Best Mobile Accounting software

Automate your billing, inventory management and accounting

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing account receivables and payables was overwhelming for our retail business. With myBillBook, we now view all account payables and receivables in real-time with 100% cloud access with real-time data sync across all devices. This has streamlined our accounting process and improved our cash flow management.”

Sandesh Skula

Retail Business Owner, Hyderabad

Recommends myBillBook for:

Product Demo for Mobile Accounting Software

“Superb customer service. Helped me set up my account as required”

myBillBook’s top features for Mobile Accounting Software

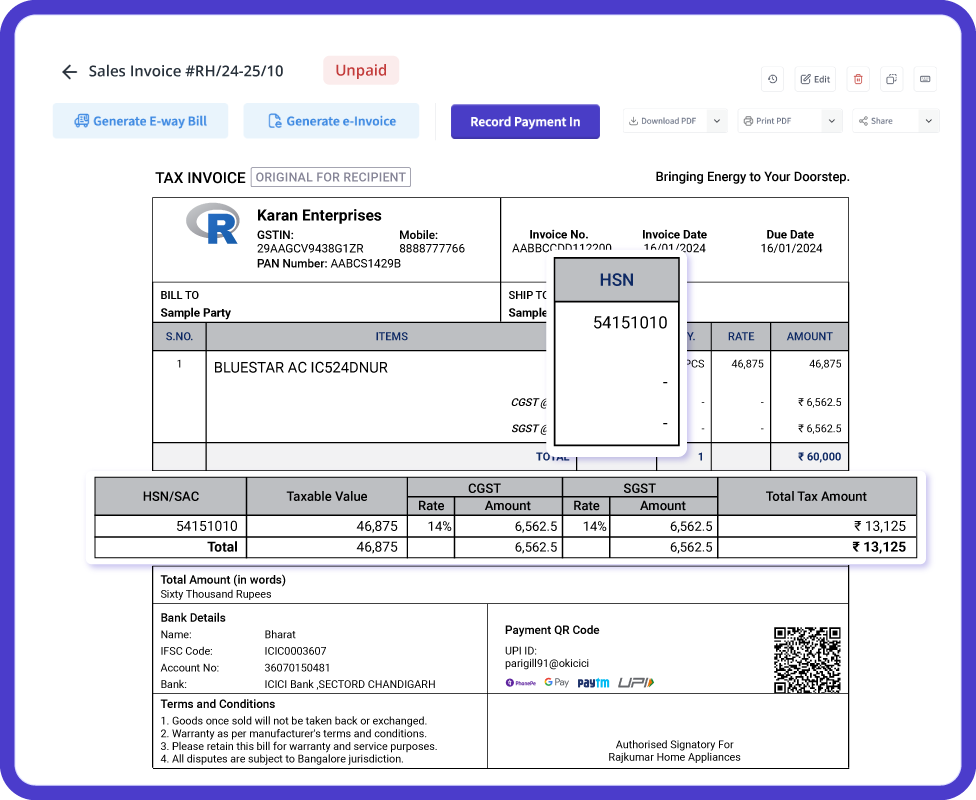

GST Compliant Invoices

Create customized and professional invoices that comply with government mandates in seconds, all on the cloud. Essential details like party GSTIN, HSN/SAC, and tax components are auto-populated based on the materials in your inventory. Easily generate credit/debit notes, delivery challans, and sales/purchase returns online.

