Catering Bill Format

Design clear, professional catering bills with food charges, service fees, and GST. Instantly share with clients using editable Word, Excel & PDF templates.

myBillBook digital billing software offers editable catering bill templates in Word, Excel & PDF—making it easy to generate branded, compliant bills with all necessary details.

Download Catering Bill Templates (Word, Excel & PDF)

Easy-to-use templates with clear pricing, GST fields, and service breakdowns. Perfect for catering events, parties, and corporate functions.

Unlock Customizable Catering Bill Formats

Features of myBillBook Catering Bill Format

Food Charges

Breakdown food items with individual costs for appetizers, main courses, beverages, and desserts. Helps clients see detailed pricing and ensures transparency in every bill.

Service Fees

Include service charges for wait staff, event setup, and cleanup. Helps clients understand additional fees and ensures clarity in the final amount due.

GST Calculation

Automatically calculate CGST, SGST, or IGST for every food item and service. Ensures compliance with GST laws while making the billing process easier and more efficient.

Client Information

Capture client name, address, event type, and contact details. Helps maintain accurate records and improves communication between caterers and clients.

Custom Branding

Add your catering business logo, contact details, and footer. Helps you maintain brand consistency across all bills, improving professionalism and client recognition.

Quick Conversion

Convert catering quotations to final bills with just one click. Saves time, reduces errors, and ensures consistency across all billing documents for quick client approval.

What is the Catering Bill Format

A catering bill format is a standardised template that outlines the details of the services provided, along with the associated costs. It serves as an official transaction record, enabling both parties to track the services availed and the corresponding charges. This format acts as a point of reference for clients, helping them understand the breakdown of costs and facilitating smoother payments.

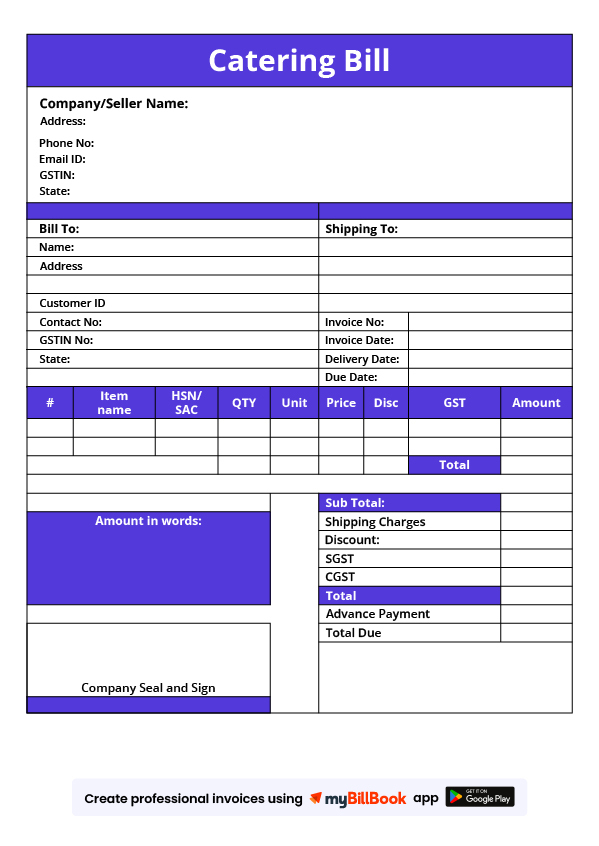

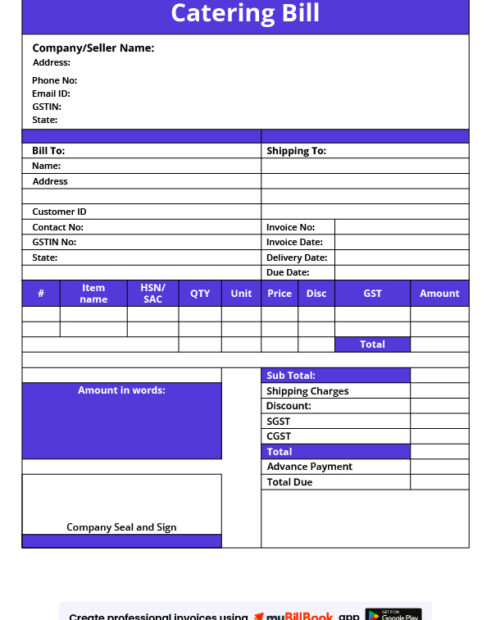

Sample Of Catering Bill Format

Essential Contents of a Catering Bill

The following details must be included in a catering bill format to ensure they are comprehensive and provide essential information for the customers.

