Affordable yet powerful solution to

manage & grow your business

Why Use myBillBook e-Way bill software?

Instant e-Way Bill Generation

Our solution can help you generate your e-Way bills in less than 30 seconds with great ease and no training at all.

Automatic Data Validation

myBillBook’s e-Way billing software provides multiple data validation checks to ensure data accuracy with absolutely zero manual intervention.

One Stop Billing Solution

With our AI-powered billing software, generate unified e-Way bills and e-Invoices in a single click. Also, complete all billings, whether GST or non-GST bills, debit and credit notes or delivery challans.

Remote Access and Anytime Billing

Our solution can help you generate, download, print, and share e-Way bills with suppliers from anywhere, at anytime.

Unlimited Generation of Bills

Create unlimited e-Way bills for all your businesses without worrying about errors or downtime.

24/7 support

We provide 24/7 support via call, chat, and WhatsApp in multiple languages.

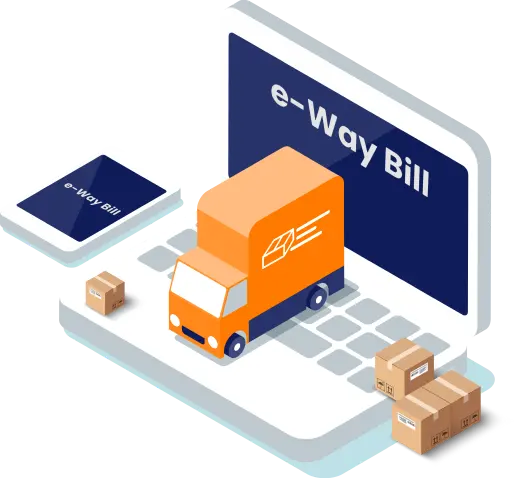

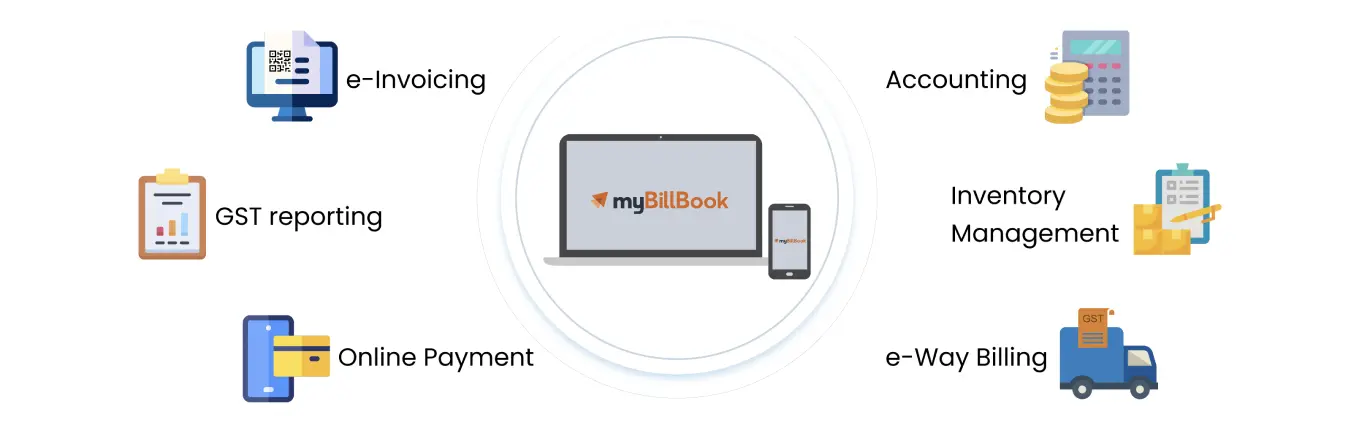

What makes myBillBook a one-stop solution

for all types of businesses?

Online store

Digitalise your store. Create digital catalogues and categories and list each product online.

Digitalise your store. Create digital catalogues and categories and list each product online. Set delivery charges or no-delivery charge policies and promote your online store by creating a personalised link that you can share via WhatsApp, Facebook, and SMS.

e-Invoicing

Create, download, and share e-Invoices and e-Way Bills for each customer or supplier. Perform multiple data validation checks to ensure data accuracy without manual intervention.

