How to Generate eWay Bills on eWay Bill Website

Learn how to generate an e-way bills without hassle. This eway bill generation guide walks you through simple steps to create an e-way bill quickly and correctly, ensuring GST compliance and saving time on your logistics tasks.

Steps to Generate e-Way Bill on e-Way Bill Portal

Before generating an e-way bill, make sure to register on the eway bill portal. eWay bill registration requires the taxpayer’s GSTIN and mobile number.

Once the e-way bill registration is completed, follow the below steps to generate or create e-way bills.

- Visit the official e-way bill portal at www.ewaybillgst.gov.in/

- Click on the ‘Login’ button, enter the ‘Username’, ‘Password’, & ‘Captcha Code’ to login to the portal.

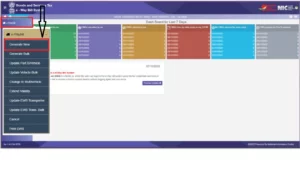

- From the left side navigation, click ‘e-Waybill’ and select ‘Generate New’

- You will then be redirected to ‘E-WayBill Entry Form’ as shown below

- Select ‘Transaction Type’ – Choose ‘Outward’ if you’re supplying the goods or ‘Inward’ if you’re receiving the shipment.

- Based on your selection, the system displays the relevant sub-types.

- Select ‘E-way Bill’ for outward transactions and

- Select ‘E-way bill, SKD/CKD (Semi knocked down condition/Complete knocked down condition)’ for inward transactions.

- From the drop-down, choose the ‘Document Type’ – either Invoice, Bill, Challan, Credit Note, Bill of Entry, or ‘Others’ if not listed.

- Enter the document or invoice number (should be unique for every eway bill)

- Select the date of the invoice or document (Should be lesser than or equal to the current date)

- In the ‘Bill From’ column, details like Name, GSTIN, and State will be auto-populated based on the account holder’s GSTIN.

- Similarly, in the ‘Dispatch From’ column, the same details will be auto-populated. If your godown and GSTIN-registered addresses are the same, you can continue with the same details. If the addresses are different, you can add the address manually in the ‘Dispatch From’ column.

- In the ‘Bill To’ column, add the details of the buyer to whom you’re sending the goods, or simply add the GSTIN to get the name auto populated. The ‘Ship to’ fields auto-populate as per the GSTIN entered in the ‘Bill To’ column. If you want to add a different shipping address, you can enter it manually in the ‘Ship To’ column.

- Under ‘Item Details’, enter the products that are being shipped. If the ‘Product Master’ file is filled out, all other details like the product description, HSN code, unit, and tax rate will be auto-populated.

- Now, enter the quantity and total taxable value. Select the applicable tax slab from the drop-down.

- You can add multiple products by clicking the ‘+’ button.

- The system will then calculate the CGST, SGST, IGST and CESS amount based on the applicable tax rates.

- Under the ‘Transportation Details’, enter

- Mode of transport (road/rail/ship/air)

- Approximate distance (km) to be covered by the shipment.

- Transporter details – name, ID, doc. Number & date or

- Vehicle number carrying the consignment

- Once all the details are entered, click on ‘Submit’.

After validating all the details, the system generates the e-way bill with a unique 12-digit number. If there is any error in the entered information, it will show the related error message.

Video Describing Step-by-Step Guide to Generate eWay Bills

How to Generate e-Way Bill on e-Invoice Portal

If you’re using e-invoice portal to report your B2B transactions, you can generate e-way bill directly from the e-invoice portal in two different ways.

- Creating e-way bill while creating e-invoice

- Creating e-way bills for existing e-invoices.

Let’s check each method in detail.

Create e-Way Bill While Reporting e-Invoices on the eInvoice Portal

You can generate an e-way bill while creating an e-invoice. If you’re sure about the mode of transportation know the transporter details like the registered transporter ID, vehicle number, and vehicle type. This method is quite helpful and time-saving for those suppliers who produce similar supplies regularly through the same transporter and vehicle.

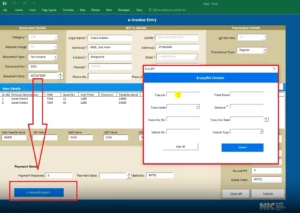

- If you’re using the GePP tool to generate e-invoices, you will find an option to enter ‘EWay Bill Details’ in the’ e-Invoice Entry’ form.

- Click on the ‘EWay Bill Details’

- Enter ‘Transporter ID, Transporter Name, Transport Mode (rail, road, air, ship, etc.), distance, document number, document date, vehicle number, and vehicle type.

- Once all the information is entered, click ‘Submit’

- The information gets auto-updated, and the e-way bill number is generated once the e-invoice is reported to the IRP portal.

