State-wise e-Way Bill Limit 2025 – Inter-State & Intra-State

Did you know that the eWay Bill limit for intra-state (within the state) movement of goods varies across different states in India? While the central government has established a standard eWay Bill limit for inter-state (between states) transportation, state governments have the discretion to set their own limits for the movement of goods within their boundaries. While most states in India adhere to the same eWay Bill limit for intra-state movement, a few have set distinct thresholds and exemptions based on their specific needs. This page will provide an in-depth exploration of eWay Bill limits for both inter-state and intra-state movements, along with a detailed breakdown of each state’s specific eWay Bill thresholds and regulations.

e-Way Bill Limit for Inter-State (State-to-State) Movement

The central government has fixed the e-way bill limit for inter-state or state-to-state movement of goods as per the CGST Rules.

As per the recent update, both registered and unregistered transporters are required to carry an e-way bill while transporting goods worth more than Rs. 50,000 between the states in a motorised vehicle.

The nature of movement may not necessarily be in relation to a supply. It could be due to the return of goods, transfer to another branch, job work or consignment. An inward supply from an unregistered person also requires an e-way bill if the bill value meets the set threshold.

The e-Way Bill provisions for inter-state supplies were implemented across India from 1st April 2018.

e-Way Bill Limit for Intra-State (within the state) Movement

The decision to implement the mandatory e-way bill for supplies within the state was left to the respective state governments.

Many states in India have made it mandatory to generate e-way bills for the movement of goods worth more than Rs. 50,000 within the state.

While most states have kept the eway bill limit at Rs. 50,000, a few states had a different eway bill limit threshold. Let’s look at each one of them in detail.

State-Wise e-Way Bill Limit

State Name |

eWay Bill Limit |

Intra-State Limits Effective From |

|

|

Within the State (Intra-State) |

State-to-State (Inter-State) |

||

|

Arunachal Pradesh |

Rs. 50,000 |

Rs. 50,000 |

25 April 2018 |

|

Assam |

Rs. 50,000 |

Rs. 50,000 |

16 May 2018 |

|

Andhra Pradesh |

Rs. 50,000 |

Rs. 50,000 |

15 April 2018 |

|

Bihar |

Rs. 1,00,000 |

Rs. 50,000 |

20 April 2018 |

|

Chhattisgarh |

Rs. 50,000 only on certain goods, |

Rs. 50,000 |

1 June 2018 |

|

Chandigarh |

Rs. 50,000 |

Rs. 50,000 |

25 May 2018 |

|

Delhi |

Rs. 1,00,000 |

Rs. 50,000 |

16 June 2018 |

|

Goa |

Rs. 50,000 only on 22 items |

Rs. 50,000 |

1 June 2018 |

|

Gujarat |

Rs. 50,000 only on 19 items |

Rs. 50,000 |

15 April 2018 |

|

Haryana |

Rs. 50,000 |

Rs. 50,000 |

20 April 2018 |

|

Himachal Pradesh |

Rs. 50,000 only on 17 items |

Rs. 50,000 |

5 May 2018 |

|

Jammu & Kashmir |

No e-way Bill Required |

Rs. 50,000 |

1 Dec 2019 |

|

Jharkhand |

Rs. 1,00,000 on all goods except for 12 items |

Rs. 50,000 |

September 2018 |

|

Karnataka |

Rs. 50,000 |

Rs. 50,000 |

1 April 2018 |

|

Kerala |

No e-way bill is required if the specified conditions are met |

Rs. 50,000 |

May 2018 |

|

Madhya Pradesh |

Rs. 50,000 on all goods except for the specified ones |

Rs. 50,000 |

March 2022 |

|

Maharastra |

Rs.1,00,000; No e-way bill required for Hank, Yarn, Fabric and Garments sent for job work. |

Rs. 50,000 |

1 July 2018 |

|

Manipur |

Rs. 50,000 |

Rs. 50,000 |

30 May 2018 |

|

Meghalaya |

Rs. 50,000 |

Rs. 50,000 |

30 May 2018 |

|

Mizoram |

Rs. 10,000 |

Rs. 50,000 |

1 June 2018 |

|

Nagaland |

Rs. 50,000 |

Rs. 50,000 |

1 May 2018 |

|

Odisha |

Rs. 50,000 |

Rs. 50,000 |

1 April 2018 |

|

Punjab |

Rs. 1,00,000 for all goods Rs. 50,000 for specified goods |

Rs. 50,000 |

8 October 2018 |

|

Rajasthan |

Rs. 2,00,000 for within-the-city movement for all goods except all types of tobacco products Rs. 1,00,000 within the state |