- Contact Information of both parties: Include your catering business’s name, address, and contact details. Include your client’s information as well.

- Invoice Number and Date: Assign a unique invoice number and mention the bill date.

- Description of Services: Provide a detailed description of the catering services provided, including the type of event, menu items, and any special requests.

- Quantity and Unit Price: List the quantity of each item provided and its corresponding unit price.

- Subtotal: Calculate the subtotal by multiplying the quantity with the unit price for each item.

- Taxes and GST: Mention any applicable surcharges and the Goods and Services Tax (GST) percentage as per Indian regulations.

- Total Amount: Sum up the subtotal and tax amount to arrive at the total payable amount.

- Payment Details: Specify the accepted payment methods and provide the banking details for electronic transfers.

Catering Bill Formats

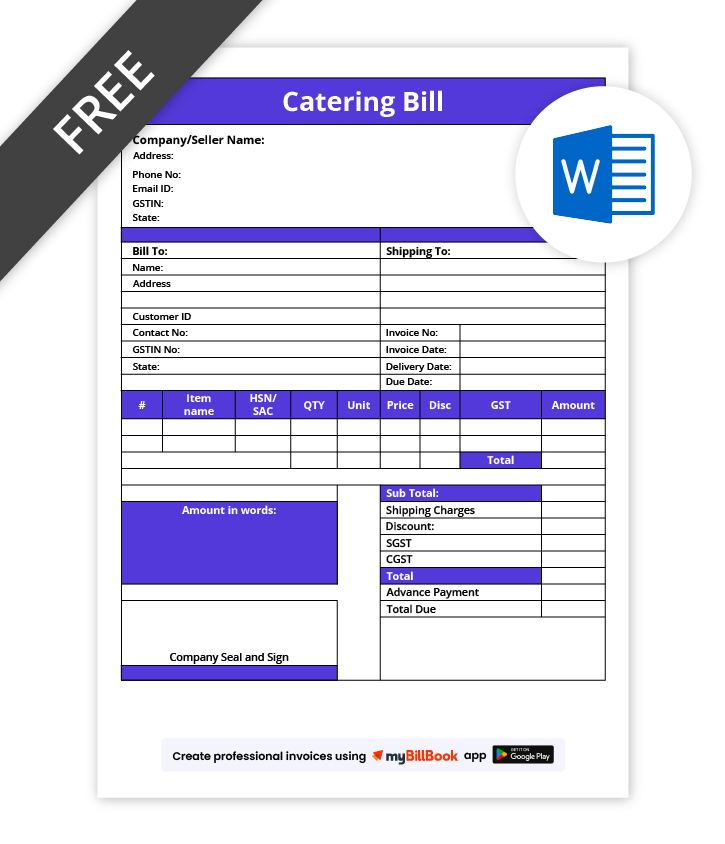

Catering Bill Format in Word

Editable Word templates allow caterers to customise every detail of the bill, including client names, event type, venue, menu items, pricing, and payment terms. These templates are ideal for small catering businesses or freelance caterers who need a flexible, professional, and easy-to-edit document for various events like weddings, corporate parties, or private gatherings. Word format also lets you include logos, contact information, and special notes, making it a fully branded and client-ready billing solution.

