Billing is essential for businesses, yet many fail to measure its performance effectively. This can lead to delayed payments, revenue loss, and compliance risks.

Billing Key Performance Indicators (KPIs) help measure the efficiency and accuracy of invoice generation and payment collection. By monitoring the right KPIs, businesses can shift from reactive to proactive billing management.

This guide outlines the importance of billing KPIs, key metrics to focus on, common pitfalls, and how billing software can improve performance.

What Are Billing KPIs?

Billing KPIs are crucial metrics that evaluate the performance and efficiency of a company’s billing process. They provide insights into how invoices are created, delivered, paid, and recorded at the transactional level. Unlike general financial KPIs that focus on profitability, billing KPIs integrate sales, invoicing, payment collection, and compliance.

These metrics are important for businesses of all sizes, from retailers handling high invoice volumes to service providers billing for milestones. Monitoring billing KPIs helps ensure compliance and maintain cash flow stability. Additionally, consistent tracking can reveal issues like payment delays or billing errors before they become serious problems.

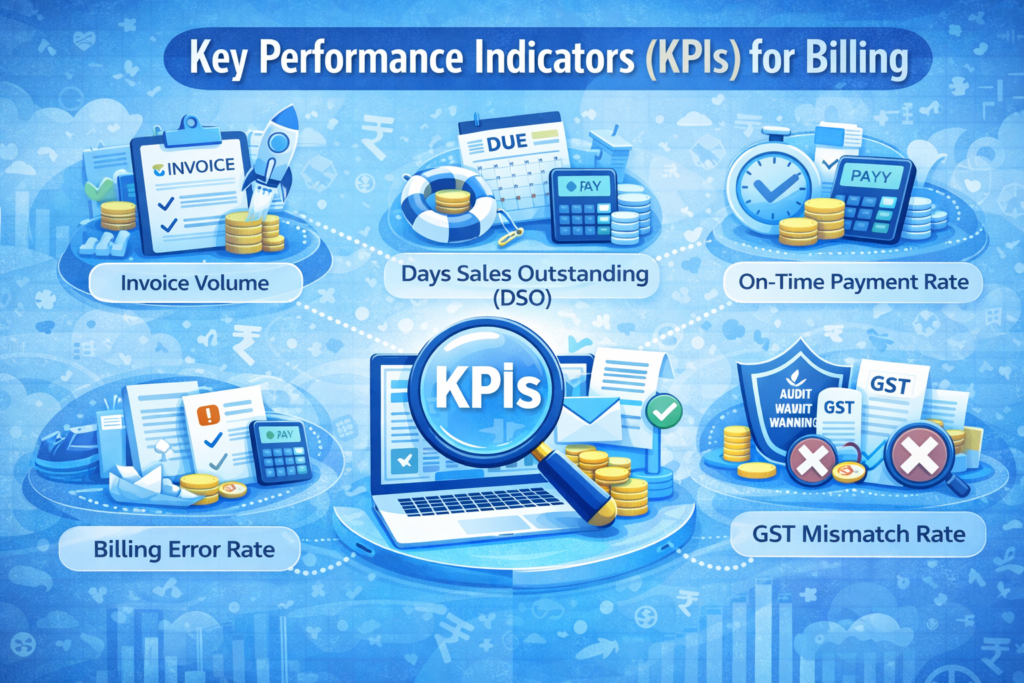

Key Performance Indicators (KPIs) for Billing

Billing KPIs can be grouped by the aspect of the billing process they measure. Tracking a balanced set of KPIs provides businesses with a comprehensive view of billing performance.

Invoice and Billing Process KPIs

Invoice Volume

Measures the total number of invoices generated in a given period. It helps businesses understand billing load and capacity requirements.

Invoice Turnaround Time

Tracks the time taken to generate an invoice after a sale or service delivery. Longer turnaround times often lead to delayed payments.

