e-Way Bill Format: EWB-1 Format

The e-way bill (EWB) format or the GST EWB-1 format is the standard template for generating an e-way bill under GST regulations. A standard EWB format ensures that all relevant consignment and transportation data are captured for compliance and inspection purposes. This page provides detailed information about the eway bill format and e-Way Bill format in PDF and Excel formats.

e-Way Bill Format (GST EWB-01)

The eway bill format is divided into two main parts that each serve specific compliance functions:

- eWay Bill Part A: This section requires shipment details, including:

- Consignor and Consignee Details: GSTIN of sender and receiver, names, and addresses.

- Item Information: Product description, HSN codes, quantity, and value.

- Invoice and Document Numbers: For traceability and record-keeping.

- eWay Bill Part B: The transporter details like the vehicle number, mode of transport (road, rail, air, or ship), and distance are recorded.

This part is especially important for physical checkpoints, where vehicle details verification ensures compliance with movement rules.

Here’s a table summarising the required fields in Part A and Part B of the e-way bill format:

| eWay Bill format – Part A Fields | eWay Bill format – Part B Fields |

| GSTIN of supplier | Mode of transportation (road/rail/air/ship) |

| GSTIN of recipient | Vehicle number |

| Place of dispatch | Transporter ID (if applicable) |

| Place of delivery | Transporter name |

| Document number (e.g., invoice) | Transporter document number |

| Document date | Approximate distance (in km) |

| HSN code | |

| Description of goods | |

| Quantity and unit of goods | |

| Value of goods | |

| Taxable value, CGST, SGST, IGST, CESS |

e-Way Bill Format in PDF

The e-way bill format in PDF is highly popular among businesses due to its fixed layout, ensuring consistency and easy readability across different devices.

- Creating a PDF e-Way Bill: The GST e-way bill portal provides an option to download the generated eway bill in PDF format directly after filling out the EWB-01 form. Businesses can save or print this document, maintaining a physical copy for transit and compliance purposes.

Downloading eway bills in PDF is secure and tamper-resistant and also helps to maintain the integrity of the information for inspections.

e-Way Bill Format in Excel

For businesses dealing with high-volume shipments, the eway bill format in Excel offers flexibility for bulk management. The GST portal’s ‘Bulk Generation Tool’ allows users to fill out multiple e-way bills in a single Excel sheet, which is then converted into JSON for direct upload.

After filling in the fields, save the sheet as a JSON file and upload it to the GST portal. Excel allows easy data manipulation and is ideal for businesses managing frequent or bulk e-way bills