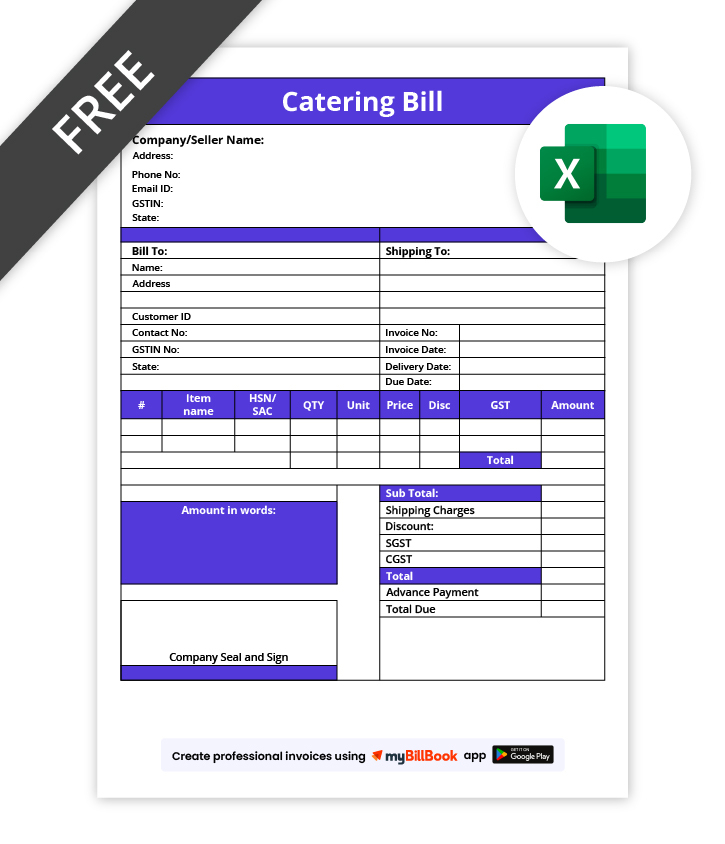

Catering Bill Format in Excel

Excel templates are ideal for catering businesses that manage multiple events or large-scale operations. They auto-calculate totals for each item, including food charges, service fees, GST, tips, and additional surcharges. This ensures accuracy, efficiency, and time savings. Excel also allows you to filter or sort events, track payments, and maintain detailed records for each client. These templates are ideal for agencies handling multiple bookings, enabling them to generate quick, professional, and error-free bills.

