A cancelled cheque is a cheque having two parallel lines drawn across it with the word “CANCELLED” written in between.

A cancelled cheque leaf confirms that the individual has a bank account and it prevents from being used for further withdrawals from the drawer’s account.

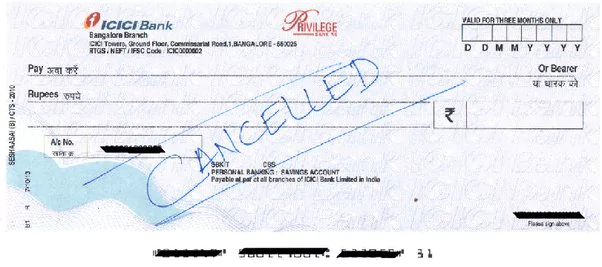

A cancelled cheque has the following components in it:

- Bank name

- Account number

- Account holder’s name

- MICR code, IFSC code

A cancelled cheque sample:

When do you need a Cancelled Cheque?

You will need a cancelled cheque under the following circumstances:

- Requirement of proof while creating an account with any bank, while applying for an insurance policy, a new Demat account, and withdrawal of PF.

- If you made a mistake when writing the cheque.

Things to be aware of while using a Cancelled Cheque

- On a cancelled cheque, always use black or blue ink. Other colours are not permitted.

- After using the cheque, shred it so no one can use it again.

- You can use the cheque several times.

- As long as the time details on the cancelled cheque remain valid, it is prone to fraudulent activities because it contains your account number, IFSC code, bank name and branch address, MICR code, and other information.

How to write a Cancelled Cheque?

Following are the steps to cancel a cheque:

Step 1: Remove a new cheque from your cheque book and cancel it.

Step 2: You must draw two parallel lines across the cancelled cheque.

Step 3: Write the term “CANCELLED” on the document in capitals between those two lines.

If the cheque contains an error, follow the steps from step 2 to cancel it.

Try not to make the following mistakes:

- Don’t sign or write anything on the cancelled cheque. There is no need to put an entry on the cheque because miscreants can fraudulently use the details and signature to withdraw money from your account because the cheque serves as proof of your bank account.

- Make sure you don’t cover important information on the cancelled cheque, such as the account number, account holder’s name, MICR code, IFSC code, address of the bank where the account exists, and so on.

- Hand over the cancelled cheque only to the person concerned, the reason being the misuse of these misplaced cheques.

Uses of Cancelled Cheques

You can use a cancelled cheque in the following situations:

1. New Bank Account Opening

Banks would ask for the submission of a cancelled cheque while someone opens a bank account to complete the account opening process.

2. Loan Applications

Every bank would need you to submit a cancelled cheque while applying for a loan.

3. EMI Payments

Financial institutions would want you for a cancelled cheque when you buy any item on an EMI basis.

4. Mutual funds

The investment organisation requires you to submit a cancelled cheque to verify your KYC details when you invest in mutual funds.

5. EPF withdrawal

The EPO(Employee Provident Fund Organization) would demand a cancelled cheque to confirm that the concerned individual is you and not someone else if you withdraw your Provident Fund (PF) offline.

6. ECS(Electronic Clearance Service)

Banks would require a cancelled cheque if you opt for the Electronic Clearance Service (ECS) to deduct funds from your account automatically.

7. Insurance

Insurance companies would ask for cancelled cheques while issuing an insurance policy, be it money back, term, endowment, or health.

8. DEMAT ACCOUNT

The stock brokerage needs the submission of a cancelled cheque along with a form for opening the account and other KYC documents such as proof of identity and address at the time of opening a Demat account.

9. Know Your Customer (KYC)

For banks, a cancelled cheque is relevant in KYC to prove active participation in stock investments and mutual funds.

[adinserter block=”3″] [adinserter block=”4″][wp-faq-schema title=”FAQs on Cancelled Cheque”]

Read Articles on:

MSME Registration in India

GST Online Payment Process

Udyog Aadhar Registration

GST Registration Status