All About Credit Note – Meaning, Contents, Generation

As per the new GST regulations, every registered business must mandatorily issue a tax invoice. Once the invoice is issued, during the course of trade, there could be some situations like –

- The seller issues the invoice with a value more than the actual value of the goods or services sold.

- The seller issues the invoice with a higher tax rate than the applicable rate for the kind of goods or services sold.

- The buyer receives less number of goods than what was declared in the invoice.

- The buyer is not happy with the quality of goods supplied or services provided and requests a partial or total reimbursement of the invoice value.

- Any other similar situations.

In all the cases mentioned above, the seller cannot cancel the issued invoice or generate a new one. Instead, he/she can issue a Credit Note to regularise these situations. Once the credit note is issued, the seller’s tax liability will be reduced. For a refresher on what is invoicing, you might want to revisit the basics.

Credit Note Meaning | What is a Credit Note

A Credit Note, a credit memo, or a credit memorandum is a document issued by a seller using which the value of the goods or services in the original tax invoice can be revised.

A credit note is an official acknowledgment of a refund, return of goods, or adjustment made to a previous transaction. It is issued for various reasons such as invoice errors, damaged goods, order cancellations, or overpayments.

An everyday example of a credit notes – A credit note is like a credit voucher we receive when we return a product to the retailer or in a shopping mall. Instead of refunding the money, the businesses give us a voucher mentioning the redeemable amount. We can use the credit voucher when we purchase at the same outlet next time. Credit vouchers, typically, come with an expiry date.

Credit Note in GST

Section 34 of the CGST Act, 2017 deals with the issuance of Credit Notes. According to the section –

“[Where one or more tax invoices have] been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient [one or more credit notes for supplies made in a financial year] containing such particulars as may be prescribed.”

“Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as may be prescribed: Provided that no reduction in output tax liability of the supplier shall be permitted if the incidence of tax and interest on such supply has been passed on to any other person.”

The official act mandates suppliers to issue credit notes in the above-mentioned scenarios to revise the invoice values. It also mentioned where to declare the credit note. It also mentions the mandatory details that must be included on a credit note. To link this with broader concepts, understanding what is invoicing can be insightful.

When to Declare Credit Notes | Time Limit for Issuing a Credit Note

As per the CGST Act, the issuer must declare the details of a credit note

- While filing the GST returns for the month in which the credit note was created.

- Can also declare in any subsequent months, but not later than 30th September following the end of the financial year in which the credit memo was issued.

- Before the actual date of filing the annual GST return for the relevant period.

All credit note records must be kept until 72 months after the due date for submitting the annual return for the relevant year. Where such accounts and documents are maintained manually, they should be kept at every related place of business. Using billing software helps you to securely store all such records digitally. It is also easy to retrieve any data while stored on software.

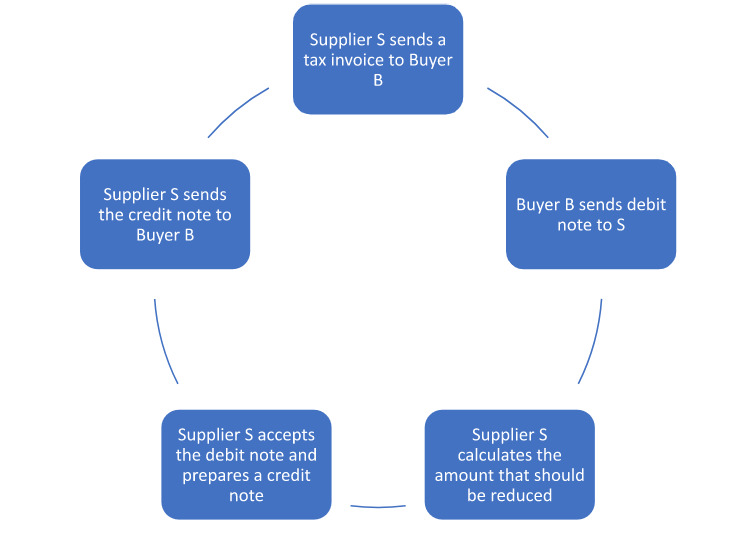

Process of Issuing a Credit Note

The process of issuing a credit note can be illustrated through the following example:

- Supplier S sells goods to Buyer B and issues a tax invoice.

- Buyer B discovers quality issues with the goods and returns them, along with a debit note.

