GST Export Invoice Format in Word, Excel & PDF

Export invoices are the key elements that represent your business in the international market. Creating professional, accurate and detailed export bills is a crucial responsibility for any business dealing with international trade. Here are some Export invoice formats you can download for free. You can also use myBillBook billing software, which helps you generate error-free export invoices effortlessly. Here are some of its features –

✅ Generate detailed & error-free export invoices

✅ GST-Compliance

✅ Be compliant with international standards

✅ Share Quotations on Whatsapp

✅ Track all export invoices in one place

✅ Enable various online/offline payments

✅ Customise export invoices

✅ Pricing Starts at INR 399/Year

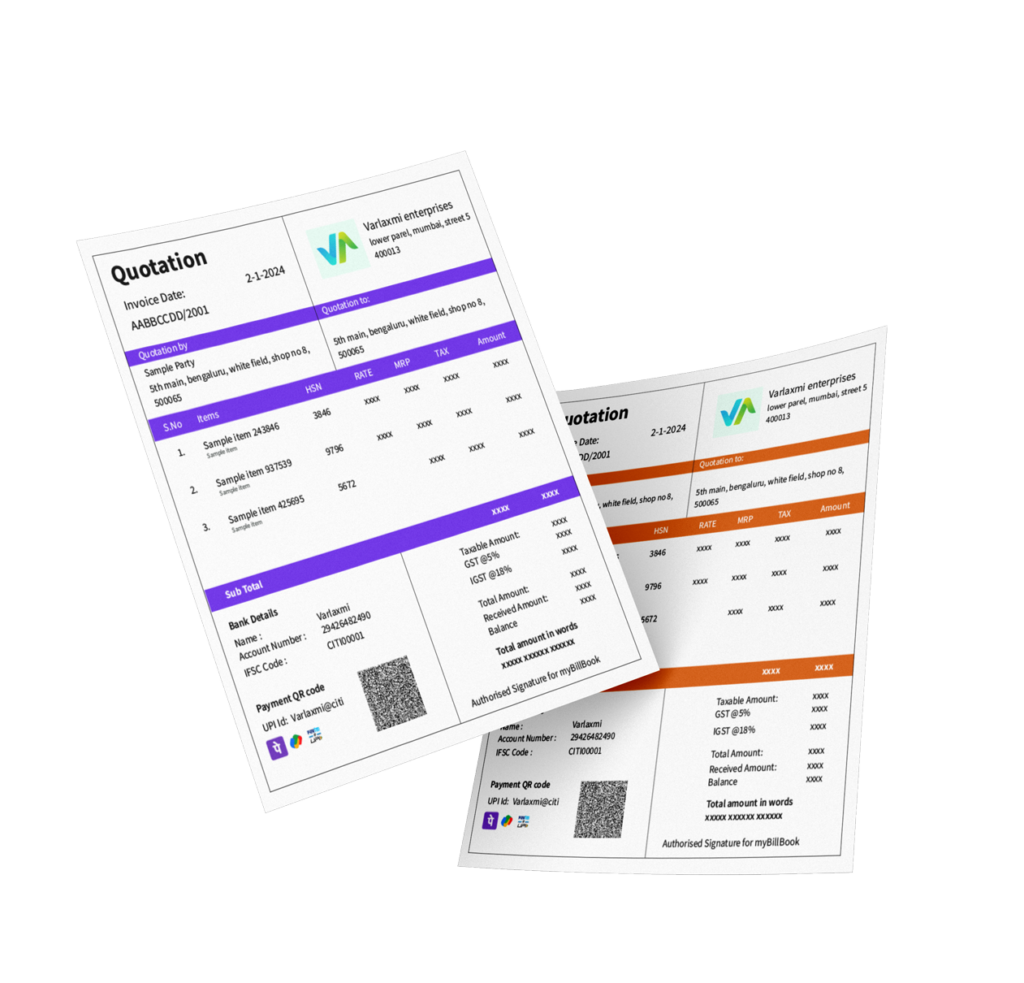

Quotation Format

A professional quotation format can significantly increase the chances of converting potential prospects into actual customers. Make your proposal clear and error-free with myBillBook – India’s No.1 Billing software.

