Billing doesn’t end when you create an invoice. The real game is when you get paid.

In India, payment delays are common—especially in B2B and distribution. A clear billing cycle and well-defined payment terms help you:

- Reduce overdue payments

- Avoid disputes

- Manage cashflow confidently

- Keep GST and accounts cleaner

This guide explains billing cycles and payment terms in easy language, with examples you can use in your business.

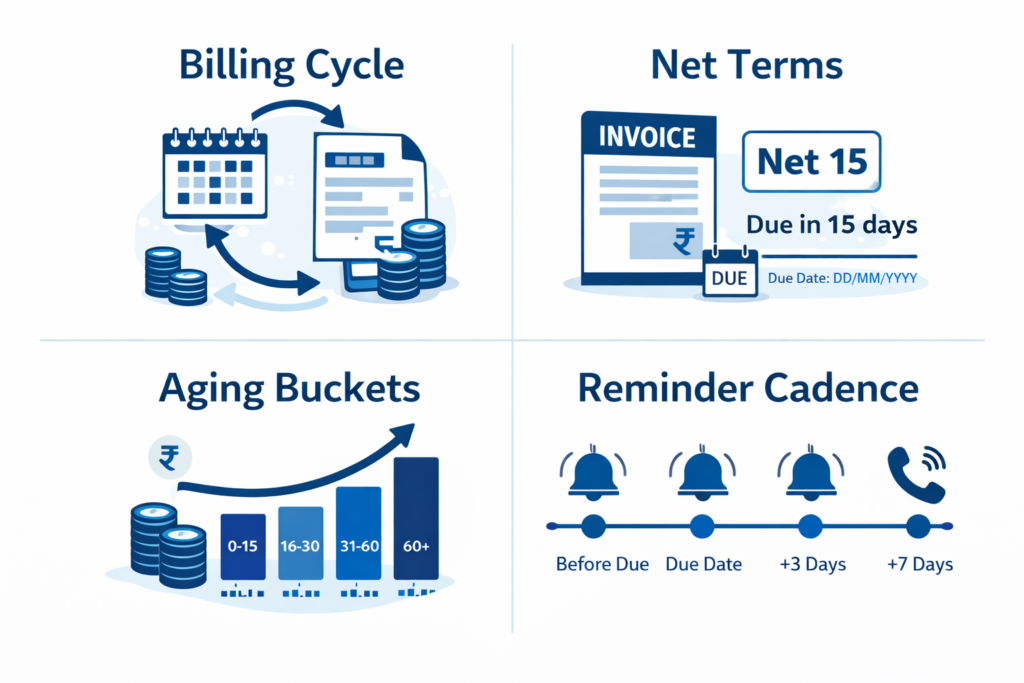

What is a Billing Cycle

A billing cycle is the time period you use to group sales and raise invoices (or collect payments). It decides:

- When invoices are generated

- When payment is due

- When reminders should go out

- How do you track outstanding and ageing?

Common Billing Cycles

- Daily billing: Invoices raised daily (typical for retail counters)

- Weekly billing: Weekly invoice summaries (some suppliers do weekly settlement)

- Fortnightly billing: Every 15 days

- Monthly billing: Most common in B2B/service retainers

- Quarterly/Annual billing: AMC, subscriptions, school/club plans

- Per-order billing: Invoice raised for each purchase order/delivery (common in wholesale)

Simple example

- You supply to a retailer daily, but you raise one invoice every Saturday → that’s a weekly billing cycle.

What are Payment Terms?

Payment terms are the rules written on the invoice that explain:

- due date or due period

- discounts for early payment (if any)

- late fee/interest (if you apply it)

- part-payment/advance expectations

- payment mode details (UPI/bank/cash)

Good payment terms remove confusion and improve collections.

Most Common Payment Terms in Business (With Examples)

1) Due on Receipt

Meaning: Pay immediately when the invoice is received.

Used in: B2C, cash-and-carry B2B, urgent deliveries.

2) Advance Payment

Meaning: Pay before you deliver goods or start service.

Used in: custom orders, high-ticket orders, and new customers.

Example

- “100% advance before dispatch”

- or “50% advance, balance before delivery”

3) Net Terms (Net 7 / Net 15 / Net 30 / Net 45)

Meaning: Payment is due in X days from invoice date (or delivery date—be clear).

Example

- Invoice date: 10 Jan

- Net 15 → due date: 25 Jan

Who uses it

- Distributors, wholesalers, B2B suppliers, and services.

4) End of Month (EOM)

Meaning: All invoices for a month are due at the month’s end (or a fixed date).

Example

- “Payment due by 5th of next month for all supplies in the current month.”

This is common when buyers want one settlement date.

5) Part Payment Terms

Meaning: You allow partial payment now and balance later.

Example

- “₹5,000 advance, balance within 7 days after delivery.”

Use this when customers are price-sensitive but you still want safety.