Rs. 50,000 |

1 April 2022 |

|

Sikkim |

Rs. 50,000 |

Rs. 50,000 |

1 May 2018 |

|

Tamilnadu |

Rs. 1,00,000 for all taxable goods |

Rs. 50,000 |

2 Jun 2018 |

|

Telangana |

Rs. 50,000 |

Rs. 50,000 |

15 April 2018 |

|

Tripura |

Rs. 50,000 |

Rs. 50,000 |

20 April 2018 |

|

Uttar Pradesh |

Rs. 50,000 |

Rs. 50,000 |

1 April 2018 |

|

Uttarakhand |

Rs. 50,000 |

Rs. 50,000 |

20 April 2018 |

|

West Bengal |

Rs. 50,000 |

Rs. 50,000 |

1 December 2023 |

|

Puducherry |

Rs. 50,000 |

Rs. 50,000 |

25 April 2018 |

e-Way Bill Limit in Rajasthan

e-Way Bill Within the City in Rajasthan:

From April 1, 2022, the Rajasthan Government increased the e-way Bill limit for moving goods within the same city to Rs. 2 Lakhs. The limit applies to all taxable goods except Tobacco and its products (chewing Tobacco, khaipi cigarettes, bidi, etc., classified under Chapter 24), Pan Masala, wood and articles of wood, and Iron and steel.

e-Way Bill Limit Within the State of Rajasthan:

From April 1, 2021, the Rajasthan Government revised the e-Way Bill limit for within the state movement of goods to Rs. 1 Lakh. This means the movement of goods within Rajasthan with a consignment value exceeding Rs. 1 lakh requires an e-way bill.

The revised eway bill limit applies to all goods except tobacco and its products like chewing tobacco, khaini, cigarettes, bidi, etc., and Pan Masala.

e-Way Bill Limit From Rajasthan to Other States:

The e-way bill inter-state limit in Rajasthan is like any other Indian state, which is fixed at Rs. 50,000 by the Central Government.

e-Way Bill Limit in Maharashtra

e-Way Bill Limit Within Maharashtra:

The Maharastra e-way bill intra-state limit or within the state limit is detailed here. As per the notification released by the Maharashtra State government in 2018, starting 1st July 2018, e-way is required to move goods with consignment value exceeding Rs. 1 lakh.

This means no eway bill is required if the consignment value of the goods in the vehicle is less than Rs. 1 lakh.

Further, an e-way bill is also not required in Maharashtra if the consignment includes goods like Hank, Yarn, Fabric and Garments transported for a distance of up to 50 KM within the State for the purpose of job work.

e-Way Bill Limit From Maharashtra to Other State:

If you’re transporting goods from Maharashtra to other states in India, you need to generate an e-way bill if the consignment value of the goods in the motorised vehicle is more than Rs. 50,000.

e-Way Bill Limit in Delhi

e-Way Bill Intra-State Limit Delhi:

The Delhi e-way bill intra-state limit or within the state limit is detailed here. As per the notification released by the Delhi State government in 2018, starting 16th June 2018, e-way is required to move goods with consignment value exceeding Rs. 1 lakh.

Further, no e-way bill is required if the supply takes place from a registered business place of a taxable person to an unregistered buyer, irrespective of the consignment value.

However, the supply must be accompanied by an invoice or bill of supply, voucher, delivery challan or bill of entry, whichever is applicable, as per Section 31 of the Delhi GST Act.

e-Way Bill Inter-State Limit Delhi:

If you’re transporting goods from Delhi to other states in India, you need to generate an e-way bill if the consignment value of the goods in the motorised vehicle is more than Rs. 50,000

e-Way Bill Limit in Karnataka

Karnataka is the first state to implement both intra-state and inter-state eway bills from 1st April 2018. Accordingly, for both intra-state and inter-state movement of goods, eway bill limit in Karnataka is Rs. 50,000.

e-Way Bill Limit in Tamilnadu

e-Way Bill Intra-State Limit Tamilnadu:

From 2 June 2018, the Tamilnadu Government implemented the eway bill requirement for intra-state movement of goods. As per the notification, no e-way is required for within-the-state movement of goods if the consignment value is less than Rs. 1 lakh. This means eway bill limit in Tamilnadu for within the state movement of goods is Rs. 1 Lakh.

e-Way Bill Inter-State Limit Tamilnadu:

If you’re transporting goods from Tamilnadu to other states in India, you need to generate an e-way bill if the consignment value of the goods in the motorised vehicle is more than Rs. 50,000.

e-Way Bill Limit in Gujarat

e-Way Bill Intra-State Limit Gujarat:

The Gujarat government has made e-way bill generation mandatory for the movement of certain goods within the state only when the consignment value is more than Rs. 50,000.