✅ Generate Professional Quotes

✅ Personalise Your Quotations

✅ Convert Quotations into Invoices

✅ Share Quotations on Whatsapp

✅ Track Open/Closed Quotations

✅ Pricing Starts at INR 399/Year

Export Invoice Templates – Download for Free

Features of myBillBook Export Invoice Generator

Customised Export Invoices

You can choose from a variety of pre-defined export invoice templates or create customised you own templates that match your brand identity.

Read more

The templates provided by the billing software comply with all export regulations, making your job easy. As part of the customisations, you can add watermarks, logos, signatures, terms & conditions, payment options, and others to suit your trade.

Multi-Currency Support

To enable international transactions, myBillBook allows businesses to create export bills in different currencies.

Read more

Whether you are dealing with euros, dollars, pounds, yen, or any other currency, you can select the appropriate currency for each invoice based on the preferences of your international clients or the currency of the transaction.

Automated Reminders and Payment Tracking

Get reminders for outstanding invoices and follow up with your clients efficiently.

Read more

The automatic reminder feature notifies both parties of upcoming due dates and overdue invoices. This reduces the risk of late payments and improves cash flow. It also provides insights into customer payment behaviour so that you can identify potential issues early and take proactive measures to resolve them.

Cloud Storage and Accessibility

Our cloud-based billing software securely stores all export invoices in fully encrypted cloud servers.

Read more

With cloud storage, you can retrieve export invoices on-demand, streamline client communication, and maintain a centralised repository for all export-related documentation. This remote accessibility empowers the exporter business to efficiently manage the invoicing process while maintaining flexibility and scalability as their business grows.

Financial Reporting

Get comprehensive reports on export transactions, revenue, taxes, and more.

Read more

The software provides valuable insights into the financial performance of your export business, helping you make informed decisions and strategic planning. The financial reporting capabilities empower you to effectively monitor and optimise your financial operations for greater success.

Tax Calculation and Compliance

This is one of the trickiest parts of compiling export invoices. With myBillBook, you can rest assured that the tax calculations are taken care of.

Read more

The export bill generator features built-in tax calculation capabilities, ensuring accurate tax calculations. Based on the type of goods or services being exported, the billing software will automatically calculate the tax and ensure compliance with international tax regulations.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