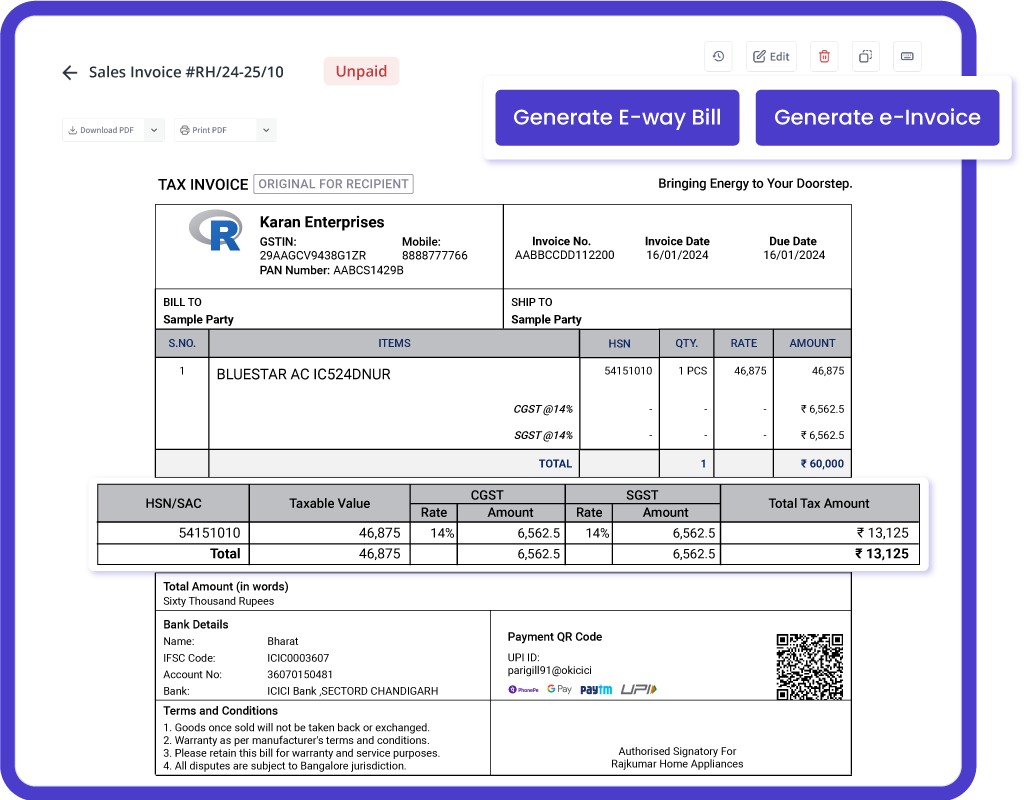

myBillBook eway bill software is India’s No:1 billing and accounting software that helps businesses streamline their billing and accounting processes. With the government mandating e-way bills, myBillBook upgraded the software to support e-way bill generation. myBillBook is powered by Masters India GST Suvidha Provider to simultaneously generate e-invoices and e-way bills. Once you enable the einvoicing option on the myBillBook billing app, you can directly convert all your B2B invoices into e-invoices in a single click. In the same step, you can generate e-way bills for all the applicable invoices.

Top Features of myBillBook e-Way Bill Software

Quick and Reliable e-Way Bill Generation

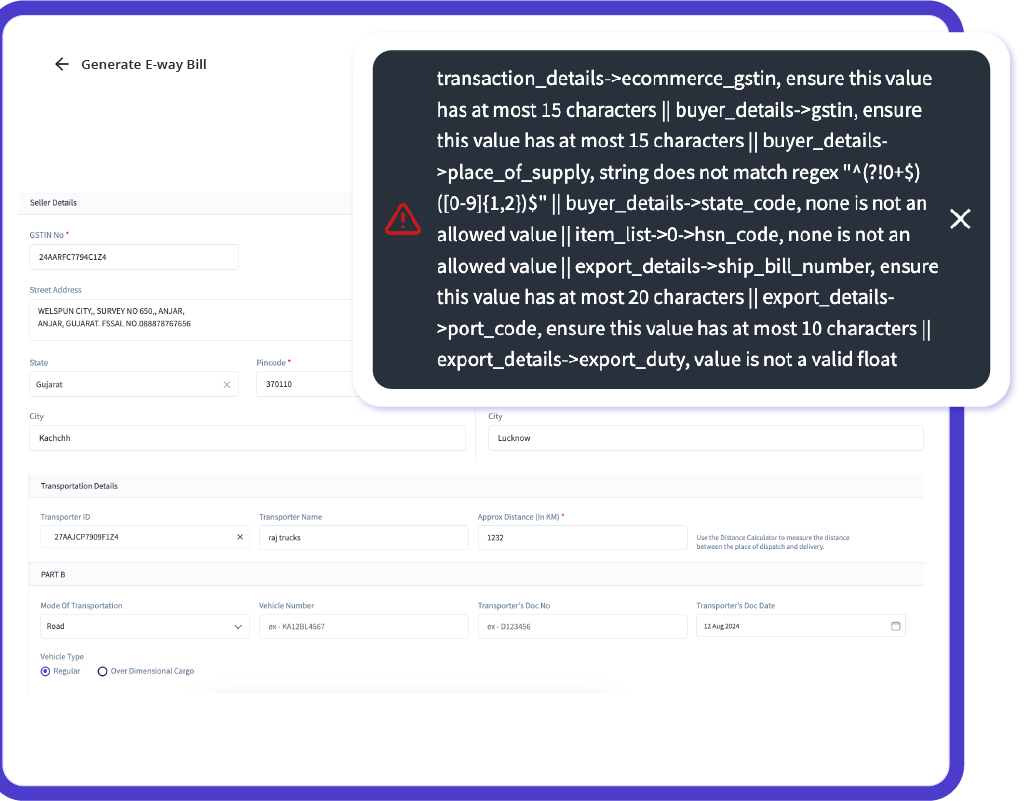

Create accurate e-way bills in less than 30 seconds by automatically filling in GSTIN, vehicle number, and transporter ID for each shipment. With over 25 intelligent error checks, you can ensure compliance, prevent penalties, and enhance your logistics operations.