The state has identified 19 items for which an e-way bill is mandatory when transported within the state. Here is the list –

- Edible oil of any kind

- Taxable Oil seeds

- Oil cakes

- Iron and steel

- Ferrous and non-ferrous metal and scrap thereof

- Ceramic tiles

- Brass parts and Brass items

- Processed tobacco and related products

- Cigarette, Gutkha and Pan Masala

- Yarn

- Plywood, Block Board, Decorative and laminated Sheets

- Coal, including Coke in all its forms

- Timber and Timber Products

- Cement

- Marble and Granite

- Kota Stones

- Naphtha

- Light Diesel Oil and

- Tea in any form

Therefore, the eway bill limit in Gujarat is Rs. 50,000.

e-Way Bill Inter-State Limit Gujarat:

If you’re transporting goods from Gujarat to other states in India, you need to generate an e-way bill if the consignment value of the goods in the motorised vehicle is more than Rs. 50,000.

e-Way Bill Limit in Haryana

e-Way Bill Intra-State Limit Haryana:

Haryana implemented eway bill for the intra-state movement of goods starting 20 April 2018. Accordingly, an e-way bill needs to be generated to move goods within Haryana if the consignment value is more than Rs. 50,000.

e-Way Bill Inter-State Limit Haryana:

If you wish to move goods outside Haryana, you must have an e-way bill if the consignment value exceeds Rs. 50,000.

For businesses managing these logistics, adopting billing software for hardware shop like myBillBook can streamline your operations, making it easier to generate e-way bills and manage your financial documentation efficiently.

