Payment Voucher Format

Record cash/bank/UPI payments with clean, audit-friendly vouchers. From petty cash to supplier settlements, create professional vouchers that keep books accurate and compliant.

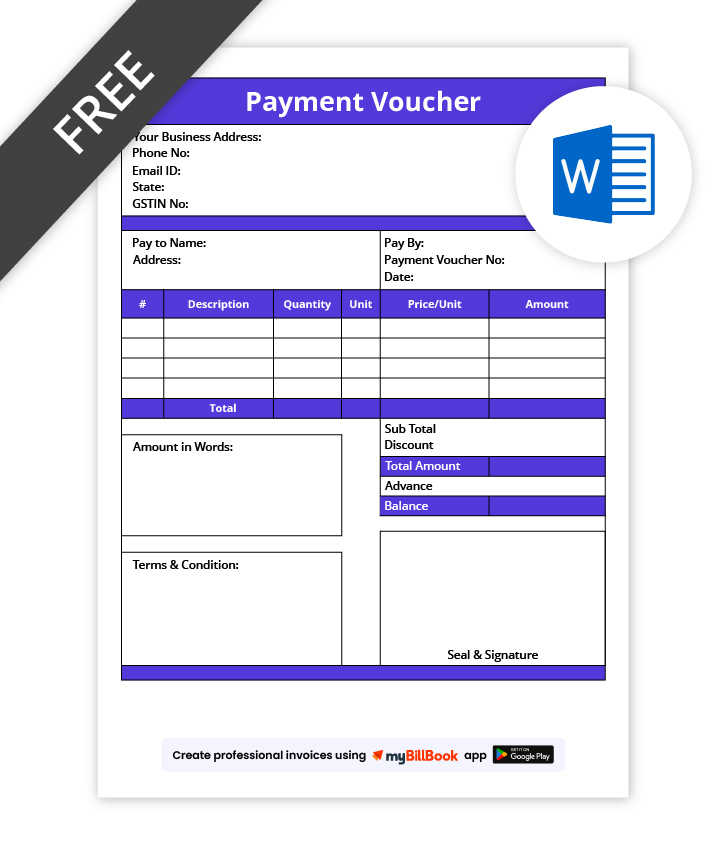

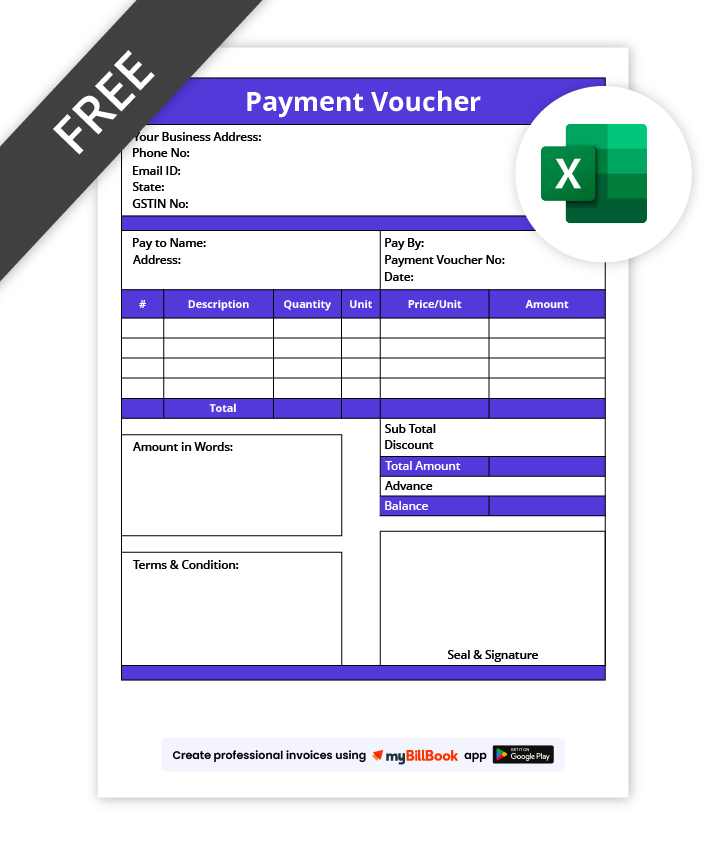

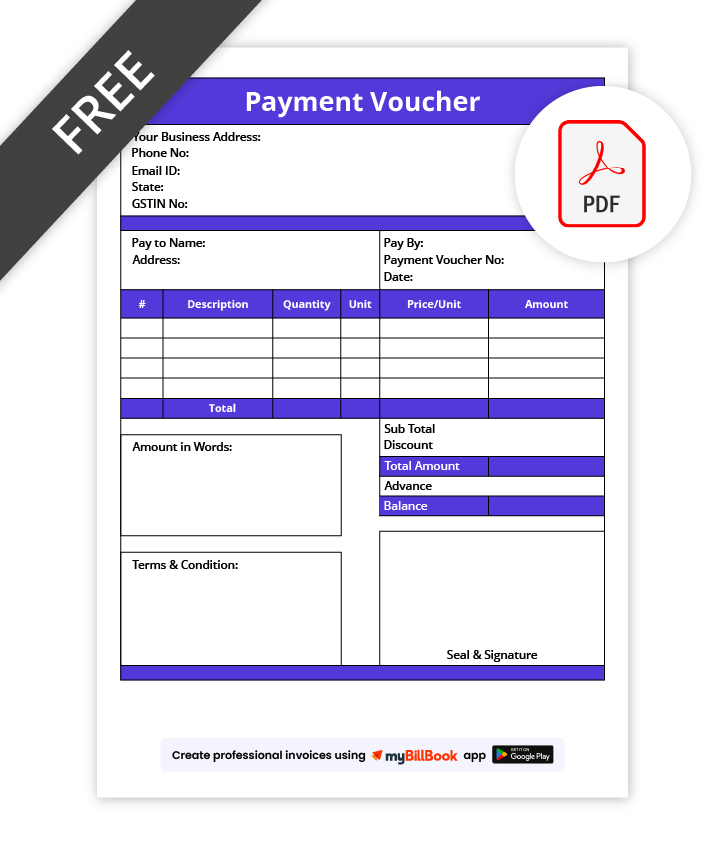

myBillBook billing solution provides editable payment voucher templates in Word, Excel & PDF—so you can capture party details, modes, references, and narrations quickly and share or print in minutes.

Payment Voucher Format in Word, Excel & PDF – Free Download

Start with ready designs for cash/bank/UPI/cheque/petty-cash vouchers, including voucher no., date, party, INR amount, mode, narration, and signature.

Explore Premium Payment Voucher Format

Features of myBillBook Payment Voucher Format

Ledger Posting

Record payment vouchers that auto-post to party and cash or bank ledgers. Maintain correct balances, dates, and narration for clean books and faster reconciliations monthly.

Payment Modes

Capture payments via cash, bank transfer, UPI, or cheque with reference numbers, UTR, deposit dates, and attachments. Standardize inputs, reduce mistakes, and speed counter operations.

Invoice Mapping

Select party invoices, allocate full or partial amounts, and mark settlements directly from the voucher. Prevent mismatches, avoid duplicates, and keep receivable payable ageing accurate.

Serial Numbering

Define financial-year voucher series with prefixes, auto-increment, and date validation. Maintain unique sequences across branches, improve traceability, and simplify audits and monthly closing procedures consistently.

PDF Sharing

Generate print-ready PDFs of payment vouchers with your branding and signatures. Share instantly via WhatsApp or email, and store copies securely for reference and compliance.

