In India, billing is closely tied to GST compliance, invoice records, and payment tracking—so choosing the right billing type isn’t just about convenience, it also helps keep your reporting and collections clean.

Billing is not “one size fits all”. The way you bill should match who you sell to, when you collect money, and how often you charge. When your billing type is right, you typically get:

- fewer counter mistakes

- clearer GST records (where applicable)

- faster collections and fewer follow-ups

- better cashflow visibility

This guide explains the most common billing types in simple language, with examples you can use.

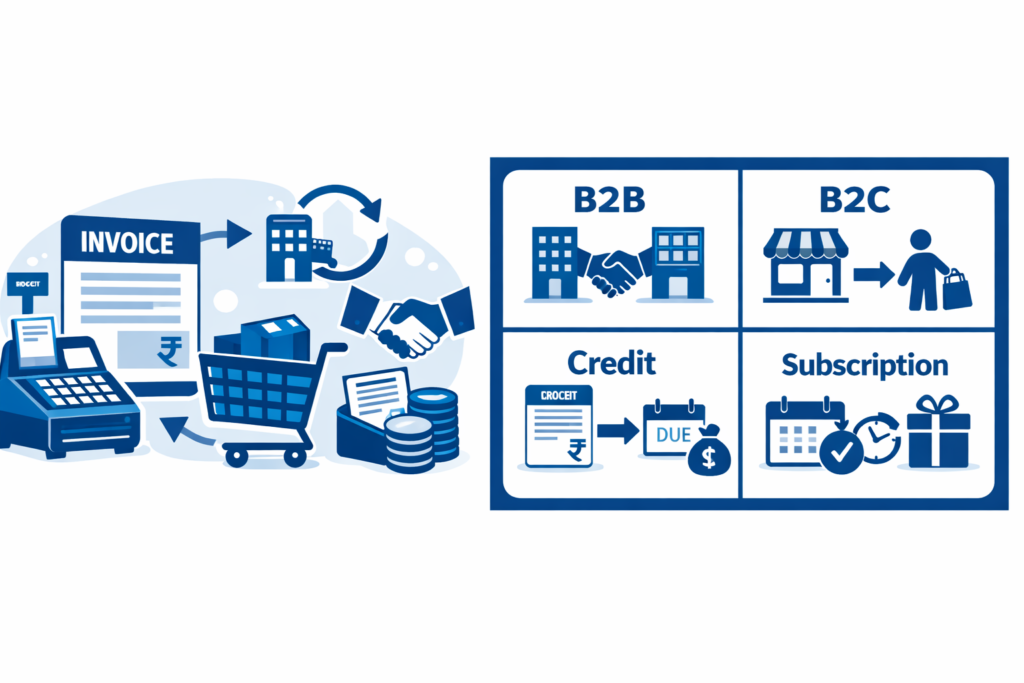

1) Billing by Customer Type

A) B2B Billing (Business-to-Business)

Meaning: You sell to another business (retailer, distributor, company, office, institution).

Common in: distributors, wholesalers, manufacturers, service agencies, B2B traders.

How it usually works

- You generate an invoice (often a GST tax invoice if you’re registered and the transaction requires it)

- You share invoice + sometimes delivery proof (as per your process)

- Payments are often credit-based (7/15/30/45 days)

- Buyers generally want clear breakup: taxable value, GST, item/service codes (HSN/SAC where relevant), totals, and terms

Example

- A stationery wholesaler bills a school canteen ₹48,000 + GST, payment due in 15 days.

- An agency bills a client monthly, with invoice details aligned to their accounting needs.

When B2B billing is a good fit

- You sell larger orders

- You give credit to parties

- You need party-wise outstanding tracking

- Your buyers prefer formal invoice documentation

B2B billing works best when you maintain

- consistent invoice numbering

- correct customer details (like GSTIN where applicable)

- correct product/service classification (HSN/SAC where relevant)

- clear payment terms and due dates

B) B2C Billing (Business-to-Consumer)

Meaning: You sell directly to end customers.

Common in: retail shops, supermarkets, salons, restaurants, clinics (counter billing), electronics stores.

How it usually works

- Fast billing (speed matters more than deep customer details)

- Payment is commonly instant: cash/UPI/card

- Returns/exchanges are common

- Invoice/receipt style varies depending on your business setup and compliance needs

Example

- A supermarket bills ₹1,250 and collects instantly via UPI.

- A salon bills ₹900 and shares the bill on WhatsApp.

When B2C billing is a good fit

- You have walk-in counter sales

- You want quick item selection + barcode billing

- You need daily sales summary and payment-mode breakup

B2C billing works best when you have

- quick checkout flow

- discount handling

- easy bill sharing (WhatsApp/PDF/print)

- a clean returns workflow

- daily closing (cash vs UPI vs card)

C) Mixed Billing (B2B + B2C)

Many Indian SMBs do both.

Example

- An electronics shop sells to customers (B2C) and supplies accessories to nearby retailers (B2B).

- A pharmacy sells retail and also supplies to a clinic.

Tip: If you do mixed billing, it helps to tag invoices as B2B/B2C and keep reports separate so your collections and filings don’t get messy.