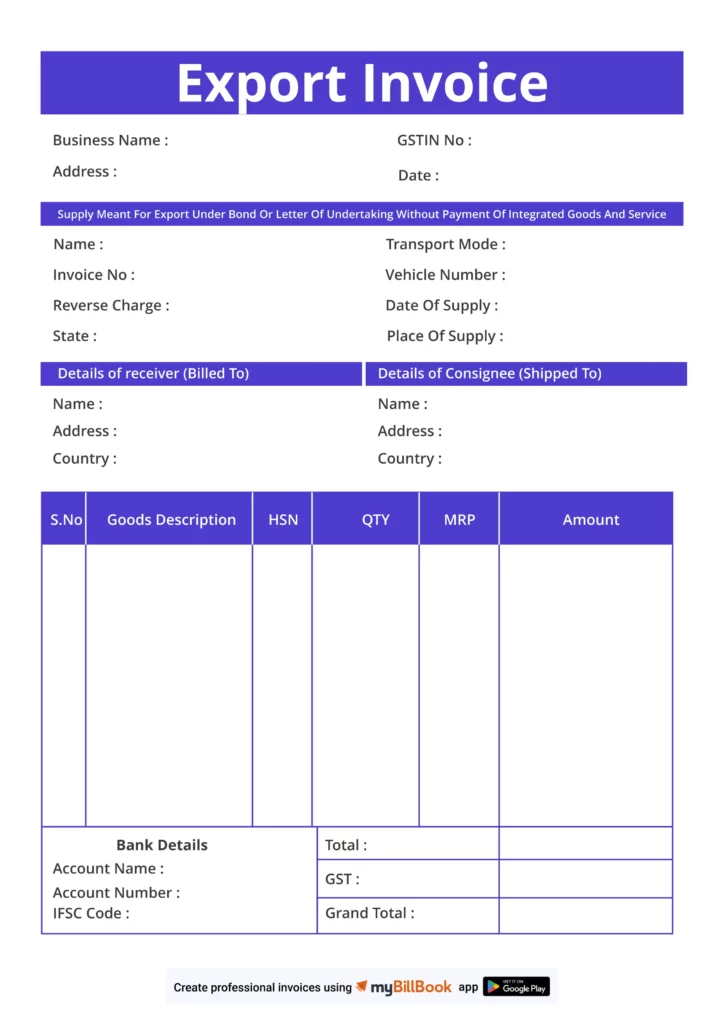

What is Export Invoice Format Under GST?

An export invoice format under GST is a document that outlines the details of a transaction between an exporter and an importer, including the goods or services sold, price, and other relevant information required for customs clearance.

An export invoice format under GST must comply with the regulations and requirements of both the exporting and importing countries. It must include specific information, such as the names and addresses of both parties, a description of the goods or services, the value of the transaction, and any applicable taxes or fees. The format may vary depending on the industry, product, or country of origin.

Export Invoice Format: Details to be Included

When creating an export invoice format under GST, it should incorporate specific essential components to ensure accuracy, such as

- Export Invoice Number

- Buyer’s Order Number

- Exporter Details – Address of the Exporter, Phone Number, Fax, Mail

- Consignee Details – Address of the Importer, Phone Number, Fax, Mail

- Buyer Details (If other than consignee)

- Pre-Carriage Done by details

- Place of Receipt of per carrier

- Country of Origin of Goods

- Country of Origin of Destination

- Vessel/Freight Number

- Port of Loading

- Port of Discharge

- Final Destination

- Terms of Delivery and Payment

- Description and number of goods

- Kind of Package

- Quantity – Gross Weight

- Total Net Weight

- Rate per carton

- FOB & Freight Charges

- Total Amount

- AWB/B/L Number

- Amount Chargeable (in Words)

- Name of the Exporter, Signature, & Date

The list includes the crucial elements that an export invoice format under GST should contain to ensure accuracy and compliance with customs regulations. By following this checklist, companies can avoid errors and potential delays in the export process.

Sample Export Invoice Format

A sample export invoice format under GST is a reference point for creating a personalised export bill format that fits a company’s specific needs. Reviewing the sample provides an understanding of the layout and information that should be included.

What is Export Proforma Invoice Format

An export proforma invoice is a preliminary bill of sale issued by the exporter to the buyer before a commercial invoice is issued. It outlines the details of the goods or services to be provided, including quantity, price, terms of sale, and other relevant information. The specific format may vary depending on the exporter’s preferences and the importing country’s requirements.

You can use myBillBook to generate export proforma invoices that match your brand identity and trading requirements. It helps you create professional export proforma invoices in less time and with more precision. You can also keep track of all the proforma invoices created and once the proposal gets approved, you can use the same information to create actual commercial invoices.

Sample Export Proforma Invoice Format in Excel

Here is a sample export proforma invoice format created using Excel. This sample invoice format would give you a basic understanding of an export proforma invoice.

Export Invoice Format in Word

The export invoice format in Word is a highly customisable and user-friendly formatting option that allows easy editing. It can be converted to PDF for sharing with clients or stakeholders. The provided sample can be used as a reference to understand the data and organisation required for an export invoice.

Export Invoice Format in PDF

The export invoice format in PDF is a secure format that enables easy sharing and accessibility to financial information on any device. The sample provided can be used as a guide to understanding the necessary data and organization required for an export bill.

Export Invoice Format in Excel

The export invoice format in Excel provides features such as calculation, graphing capabilities and password protection for security purposes. The sample export bill format in Excel available here is a pre-designed template that can be used to create export invoices. The template is created in Excel and can be easily edited to include all the necessary information required for invoicing. In addition, the invoice can be printed or exported to a PDF for easy sharing and storage.