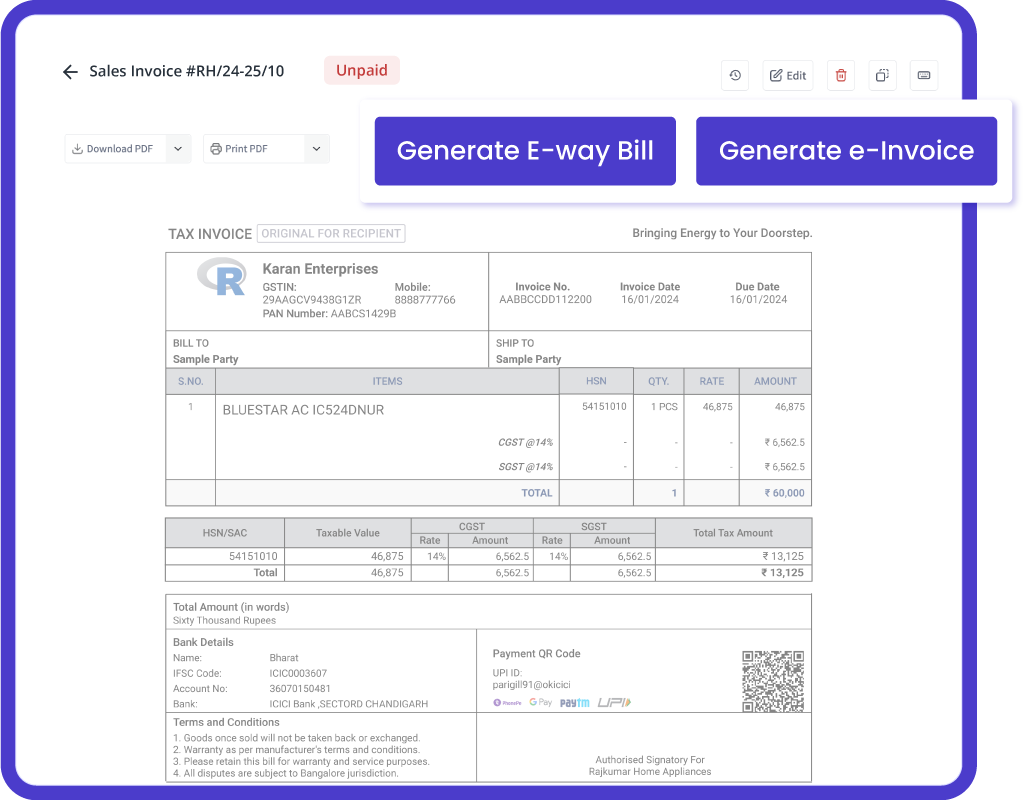

Effortless E-way Billing & E-Invoicing

Generate e-way bills with a click for relevant transactions on the cloud. myBillBook enables you to send authenticated e-Invoices for B2B transactions electronically via GSTN, all online.