2) Billing by Payment Timing (When You Collect Money)

A) Instant Payment Billing (Cash/UPI/Card)

Meaning: Payment is collected at billing time.

Best for: counter sales, small tickets, fast-moving items.

Pros

- simpler cashflow

- lower outstanding risk

- easier daily reconciliation

Cons

- payment-mode mismatches happen if staff forgets to record correctly

- refunds/returns need proper entries to avoid confusion later

Example

- A cafe bills ₹120 and collects via UPI immediately.

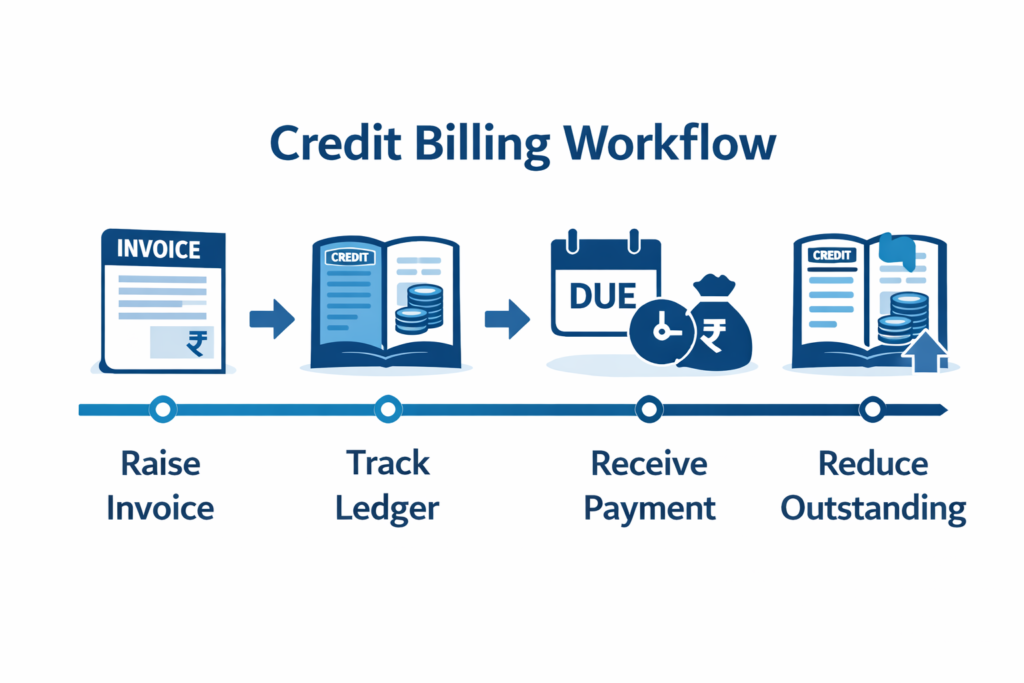

B) Credit Billing (Pay Later)

Meaning: You bill now and collect later. This is very common in wholesale and distribution.

How credit billing typically works

- You raise an invoice with payment terms (e.g., “Due in 15 days”)

- The customer’s outstanding increases in the ledger

- Customer pays later (full or partial)

- You record the receipt; outstanding reduces

- You follow up for overdue invoices based on aging

Best for: wholesalers, distributors, B2B suppliers, some service providers.

Pros

- helps drive repeat orders

- supports larger ticket sizes

- buyers often prefer credit flexibility

Cons

- overdue risk and cashflow pressure

- manual follow-ups take time

- if ledgers aren’t updated, you lose visibility

Examples

- An FMCG distributor bills a retailer ₹32,500 today, due in 21 days.

- A repair shop bills ₹8,000; the customer pays ₹3,000 now and ₹5,000 later (part-payment).

If you do credit billing, it’s useful to track

- invoice-wise due dates (not only total outstanding)

- aging buckets (0–15, 16–30, 31–60, 60+)

- promised payment dates and notes

- receipts linked to invoices

- disputes/returns linked to original invoices

Soft note: Tools like myBillBook are often used to keep billing + party ledger + dues tracking in one place, which can reduce “who owes what” confusion.

C) Advance Billing / Part-Payment Billing

Meaning: Customer pays in advance, or pays a portion now and the rest later.

Common in: custom orders (furniture, printing, jewellery), services (events), and larger retail orders.

Example

- Customer pays ₹10,000 advance for a sofa; the remaining is paid at delivery.

What usually matters

- recording advance/part-payments clearly

- linking receipts to the final invoice

- tracking balance accurately

3) Billing by Frequency (How Often You Charge)

A) One-Time Billing

Meaning: One invoice per sale.

Common in: most retail transactions, many B2B orders.

Example

- A shop sells items and issues one bill for that purchase.