6) Early Payment Discount (Optional)

You may offer a small discount to get paid faster.

Example

- “2% discount if paid within 7 days, otherwise Net 30.”

How to Set Payment Terms That Actually Work

Payment terms should match:

- your cashflow needs

- customer reliability

- delivery frequency

- order size

- your industry norms

A practical framework (simple)

New customer → advance / shorter credit

Regular trusted customer → Net 15 / Net 21

High-risk/slow payer → reduce credit limit or shift to partial advance

High volume buyer → weekly/monthly billing + fixed settlement date

Billing Cycle vs Payment Term (Don’t Mix These)

Many businesses confuse these two:

Billing cycle = “When do I invoice?”

Example: Monthly billing (invoice generated on the 1st of every month)

Payment term = “By when should I get paid?”

Example: Net 15 (payment due 15 days from invoice date)

So you can have:

- Monthly billing + Net 7

- Weekly billing + Net 15

- Per-order billing + Advance payment All combinations are possible.

Credit Period, Due Date, and Grace Period

Credit period

Credit Period is the time you allow before payment becomes “due”.

Example: Net 15 = 15 days credit

Due date

The exact date by which the payment should be received.

Example: Invoice 1 Feb + Net 15 → Due 16 Feb

Grace period

Extra days you allow before you treat it as overdue (optional).

Example: due date 16 Feb, grace 3 days → overdue from 20 Feb

If you allow grace, define it internally. You don’t always need to print it on invoice.

Understanding “Ageing” (The Most Important Collections View)

Ageing tells you how long invoices have been unpaid.

Typical ageing buckets:

- 0–15 days (current)

- 16–30 days (attention)

- 31–60 days (risk)

- 60+ days (high risk)

If you track only ‘total outstanding’, you miss the real problem. Ageing helps you prioritise follow-ups.

Billing Cycle Models for Different Businesses

Retail Shop (mostly B2C)

- Billing cycle: per sale (instant)

- Payment term: immediate

- What matters: daily closing, payment mode split, returns tracking

Distributor / Wholesaler (B2B credit)

- Billing cycle: per-order OR weekly

- Payment terms: Net 7/15/21/30

- What matters: invoice-wise due dates, ageing, party credit limits

Services / Agencies

- Billing cycle: monthly

- Payment terms: Net 7/15, milestone, or advance

- What matters: recurring invoices, reminders, clear scope and milestones

Subscription/AMC

- Billing cycle: monthly/annual

- Payment terms: advance or due on invoice

- What matters: renewal reminders, stop/renew flow

Best Practices to Reduce Delays

1) Write terms clearly on every invoice

Avoid vague lines like “pay soon”.

Better:

- “Payment due by: 25 Jan 2026”

- “Terms: Net 15 days from invoice date”

2) Share the invoice immediately

Late invoice = late payment.

3) Keep “invoice-wise” tracking

You should always know:

- Which invoice is overdue

- since when

- for how much

- Why it’s pending (dispute, return, no funds, ignored)

4) Fix a reminder cadence

Example cadence (polite + effective):

- Reminder 1: 3 days before due date

- Reminder 2: on the due date

- Reminder 3: 3 days after due

- Call: 7 days after due (if still unpaid)

5) Use credit limits

Even a simple limit prevents runaway outstanding.

Example:

- “Credit limit: ₹50,000 OR 15 days, whichever is earlier.”

Common Mistakes with Billing Cycles & Terms

- The invoice date and delivery date mismatch creating disputes

- No due date written → customer delays by default

- Changing terms verbally without recording them

- Giving credit to slow payers without limits

- Not linking returns/credit notes to invoices

- Only tracking total outstanding (no ageing)

Example Payment Terms

Simple Net Terms

- “Payment Terms: Net 15 days from invoice date. Due Date: DD/MM/YYYY.”

Advance + Balance

- “50% advance. Balance payable before dispatch.”

EOM Settlement

- “Monthly settlement. Payment due by 5th of next month.”

Part Payment

- “Advance received: ₹____. Balance due by: ____.”

FAQs on Billing Cycle

1) What is the best billing cycle for distributors?

Most distributors use per-order billing with Net 7/15/21/30 terms, or weekly billing with a fixed settlement day. The best choice depends on delivery frequency and buyer behaviour.

2) Is Net 30 billing cycle always safe?

Not always. Net 30 can work for reliable customers, but for new or slow-paying parties, shorter terms or partial advance usually reduces risk.

3) Should I calculate the due date from the invoice date or the delivery date?

Either can work—what matters is consistency and clarity. Choose one approach and mention it clearly in your terms.

Use clear due dates, invoice-wise tracking, aging buckets, and a consistent reminder cadence. Credit limits also help a lot.

A good billing system typically makes it easier to set due dates, track party-wise outstanding, view aging, and share invoices quickly. If you’re using myBillBook, you can keep invoices + ledger + dues tracking in one flow, which reduces manual follow-ups.