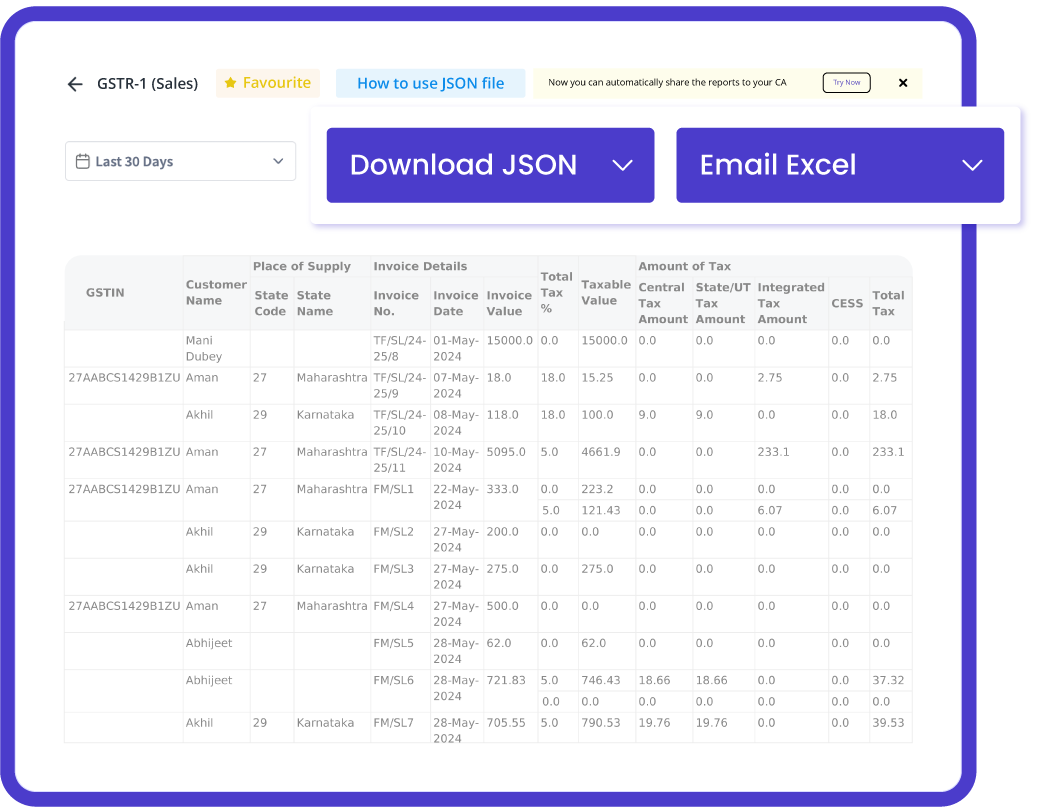

Easy GST Returns Filing

Generate and file error-free GST returns with GSTR-1, which details outward supplies of materials, all on the cloud. Reconcile GSTR-2 for monthly purchases/inward supplies online. GSTR-3b provides a consolidated summary of outward supplies, inward supplies, and ITC available, all accessible online.

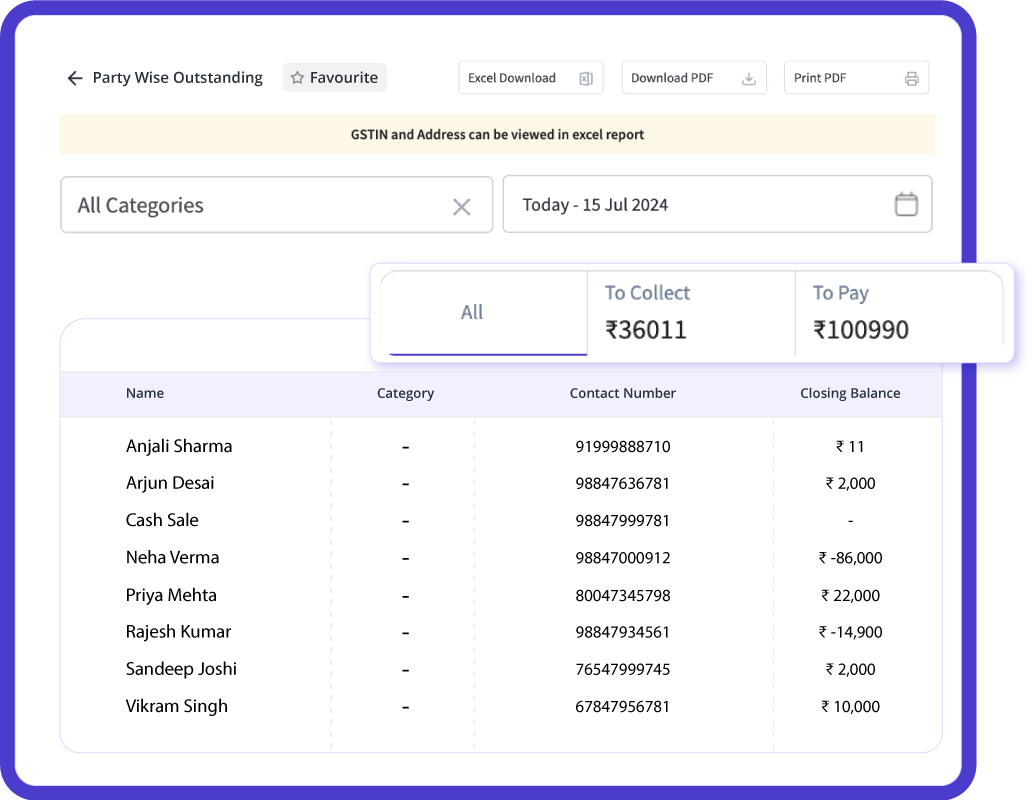

Track Account Receivables & Payables

View real-time account payables and receivables for customers and suppliers with party-wise outstanding reports on the cloud, accessible via both mobile and laptop, with support on both iOS and Android. Track outstanding customer payments with the Receivable Ageing Report, all online.

