Free Cash Memo Formats in Word, Excel, PDF

Download cash memo formats for multiple businesses

Simple Cash Memo Format

A simple cash memo format helps you record cash transactions quickly and efficiently. Ideal for small businesses and retailers, this format makes record-keeping hassle-free. Download a simple cash memo template in Word, Excel, or PDF and start using it instantly.

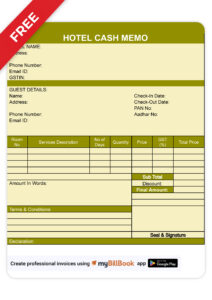

Cash Memo Template for Hotels

A hotel cash memo format allows you to provide customers with a detailed bill for their stay, food, and other services. The cash memo template for hotels helps you maintain accurate billing records and ensures transparency with guests. Download it in Word, Excel, or PDF format for easy use.

Mobile Shop Cash Memo Format

A mobile shop cash memo format helps you provide customers with a clear record of their purchases, whether it’s mobile phones, accessories, or repair services. This format ensures transparency and serves as proof of purchase for warranty claims. Download it in Word, Excel, or PDF format for hassle-free billing.

Restaurant Cash Memo Format

A restaurant cash memo helps you provide customers with a detailed bill for their food and beverages. The restaurant cash memo ensures clear and professional billing while keeping records organized for accounting purposes. Download it in Word, Excel, or PDF format for easy use.

“Best free software to create invoices like quotations, sales and purchase invoices, delivery challans and more, on both mobile and laptop”

Features of Cash Memo Formats on myBillBook

Effortless Cash Memo Creation

Generate cash memos quickly and professionally without the hassle of manual writing. Simply enter the transaction details, print, and get a well-structured receipt in seconds.

Pre-Defined Invoice Templates

No need to create cash memo formats from scratch! Choose from a variety of professionally designed templates that match your brand image. Simply select a template and start using it instantly.

Personalized Designs

Customise Cash Memos – Add company logo, watermark, signature, and more. Choose the font style, colour, and other design elements to create a professional and unique cash memo that represents your business.

Print or Share with Ease

Easily download, print, email, or WhatsApp your cash memo directly from the billing software. Whether you prefer physical copies or digital receipts, sharing cash memos has never been simpler.

Automatic Calculations

Eliminate manual errors with automated calculations for totals, taxes, and discounts. The billing software ensures accuracy in every transaction, saving time and effort while preventing miscalculations.

Secure Cloud Storage

Keep all your cash memos safe and easily accessible with cloud storage. No need to worry about misplaced receipts—retrieve past records anytime, anywhere for seamless accounting and record-keeping.

Try India’s easiest billing and invoicing platform

“Creating cash memos is now quick and easy. The ready-made templates save time and look professional.”

Rajesh Verma, Verma Electronics

“Printing and sharing cash bills is seamless. I can send receipts via WhatsApp in just one click.”

Sneha Patel, SP Supermarket

“The customization options are great! I can add my logo and signature to make my cash memos stand out.”

Amit Khanna, Red Rose Restaurants

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Cash Memo: Meaning, Formats in Word, Excel

What is a Cash Memo?

A cash memo, also known as a cash receipt, is a document issued by a seller to a buyer recording a sale made in cash. It serves as a piece of evidence that the purchaser has made the payment. A cash memo acts as documentary evidence of all the cash sales made by a business. A cash memo is issued to a buyer and is typically created along with a duplicate copy, which is retained with the business for its own records.

A cash memo is no less than an invoice and is considered a legal document. A duplicate cash memo is always filed to record all the cash sales of a business. The records are further used to pay taxes and file tax returns for stock management and cash flow management.

A cash memo lists the name of the products, number, price, discount, taxes, etc., along with the buyer’s name and contact details. The sellers usually hold a copy of every cash receipt for themselves and record it in the books of accounting.

These Invoice Formats are typically used by micro, small and medium enterprises across industries, including FMCG, vegetables & fruits, kirana, textiles, electronic goods, and so on.

Difference Between a Cash Memo and an Invoice

Both invoices and cash memos serve as records of sales transactions. However, the use case of both documents is different. A cash memo is issued for immediate cash transactions, while an invoice is used for credit transactions where payment is made at a later date.

A cash memo records only the sales made in cash. In contrast, an invoice is used to record credit sales transactions.

An invoice is issued requesting payment for the goods or services sold on credit. On the other hand, cash memos are usually issued after receiving the cash payment at the time of purchase.

Invoices are used for credit transactions, where the buyer is allowed to pay at a later date, typically within a specified credit period. Unlike a cash memo, an invoice does not involve immediate payment at the time of the transaction.

Sample Cash Memo Format – Main Contents

Different businesses follow different cash memo bill formats. There is no standard format set by any regulations for cash memos. However, while using a cash memo, make sure the following fields are included for easier data entry.

- Name of the buyer and contact details

- Name of the purchaser and contact details

- Serial number of a cash memo

- Date

- Order number

- Item description

- Quantity

- Price

- Discount

- Tax registration number

- Terms and conditions

Cash Memo Format in Word or Google Docs

Using MS Word is one of the easiest ways to create a cash memo format. Using a sample cash memo format, you can create a similar one in a blank Word document.

Using the sample cash memo format provided here, open a blank Word document, create a similar document with your business details, and save it. Make sure to insert all the contents listed here.