Unified GST and e-Invoicing Integration

Seamlessly integrate with GST billing and e-invoicing modules to automatically generate and share e-way bills from your invoices. Say goodbye to manual intervention and ensure a more efficient and unified compliance process.

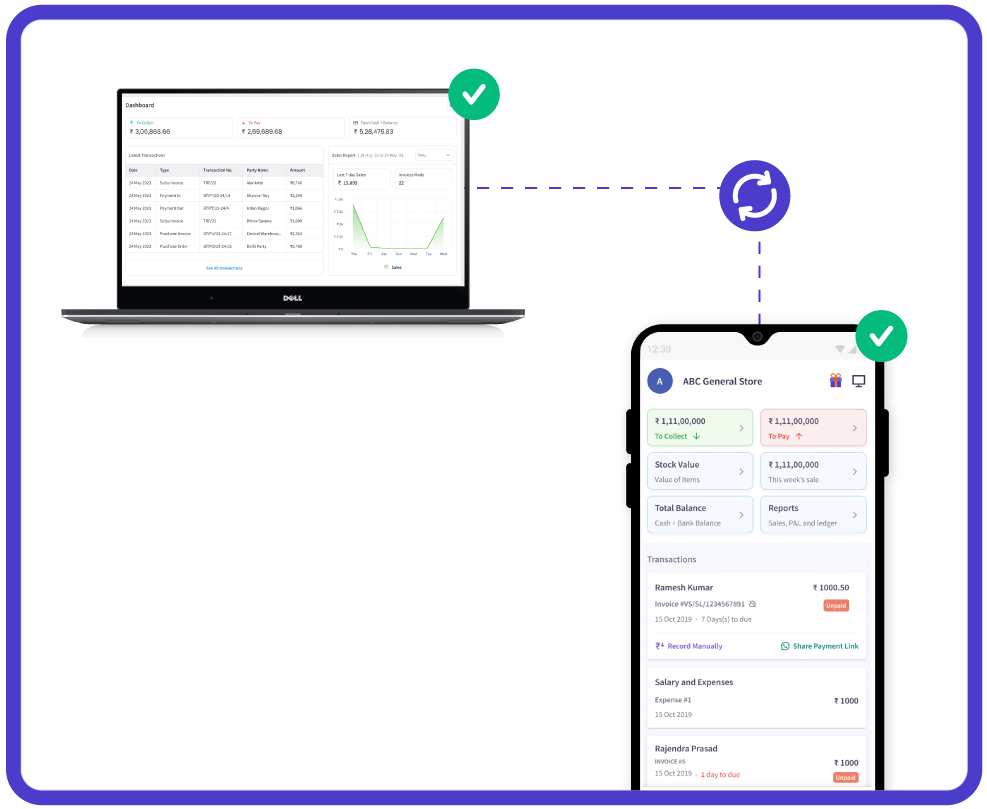

Flexible Multi-Device Support with Real-Time Data Sync

Access your e-way billing transactions securely on any device—phone, computer, or tablet—using myBillBook’s cloud-based solution. Enjoy seamless real-time data synchronization, ensuring your information is always up-to-date.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

FAQs on eWay Bill Format

What is eWay Bill format?

The e-way bill format is a standardised document required to generate eway bills. It consists of two main parts, Part A and PART B, to capture all the details related to the consignment, transporter, mode of transport, etc.

Can the eWay bill format be edited after submission?

Limited fields can be updated once an eway bill is generated, but major modifications require a new e-way bill.

Are PDF and Excel formats mandatory for e-way bills?

eWay bill format in PDF is convenient for single transport, while eway bill format in Excel is beneficial for bulk generation but is not mandatory.