- If you want to print the e-way bill, go to the home page of the einvoice portal.

- From the left side navigation, click on ‘e-Way Bill’ and select ‘Print e-Way Bill’

- You will see the print preview of the e-way bill, click on ‘Print’ or ‘Print in Detail’ to take a printout of the e-way bill.

Creating e-way Bill for Existing e-Invoices on eInvoice Portal

Another way of generating eway bills on einvoice portal is creating eway bills for existing einvoices. Using this method, you don’t have to enter the invoice details manually while creating eway bill. Since you use the IRN of the generated invoice, Part-A of the eway bill, which includes the invoice details, gets autopopulated. You just need to fillin the Part-B details like the transporter and vehicle details to generate the e-way bill. Let’s check the process in detail.

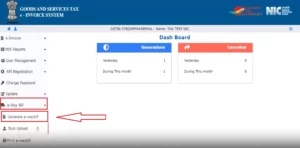

- Login to the einvoice portal at www.einvoice1.gst.gov.in

- From the left side menu, go to ‘e-Way Bill’ and select the ‘Generate e-Way Bill’ option.

- Next, on the ‘Generate E-way bill’ page, enter your GST number, and select any one from ‘Acknowledgement Number, IRN, and Date’ pertaining to the e-invoice for which you want to generate eway bill.

- Based on your preference, fill in the next field and click ‘Go’.

- If you enter the date, all the e-invoices generated on that particular date will appear. You need to choose the einvoice for which you want to create eway bill.

- Once you choose the einvoice, you will see that the ‘Part-A’ of the e-way bill is already filled with the invoice details; you need to fill ‘Part-B’.

- You need to enter ‘Transporter ID’, Transporter Name, Distance, Mode of Transportation, Vehicle Type, Vehicle Number, Transporter Doc Number, and Date and click on ‘Save’.

- If all the details are correct, the e-way bill gets generated instantly.

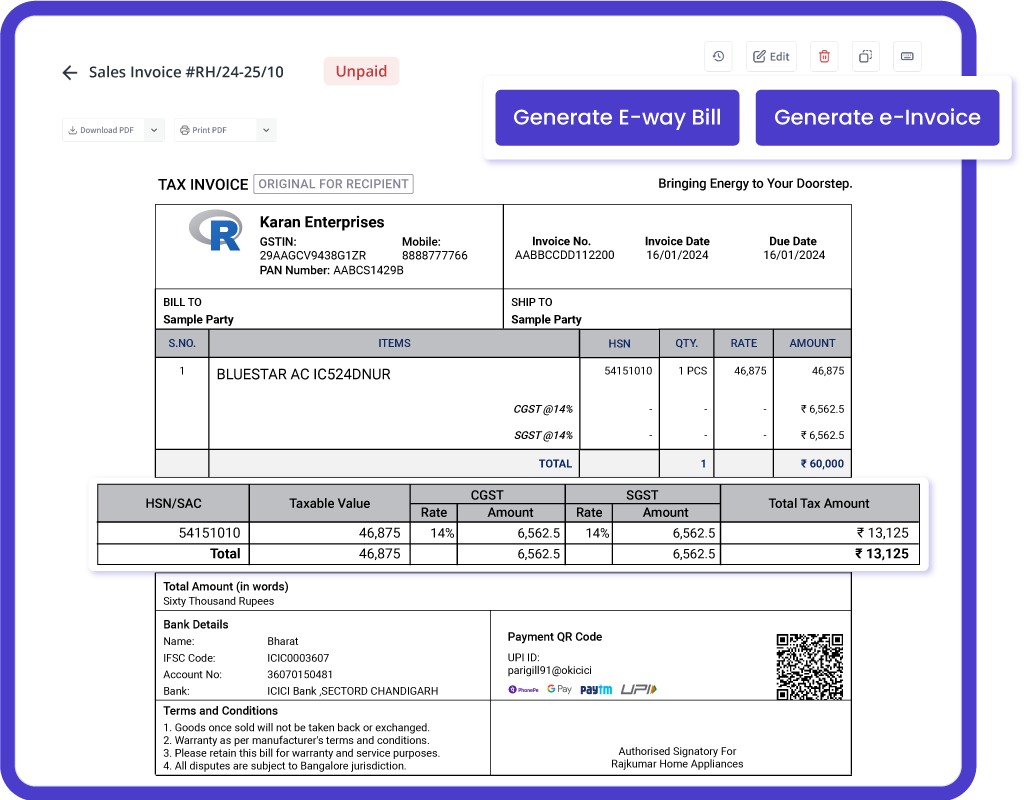

Generate eWay Bills Using myBillBook in a Single Click

myBillBook eway bill software is India’s No:1 billing and accounting software that helps businesses streamline their billing and accounting processes. With the government mandating e-way bills, myBillBook upgraded the software to support e-way bill generation. myBillBook is powered by Masters India GST Suvidha Provider to simultaneously generate e-invoices and e-way bills. Once you enable the einvoicing option on the myBillBook billing app, you can directly convert all your B2B invoices into e-invoices in a single click. In the same step, you can generate e-way bills for all the applicable invoices.