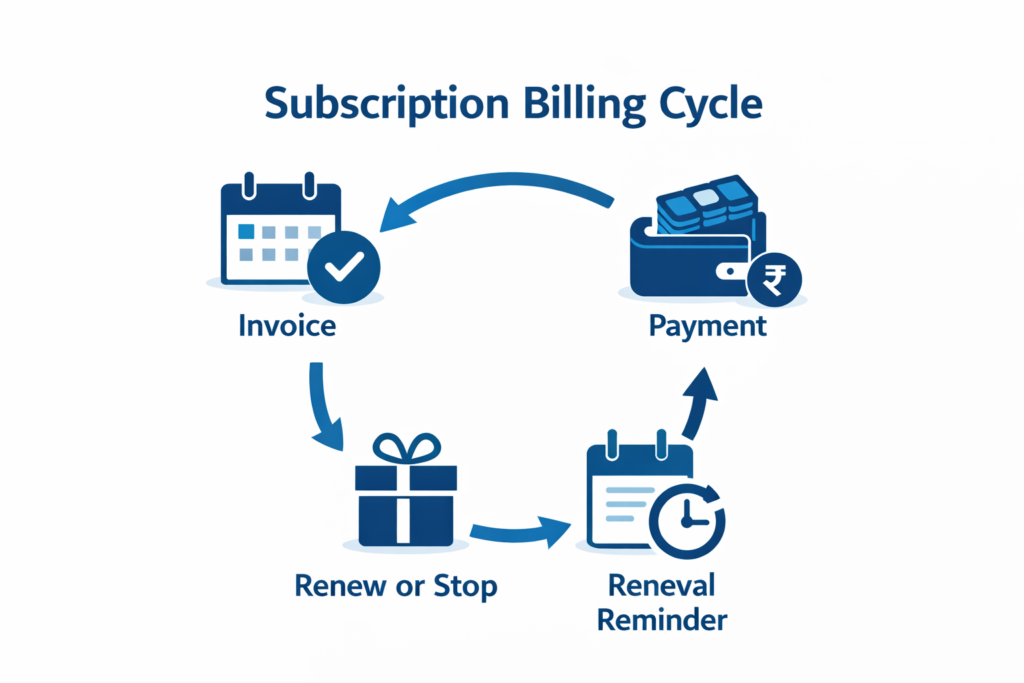

B) Subscription Billing (Recurring Billing)

Meaning: You charge customers regularly—monthly/quarterly/yearly—for a product/service.

Common in

- memberships (gym, coaching)

- AMC (annual maintenance)

- retainers (agencies, consultants)

- local services

How it typically works

- Set a plan amount + frequency

- Generate recurring invoices

- Collect payment and track renewals

- Send reminders for upcoming/overdue cycles

- Pause/cancel as needed

Example

- Pest control service bills ₹999/month.

- Coaching class bills ₹6,000/quarter.

Pros

- more predictable revenue

- easier forecasting

- renewals become routine

Cons

- missed renewals if reminders aren’t consistent

- delays if invoices aren’t generated on time

C) Milestone / Project Billing

Meaning: You bill based on stages: advance → mid → final.

Common in: contractors, interior design, agencies, manufacturing orders.

Example

- 30% advance, 40% on delivery, 30% on completion.

Best practice

- write milestone terms clearly on quotation/invoice

- keep stage-wise receipts

- track pending amount per project

D) Time-Based / Usage-Based Billing

Meaning: Bill depends on hours, units, usage, or consumption.

Common in: consultants/freelancers (hourly), rentals (daily/weekly), equipment usage.

Example

- Consultant bills 12 hours × ₹2,000/hour.

Quick Guide: Which Type Fits You?

B2B billing usually fits if you sell to businesses and need invoices + party tracking.

B2C billing usually fits if you run counter sales and need speed + daily reports.

Credit billing fits if you often collect later and want invoice-wise due control.

Subscription billing fits if you charge the same customer repeatedly on a schedule.

Project/milestone billing fits if work is delivered in stages.

Most growing SMBs end up using a mix (example: B2B + credit + some subscriptions/AMC).

Checklist to Pick Your Billing Setup

Answer these:

- Who is your customer? (Business or consumer)

- When do you collect money? (Same day or later)

- How often do you bill the same customer? (One-time or recurring)

Then map:

- Business + pay later + repeat → B2B + credit (and sometimes recurring)

- Consumer + same day → B2C + instant payment billing

- Service + monthly fixed → Subscription billing

- Project work → Milestone billing

Common Billing Mistakes (and how to avoid them)

- Mixing B2B and B2C reports → separate tags/reports helps

- No due dates on credit invoices → add terms + due date consistently

- Only tracking total outstanding → track invoice-wise dues

- Unrecorded part-payments → record receipts the same day

- Returns not linked to original invoice → link return/credit note to original sale

- Manual spreadsheets for collections → workable early, but often breaks at scale

FAQs on Types of Billing

Yes. Many businesses do both. It’s generally easier if you keep customer type and reports separated.

It can be, especially without due dates and follow-up discipline. Credit becomes more manageable when you track aging and invoice-wise outstanding.

Predictability. You can forecast cashflow better and reduce dependency on one-time sales.

Most SMBs see quick value by systemizing: invoice creation → payment mode tracking → outstanding list → reminders → daily/weekly reports.

A billing system typically helps by keeping invoices, payments, inventory (if needed), and reports in one workflow—so you spend less time reconciling manually. If you’re considering myBillBook, it’s commonly used for billing + ledger + dues tracking in one place.