GSTIN

As a person deciding to commence a business, there will be several things you shall consider as rules and regulations to follow. One of them would be taking a GSTIN for the business.

As per the new regulation, every business (for the sale of goods) whose aggregate turnover (income of a financial year) is more than INR 40 lakhs must register under GST. You can find it by calculating the aggregate turnover of the business in a fiscal year.

To begin with, you should have an understanding of the GSTIN.

What is GSTIN Number?

GSTIN is a PAN-based 15-digit unique identification number allotted to every person registered under GST.

GSTIN stands for the GST Identification Number.

For more information on the basics of invoicing, refer to what is invoicing.

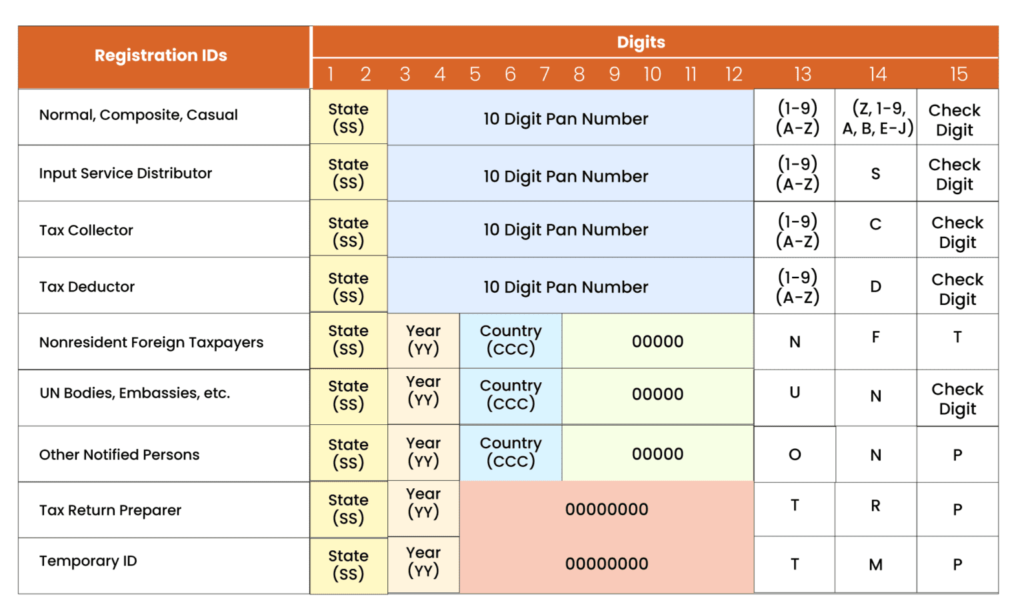

GSTIN Number Format

The GSTIN consists of 15 digits in which the numbers depict different codes. Here are the specifications of the codes:

- The first two numbers represent the state cord of a registered person.

- The following ten digits represent the PAN of the registered person.

- The 13th digit represents the entity number of the same PAN.

- The 14th is the alphabet, “Z,” set by default.

- The 15th, the last, can either be an alphabet or a number and is used to detect errors.

Why Do You Need a GSTIN?

The reasons for the implementation of GSTIN were:

- It replaces many other central and state-levied taxes like excise, VAT, and service tax.

- It offers a single platform to consolidate all taxpayers.

- It makes a single authority administer all processes related to taxpayers registered.

- It helps you have a valid GSTIN to be eligible for a business loan.

- It assists in paying off GST liability.

How to Get GSTIN Number

To get the GSTIN(GSTIN full form- the GSTIN number), you should apply for it online on the government website with the following steps:

- First, log in to that GST online portal www.gst.gov.in.

- Then, click on “Register Now”.

- Fill in the application Part A by entering your name, email ID, and mobile number.

- The portal verifies your details by sending an OTP to your mobile and email.

- After verification, you will receive the Application Reference Number –ARN on your mobile or email.

- Next, fill out the application – Part B using the Application Reference Number. The documents you need in this step consist of a photograph, constitution of the taxpayer, proof(s) of the place of business, bank account details, and an Authorisation Form.

- Afterwards, upload all the necessary documents.

- Submit the applications using Aadhaar OTP or DSC.

The GST officer verifies your application within three working days. Then, the officer will either approve your application and provide you with the Certificate of Registration (Form GST REG 06) or might ask for more information if the details are unsatisfactory.

GSTIN Verification Process

You can perform the GSTIN verification online using a laptop or smartphone. There are two ways to do this:

Through the Government Website

- Login to the GST portal

- Click on “Search Taxpayers.”

- Select “Search by GSTIN/UIN” (Goods and Services Tax Identification Number/ Unique Identification Number)

- Enter the GSTIN Number stated on the invoice in the search column and the captcha.

- Click on “Search”.

Using the Tools

Many online tools collect the data directly from the GSTIN portal and display the GSTIN search results. For using one:

- Open a GSTIN Search Tool and enter the GSTIN in the search area.

- Then, enter the correct format and click on “Search and Verify”.

Guidelines for GSTIN Search

You can identify the GSTIN meaning the GST Identification Number of a person according to the PAN. Here are the guidelines for the search:

- Visit the GST portal

- Click on the “Search Taxpayer” tab,

- Select “Search by PAN”.

- Enter the PAN number and character shown in the image.

- Click on “Search”.

- The website will display the details of the GSTIN registration held against the given PAN.

How do I search GSTIN by pan, and what are the GSTIN details I receive?

First, click “Search Taxpayer” on the homepage and select “Search by PAN” . Then, enter the PAN number of the business concerned and click on Search.

On searching, you will get the following GSTIN details

- GSTIN of the taxpayer

- The legal name of the business

- Principal place of business

- An additional area of business, state jurisdiction

- Centre jurisdiction, date of registration

FAQs

Is mentioning GSTIN on the invoices mandatory?

Yes.

Apart from mentioning a GSTIN, the GST-registered person should display the GST registration certificate at all places of business.

How can I get a GSTIN?

You must submit the Form GST REG-01 and the required documents using the GST portal to get one. Then, after an officer verifies, the portal allocates you a GSTIN.

When is a GSTIN usually allocated?

The GST portal will allocate a 15-digit GSTIN to an applicant once the GST registration application is processed successfully.

Can I hold multiple GSTINs?

If you have a business that operates from more than one state, you can hold separate GST registration for each state and thus multiple GSTINs.

What are the possible things you can do using a GSTIN?

You can use GSTIN to:

- Check whether a firm is registered or not.

- Verify a GSTIN of a taxpayer.

- Find someone with a GST number.

- Check to see if a GSTIN is active.

- Check for the business name, location, state and local centre, registration date, business constitution, taxpayer type, and cancellation date.