Udyam registration is a certification specifically for MSME enterprises operating in India since 1st July 2020. It is another name for MSME Registration, and the Indian Ministry of Micro, Small, and Medium Enterprise replaced it with the new name.

Who can Apply?

Anyone wanting to establish an enterprise and avail of benefits from the Central or State Government and the Banking Sector can apply for an Udyam registration.

Enterprise types for Registration

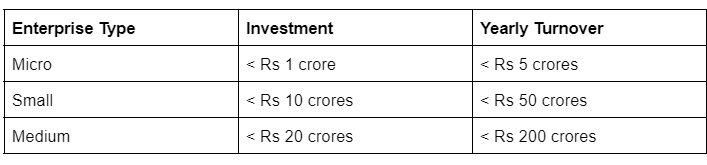

Your enterprise can fall under any of the below three categories:

Documents required for Udyam Registration

You would require the following documents for the registration.

- Pan card

- Aadhar card(12-digit number)

- Postal address with district and pin

- Bank account details of business

The Udyam Registration Process

For a New Business

If you are a new enterprise, you must register for the Udyam registration first. It is paperless and needs no document uploads.

Here are the steps to register:

- Apply for online Udyam Registration in Udyam Registration Portal.

- Upon application submission, you will receive the “Udyam Registration Number“(i.e., permanent identity number) assigned to your business.

- Once the registration is complete, your business will be issued an “Udyam Registration Certificate“.

Note: An aadhar number is mandatory for Udyam registration. Below are the details of the person who should produce the number concerning the firms:

- Proprietor of a Proprietorship firm

- Managing partner of a partnership firm

- Karta of a Hindu Undivided Family

- Authorised signatory of a Company or a Co-operative Society or a Trust or a Limited Liability Partnership

For an Existing Enterprise

Existing enterprises must register again and obtain the registration on the Udyam Registration Portal on or after 1st July 2020.

If there are enterprises registered before 30th June, they should consider the following:

- They will be reclassified based on the revised criteria notified under notification dated 26th June 2020.

- They shall be valid only till 31st March 2021.

How to update information on the Udyam Registration Portal

If you are an Udyam registered enterprise, you must update the information online on the Udyam Registration Portal. Otherwise, you will be liable for suspending your registration.

Note: Any updation in the classification of your enterprise will result in a consequence like:

- If your updation is upward graduation, your enterprise will continue to maintain its status. It will then expire a year from the end of the year of the registration.

- If your updation is downward graduation, your enterprise will maintain its status until the end of the financial year. The changed status will start to appear from the substantial financial year.

How does Udyam Registration help businesses?

The Udyam registration would help you claim government-announced benefits for your businesses. It facilitates the development & promotion of enterprises through these schemes and benefits.

Other benefits include:

- Acquirement of government tenders

- Receival of affordable bank loans at low-interest rates

- Access to tax allowances

- An exemption of 1 per cent on the interest rate on Bank Overdraft

- Easy gain of licenses, registrations and approvals

- A high preference for your business

- Making of tariff, capital and tax subsidies

- Low patent cost or industry set-up cost

- Electricity bill concessions

- Fast dispute resolutions

[wp-faq-schema title=”FAQs on Udyam Registration”]