Create, download, and share e-Invoices and e-Way Bills for each customer or supplier. Perform multiple data validation checks to ensure data accuracy without manual intervention. Create tamper-proof delivery challans in seconds and get the consignor and the consignee to sign them and acknowledge the delivery of goods. A search tab allows you to find delivery challans quickly. Download, print/thermal print the challan, and share it via email, SMS, or Whatsapp.

POS billing

Use myBillBook's POS billing with barcode scanning and keyword shortcuts for quick and accurate billing and avoid long customer lines at billing counters.

Use myBillBook's POS billing with barcode scanning and keyword shortcuts for quick and accurate billing and avoid long customer lines at billing counters. Manage multiple counters and automatically update the related stock items when you generate an invoice using the retail POS billing platform. Also, get low stock alerts to avoid no-stock situations, preventing revenue losses and unnecessary expenses.

Inventory management

Start free trial to manage your company's inventory. Categorize your products, use a centralized dashboard view, and receive low-stock alerts.

Start free trial to manage your company's inventory. Easily categorise your products, use a centralised dashboard view, and receive low stock alerts. Generate reports to track overall inventory performance, view stock summaries, and sales and purchase totals. Know your best-selling item and restock it on time to avoid out-of-stock situations. Finally, add all new items to the accounting software.

Intelligent Reports

Convert your business data into 25 smart analytical reports for strategic business decisions. Create sales summary reports, party ledgers, profit and loss statements,

Convert your business data into 25 smart analytical reports for strategic business decisions. Create sales summary reports, party ledgers, profit and loss statements, GSTR sales and purchase reports, inventory reports, expense reports, and other documents. You can access all reports and change business plans with a few clicks and share them with CAs, accountants, and clients directly via WhatsApp or email.

The e-Way bill or electronic waybill refers ta paper under the GST regime before transporting or shipping goods worth more than Rs 50,000 within states. If you are in charge of a conveyance, you should carry a physical copy of the e-Way bill.

You should generate an e-Way bill if you are a:

- A GST-registered buyer or a seller who triggers goods movement in your vehicle

- A GST-registered transporter who receives goods without an e-Way bill

- An unregistered person inducing a transfer of merchandise by yourself or with the help of a transporter

- An unregistered person providing goods to a registered person

You should have the following documents handy before generating the e-way bill:

- Tax invoice, sales bill, or delivery challan

- Transporter’s Id

- Vehicle number

The e-Way bill has two parts:

- Part A:

- Recipient’s GSTIN

- Pincode

- Invoice

- Goods value

- HSN code

- Transport document number

- Transportation reasons

- Part B:

- Transporter Details

You can generate an e-Way bill using :

- SMS

- Web

- Android apps

- Bulk generation facility

- Site-to-site integration

- Visit the e-Way bill portland login.

- Under “e-Way Bill” on the dashboard, click “Generate New.”

- Fill in the required fields.

- Print the e-Way bill and carry it for transportation of goods.

The minimum distance needed for the e-Way bill is 50 Km from the consignor's place to the transporter's place.

- Visit the GST e-way bill portal.

- Select option 'For SMS' under the main option 'Registration'.

- To register the mobile number, enter it and enter the OTP.

- Log in to the e-way bill portal with your credentials.

- Next, enable the SMS e-Way bill generation on Mobile.

- Once the mobile number validation is complete, you can generate an e-way bill.

- The mobile number to send SMS for e-way bill generating is 77382 99899.

- The request is formatted as follows in SMS-'EWBL Date.' Send this SMS to 7738299899.

You need not generate an e-Way bill in the transport of:

- Transit cargo from Nepal to Bhutan

- Goods from ICD to customer port under the customs bonds

- Goods under custom supervision

- Goods for clearance from customs port, air, or land customs

- Goods with a non-motor vehicle

- Specific goods

- Goods that come under e-Way bill exemptions

- Goods through rail

- Goods within 20 km with a delivery challan

- Empty containers

- Goods under the defence ministry

No. If there is an error or improper entry in the e-way bill, you cannot edit or correct it. The only option is to cancel the e-Way bill and generate a new one with the correct details.