Petty Cash Book

A petty cash book is a useful accounting tool for managing small, routine expenses in a business. This page provides an overview of petty cash books, including what they are, how they work, and why they are important for effective financial management. Learn how to set up and maintain a petty cash book and best practices for keeping accurate records and avoiding common pitfalls.

What is a Petty Cash Book, Petty Cash Fund & Petty Cashier

- A petty cash book is a ledger that records all the petty cash transactions or petty expenses in an organization.

- A small amount of cash, known as petty cash or petty cash fund, is set aside in every company for small day-to-day expenses such as stationery, office supplies, travel, refreshments, etc.

- The person responsible for recording these transactions is called a petty cashier.

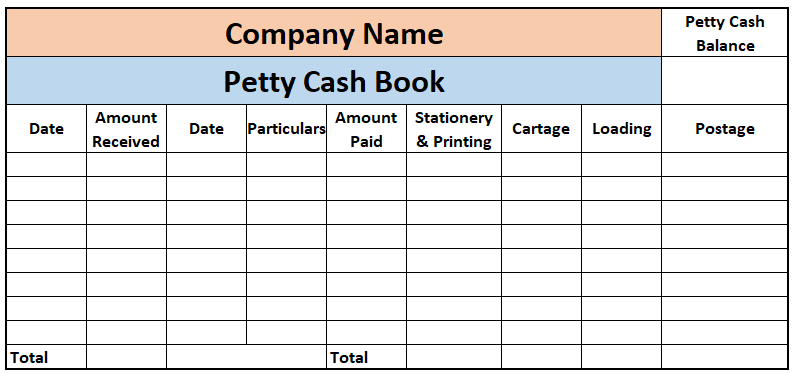

Format of Petty Cash Book

A petty cash book is usually a small notebook or ledger to record all small cash transactions. The format of the petty cash book may vary depending on the organisation’s specific needs and requirements. Here is an example of a petty cash book format:

Contents Explained

- Heading: The petty cash book should have a clear and concise heading

- Date: The date column records the date on which the transaction occurred. This column should be left-aligned.

- Description: The description column records the purpose of the transaction, such as postage, office supplies, or other small expenses. This column should be left-aligned.

- Voucher Number: If the petty cash system uses vouchers, this column records the voucher number for the transaction. This column should be centre aligned.

- Amount: The amount column records the amount of the transaction. This column should be right-aligned.

- Debit/Credit: This column indicates whether the transaction is a debit or a credit. This column should be centre aligned.

- Balance: The balance column records the remaining balance of the petty cash fund after each transaction. This column should be right-aligned.

Which Transactions Are Recorded in Petty Cash Books

Small and incidental expenses that occur during the course of business operations are typically recorded in petty cash books. These transactions may include:

- Postage and courier charges

- Office supplies such as pens, papers, staples, and clips

- Cab or local transportation expenses

- Small repairs and maintenance expenses such as light bulbs, cleaning supplies, etc.

- Refreshments and snacks for small meetings

- Payment of small bills such as newspaper subscriptions, telephone, etc.

- On-the-spot donations or charitable contributions

These transactions are typically small and require cash payments and, therefore, are recorded in the petty cash book.

Importance of Petty Cash Book

A petty cash book –

- Keeps track of small expenses that may not be significant enough to warrant a cheque or a bank transfer.

- Helps ensure all small expenses are accounted for

- Helps maintain accurate records of the cash flow.

- Can be used to reconcile the petty cash fund at the end of each month or a specific period

- Can be used to detect any kind of discrepancies in the petty cash fund.

How to Maintain a Petty Cash Book

The petty cash book can be maintained manually or using the software. However, manual bookkeeping is more common in small businesses. To create a manual cash book, you need to follow these simple steps:

Step 1: Create a Petty Cash Fund

Before creating a petty cash book, you need to establish a petty cash fund. The amount of petty cash funds depends on the size of the business and the number of petty cash expenses incurred. Usually, the amount is kept between Rs.5,000 and Rs.10,000. The fund is typically kept in a safe or locked drawer in the office.

Step 2: Choose a Petty Cash Book

Select a petty cash book that meets your business requirements. It should have columns to record the date, description, amount, and the person or department responsible for the expense. Some books have additional columns to record the receipts and the balance of the cash fund.

Step 3: Record the Opening Balance

Record the opening balance of the petty cash fund. This is the amount of cash that is available in the fund.

Step 4: Record Expenses

Whenever a small cash expense is made, the transaction should be recorded in the petty cash book. The person who made the expense should fill out a petty cash voucher, including the date, description, and amount of the expense. The voucher should also include the person or department responsible for the expense. The voucher should be attached to the receipt and kept in the petty cash book for future reference.

Step 5: Reconcile the Petty Cash Book

Periodically, you should reconcile the petty cash book to ensure that the amount of cash in the fund matches the transactions recorded in the book. To do this, add up all the expenses recorded in the petty cash book and subtract them from the opening balance. The result should be the cash left in the petty cash fund. If there is a difference, you need to investigate and find out the reason for the discrepancy.

Petty Cash Maintenance

Two main systems are followed for petty cash maintenance: the Imprest system and the Non-imprest system.

Imprest System: The most common and widely used method of maintaining petty cash. A fixed amount of money is set aside for petty cash, and a cashier is appointed to manage it. The cashier is responsible for maintaining, recording, and reconciling the petty cash fund at the end of each period. He will request reimbursement from the finance department to restore the fund to its original amount when it is depleted.

Non-Imprest System: No fixed amount of money is set aside in this system. Instead, the finance department replenishes the petty fund as and when required by the finance department, based on receipts or vouchers submitted by the cashier. This system is typically used when petty cash transactions are irregular and cannot be predicted in advance.

While the imprest system provides greater control over petty cash and helps to prevent the misappropriation of funds, the non-imprest system provides greater flexibility in managing petty cash. Further, the latter requires more administrative effort to maintain accurate records of all transactions. Ultimately, the type of petty cash maintenance a company chooses depends on its specific needs, the volume of petty cash transactions, and the level of control required over the fund disbursements.

Use myBillBook billing and invoicing software to manage all your bookkeeping tasks accurately and efficiently.