Before the ITR filing process, there are many documents you need to keep in handy. Form 16A is one among them.

What is Form 16A?

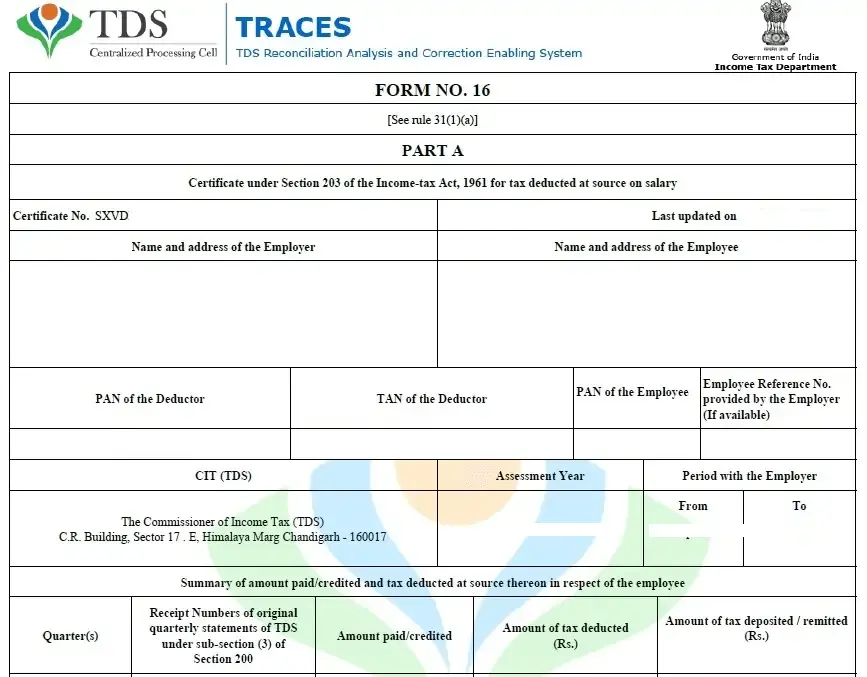

Form 16A is a document every employer of an organisation maintains for its employees. The document states the income sources of the employee and is more like a TDS(Tax Deducted at Source) certificate.

However, Form 16A shows TDS deducted and deposited on all other payments except salary.

[adinserter block=”3″] [adinserter block=”4″]The Components of Form 16A

The Form 16A means a document comprising many components, and they are:

- Deductor’s Name, PAN and TAN: The deductor can be:

- The bank deducting your TDS

- The insurance company from where TDS is applicable

- A person or place from whom you receive income on which TDS is applicable

- Deductee’s Name and PAN- the deductee can be an individual who receives TDS benefits

- Payment details such as:

- Payment date

- Payment amount

- Nature of payment

- TDS payment’s receipt number

How to Fill Form 16A?

- Enter the Deductor’s name and address, including their PIN (Postal Index Number).

- Fill in the Deductor’s TAN (this is an alphanumeric number with the first four digits in alphabets and 5 in digits, and 1 in alphabets).

- You will also need to enter the Deductor’s PAN (an alphanumeric number with the first four in alphabets, five in digits, and one in alphabets).

- Enter the data for four acknowledgement numbers.

- The type of payment follows, whether contractual, professional or otherwise.

- Enter the corresponding codes for all payments mentioned.

- The name of the deductee.

- Enter the PAN number of the deductee in the specified column.

- Enter the period, which will be the fiscal year. For example, the fiscal year will run from 1 April 2019 to 31 March 2020.

- After you’ve completed all of these fields, you’ll need to enter the TDS deduction information.

- State the TDS amount in words.

How to Get Form 16A?

Usually, the deductor issues the form 16A document to an employee for the current financial year and reflects the following:

- Total earnings

- Total income taxes deducted for that financial year from other sources of income apart from your salary

You can get the form 16A document by following the below steps:

- Navigate to the online website of the income tax department.

- Download the form 16 A document either in the fillable form or pdf.

When is Form 16A Required?

A “TDS Certificate.” is issued by a deductor when payments from non-Salary incomes are made like – TDS Professional fees, Rent, and Bank Interest payments to the IT Department.

As it carries all amounts of TDS deposited with the Income Tax Department, the form 16A document acts like a TDS certificate. Therefore, when filing Income Tax returns, you need all these details in Form 16A.

[wp-faq-schema title=”FAQs about Form 16A”]