Invoice Accuracy Rate

Shows the percentage of invoices issued without errors. A low accuracy rate indicates frequent corrections, disputes, or rework.

Billing Error Rate

Measures how often invoices require corrections due to incorrect pricing, taxes, or customer details.

Payment and Collection KPIs

Days Sales Outstanding (DSO)

Represents the average number of days taken to collect payment after issuing an invoice. A rising DSO is a clear warning sign for cash flow problems.

On-Time Payment Rate

Tracks the percentage of invoices paid within the agreed payment terms. This KPI reflects customer payment behaviour and billing clarity.

Outstanding Dues Percentage

Shows how much of the total billed revenue remains unpaid. High outstanding percentages indicate weak follow-ups or inefficient collections.

Payment Success Rate

Measures how many invoices are fully paid without disputes, retries, or delays.

Accuracy and Adjustment KPIs

Credit Note Rate

Tracks how frequently credit notes are issued compared to total invoices. A high rate may indicate pricing errors, return issues, or unclear billing terms.

Return-to-Invoice Ratio

Measures how often billed items are returned or cancelled, impacting revenue predictability.

Adjustment Frequency

Tracks how often invoices are modified after issuance. Frequent adjustments suggest workflow or validation gaps.

Compliance and Control KPIs

Tax Error Rate

Measures the frequency of incorrect tax calculations or missing tax details on invoices.

GST Mismatch Rate

Tracks discrepancies between billed GST data and filed returns, helping identify compliance risks early.

Audit Exceptions Count

Monitors the number of billing-related issues flagged during audits or reviews.

Operational Efficiency KPIs

Invoices per Employee

Measures billing productivity and workload distribution.

Billing Cost per Invoice

Estimates the operational cost involved in generating and managing each invoice.

Billing Automation Rate

Tracks how much of the billing process is automated versus manual, indicating scalability readiness.

Common Mistakes Businesses Make While Tracking Billing KPIs

- Tracking too many KPIs at once leads to information overload and makes it difficult to focus on metrics that actually impact cash flow and accuracy.

- Measuring KPIs without clear business goals results in tracking numbers without understanding how they influence decisions or outcomes.

- Reviewing billing KPIs too infrequently, often monthly or quarterly, causes early warning signs like delayed payments or rising errors to go unnoticed.

- Relying on manual KPI tracking, such as spreadsheets, increases the risk of data errors and outdated insights.

- Not assigning ownership for KPIs leads to a lack of accountability when performance drops.

- Ignoring trends and patterns, and focusing only on current values instead of changes over time.

- Tracking KPIs without taking action, where insights are recorded but no corrective steps are implemented

How Billing Software Helps Track and Improve Billing KPIs

- Automatically captures billing data in real time, ensuring KPIs are always accurate and up to date without manual data entry.

- Provides centralised KPI dashboards, giving instant visibility into invoice performance, collections, outstanding dues, and accuracy metrics.

- Improves invoice turnaround time by automating invoice creation and delivery, directly impacting cash flow-related KPIs.

- Reduces billing and tax errors, improving invoice accuracy rate and lowering compliance-related risks.

- Simplifies payment tracking and reconciliation, helping businesses reduce Days Sales Outstanding (DSO) and outstanding dues.

- Enables trend analysis and performance tracking, allowing businesses to monitor KPI movements over time rather than static snapshots.

- Triggers alerts and reminders, helping teams act quickly on overdue payments or unusual KPI changes.

- Scales KPI tracking as the business grows, ensuring consistent measurement even with higher transaction volumes and multiple users.

Frequently Asked Questions

The most important billing KPIs include invoice turnaround time, invoice accuracy rate, Days Sales Outstanding (DSO), outstanding dues percentage, and tax error rate.

Critical billing KPIs should be reviewed weekly or monthly to catch issues early. High-growth businesses may benefit from real-time monitoring.

Yes. Billing KPIs help small businesses maintain cash-flow discipline, reduce errors, and build scalable processes from the outset.