GST Invoice Format

A well-designed GST invoice format is crucial for businesses to document their transactions accurately while complying with GST regulations. Using the right GST bill format allows businesses to easily create invoices, track taxable supplies, and ensure smooth tax filings. Use myBillBook billing software to generate GST-compliant invoices seamlessly!

✅ Automatic GST Calculation

✅ Customisable Invoice Templates

✅ Single Click e-Invoice Generation

✅ Easy GSTR Filing

✅ GSTR Reports

✅ Pricing Starts at INR 399/Year

GST Invoice Format

A well-designed GST invoice format is crucial for businesses to document their transactions accurately while complying with GST regulations. Using the right GST bill format allows businesses to easily create invoices, track taxable supplies, and ensure smooth tax filings. Use myBillBook billing software to generate GST-compliant invoices seamlessly!

✅ Automatic GST Calculation

✅ Customisable Invoice Templates

✅ Single Click e-Invoice Generation

✅ Easy GSTR Filing

✅ GSTR Reports

✅ Pricing Starts at INR 399/Year

Free GST Invoice Format in Word, Excel & PDF | Download Free

Features of myBillBook GST Invoice Generator

Customised GST-Compliant invoices

myBillBook offers fully customisable GST invoices with multiple invoice theme options that can comply with GST requirements.

Read more

You can easily customise GST bill formats by adding your company’s logo and changing font, colours and other aesthetics that suit your brand identity. The invoices prepared in myBillBook comply with GST by containing all the mandatory fields required under GST.

GST Invoice Prefix & Invoice Number of Your Choice

Set your own invoice prefixes and number sequence.

Read more

This means businesses can have a continuous numbering system for their invoices, making it easier to keep track of all invoices. Organisations can easily arrange their invoices by changing the prefix and number digits to streamline their invoicing process.

Single Click e-Invoice & e-Way Bill Generation

myBillBook produces e-invoices and e-way bills without any hassles.

Read more

With just one click, you can automatically generate e-invoices without visiting the government’s Invoice Registration Portal (IRP). Similarly, you can generate e-way bills directly from the software.

Easy GSTR-1 Filing

GSTR-1 filing is an important compliance requirement under the GST regime.

Read more

myBillbook has simplified this process through the GSTR-1 easy filing feature. Businesses can easily generate GSTR-1 reports directly from the platform instead of compiling and filing forms manually, which takes time and effort. Our system helps streamline GSTR-1 filing, ensuring companies do not default late or file incorrectly, attracting penalties.

Detailed GSTR-2 & GSTR-3b Reports

In addition to filing GSTR-1, myBillBook provides detailed GSTR-2 and GSTR-3B reports that help businesses track their input tax credit and tax liability.

Read more

These reports offer an overview of all GST transactions carried out by the business, making it easier to reconcile the tax credits and liabilities. With these detailed reports and comprehensive information, companies can make sound financial decisions and maintain accurate records.

Easily Track the Status of Paid & Unpaid Invoices

Tracking paid and unpaid invoices is very important for cash flow management and financial planning.

Read more

myBillBook makes tracking simple for businesses through updates on invoice status. From monitoring overdue invoices to keeping track of payments received and taking necessary steps towards managing cash flow efficiently, the billing app does it all.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