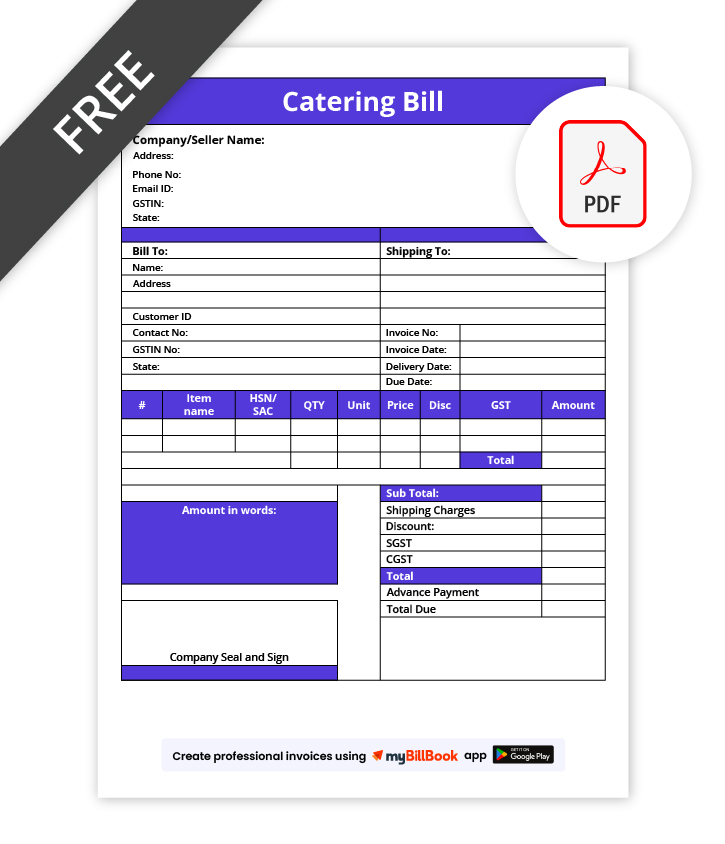

Catering Bill Format in PDF

A PDF format provides a fixed, professional layout that is tamper-proof and ideal for distributing to clients. Once generated from Word or Excel, it is easy to share via email, WhatsApp, or print for client approval or record-keeping. PDF bills maintain consistent formatting and are perfect for audits, ensuring all event charges, GST details, and payment terms remain intact. This format is suitable for finalised, client-ready bills that require professional presentation and secure archiving.

Using myBillBook to Create Catering Bill Format

myBillBook is India’s No. 1 billing and accounting software, offering numerous advantages for catering businesses.

- Ease of Use: myBillBook provides user-friendly templates that simplify bill creation. You don’t have to be an expert in using the software; creating an invoice in myBillBook is as simple as using any other app on your mobile device.

- Customisation: Tailor bills to suit your catering business’s branding by adding logos and customising colours. The custom invoice feature available in myBillBook enables you to create custom invoices tailored to your specific needs. You can add your logo, watermark, custom fields, and other details to make your invoice look unique and professional.

- GST Compliance: myBillBook offers two distinct options for creating invoices – GST Bills and non-GST bills. Choosing GST bills enables you to develop GST-compliant invoices without any extra effort. The software will automatically add the required fields and tax rates to the invoice, ensuring it aligns with the GST terms.

- Digital Record Keeping: Say goodbye to the hassle of storing all your manual bills. myBillBook stores all the invoices created using the software and all transactions safely and securely, enabling easy access and reference in the future.

- Automated Calculations: myBillBook automatically calculates subtotals, taxes, and totals, reducing errors and saving time.

- Efficient Payments: The software enables you to accept online payments through integrated payment gateways, enhancing convenience for clients.

Frequently Asked Questions

What information can I include in my catering bill format using myBillBook?

With myBillBook, you can easily include your catering business's contact details, a unique invoice number, the date of the bill, detailed descriptions of services provided, quantities, unit prices, subtotals, taxes (such as GST), and the final total. You can also outline payment methods and terms and conditions for your services.

Can I personalise the catering bill format in myBillBook?

myBillBook allows you to personalise your catering bill format to align with your branding. You can upload your business logo, choose colours that reflect your company's identity, and format fonts to maintain consistency.

Does myBillBook help me comply with GST regulations in my catering bill format?

Yes, myBillBook provides predefined GST templates, allowing you to easily include GST details in your catering bill format. This ensures compliance with tax regulations and helps clients understand the GST implications on their bills.

Can myBillBook help me keep track of my catering business's financial records?

Yes, myBillBook provides a comprehensive record-keeping feature that allows you to store digital records of all your transactions. This makes accessing and referencing past bills easier, aiding in financial tracking and reporting.

Is myBillBook suitable for both small and large catering businesses?

Whether you're just starting a new catering business or managing a well-established one, myBillBook's features and customisable templates can adapt to your needs, helping you streamline your billing process effectively. The software is scalable to the growing needs of SMBs and MSMEs.

What details should be included in a catering bill format?

Include client name, event type, venue, food and beverage charges, service fees, GST, total amount, payment terms, and signature for transparency and compliance.

Is GST mandatory on catering bills in India?

Yes, GST is applicable for registered catering businesses. Ensure correct CGST, SGST, or IGST rates are included in every bill.

Which format is best for catering bills – Word, Excel, or PDF?

Word is ideal for editable and customised bills, Excel for auto-calculation of costs and GST, and PDF for tamper-proof, shareable, and audit-friendly bills.

Can I use free catering bill templates instead of software?

Yes, free templates are available online, but using myBillBook ensures accurate GST calculations, professional branding, and easy sharing.

How can I make catering bills more professional and client-ready?

Add your logo, maintain consistent formatting, include GST fields, and clearly itemize food, beverages, and service charges. Export as PDF for final delivery.

Know More About Bill Formats