Whenever you wish you generate a cash memo bill, open the cash memo Word document, make a copy of it, fill in the details, save it with a different name and use it. Make sure not to make any changes to the original cash memo format document.

If you don’t have MS Word, you can follow a similar procedure to create a cash memo format in Google Docs, which is a free source. All you need is a Google account to access G-Docs.

Cash Memo Format in Excel or Google Sheets

MS Excel has the edge over MS Word as it allows tables and formulas to auto-populate information. For instance, the total price of the products in a cash memo can be auto-generated by inserting a formula. Similarly, the date, tax rate, discount, etc., can be calculated automatically using an Excel sheet.

If you want to create a cash memo format in Excel, you can do it in a blank Excel Sheet by using any sample cash memo format as a reference.

If you don’t have access to Excel, you can also use Google Sheets to do the same. Google Sheets is a free source available to everyone with a G-mail account.

Cash Memo Format in PDF

To create a cash memo format in PDF, you should first create a cash bill format in Word or Excel using the above-mentioned details.

Once it is ready, you can download it as a PDF to view the cash bill format in PDF. However, you cannot make any changes once the file is downloaded. Therefore, fill the cash memo format in Word with all the required details, and once you’re sure that the data entered is correct, you can download it as a PDF.

One advantage of using PDF cash memos is that the data cannot be edited or changed. Especially when sharing online, cash bills in PDF are safer than cash memos in Word and Excel. However, any cash memo format is fine when taking hard copies, i.e., as printouts.

The Pros and Cons of Using a Cash Memo

For small businesses, a cash memo is a handy tool to generate bills. Cash memo is simple to use and is easy to keep track of all sale transactions. A cash memo is a legal document and hence can be used for all bookkeeping and tax filing purposes.

No computers or other hardware is required as cash memos are handwritten. A cash memo is signed by an authorized person and hence is an authorised document. Cash memos are best for cash flow management as the business receives cash immediately after the sale. There won’t be any outstanding dues on the cash memos hence making the working capital position of the business good.

The major drawback of using cash memos is that they can be easily manipulated as they are handwritten. They are not suitable for large enterprises as the sales take place on a larger scale.

Tax filing becomes difficult as everything needs to be done manually. For those vendors who need goods on credit, a cash memo cannot serve the purpose. More chances of errors in calculations due to manual filing and calculations. Cash sales on a large scale are often risky as it increases the instances of fraud and stealing.

Benefits of Using myBillBook to Generate Cash Memos

If your business is in a transition phase and when you’re upgrading your billing practices, you can look for alternatives to cash memos, as they possess significant drawbacks. Choosing an efficient billing and account software is one such option available in today’s market. myBillBook offers a variety of GST-compliant billing and accounting features that enhance efficiency. For businesses in retail, consider exploring our retail billing software to further streamline your operations.

With myBillBook billing software, choosing an ideal cash memo bill format for your business becomes highly convenient and efficient. Check out some of the benefits of using myBillBook for generating cash memos for your business:

Downloadable formats: The templates available on myBillBook invoicing software are simple designs that you can easily download on your PC or mobile. You can also sync these devices to access cash memos on the go.

Easy to print and share: Cash memos generated using myBillBook can be printed using a regular thermal printer. However, if you believe in reducing your carbon footprint, you can also share these memos online via email and Whatsapp.

Variety to choose from: You can select the cash memo bill format of your choice, among those available on myBillBook, as per the details you want to be included in it. These cash memos are suitable for all types of industries and businesses.

Improved business efficiency: By managing your inventory in real-time and organising all your payables and receivables in one place, you can focus on other essential aspects of the business and improve your business efficiency to a significant extent.

Other features: With myBillBook, you get access to many more accounting and billing features that can propel the growth and advancement of your business. These include invoice generator, quotation generator, proforma invoice generator, inventory management software, business reports, POS billing and a lot more.

FAQs on Cash Memo Formats

What is a cash memo?

A cash memo, also known as a cash receipt or sales receipt, is a document issued by a seller to a buyer as proof of a cash transaction. It includes details such as the date, seller and buyer information, description of goods or services, quantity, price, and total amount due.

Is a cash memo different from an invoice?

Yes, a cash memo is issued at the time of a cash sale, while an invoice is issued for credit transactions where payment is made at a later date. While both serve as records of sales transactions, a cash memo is for immediate payment transactions, whereas an invoice is for credit transactions.

Can I customize the cash memo format?

Yes, you can customize the format of your cash memo to suit your business needs. You can include your company logo, customize the layout and design, and add any additional information or branding elements as desired.

Is a cash memo legally binding?

While a cash memo serves as proof of a transaction, it may not always be legally binding on its own. However, it can be used as evidence in case of disputes or discrepancies and is generally recognized as a valid record of the transaction.

Why is a cash memo important?

A cash memo serves as a record of the transaction and provides both parties with documentation for accounting and reconciliation purposes. It helps ensure transparency and accuracy in cash transactions and facilitates smooth business operations.

Know more about Billing & Accounting Software for Small Businesses

Retail Inventory Management Software

Real Estate Billing and Accounting Software

Department Store Billing Software

Ecommerce Inventory Management Software

Travel Agency Accounting Software

Restaurant Inventory Management Software

Construction Accounting Software