice provided by a supplier of products or services shall provide the appropriate HSN for the materials supplied or for the services rendered under the GST regime. As a result, any distributor or service provider must be mindful of the HSN Code List for all products and services that are subject to GST.

Why is HSN essential in the context of GST?

The GST return filing process is fully automatic. As a result, uploading the summary of the goods provided by taxpayers would be difficult. To prevent such a problem, the HSN Code System was implemented. The HSN Codes are immediately retrieved from the taxpayer’s registration information in this scheme. As a result, the licensed taxpayer is not required to upload a clear summary of the goods he sells. This will save you time and make filing your GST Return a breeze. As a result, a distributor or service supplier must submit an HSN or SAC-by-SAC description of products or services offered in GSTR-1. This must be achieved if the dealer’s or service provider’s annual turnover is below the applicable slabs listed above.

What are the ramifications of referencing or incorrectly mentioning the HSN Code?

It is critical to include the correct HSN Code on tax invoices and Form GSTR-1, otherwise, a liability of Rs. 50,000 (Rs 25,000 each for CGST and SGST) can be imposed under Section 125 of the CGST Act for failing to include or including the incorrect HSN Code.

Has the Government notified HSN Codes?

Yes. HSN Codes are available on the Ministry’s website. ACES website controls them at present. However, this was previously used for operation by the CBEC – Central Board of Excise and Customs.