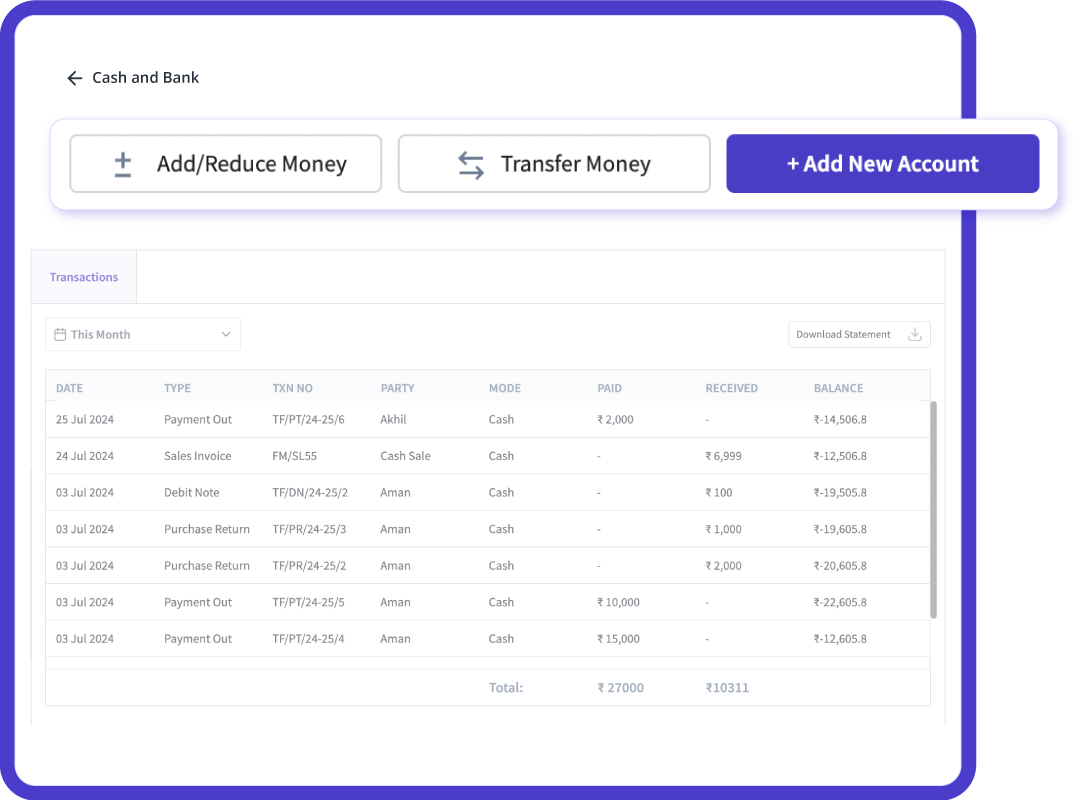

Manage Cash & Bank Accounts

View real-time account payables and receivables for customers and suppliers with party-wise outstanding reports on the cloud, accessible via both mobile and laptop, with support on both iOS and Android. Track outstanding customer payments with the Receivable Ageing Report, all online.