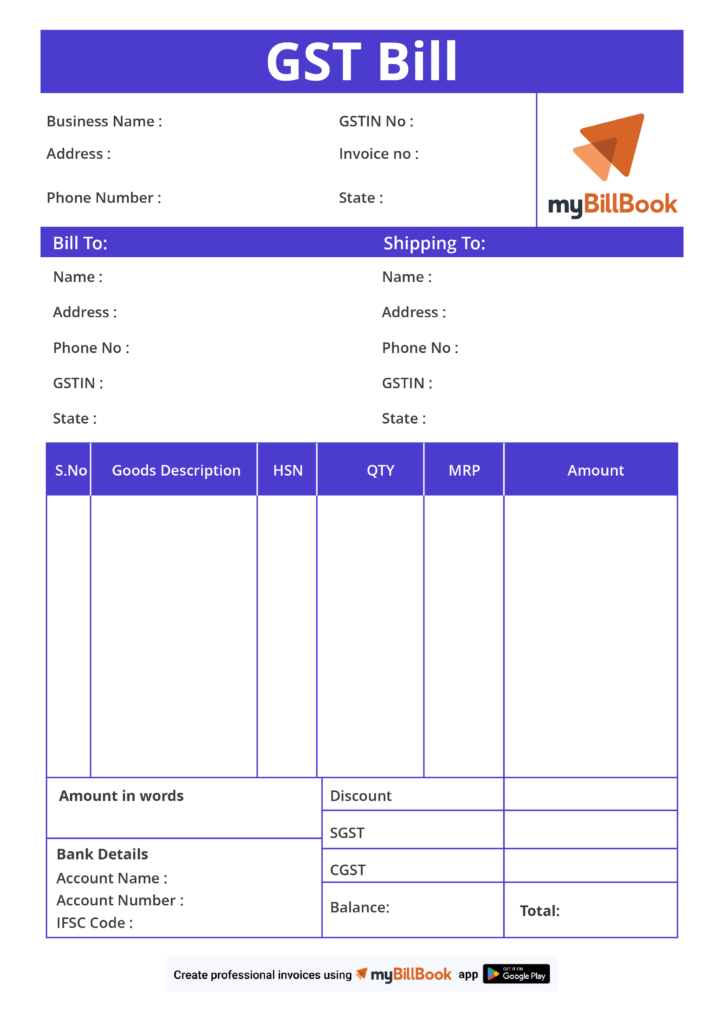

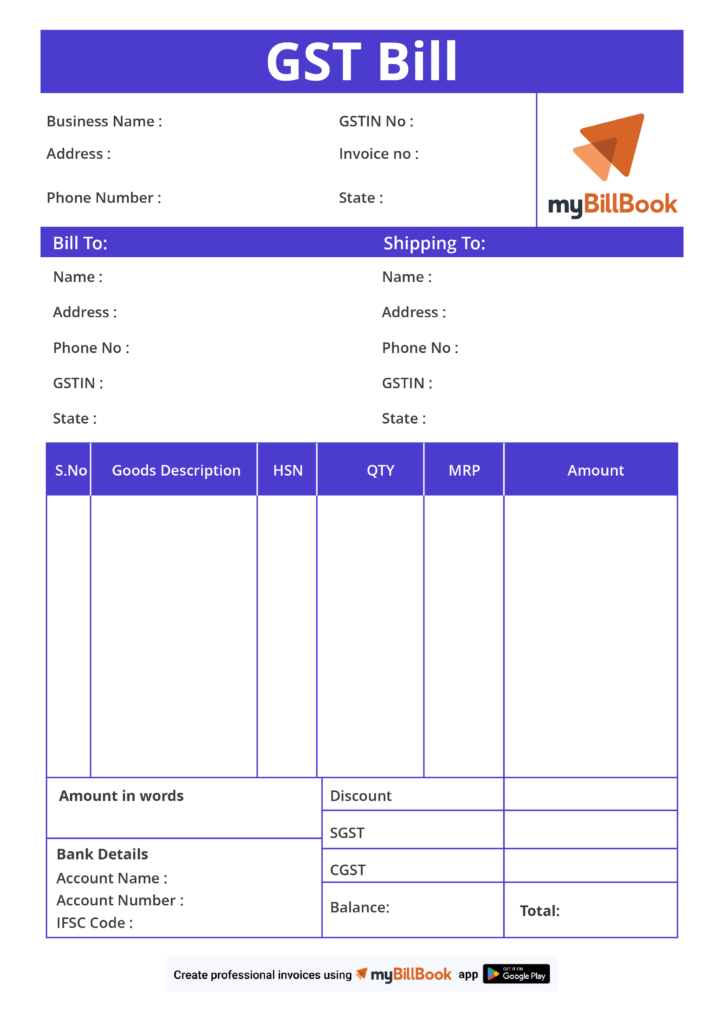

What is GST Invoice Format | GST Bill Format Meaning

GST invoice format is a standard document layout that records the sale of goods or services and transactions under GST. It includes important details such as the seller’s and buyer’s information, description and quantity of the offered goods or services, applicable tax rates, total amount charged, and other required tax compliance details.