Top Features of myBillBook e-Way Bill Software

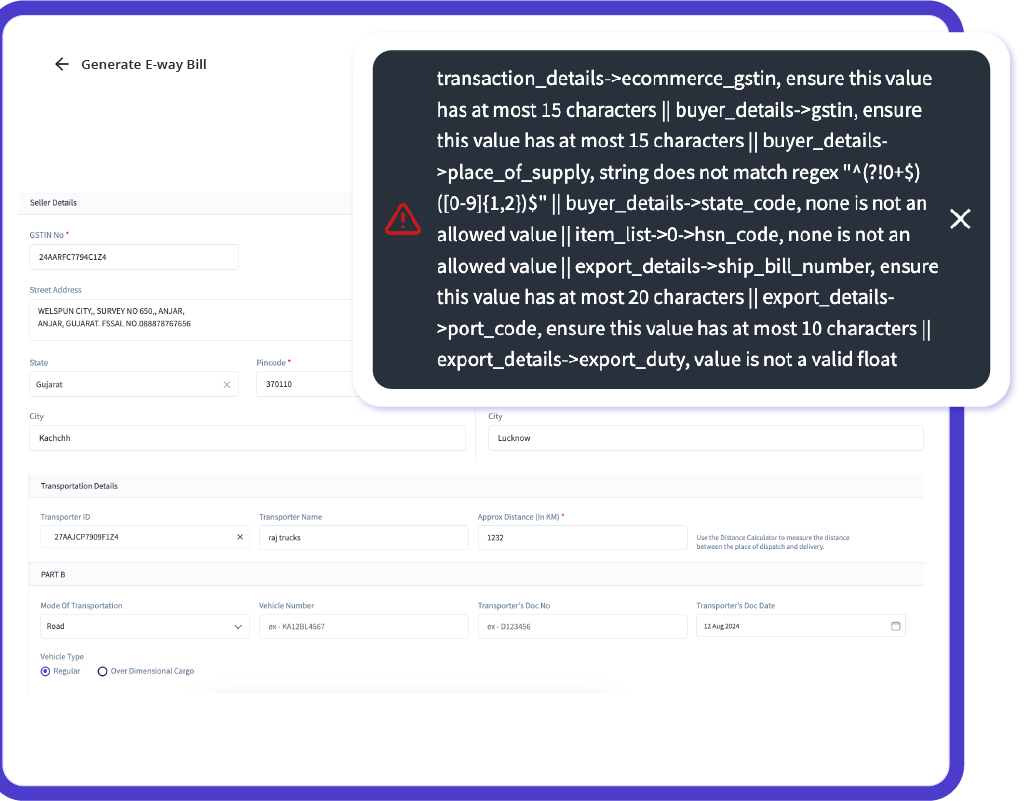

Generate e-Way Bills Instantly with Auto-Validation

Create accurate e-way bills in under 30 seconds by automatically filling in essential information like GSTIN, vehicle number, and transporter ID for each shipment. Stay compliant with over 25 intelligent error checks, avoiding costly penalties and manual mistakes, while optimizing your logistics processes.

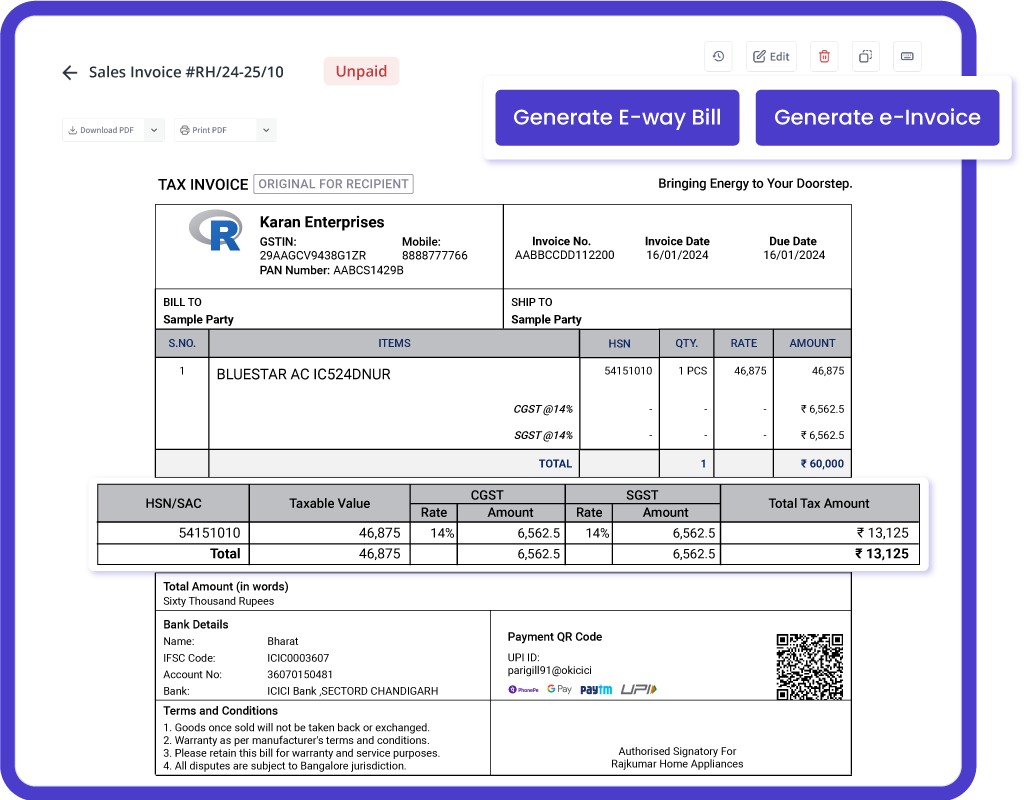

Easy Integration with GST and e-Invoicing

Enjoy seamless integration with GST billing and e-invoicing modules. Effortlessly generate and share e-way bills directly from your invoices, with no manual input required, ensuring a streamlined and efficient compliance process.

