GST Invoice

Every GST-registered business must provide a GST bill or a GST invoice to its customers, and so are you. Whether dealing with goods or services, your business must provide GST bills or invoices to comply with the new GST laws.

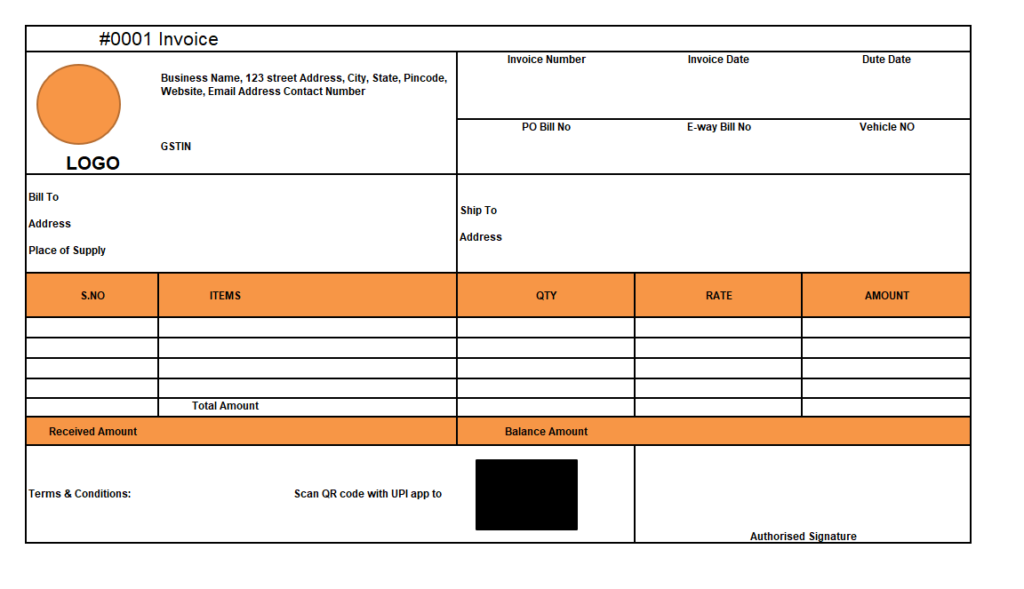

Sample of GST Invoice or Bill

Difference b/w Invoice and GST Invoice

What is an Invoice or bill?

An invoice is a commercial document issued by a business (seller) to its customers (buyers). Generally, it is a bill you issue to your customers after they purchase products or services from your business. You give the bill, and the customers make the payment. o better understand this, what is invoicing can be explained as the process of creating and managing these documents.

As you know, an invoice or bill contains information about your business, the customer details like name, contact number, date of sale, name of the products/services purchased, price details, discounts, payment terms, etc.

An invoice serves as a demand for payment before the money is paid. It becomes a document of title, once the payment is made.

What is a GST-Invoice or GST Bill?

The GST law refers invoice as ‘Tax Invoice’ in section 31 of the CGST Act, 2017.

According to the Act, all GST-registered businesses (turnover exceeds Rs.40 lakh) must issue an invoice or a bill of supply for every sale of goods or services. Thus generated invoice is termed a GST invoice or GST bill.

A GST invoice contains all the details related to the parties and products along with the mandatory goods and services tax broken down into Central tax (CGST), State tax (SGST), Integrated tax (IGST), or Union territory tax (UTGST), whichever is applicable. A GST invoice is thus an important document that serves as proof of the supply of goods or services.

Hence the basic difference between a normal and a GST invoice is the addition of the new goods and services tax.

Contents of a GST Invoice – Mandatory Fields

There is no specific invoice format as mandated by the Act. You can create GST invoices as per your business needs. However, the GST act makes it mandatory to include the following information in GST bills.

- Supplier’s name, address, and GSTIN (GST Identification Number)

- A consecutive serial number unique for a financial year.

- The serial number might be in one or multiple series and can contain letters, numbers, special characters, in any combination.

- Date column

- If the buyer is a registered business – Name, address, GSTIN or UIN of the business.