- Supplier A accepts the debit note and prepares a credit note as an acknowledgement to Buyer B.

This process is depicted in the following flowchart:

How to Generate a Credit Note Using myBillBook

myBillBook is a billing and accounting software that helps businesses generate various kinds of invoices, including credit notes. Using software to generate credit notes makes your job easy as all the mandatory fields are already present in the template, and all you need to do is enter the required details. myBillBook stores all the generated credit notes securely, making it easy during the return filing process. Here is a step-by-step guide to generating credit notes using myBillBook billing software.

- Login to myBillBook mobile or desktop application.

- From the left side navigation menu, find the ‘Create Sales Invoice’ button

- Click on the drop-down next to it to find the ‘Credit Note’ option

- Click on ‘Credit Note’ to find the ‘Create Credit Note’ page on the right

- Start by adding a party name by clicking on ‘Add Party’ option

- If you have already added your buyer details earlier, the next two fields will be auto-filled with the required details.

- In case the party is not added, you can add details by clicking on ‘Create Party’

- Add buyer details, contact details, GSTIN and other details

- If the shipping address differs, you can add it to the next field.

- Add a unique number in the ‘Invoice Number’ field

- Add date under ‘Credit Note Date’

- Under the ‘Create Item’ column, you can include the details of the returned goods, their price, the rate of tax, and the amount of the tax credited to the recipient.

- Click on ‘Add Notes’ to enter the serial number and date of the corresponding tax invoice or bill of supply.

- Add signature in the ‘Authorised Signatory’ field

Double check all the details before clicking on the ‘Save Credit Note’ option on the top. Once it is saved, you can share it through Whatsapp or SMS, download it and take a print out.

FAQs on Credit Note

Is credit note and invoice same?

No, a credit note is not an invoice but a supplementary document that accompanies an invoice in case of revisions to the actual invoice.

What is the difference between debit notes and credit notes?

Debit notes are issued by a buyer to the seller to indicate a return of goods or a need for a reduction in the amount payable. On the other hand, credit notes are issued by a seller to the buyer, acknowledging the return of goods or a reduction in the invoice amount.

Who issues credit notes?

Credit notes must be issued by the seller to the buyer as an acknowledgment of the return of goods and indicating a reduction in the amount payable.

Is a refund a credit note?

A refund is not the same as a credit note. A refund is the actual return of money to the buyer, while a credit note is a document issued by the seller to the buyer indicating a reduction in the amount payable or acknowledging the return of goods. A credit note can be used for future purchases or offset against future invoices.

Does the issuance of a credit note always lead to a refund?

Against a credit note, businesses can decide if they wish to provide a refund for the amount or allow the customers to buy products in the future against that amount.

Do credit notes expire?

The expiration date of the credit notes depends on the terms set by the issuing seller. Some credit notes might have a specified validity period, while others might be valid indefinitely.

Can I cancel a credit note?

Yes, a credit note can be cancelled if it is not used or applied to an invoice. To cancel a credit note, you can issue a debit note or a correcting document to nullify the credit note’s effect. It’s essential to follow the appropriate procedures and maintain accurate records to reflect this adjustment in the accounts.

Is a credit note a legal document?

Yes, a credit note is a legally binding document and is required as per the CGST rules.

Can I get a refund using a credit note?

A credit note does not equal a refund. It depends on the terms of the agreement between the supplier and the recipient. In some cases, the supplier may agree to give a refund, while others may agree to hold the funds “in credit” so that the recipient may make future purchases without payment.

Can I get a tax rebate on a credit note?

You can get a reduction in tax liability if you enter all the details on the GSTR-1 correctly and they match the details on your credit note.

What is the record retention of a credit note?

Record retention of a credit note refers to a situation wherein the supplier is entitled to retain documents relating to credit notes for a specified period of time.

What are the guidelines for record retention of a credit note?

The record of credit notes should be preserved for at least 6 years from the date of filing the return.

When credit notes are managed manually, they should be made available at the primary as well as all other additional places of business specified in the certificate of registration.

If credit notes are maintained electronically, they should be accessible from every concerned place of business.

What should you do when credit notes are issued for multiple invoices?

One credit note for multiple invoices is permissible. So, instead of sending individual credit notes for multiple invoices throughout the financial year, a registered person can raise a consolidated invoice.

Do credit notes have to be issued during specific financial periods, such as quarterly or monthly accounting?

No. Credit notes can be issued whenever needed or a business situation arises