Top Features of myBillBook e-Way Bill Software

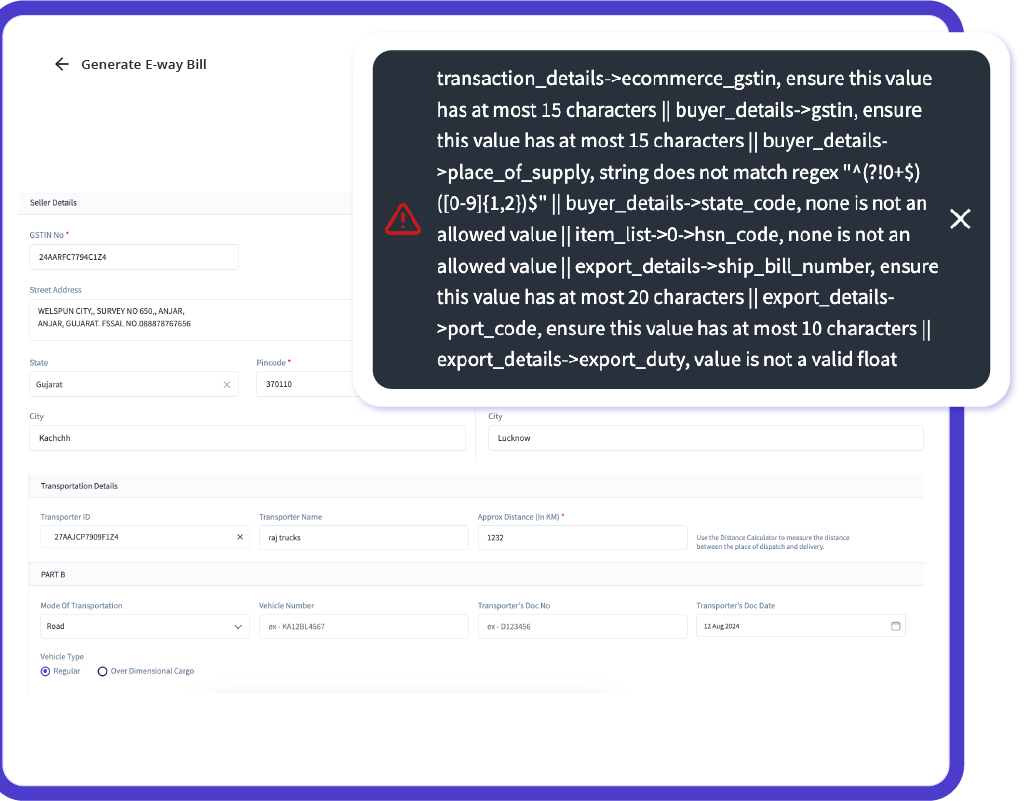

Seamless e-Way Bill Creation with Auto-Validation

Create e-way bills instantly, with automatic population of GSTIN, vehicle number, and transporter ID, in under 30 seconds. Rely on 25+ intelligent error checks to maintain compliance, prevent errors, and reduce penalties, all while optimizing your logistics operations.

Streamlined Integration with GST and e-Invoicing

Benefit from seamless integration with GST and e-invoicing modules. Automatically generate and share e-way bills from your invoices with zero manual effort, ensuring a more unified and efficient compliance workflow.