Audit Reports

See payment registers, cash & bank books, day-book summaries, and filters by party, user, and date. Export to Excel, close months faster, and stay audit-ready.

What is a Payment Voucher Format

A payment voucher format is a structured document used to record and authorise payments made by an organisation. It includes essential details such as the payment date, the recipient’s name or company name, the payment amount, the purpose of the payment, any applicable reference numbers, and the authorised signatures. The payment voucher format is a crucial record-keeping tool for tracking all outgoing payments and ensuring transparency and accuracy in financial transactions. Payment vouchers are essential for maintaining a clear GST audit and verifying the legitimacy of each payment made by an organisation.

Features of a Payment Voucher Format

The cash payment voucher format or the cash voucher format generally has the below-mentioned features:

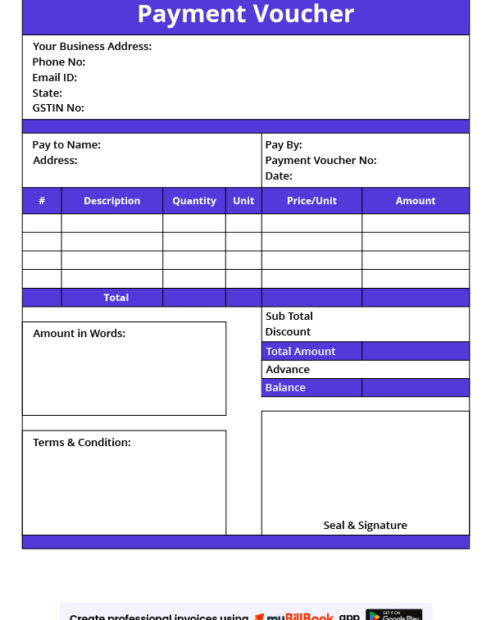

- Identification Details: The payment voucher typically includes identification details such as the voucher number, the date of the transaction, and the name of the payee or vendor.

- Payment Details: It contains specific details about the payment, including the amount paid, the payment method used (cash, cheque, electronic transfer), and the purpose of the payment.

- Authorisation Signatures: To validate the transaction, the payment voucher often includes authorised signatures from both the payer and the payee, ensuring the payment is acknowledged and accepted.

- Account Codes: In many cases, the payment voucher includes account codes or references to specific accounting categories, helping to allocate the payment accurately in the company’s financial records.