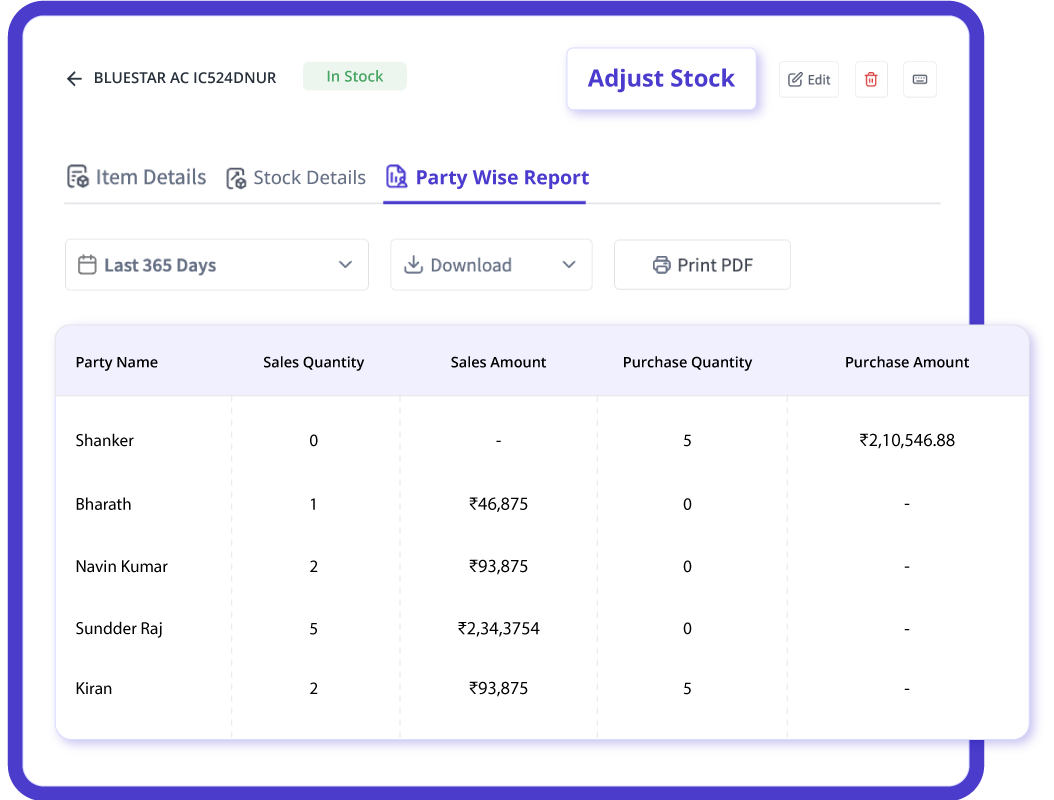

Inventory Management

Automatically track and update stock with each sales or purchase invoice on the cloud, accessible via both mobile and laptop, with support on both iOS and Android. Quickly add items from a library of over 1 lakh products, edit items in bulk, and set low stock alerts, all online.

