Proforma Invoice Format Templates in Excel, Word & PDF

Quickly create professional Proforma Invoices with ready-to-use templates—perfect for Indian businesses.

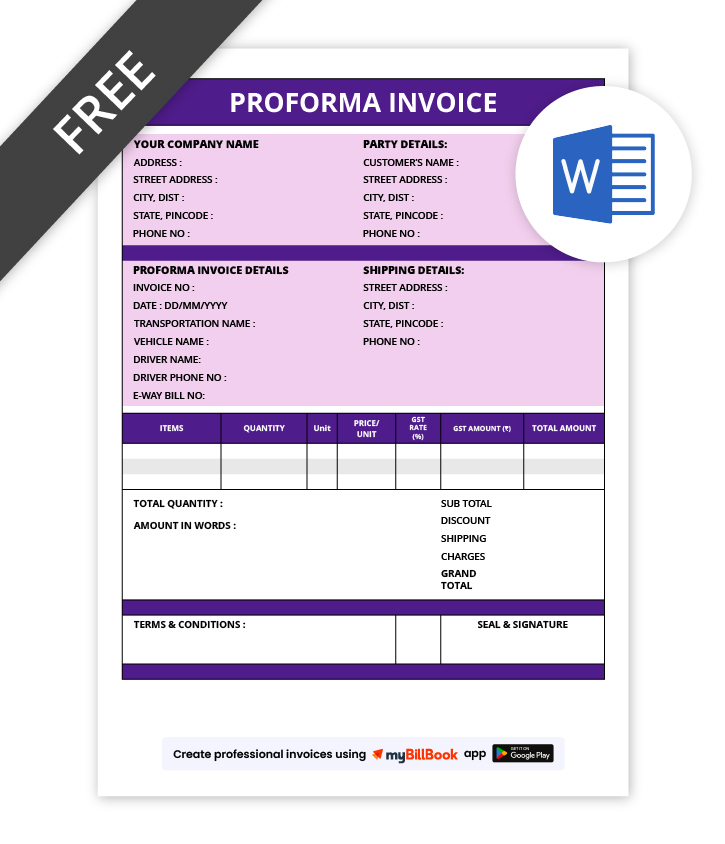

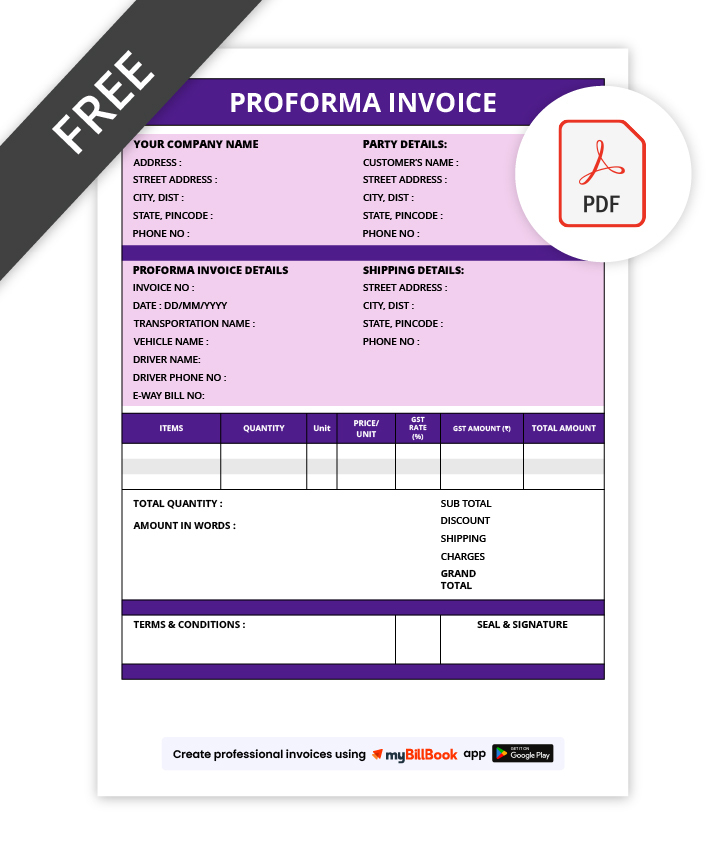

- Editable Proforma Invoice Templates for Excel, Word, and PDF

- GST-compliant templates for seamless tax filing

- Fully customizable to fit your business needs

Powered by myBillBook - India's #1 Billing Software

What is a Proforma Invoice Format?