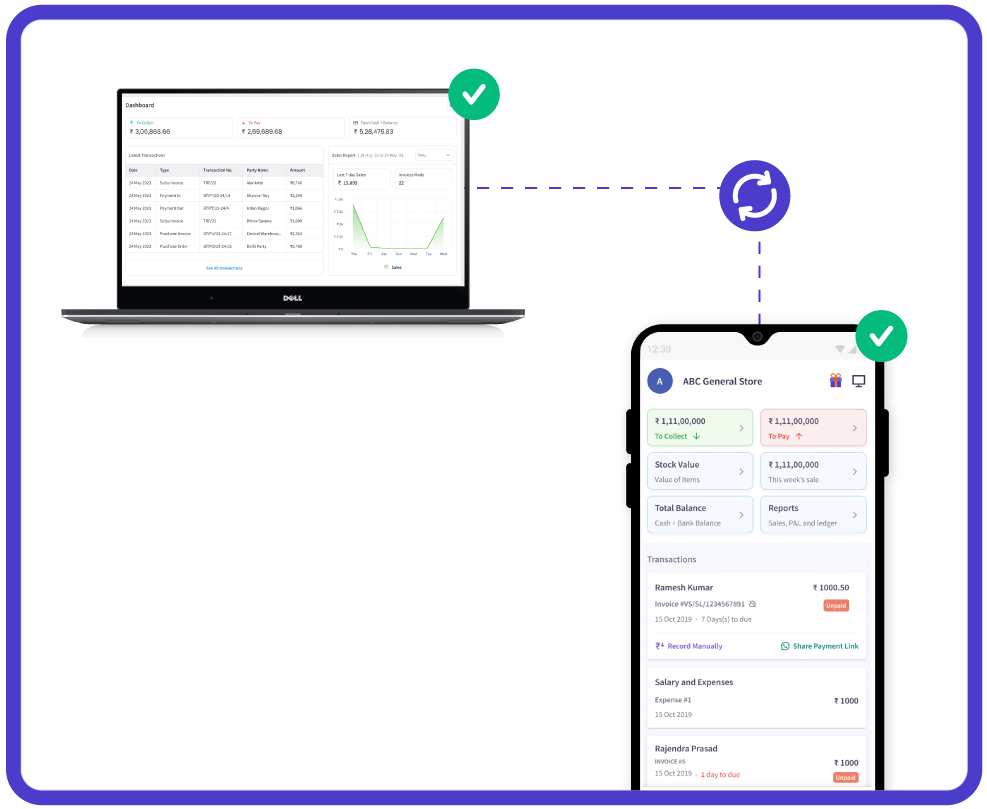

Seamless Multi-Device Support with Real-Time Sync

With myBillBook’s cloud solution, you can securely access e-way billing transactions from any device—phone, tablet, or computer—at the same time. Real-time data sync keeps all your devices updated and synchronized.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

Frequently Asked Questions (FAQs) on e-Way Bill Generation

What modes are available to generate an e-way bill?

Registered individuals can generate an e-way bill through various modes, including:

- Web-based system or waybill official portal or einvoice portal

- SMS-based facility

- Android App and iOS App

- Bulk generation facility

- Site-to-Site integration

- GSP (Goods and Services Tax Suvidha Provider)

Why do transporters need to enrol on the e-way bill system?

Unregistered transporters, not having GSTIN, might handle goods movement for their clients. To facilitate this, they must enrol on the e-way bill portal to acquire a 15-digit Unique Transporter ID, which enables them to generate e-way bills for the goods they transport.

Who should generate e-way bills?

Any registered individual moving goods or consignment worth more than Rs. 50,000 concerning a supply, for reasons apart from the supply or due to inward supply from an unregistered individual, should generate e-way bills.

Where can I generate an e-way bill?

You can generate an e-way bill on the government e-Way Bill portal at www.ewaybillgst.gov.in/.

What are the prerequisites for online e-way bill generation?

Here are the prerequisites for online e-Way Bill generation:

- Registration on the e-Way Bill portal

- The bill/invoice/delivery challan related to the consignment of goods

- Transporter ID, transport document number, vehicle number and vehicle details.

Can we generate eway bill after delivery?

No, an e-way bill needs to be generated before the movement of goods commences. It cannot be generated after the delivery is made.

Can I generate eway bill without GST number?

No, a valid GST number is mandatory for generating an e-way bill. However, unregistered transporters without GST number can enrol themselves, get a transporter ID and generate eway bills for their clients.

Can I generate eway bill without a vehicle number?

- Yes, you can initially generate an e-way bill without the vehicle number. However, it needs to be updated with the vehicle number before the movement of goods begins.

How do I find my eway bill ID?

If you forgot your eway bill ID or username,

- Visit the www.ewaybillgst.gov.in/Login.aspx

- Click on the ‘Forgot Credentials’ > ‘Forgot User Name’

- Enter GSTIN/Transin, registered mobile number, and captch code and click on ‘Submit’

- On successful verification, the system will send the username to your registered mobile number and email address.

How to I generate my e-way bill from my phone?

You can generate an e-way bill using the e-way bill mobile app available on Android platform. Just download the app, log in, and follow the steps to generate the bill.

How do I generate einvoice and an eway bill?

You can generate einvoice and eway bill together through the einvoice official portal at www.einvoice.gst.gov.in.

How can I generate eway bill by SMS?

To generate eway bill by SMS, first you need to register your mobile number in e-way bill portal. Once registered, you can send the SMS in the specified format to 77382 99899 to generate eway bill.

The typical SMS format to generate eway bill is – ‘EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle’.