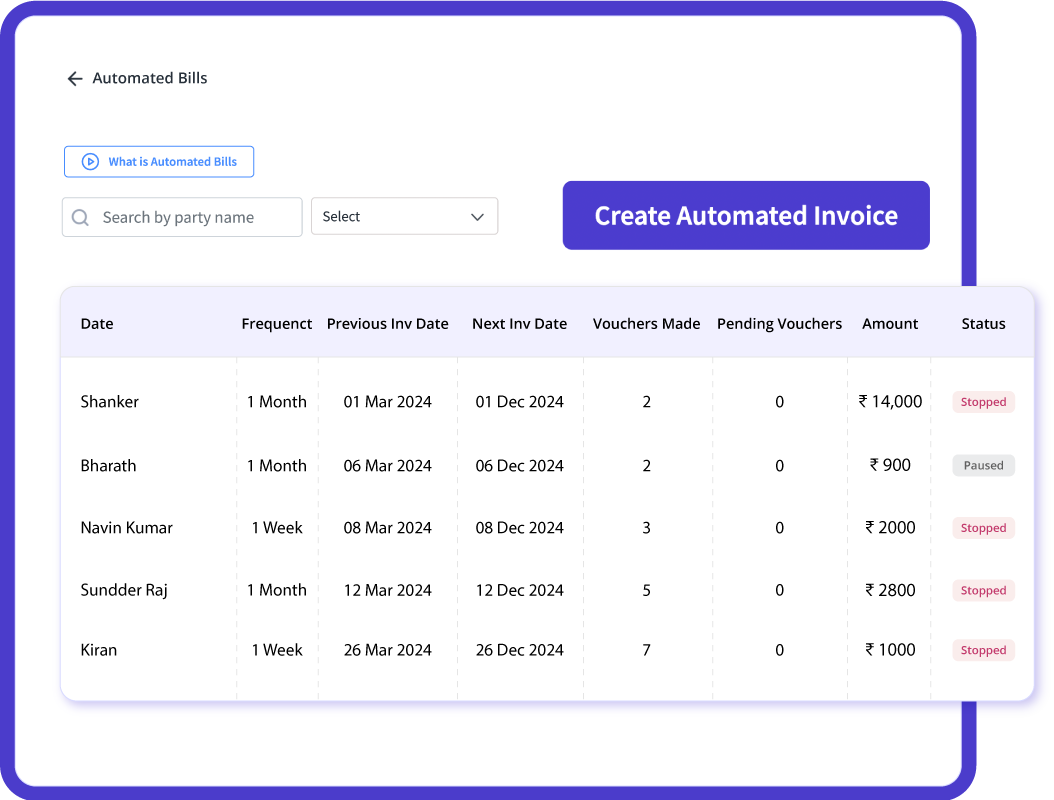

Automated Billing

Automate invoice creation with precise tax calculations and custom branding on the cloud, accessible via both mobile and laptop, with support on both iOS and Android. Flexible bill generation options include yearly, monthly, weekly, or custom periods, all managed online.

myBillBook helps Business succeed

“Creating customized, professional invoices that comply with government mandates has never been easier. With myBillBook on both mobile and laptop, supporting iOS and Android, we can auto-populate essential details and generate credit/debit notes, delivery challans, and returns effortlessly.”

Rakesh K,

7 Mart – Chennai

“Generating e-way bills and e-invoices used to be time-consuming. With myBillBook, we create e-way bills and send authenticated e-invoices electronically via GSTN for B2B transactions, managed online from both mobile devices and laptops, on iOS and Android.”

Shivam Jain,

Wholesale Business Owner – Banglore

“Keeping track of cash and multiple bank accounts was difficult. With myBillBook, we manage cash registers, record payments, transfer money between accounts, and track payments across different modes, all on the cloud from mobile devices and laptops, with iOS and Android support.”

Mahesh Roa,

Clothing Retailer – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Mobile Accounting Software?

Mobile accounting software or app is nothing but an application where you maintain a record of all the invoices and transactions. In the application, you would need to recheck the pages to check out the unpaid bills and follow up with your customers accordingly. In addition, it even estimates your sales tax at the end of the financial year. If you have no idea of managing your finances in the right way, you can prefer one of the best mobile accounting apps rather than hiring a chartered accountant or bookkeeper which can be costlier than having an app. You can now let your mobile handle and automate all the transactions anywhere and anytime.

How to Choose the Best Accounting App for Android?

When it comes to choosing the best accounting app for android, it might be a bit challenging as there are a plethora of accounting apps available for androids. For looking out the sensitive information and finances of your business, you cannot rely on any random application. You should always choose a well-trusted and authorized app for ensuring a top level of safety. Before selecting a mobile accounting app, you should also ensure that it has a proper payment gateway with the ability to save all your transaction history and connect with your bank. In short, you should check whether the accounting app you are selecting has all the features you want for doing easy and smart accounting for your business.

Why Use myBillBook Mobile Accounting Software?

There are few reasons behind one’s use of mobile invoicing software which are given below:

Time-Saving

The mobile invoicing app saves a lot of time every week by automating accounting processes and managing time-consuming manual bookkeeping. It simply draws all the information for you automatically.

Synchronizes All Your Financial Data

Good accounting software has the power to synchronize all your financial data from across multiple platforms like credit card accounts, bank accounts, etc. without the need to go back and forth between the platforms to accumulate the data you require.

Generates Key Financial Reports Instantly

The accounting application is equipped with in-built reports that are updated automatically. You can now download your balance sheet, P&L Statement, and Cash Flow Statement in one click. You can even customize reports if required just by adding extra detail or filtering the data and save the reports to use in the future.

Simplifies Payroll

An effective accounting application even comes with a specialized payroll system that calculates insurance and healthcare contributions, automates payments to employees, and receives accurate payroll tax data.

Reduces Inventory Mistakes

Some accounting applications have basic inventory management tools that update automatically to disclose the number of each product you have been sold, you have on hand, and when you require to restock. It offers you accurate and real-time details of your stock levels.

Generates Professional-looking Financial Statements

While dealing with potential investors, you have to present properly formatted and accurate financial statements that are delivered on time. Accounting application generates standardized-formatted financial statements that can be downloaded and shared when requests arise.