A Proforma Invoice Format is a preliminary document issued by a seller to a buyer before a sale is completed. It provides a detailed outline of the products or services being offered, including descriptions, quantities, prices, and payment terms. While it resembles an official invoice, it is not a payment request and doesn’t serve as a final financial record. The proforma invoice helps both parties clarify transaction details and serves as a reference for future invoicing. It is often used for quoting, customs procedures, or securing approval before finalising a sale, especially in international transactions.

Proforma Invoice Formats In Excel, Word, PDF – Download for free

How to Create a Proforma Invoice Format?

Create Professional Invoices in Less Time

Invoice templates may get you started, but repeated edits and manual calculations slow you down.

Our free invoicing software helps you generate accurate, customised invoices instantly.

What Are the Key Differences Between a Proforma Invoice and a Commercial Invoice Format?

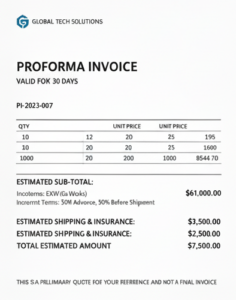

Proforma Invoice Format

A Proforma Invoice is a preliminary document provided by a seller to a buyer before the sale is finalized. It serves as an estimate or quotation, outlining the goods or services being offered, along with their prices, quantities, and terms. It is not a demand for payment and is typically used to give the buyer an idea of costs before confirming the transaction. It's often used for quotes, negotiations, or customs purposes.

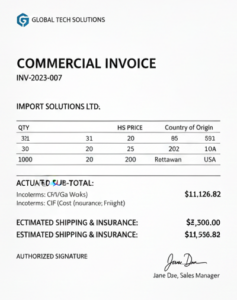

Commercial Invoice Format

A Commercial Invoice, on the other hand, is the final, official bill used after the goods or services are delivered. It contains the same details as the proforma invoice but serves as a legal document demanding payment. It is used for financial records, tax purposes, and customs clearance. Unlike the proforma invoice, a commercial invoice is binding and includes actual payment terms, taxes, and other necessary legal details.

A Step-by-Step Guide on How Proforma Invoice Format Works

What Are the Essential Elements That Must Be Included in a Proforma Invoice Format?

Here are the essential elements that must be included in a Proforma Invoice Format:

Seller’s Information:

Name, address, contact details, and business registration number

Buyer’s Information:

Name, address, contact details, and any relevant identification number.

Invoice Number:

A unique identifier for the proforma invoice.

Date of Issue:

The date when the proforma invoice is issued.

Description of Goods/Services:

Detailed list of products or services being quoted, including quantities, unit prices, and any variations.

Total Amount:

The sum of all products/services, including taxes, discounts, shipping, and additional charges.

Payment Terms:

Conditions regarding the payment method, due date, and any advance requirements.

Delivery Terms:

Shipping method, delivery date, and any applicable shipping charges.

Tax Information:

GST details or other tax identification, if applicable.

Validity:

The period during which the proforma invoice is valid.

What Are the Advantages of a Proforma Invoice Format?

1. Clarity for Both Parties

A Proforma Invoice provides both the buyer and seller with a clear understanding of the transaction before the final sale. It includes detailed descriptions of products or services, quantities, prices, and terms. This helps avoid confusion and ensures that both parties are on the same page about the goods, pricing, and conditions before proceeding with the transaction.

2. Facilitates Customs Clearance

In international trade, a Proforma Invoice is crucial for customs clearance. It acts as an estimate of duties, taxes, and shipping costs. Customs authorities often require this document to assess the value of goods being imported or exported, ensuring compliance with regulations and facilitating smooth customs procedures.