Contents of GST Tax Invoice Format

According to GST laws, a tax invoice shall be issued by the registered person containing the following particulars-

- Name, address and Goods and Services Tax Identification Number of the supplier;

- A consecutive serial number not exceeding 16 characters, in one or multiple series, containing alphabets or numerals or special characters- hyphen or dash and slash symbolised as ―-‖ and ―/‖ respectively, and any combination thereof, unique for a financial year;

- Date of its issue;

- Name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;

- Name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is INR 50,000 or more;

- Name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is less than INR 50,000, and the recipient requests that such details be recorded in the tax invoice;

- Harmonised System of Nomenclature Code (HSN code) for goods or services

- Description of goods or services;

- Quantity in case of goods and units or Unique Quantity Code thereof;

- Total value of supply of goods or services or both;

- Taxable value of the supply of goods or services or both, taking into account discount or abatement, if any;

- Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- Place of supply along with the name of the State, in the case of a supply in the course of inter-state trade or commerce;

- Address of delivery where the same is different from the place of supply;

- Whether the tax is payable on a reverse charge basis;

- A signature or digital signature of the supplier or his authorised representative

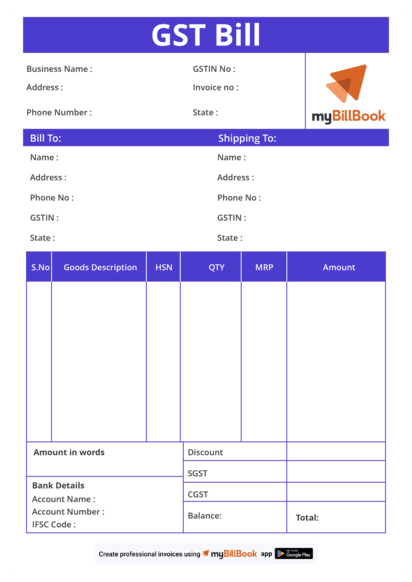

Sample GST Invoice Format

Here is a sample GST bill format or template for your reference. The design element can vary based on your brand’s image or other factors, but the content and the fields must follow GST regulations.

GST Invoice Format in Word | Bill Format in Word

Creating a GST bill format in Word is one of the easiest methods. Word is best suitable for small and medium-sized enterprises as it is an affordable and easy-to-use tool. Anyone with basic Word knowledge can use the software to create an invoice template. Here are the steps to create GST invoice format in Word from scratch.

- Open Microsoft Word on your laptop or computer.

- Open a blank document to start your invoice template.

- Insert the company logo by selecting ‘Insert > Image’ and uploading the logo image.

- Click on the ‘Header & Footer’ tab and give the header for the sheet as ‘Tax Invoice’.

- Enter your company details, including company name, address, email ID and GSTIN.

- Next, enter customer details like name, company name, address, email ID and GSTIN/UN.

- Now, create fields like Invoice No., Date, Due Date, Terms, etc.

- Then, create the ‘Goods or services’ section to enter data, including the name of the product/service, quantity, tax rate, discount, unit, total amount, etc., as per your business requirement.

- At the bottom of the page, provide your bank details and other payment modes like UPI bar code, UPI ID, or UPI phone number.

GST Invoice Format in Excel | Bill Format in Excel

The GST invoice format in Excel is another great way to format invoices. Excel has an extra feature compared to Word, as it allows the insertion of formulas to auto-populate data. This feature is not available in Word, making GST bill formats in Excel a better alternative for accurate billing. Here is how to create a GST bill format using MS Excel-

- Open MS Excel on your laptop or mobile and start with a new worksheet.

- Upload the company logo in the blank sheet by clicking on ‘Insert > Picture’.

- Click on the ‘Header & Footer’ tab and give the header for the sheet as ‘Tax Invoice’.

- In the next cell, enter your company details, including company name, address, email ID and GSTIN.

- In the next cell, create an ‘Invoice To’ field to enter customer details such as name, company name, address, email ID, and GSTIN/UN.

- To the right of the ‘Invoice To’ section, create fields like Invoice No., Date, Due Date, Terms, etc.

- Right below the ‘Invoice To’ section, create the ‘Goods or services’ section to enter data, including the product/service name, quantity, tax rate, discount, unit, total amount, etc., as per your business requirement.

- At the bottom of the page, provide your bank details and other payment modes like UPI bar code, UPI ID, or UPI phone number.

You can also insert some Excel formulas to auto-populate the cells when creating invoices.

