Rent Receipt Format

Rent receipt – A document which is quite popular among most tax-paying employees staying in a rented house. It must be that time of the year to submit your investment proofs if you’re looking for a rent receipt format. To make your task easy, here is a free rent receipt format for download, along with the information you must know to verify the authenticity of the rent receipt you’re using.

Rent Receipt Meaning

A rent receipt is a document that records the tenant’s rent to the landlord. If you’re an employee paying rent every month, you can claim house rent allowance, aka HRA using rent receipts. Basically, rent receipts are proofs that you have paid the same declared amount as rent to the landlord.

Rent Receipt Format

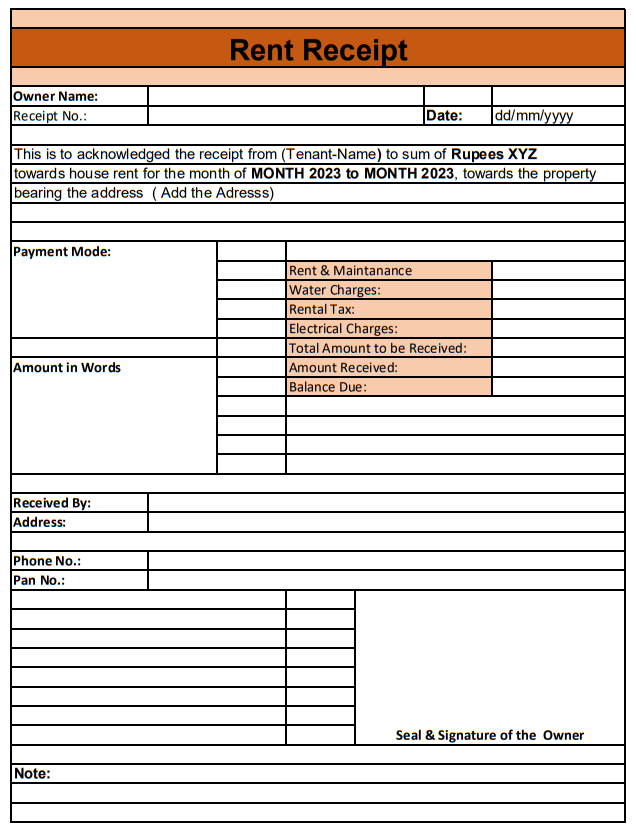

There is no specific or fixed format for rent receipts as such. However, making sure all the required fields are present on the rent receipt is important. You can find a sample rent receipt format here along with a downloadable version and the details that must be included in the rent receipt.

Sample Rent Receipt Format

Here is a sample rent receipt format for your reference. You can download rent receipt, fill it and use it as per your requirement. Rent receipts can be filled manually. Hence, you can download the required number of copies and use them.

Rent Receipt Format – Must Have Details

When using any rent receipt format available on the internet, ensure the fields below are present.

- Name of the landlord

- Name of the tenant

- House address

- Rent amount

- Duration

- Date of payment

- Signature of landlord

Rent Receipt Format in Word

You can also create a rent receipt format in Word if the software is installed on your PC. Simply open a new blank document, create fields as shown in the reference document and save it. Then, take a printout of the saved document, fill it out manually and upload it to your tax portal.

Rent Receipt Format in Excel

To further ease your rent receipt creation process, you can use MS Excel. It has pre-defined cells that would help you create a rent receipt in a few steps.

FAQs about Rent Receipt Format

No, there isn’t any. However, you need to include all the necessary information for it to become legit. If your annual rent is less than Rs.1 lakh, PAN number is not required on the rent receipt. If the rent is paid in cash and is more than Rs.5,000 per month, you need to affix a revenue stamp on a rent receipt. However, if the revenue stamp on a rent receipt is not required e rent is paid through online transfer or cheque. If your income is more than Rs.3 lakhs and HRA or house rent allowance is more than Rs.3,000, you must submit rent receipts to claim HRA. If the monthly rent exceeds Rs.8,333, the landlord’s PAN number is required to claim HRA. Is there a specific format for creating rent receipts?

Do I need to add my PAN number to my rent receipt?

Is a revenue stamp required on a rent receipt?

Is rent receipt submission mandatory?

Is the landlord’s PAN number required to claim HRA?