3. Helps with Financial Planning

Proforma invoices can assist businesses in financial planning by outlining the cost of a transaction before it is finalised. They are instrumental when businesses require advance payments or when securing loans or credit. By knowing the anticipated total costs upfront, businesses can better manage cash flow and avoid any financial surprises.

4. Builds Trust

Issuing a Proforma Invoice demonstrates transparency, which builds trust between the buyer and seller. It demonstrates professionalism and a clear commitment to the transaction terms. Both parties can review the details, including pricing, before agreeing, ensuring there are no surprises later in the process. Trust is crucial, especially when dealing with new customers or international transactions.

5. Reduces Errors

By providing a detailed breakdown of the products, services, and terms, a Proforma Invoice helps identify potential mistakes early in the process. Both the seller and buyer can review the document and address any discrepancies, such as incorrect quantities, pricing errors, or miscommunications about terms, before the official sale is finalised. This reduces the chances of costly mistakes.

6. Legal Protection

While a Proforma Invoice is not legally binding like a Commercial Invoice, it remains an essential reference document in the event of disputes. In the event of disagreements over pricing or terms, the Proforma Invoice can act as evidence of the initial agreement. It records what was agreed upon before the official transaction, providing some legal protection for both parties.

7. Helps with Internal Record-Keeping

For businesses, a Proforma Invoice acts as a useful document for internal record-keeping and tracking pending transactions. It provides an overview of upcoming sales or purchases, enabling better inventory management, forecasting, and planning. This helps companies maintain accurate financial records and track pending orders or payments.

Explore More About Proforma Invoice Templates in Word, Excel, and PDF

Proforma Invoice Format in Word

A Proforma Invoice Format in Word offers flexibility in customization, allowing businesses to easily modify text, logos, and layouts. This format is ideal for users who prefer working with text-heavy invoices and need to tailor each document before sending. Word documents are easy to edit and update, making it a popular choice for businesses requiring frequent changes or personalized communication with customers.

Proforma Invoice Format in Excel

A Proforma Invoice Format in Excel provides a structured, spreadsheet-based approach to invoicing. It allows for automatic calculations of totals, taxes, and discounts, making it highly efficient for businesses handling large quantities of items or services. The format’s grid layout is perfect for easy data entry, and businesses can also track inventory and sales metrics within the same file, streamlining the invoicing process.

Proforma Invoice Format in PDF

A Proforma Invoice Format in PDF is a secure, non-editable format that ensures the document remains consistent when shared with customers. It is ideal for businesses seeking a professional, finalized invoice that cannot be tampered with. PDFs are universally accessible, ensuring that the buyer can view the invoice on any device without formatting issues, making it a trusted format for official communications and international transactions.

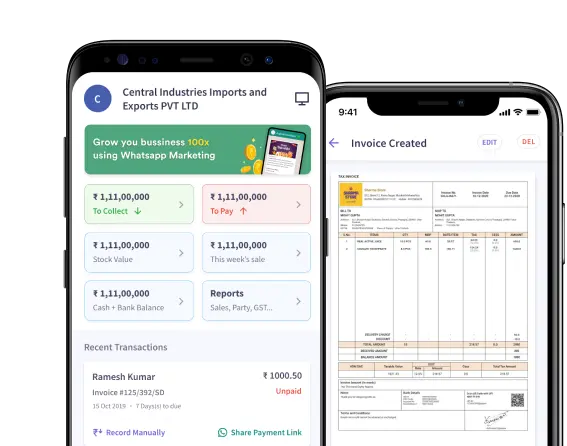

Benefits of using myBillBook to Generate Proforma Invoice Formats

1. Ease of Use

myBillBook offers an intuitive, user-friendly interface that makes it easy to create and customise Proforma Invoices without technical expertise. Input the required details, and the software automatically formats the invoice.

2. GST-Compliant

Generate GST-compliant proforma invoices, ensuring all tax details are accurately reflected in accordance with Indian tax regulations. This helps maintain proper documentation for tax filings.

