Grow Your Business with Our Free Marketing Tools

Free WhatsApp Marketing, SMS Marketing & Online Store

Your Complete Marketing Toolkit

Integrated Whatsapp Marketing, Free Online Store Set-Up & SMS Marketing at Your Finger Tips

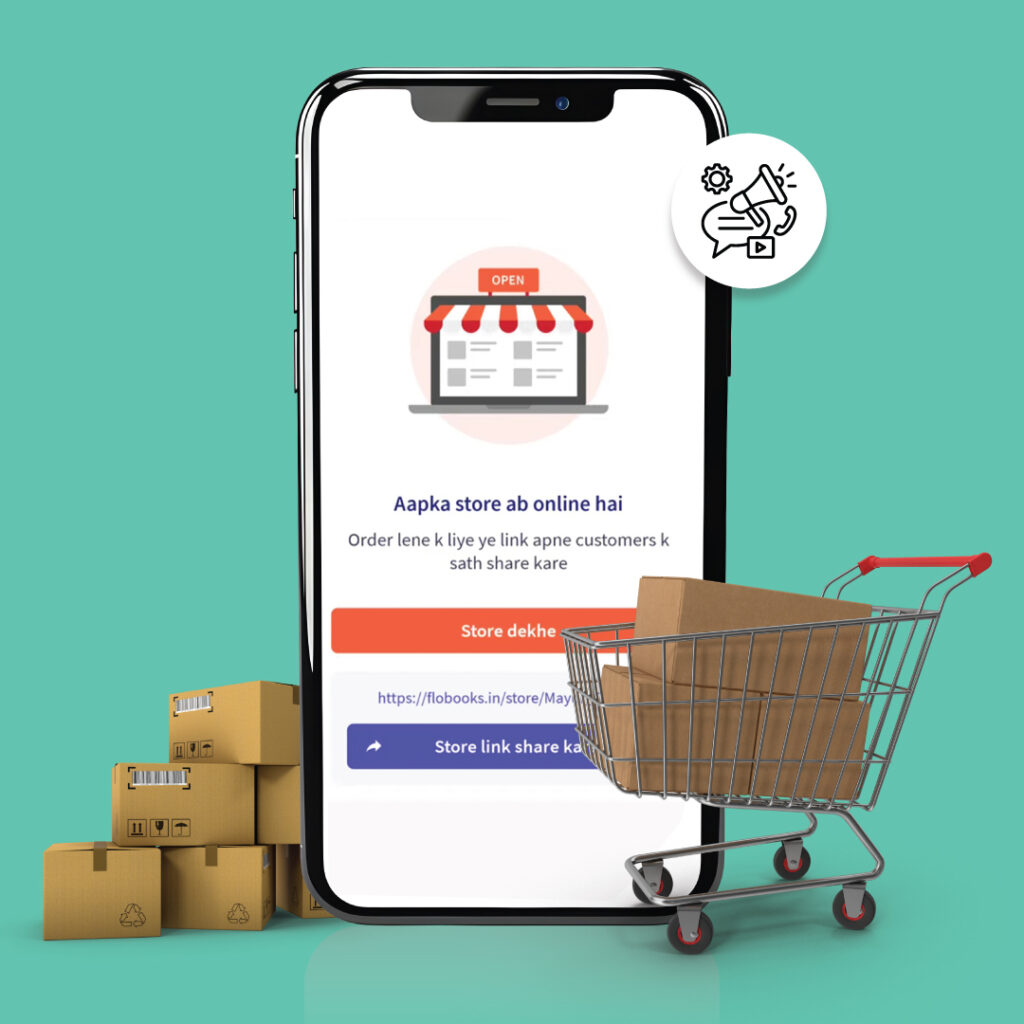

Open a Free Online Store

Create Your Store in 5 Minutes

Add your business details, logo, and start uploading products directly from your myBillBook inventory.

Secure Online Payments

Accept payments through UPI, credit/debit cards, and other popular Indian payment gateways.

Share & Sell Anywhere

Share your store link on WhatsApp, social media, and directly with customers.

Manage Orders Effortlessly

Get instant notifications for new orders and manage everything from a single dashboard.