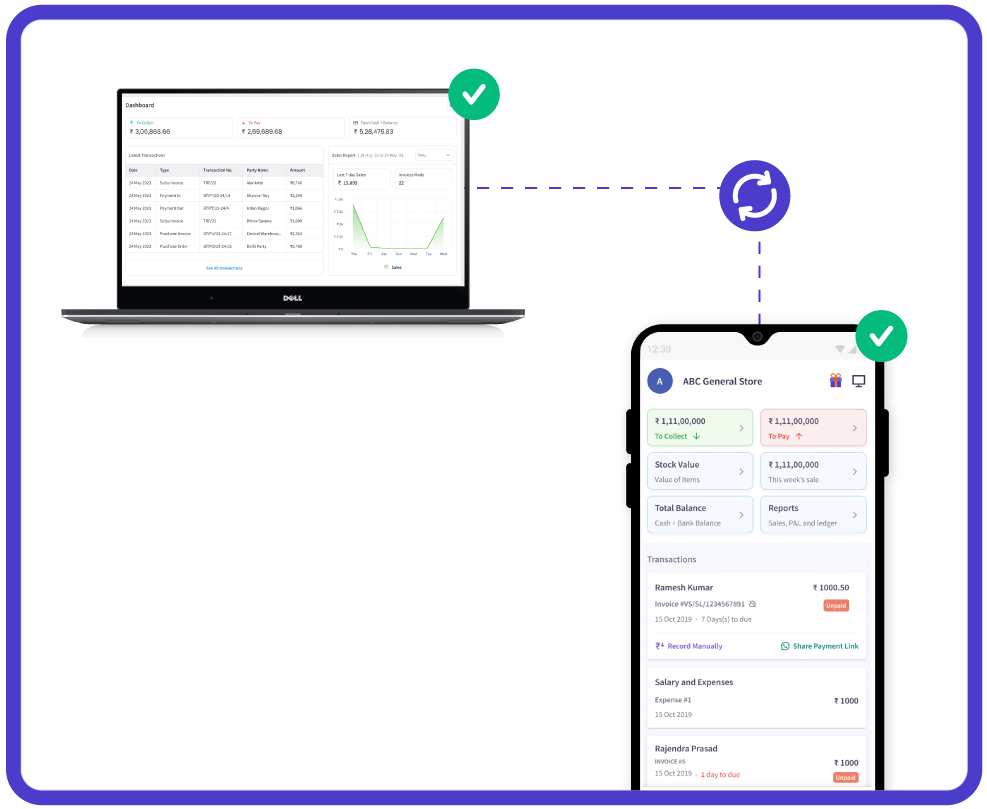

Real-Time Data Sync & Access from Any Device

Access your e-way billing transactions securely from anywhere with myBillBook’s cloud-based solution. Use multiple devices (phone, computer, tablet) simultaneously, and enjoy real-time data synchronization across all devices, ensuring your information is always current.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

FAQs on e-Way Bill Limit

What is the e-way bill limit for inter-state supply?

The e-way bill limit for interstate supply is currently set at Rs. 50,000.

What is the e-way bill limit from one state to another?

For moving goods from one state to another, the e-way bill limit is Rs. 50,000.

Is e-way bill compulsory for interstate movement?

Yes, the e-way bill is compulsory for interstate movement if the value of the consignment exceeds Rs. 50,000.

What is the limit of e-way bill in 2024?

As of 2024, the e-way bill limit remains at Rs. 50,000 for interstate supply..

Is eway bill mandatory for value above Rs. 50,000?

Yes, an e-way bill is mandatory for transactions above Rs. 50,000, whether it’s for interstate or intrastate movement. However, for some states, the intra-state e-way bill limit is different. Check the above table for state-wise eway bill limit for intra-state movement of goods.

Is e-way bill mandatory for value below Rs. 50,000?

No, for transactions below Rs. 50,000, the generation of an eway bill is not mandatory, whether it’s for interstate or intrastate movement.

What is interstate or intrastate supply?

Interstate supply involves the movement of goods from one state to another, while intrastate supply refers to the movement of goods within the boundaries of the same state.

What is an example of interstate supply?

Interstate supply means transporting goods from one state to another. For instance, goods transported from Karnataka to Maharashtra come under interstate supply.

What is the eway bill limit in Rajasthan and other states?

The eway bill limit varies for every state. In Rajasthan, the intrastate limit was Rs. 1 Lakh, and Rs. 2,00,000 for within-the-city movement of all goods except tobacco and its related goods. The eway bill limits for other states are listed in the table above.

What is the eway bill limit in Maharashtra?

Maharashtra, like other states, has an interstate eway bill limit of Rs. 50,000. For intra-state movement, the limit is Rs. 1,00,000.

In which case is an e-way bill not required?

An e-way bill is not if the distance between the supplier and the recipient is less than or equal to 50kms. It is also not required for specific exempted goods or certain transportation situations, such as from ports to inland depots for customs clearance.