3. Multiple Format Options

myBillBook allows users to create Proforma Invoices in multiple formats, including Word, Excel, and PDF, giving businesses flexibility based on their needs.

4. Customisation

With myBillBook, businesses can customise their Proforma Invoices with their branding, such as logos, contact details, and specific terms and conditions, providing a professional touch for clients.

5. Automated Calculations

The software automatically calculates totals, taxes, discounts, and shipping costs, reducing human error and saving valuable time during invoice creation.

6. Real-Time Updates

myBillBook offers real-time updates, ensuring that any changes made to the invoice, such as price updates or quantity adjustments, are immediately reflected in the document.

7. Secure and Cloud-Based

With myBillBook’s cloud-based platform, Proforma Invoices are securely stored and accessible from any device, ensuring data safety and accessibility from anywhere.

8. Efficient Record Keeping

Track and store Proforma Invoices for future reference or audits, making it easier to manage records and maintain organised business operations.

Manage invoicing the smarter way

Skip rigid invoice formats and handle all your invoicing digitally using our free invoicing software.

Frequently Asked Questions

How do I correctly format a proforma invoice for international trade and customs purposes?

When formatting a Proforma Invoice for international trade, include detailed descriptions of goods, quantities, prices, shipping terms, customs codes, and the estimated total value. It helps streamline customs processing and ensure compliance with import/export regulations.

How often should businesses review their proforma invoice format for compliance and efficiency?

Businesses should review their Proforma Invoice format at least once a year or when there are significant changes in regulations, taxes, or business operations. Regular reviews ensure the invoice remains compliant with updated laws and enhances overall efficiency.

What specific information about goods or services should be included in an international proforma invoice format?

Include a detailed list of goods/services, including product descriptions, quantities, unit prices, total value, shipping terms, customs codes (HS), and applicable taxes. This ensures smooth customs clearance and accurate invoicing for international transactions.

What are the legal implications of a proforma invoice for both buyer and seller?

A Proforma Invoice is not legally binding and does not require payment. It serves as a preliminary agreement outlining transaction details, providing clarity but not a final demand for payment. It helps prevent disputes but has no legal standing until replaced by a Commercial Invoice.

What software or tools are best for generating customized proforma invoice formats?

For creating customized Proforma Invoice formats, myBillBook is an excellent tool. It provides easy-to-use templates, supports GST compliance, and allows customization to fit your business needs, making the process efficient and professional.

What factors might necessitate changes to an existing proforma invoice format?

Changes might be needed due to updates in tax laws, product pricing, shipping terms, payment methods, or changes in industry standards. Regular reviews ensure that the invoice stays accurate and relevant to the business's evolving needs.

Why is it important to clearly label a document as a 'Proforma Invoice'?

Clearly labeling the document as a "Proforma Invoice" helps differentiate it from a final, legally binding invoice. This prevents confusion and ensures the buyer understands that the document is a preliminary agreement, not a demand for payment.

Why is a proforma invoice format necessary before issuing a final commercial invoice?

A Proforma Invoice ensures that both parties agree on the transaction details before finalizing the sale. It helps clarify the terms, pricing, and expectations, reducing the chance of disputes once the final Commercial Invoice is issued.

Why should a proforma invoice be used for requesting payment in advance?

A Proforma Invoice is often used to request advance payments because it outlines the terms, amounts, and conditions of the sale. It serves as a formal document to ensure the buyer understands the payment commitment before the transaction is finalized.

Where can I find free downloadable templates for a professional proforma invoice format?

You can find free Proforma Invoice templates on myBillBook, which offers customizable and professional templates in Excel, Word, and PDF formats. These templates are easy to use and ensure compliance with relevant regulations.

Where can I get a blank proforma invoice format for a specific industry?

For specific industry-based Proforma Invoice formats, myBillBook offers customizable templates that can be tailored to fit your business requirements, whether it’s for retail, wholesale, services, or other sectors.

When should a proforma invoice format be updated or revised?

A Proforma Invoice format should be updated when there are changes in tax laws, business operations, or if new product details, payment methods, or terms need to be added. Revisions help maintain accuracy and legal compliance.