- If the buyer is a non-registered business – Name, address, address of delivery, state name and code (only when taxable goods worth INR 50,000 or more are sold).

- HSN Code for goods or SAC Code for services

- Details of the goods or services and their quantity or unique quantity code

- The total worth of goods or services and their taxable value

- Rate and amount of GST (CGST, SGST, IGST, UTST or cess)

- For inter-state trade – Place of supply (city and state) and delivery of supply, if different from the former.

- Mention the tax if payable on a reverse charge basis

- Signature/digital signature of the supplier

Time Limit to Issue GST invoices

According to GST regulations, there is a time limit to issue GST tax invoices depending on the type of sale and the nature of the supply.

- For normal supply of goods, a GST bill must be provided on or before the delivery date.

- For continuous supply of goods, a GST invoice must be issued on or before the date of issue of the account statement or payment.

- For general services, a GST bill must be issued within 30 days of the supply of services.

- For services related to banks and NBFCs, a GST invoice must be provided within 45 days of catering the services.

How to Create GST Invoices

As the new norms do not mandate a format for GST invoices, every business can customise their invoice as per their business requirements.

Various online sources to create GST invoices include:

- Free GST invoice templates online

- Free GST Invoice Generators online

- Online Billing Software like myBillBook

You can create GST invoices in seconds using these online sources and web and mobile applications. Not all sources may offer the customisation feature. Choose the one that allows you to create and customise the invoice as per your business requirements.

Types of GST Invoices

-

- Bill of Supply: A registered business dealing in exempted goods or services issues a bill of supply instead of an invoice. Also, a composition dealer (the one who avails the GST composition scheme) issues a bill of supply in place of a tax invoice. A bill of supply does not contain any GST amount, as the above-mentioned businesses cannot charge GST to the buyer.

- Invoice-cum-bill of supply: A registered business dealing with both exempted and taxable goods can issue an Invoice-cum-bill of supply instead of a GST invoice.

- Aggregate Invoice: When a registered business has to issue multiple invoices worth less than INR.200, each to an unregistered buyer, a single aggregate invoice or a bulk invoice can be issued on a daily basis instead of multiple invoices. Thus issued aggregate invoice is a consolidated invoice of all the single invoices.

myBillBook to Generate GST Invoices

A billing software like myBillBook allows retailers to bill faster and produce various invoices much more efficiently than creating manual bills while also keeping data accuracy in check. What’s more, myBillBook invoicing software lets you access all your data through the web at any given time for no extra charge.

- Billing software provides a professional and sophisticated image of your business with professional-grade paper bills.

- You get regular notifications on the status of payables and receivables

- It provides 24×7 access to sale and purchase orders and allows you to monitor them till they’re delivered/received by relevant parties.

- myBillBook paid invoice app helps you get your stock’s real-time status, which further helps with timely purchasing decisions.

- You receive 10+ exclusive reports that ensure the smooth functioning of the business, including sales summaries, profit and loss reports, party statements, etc.

- Protect your data with daily automated backup.

- Sync your mobile app with your desktop software so that you can access all your records on the go through your mobile phone.

- Create purchase vouchers, payment receipts, quotations (estimates/sale orders), purchase orders, sale returns, purchase returns, delivery challans, and expense vouchers from your mobiles.

- You can upload an entire inventory of the stocks by transferring items from other accounting apps or with the use of excel sheets and images.

FAQs on GST Invoice or GST Bill

How many copies of the GST invoice need to be provided?

- For goods - 3 copies - original, duplicate, and triplicate.

- For services - 2 copies - original and duplicate.

What are the 3 goods invoice copies used for?

- Original copy for the buyer

- Duplicate copy for the individuals sending the products from suppliers to the recipients.

- The triplicate copy is for the dealer.

What are 2 service invoice copies used for?

- The original copy is for the buyer.

- Duplicate copy remains with the service provider.

What is a reverse charge invoice?

A business that pays tax under Reverse charge mechanism has to issue a reverse charge invoice.

Which businesses are exempt from GST registration?

Broadly, businesses whose annual turnover exceeds Rs.40 lakh and those selling only exempted goods or services are exempted from GST registration.