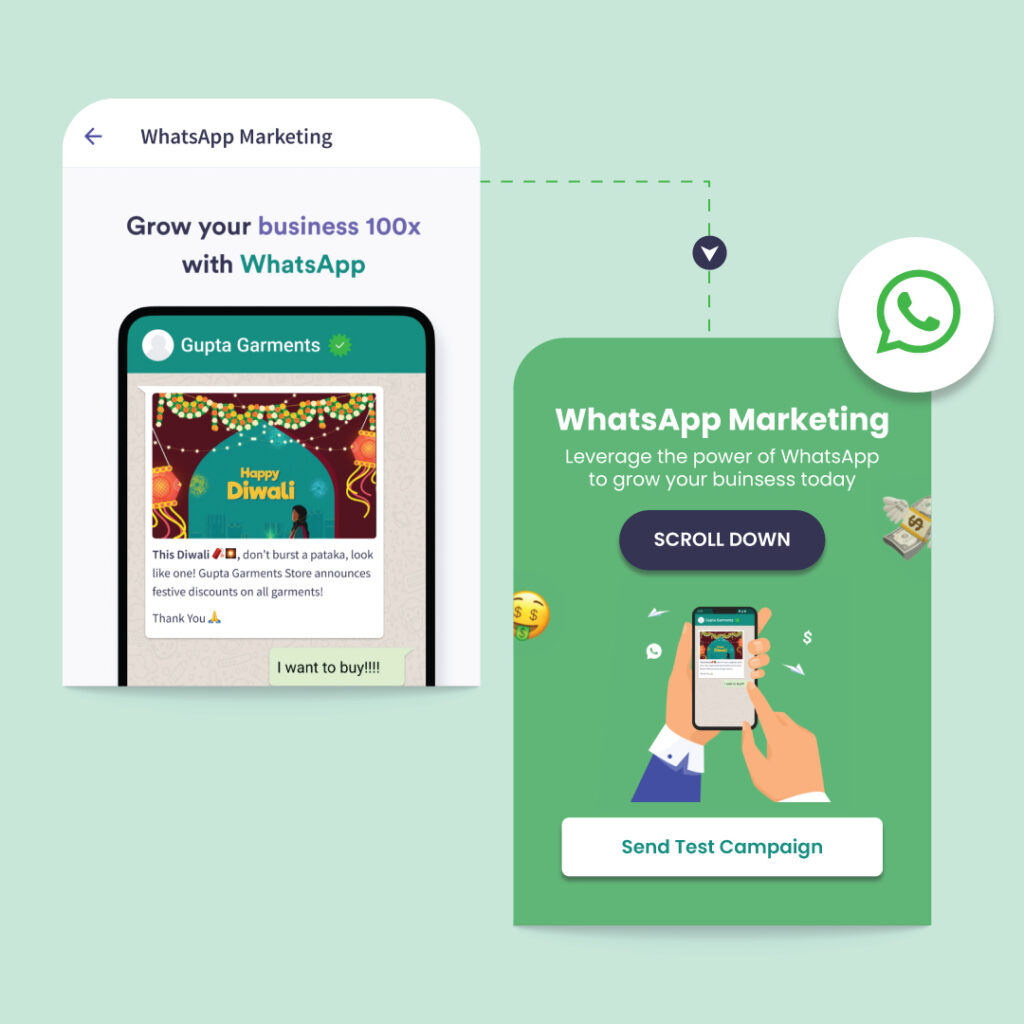

WhatsApp Marketing

Sell, Wish, or Remind

Send product catalogues, festive offers, and payment reminders directly to your customers’ WhatsApp.

Send Bulk Messages Safely

Reach thousands of customers with personalized greetings and offers in a single click.

Automate Customer Communication

Send automatic payment reminders, order confirmations, and thank you messages.

SMS Promotions

Instant Delivery

Send time-sensitive offers and updates that reach your customers instantly.

Cost-Effective Marketing

A budget-friendly way to communicate with your entire customer database.

Guaranteed Reach

Connect with every customer on their mobile phone, regardless of internet connectivity.

Drive Footfall

Send location-specific offers and invite customers directly to your physical store.

Trusted by Over 1 Lakh Businesses Across India

“My online store on myBillBook was a game-changer. I got orders from all over NCR, not just my local area. The WhatsApp campaigns for new arrivals sell out in hours!”

Retailer, Delhi

“We use the SMS promotions to send our ‘deal of the day’. It’s the best way to get a rush of customers during lunch hours. Simple and very effective.”

Restaurant Owner, Mumbai

“Managing my business got so much easier. I send payment reminders via WhatsApp and new price lists via SMS. My customers appreciate the direct communication.”

Wholesaler, Bengaluru

Step-by-Step Guide to myBillBook's Whatsapp Marketing Set-Up

1.Create Your Campaign

Choose a professional template from the gallery.

2.Select Your Customers

Tap to select the specific clients or customer groups

3.Name & Send

Give your campaign a name and tap “Send” to deliver the promotional messages

4.Track Your Results

Monitor your campaign’s success directly on the dashboard.

Affordable Pricing Plans for Every Business

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is WhatsApp Marketing?

In layman’s terms, Whatsapp marketing is using WhatsApp messenger to craft messages and then send them to your clients with the intention of brand promotion.

Also, we frequently use Whatsapp to communicate with our friends and family. Hence, using the app to promote your products and respond to your customers’ questions transforms into the most personalised form of communication and purchasing experience.

Here at myBillBook, you can promote your business through the app without much effort, as it is automated.

Why Should You Use the Whatsapp Marketing Technique for Your Business?

Whatsapp was and is one of India’s most used apps for messaging. That being the case, here is a list of reasons for using it to market your business;

The Popularity of Whatsapp

Even today, the app is the most preferred for people since 2010 to enquire about a product. The reason for the preference is the app’s popularity since its launch.

The Increasing Number of Users

Every day more people are installing the app. Hence you can choose the channel WhatsApp for guaranteed conversions.