Simple GST Invoice Format

GST-registered businesses have to issue simple GST invoices to customers. If a business is to be compliant with GST, it has to have an invoice numbering system along with GSTIN and a unique serial number on the tax invoice. Each invoice should include details such as the date of the invoice, sender’s and recipient’s information, descriptions of items, quantities, taxable supply values, tax rates applicable on supplies made to customers, amounts payable by customers towards taxes and final value. A simple GST bill format commonly comprises the goods or services supplied and the payment amount due.

How to Create GST Invoices Using myBillBook

Creating invoice format in Word or Excel can be time-consuming and difficult and might not always be the right choice. myBillBook is user-friendly accounting software designed to simplify invoice generation. By offering comprehensive features and an intuitive interface, myBillBook is a better solution for generating GST bills. Here is how to create a GST invoice using myBillBook-

- Login to myBillBook

- Go to “Settings” and then click “Manage Business.”

- Enter your business details, including your business name, type, industry, address, logo, bank account details, signature, etc., to be displayed on the invoice.

- Under ‘Sales’, click on ‘Sales Invoice > Create Sales Invoice.’

- Click on ‘Add Party’ – Enter your customer details like party name, mobile number, address, and GSTIN

- Click on ‘Add Item > Create New Item’ – Enter details like item type, item name, sales prices, category, item code, etc.

- You can also add details like discount amount, delivery charges, terms and conditions, bank details, etc., to be displayed on the sales invoice.

- Click on ‘Save Sales Invoice’

- Once it is done, you can view the complete invoice.

- Now, ‘Print’ or ‘Download’ the invoice and share it with your customers.

GST Invoice Format in PDF | Bill Format in PDF

A GST Invoice Template in PDF is the simplest way to send clients a visually appealing and organised invoice. Simply download the GST bill format, customise it with your company and client details, and email or print the invoice to your customer in PDF format. The invoices generated in PDF cannot be edited further, so they are secure. In addition, PDF invoice formats look professional so that users can share them directly with customers.

FAQs about billing software for PC

Can I use myBillBook Quotation Generator for free?

You can create up to 14 quotations for free on the myBillBook quotation generator. After that, you need to subscribe to avail of the service.

Quotation format in Word or Quotation Format in Excel, which is better?

Quotation format in Excel is easy to use compared to quotation format in Word as the rows and columns in sheets are predefined.

Can I trust myBillBook billing software with my business data?

Another important factor that makes myBillBook more reliable than any other online quotation generator is the safety and security of the information entered during the quotation generation process. All the information entered in myBillBook is end-to-end encrypted and is saved in secured cloud servers accessible only by authorised personnel. Further, the application takes regular backups to prevent any data loss.

What is the difference between quotation format and invoice format?

Both quotation and invoice formats might look almost similar, but the difference lies in the purpose they’re used for. While a quotation is generated even before the sale is confirmed, an invoice is generated before or after delivering the goods or services.

Is myBillBook quotation maker expensive?

By subscribing to myBillBook with a nominal fee, you will experience a lot more benefits than just quotation generation. myBillBook is a complete billing & accounting software that takes your bookkeeping practices to the next level. The basic plan starts at INR 399 per month.

Know more about Billing & Accounting Software for Small Businesses

- Restaurant Billing Software

- Billing Software for Distributors

- Jewellery Billing Software

- Billing Software for Grocery Store

- Legal Billing Software

- Hotel Billing Software

- Kirana Billing Software

- Supermarket Pos Software

- Pharmacy Billing Software

- Supermarket Billing Software

- Transportation Billing and Accounting Software

- 7 Tips for Choosing the Best Billing Software

- Mobile Shop Billing Software

- Restaurant POS Software

- Store Inventory Management Software

- Society Billing and Accounting Software

- Medical Billing Software

- Salon Billing Software

- Hospital Billing Software

- Textile Billing Software

- Cable TV Billing Software

- Billing Software for Bakery Shop

- Billing Software for Mac

- Accounting Software for Mac

- Retail Inventory Management Software

- ERP Accounting Software

- Real Estate Billing and Accounting Software

- Hospital Accounting System

- School Billing Software

- Department Store Billing Software

- Ecommerce Inventory Management Software

- Travel Agency Accounting Software

- Restaurant Inventory Management Software

- Construction Accounting Software

- How to Create Custom Invoice in myBillBook

- 31 Hacks to Streamline Your Billing Process