Choosing an export invoice format in Excel is a smart choice for several reasons. Excel is easy to use and customisable, has built-in functions for calculations, and allows for the creation of visual aids. Plus, it is a digital format that is easy to store and share, especially with international customers. Excel files can also be password-protected for added security.

myBillBook offers free export invoice templates that you can download in Excel. These templates are expertly crafted and contain all the important information that an export invoice should have, saving you time and effort. Having accurate export invoices handy can also aid you with your inventory logistics.

How to Create Export Invoice Format in Excel

If you wish to create export bill templates in Excel, you can follow the below-given steps.

- Start by opening a new Excel document and creating a table with appropriate columns for the invoice information, such as item description, quantity, unit price, and total amount.

- Include a header row with the company’s name, contact information, and a unique invoice number.

- Include a section for the customer’s information, including their name, address, and contact details.

- Add a section for the shipping details, including the date of shipment, shipping method, and destination address.

- Add columns for any taxes or additional charges that may apply to the invoice.

- Make sure to include a calculation for the invoice total by adding up all the charges.

- Add a footer with additional information, such as payment terms and instructions.

- Save the document as a template for future use.

FAQs about billing software for PC

Why is it important to comply with regulations when creating an export invoice format?

Compliance with regulations ensures the invoice is legally valid and facilitates a smooth export process.

Can the format of an export invoice vary between industries or countries?

The format may vary depending on the industry, product, or country of origin.

What is the purpose of including HSN codes in an export invoice format?

HSN codes identify the products being exported and are required for customs clearance.

Is it necessary to include the signatures of both parties in an export invoice format?

Yes, including both parties' or authorised representatives' signatures provides legal validation of the transaction.

How can an export invoice format in Excel be beneficial?

Excel provides features such as calculation, graphing capabilities, and password protection for security purposes, making it an efficient and secure option for creating and sharing an export invoice format.

What is the standard format for an export Invoice in Excel?

The standard export invoice Excel format typically includes the following information: invoice number, invoice date, buyer and seller data, description of goods, quantity and unit price of goods, total amount, shipping information, and applicable taxes or discounts.

Can you provide an Excel sample export invoice format that I can use for my business?

You can find many sample export invoice formats in Excel templates online that you can use for your business. Some of these templates can be customised according to your needs and preferences.

Are there any legal requirements for the export invoice format in Excel that I need to be aware of?

Depending on the country of export and import, there may be specific legal requirements for the export invoice Excel format that you need to follow. So, it is best to check with your local government's trade department or consult a trade lawyer to ensure compliance.

How do I include shipping information in my export invoice format in Excel?

You can include shipping information in your export invoice format in Excel by adding a section for the shipping details, such as the carrier, tracking number, mode of transport, and estimated delivery date.

Can software or tools help me create an export invoice format?

Yes, there are several software and tools available that can help you create an export invoice format in Excel. Some popular options include invoicing and accounting softwares like myBillBook, and spreadsheet software such as Microsoft Excel.

Know more about Billing & Accounting Software for Small Businesses

- Restaurant Billing Software

- Billing Software for Distributors

- Jewellery Billing Software

- Billing Software for Grocery Store

- Legal Billing Software

- Hotel Billing Software

- Kirana Billing Software

- Supermarket Pos Software

- Pharmacy Billing Software

- Supermarket Billing Software

- Transportation Billing and Accounting Software

- 7 Tips for Choosing the Best Billing Software

- Mobile Shop Billing Software

- Restaurant POS Software

- Store Inventory Management Software

- Society Billing and Accounting Software

- Medical Billing Software

- Salon Billing Software

- Hospital Billing Software

- Textile Billing Software

- Cable TV Billing Software

- Billing Software for Bakery Shop

- Billing Software for Mac

- Accounting Software for Mac

- Retail Inventory Management Software

- ERP Accounting Software

- Real Estate Billing and Accounting Software

- Hospital Accounting System

- School Billing Software

- Department Store Billing Software

- Ecommerce Inventory Management Software

- Travel Agency Accounting Software

- Restaurant Inventory Management Software

- Construction Accounting Software

- How to Create Custom Invoice in myBillBook

- 31 Hacks to Streamline Your Billing Process