Provides Detailed Insights

If you have a properly set up chart of accounts, you can make use of accounting software for mobile to record your transactions by projects, departments, classes, or locations. It further helps you to make strategic decisions and produce more specific reports by giving you a clear picture of your areas of expense and what your income is attributable to.

Smoothens the Process of Tax Filing

Few accountings systems involve built-in specific tax reports that are formatted in an accurate and standardized way which thereby helps the tax accountants to easily file the return and estimate available tax credits.

Promotes Data Accuracy

Accounting software updates your financial reports and statements automatically to help you keep your data free of mistakes by reflecting any changes you make. Therefore, you do need to update multiple cells manually in multiple sheets if you make an alteration to your records.

Significance of Mobile Accounting Software for Small Businesses

Check out the importance of mobile billing software for small businesses which are as follows:

Mobile Payroll Processing

When payroll is being processed through billing software, it offers a lot of advantages to both employees and employers. Individuals can now use their mobiles to check their payroll details and review the accuracy of their finances and it would be a great help for them. In another way, mobile payroll apps help you lessen the administrative and operational costs of checks and smoothen your payroll management.

Monitoring Expenses and Budget

Startups and small businesses require to keep an eye on how their money is being spent and where it goes with limited resources available. Mobile invoicing apps has expense tracking functions with the help of which your employees can offer you real-time information on their expenses, monitor their expenses, and even book hotels or flights. Your employees’ availability on your smartphone connected with an accounting app helps you approve and track transactions anywhere and anytime.

Create, Manage, and Send Quotes and Invoices

myBillBook is one of the best cloud accounting software that lets users create, manage, and send their quotes and invoices to suppliers as well as customers. This feature can effectively boost your business cash flow and margins by reducing the lag time between the receiving and sending of your bills. Moreover, its functionality to manage quotes and invoices through mobile enhances your customer satisfaction by presenting yourself as a technologically modern business and rendering real-time quotes and bills.

Access to Real-time Accounting and Finance Information

The greatest advantage of using the best accounting app for android is that it provides you access to real-time information on your bank accounts, finances, and books. This information can assist you to monitor your chase debtors, accounts receivable, check your cash flow anytime, and keep up with bank reconciliation.

Best Features of Mobile Accounting Software

Have a look at the best features of mobile invoicing software which are mentioned below:

Choose Invoice Themes:

For generating an invoice, different types of themes are available in the software which is just unlimited. You have various invoice templates in the app to select from and customize them as per your brand requirements and colours.

Create Invoices:

With the use of accounting software, you can now create invoices with ease as it allows you to automate the frequent entries in it and save a template as well.

Send Quotations & Estimates:

With the help of the GST accounting app, you can create and send quotations as well as estimates to your potential clients in just a few clicks. The software helps you to stand out from your competitors who email or text quotations by creating professional-looking estimates and quotations.

Automatic Data Backup:

In the GST accounting software, you can set up automatic backups of your company quickly to your Drive of Google as per the fixed schedule. Further, it would help you to make sure no loss of data during technical problems. This way, your business’ finances will remain safe always.

Record Expenses:

Using the accounting app, you can record any expense. As a matter of fact, your business needs cash to carry out operations and if you add the expenses on time, you can get a precise idea about the finances of your business. It will thereby help you save a lot of time while filing taxes.

Cheques:

When you get the bills and invoices, you can mark the cheque payments and track them until the money is withdrawn. The app makes things possible when it comes to monitoring and closing the list of all open cheques once the money is deposited or withdrawn.

Bank Accounts:

Free accounting android app allows you to manage, add, and track payments you receive in your e-wallets, bank accounts, cash, or cheque. With the accounting app, you can handle all cash-in and cash-out in one location and keep complete control over your business.

Create Purchase/Sale Orders:

Using the software, you can look after all of your purchase and sale orders for a given period of time. It will assist you to cross-check that you did not miss out on delivering products to your customer or did not forget to place any critical order from your suppliers.

Data Security and Safety:

The accounting application never allows you to lose the valuable data of your business. It keeps your information 100% safe and offers you an effective backup system. It helps you to create local backups the time you need and automate the process of backup.

Explore our Hospital Billing Software for specialized solutions tailored for healthcare businesses.