Users Using Them Every Day

Unlike other messenger apps like Facebook or Instagram, which users use only a few times a day, WhatsApp is an app user open and use during all times of the day.

Customer’s Eternal Love for This Channel

The interface, features and emoji-added texts they receive make customers almost happily addicted to this channel. Therefore you can invest in WhatsApp marketing without any second thoughts.

Customer’s Trust in Products Information They Receive via Chat

Most of us tend to trust people who come up to us with products in a personalised tone. The satisfaction and trust would increase even further when they do the same via a personal chat messenger like WhatsApp.

Benefits of WhatsApp Marketing for Your Business

You Can Build the Best Relationships With Your Customers.

Consider the first example of purchasing from the store at the mall. The more messages you receive on messengers on your phone, the more you will feel connected to that store. Otherwise, you will probably forget that you made the purchase itself.

Consumers say they engage only with personalised marketing messages. You can also curate personalised messages in WhatsApp, unlike other channels.

So, you will retain half the customers if you maintain that connection.

You Will Have a Higher Conversion Rate.

Nowadays, people find traditional methods like phone calls inadequate in staying connected. So instead, they chose social media and emails as more convenient.

Most customers will answer your chats in WhatsApp. The better the messages, the more your conversions will be.

You Will Witness Better Sales.

Imagine that you liked the store mentioned in the first paragraph and browsed their website to find a contact number. The number available in WhatsApp can make you happier because it allows you to text them immediately and grab offer details.

There is also a growing tendency for people to purchase through messaging apps like WhatsApp.

You Can Enjoy a Lower Cost of Marketing.

The channel of Whatsapp is very economical. You can install the app, draft messages, send them over and wait for a great brand reach compared to before.

The low-cost marketing technique is very effective as it improves your relationships with clients, brings in more revenue, retains clients and more.

WhatsApp Marketing Tips

You, as a brand, sure would have a solid marketing strategy. But, apart from that, you can also follow these small tips for improving your marketing.

You Can Create Broadcast Lists.

A broadcast list means a group of recipients you have selected and placed together.

The great side is that none of your group members can see each other, yet they receive the same messages.

The lists are similar to mailing lists; you can use them to send campaign information to your customers. In addition, you can collectively form groups of VIP customers and others to send personalised messages or referrals when in need. Thus, you can engage your customers.

You Can Utilise Group Chats.

Group chats are similar to broadcast lists. However, everyone in the group can view the chats and interact within the group.

The chats are an elegant way to improve your customer interaction, and it lets them express their opinions. Then, you can consider them and work on your product’s pain points.

One more thing to keep in mind is that there is a human tendency to take decisions based on the opinion of the mass majority. In a group, if you can initiate a purchasing decision and get it backed by others, you can influence the purchase decisions of the other members of the group.

You Must Employ Whatsapp Statuses.

A Whatsapp status is a feature in the messenger app where you can upload text or multimedia files for 24 hours and receive feedback from all your contacts.

You can use this feature to introduce your product to your clients, inform them of new offers, share details of product updates etc.

In addition, you can inform your customers about the flash sale.

You Must Craft Product Catalogues.

Product catalogues allow you to showcase your products. You can add up to items as 500 in your WhatsApp product catalogue. Your potential customers may browse through it, share links to some products, or ask questions about them.

You may also send catalogue items to WhatsApp users or share a link to the showcase anywhere online. Catalogues are helpful for aspiring entrepreneurs or small businesses with no websites.

WhatsApp marketing is the best choice to reinforce your brand and build long-lasting customer relationships. However, for better results, master all the channels your customers prefer. For example, try Facebook and Telegram messages, and improve your marketing strategy with email and web push notifications campaigns. Of course, you can always sign up with myBillBook billing software and learn more about the automated WhatsApp marketing technique.

Frequently Asked Questions

How do I set up my Online Store?

To set up your Online Store on myBillBook, simply log in to your account, go to the "Online Store" section, and follow the step-by-step setup guide to customize your store, add products, and choose your payment and shipping options.

Are there any hidden charges for the Online Store?

No, there are no hidden charges for the Online Store. The cost of using the feature is clearly mentioned in your subscription plan. Any additional charges, if applicable, are fully disclosed before purchase.

Is WhatsApp marketing legal in India?

Yes, WhatsApp marketing is legal in India as long as it follows the guidelines set by the government and WhatsApp’s own policies. This includes ensuring opt-in consent from customers and avoiding spam.

Do I get a report for my SMS and WhatsApp campaigns?

Yes, myBillBook provides detailed reports for your SMS and WhatsApp campaigns. You can track delivery status, open rates, and responses to measure the success of your campaigns.

Can I link my own domain to the Online Store?

Yes, you can link your own custom domain to your Online Store on myBillBook. Simply follow the instructions in the store settings to connect your domain for a more personalized web address.

Do my customers need to have the myBillBook app?

No, your customers do not need the myBillBook app to interact with your Online Store. They can access the store via any web browser. However, if you are using features like invoicing or payment tracking, they may need the app for a more seamless experience.