- Vendor Details: The voucher details includes about the vendor or the payment recipient, such as their name, address, and unique identification numbers or references.

- Supporting Documents: Some payment vouchers may also include references to supporting documents, such as invoices or purchase orders, to provide additional context and ensure proper transaction documentation.

- Terms and Conditions: Depending on the nature of the transaction, the payment voucher may include specific terms and conditions related to the payment, such as any applicable discounts, due dates, or penalties for late payments.

- Company Logo and Branding: To maintain a professional image, the payment voucher may include the company’s logo, branding elements, and contact information, reinforcing the company’s identity and enhancing brand recognition.

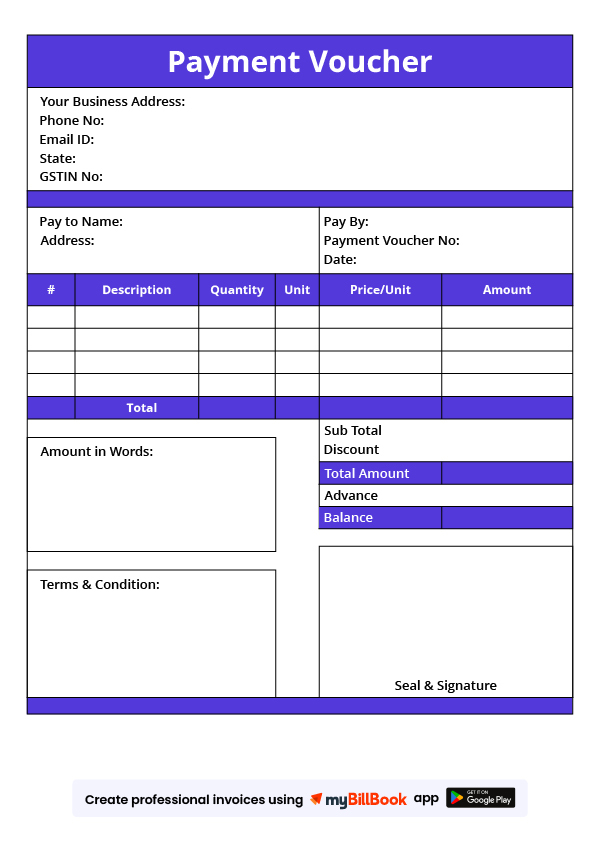

Sample of Payment Voucher Format

Types of Payment Voucher Format

Even though small businesses and organisations have a limited number of bank and cash transactions, they can use a single voucher type to record all the above payments. However, many cash and bank payments occur daily in larger organisations and businesses. As a result, you need two types of vouchers to record the transactions:

- Voucher for Bank Payments: If a cash payment occurs through the business firm or its bankers, you can use the bank voucher or payment voucher.

- Voucher for Cash Payments: The cash voucher payment format is for making a payment in cash.

Details included in the Payment Voucher Format

You should include the following information on the Payment Voucher:

- Supplier’s name, address, and GSTIN (if registered)

- The fiscal year’s unique serial number (not exceeding 16 characters )

- Date of payment voucher issuance

- The recipient’s name, address, and GSTIN

- Goods and services descriptions (on which tax payment happens on the Reverse Charge mechanism)

- Payment made to the Supplier

Advantages of a Payment Voucher Format

Record Keeping: A payment voucher format makes it possible to organise and systematically record all financial transactions, giving a comprehensive overview of all payments made throughout a specific period.

Expense Management: Using a payment voucher format simplifies businesses to manage their expenses effectively and assess and track their spending trends because it categorises and itemises expenses.

Legal Documentation: Payment vouchers protect the rights of both the payer and the payee by providing legal documentation that proves payments were made and evidence of financial transactions.

Easy audit: The structured payment voucher format makes it simpler to track and verify expenses during financial audits and helps to maintain internal controls and compliance with auditing standards.

Financial Control: The payment voucher format helps with financial control and planning by giving a clear picture of all departing cash, enabling firms to make wise decisions about future spending and resource allocation.

Payment Voucher Format in Word

There are various ways to create payment vouchers in Word. One choice is to utilise a pre-made template, which you may discover in Word’s “Templates” section or by simply searching online. These templates typically have a basic layout and placeholder text that you may edit to meet your needs and your company’s. Alternatively, companies can create payment vouchers in Word starting from scratch.

Payment Voucher Format in Excel

Excel is one of the best formats for generating a payment voucher. A payment voucher format in Excel can be helpful for companies that need to track many transactions and provide reports using this information. Businesses can create a new spreadsheet and add columns for the pertinent data to make payment voucher format in Excel.

Payment Voucher Format in PDF

Many companies prefer to create payment voucher formats in PDF because sharing files with clients and maintaining a digital record of their sales activities is simple. Important papers can be securely stored in PDFs since they are less likely to be y changed or amended.

Businesses can create a payment voucher format in PDF using a Word or Excel template to save the document as a PDF. Additionally, PDF documents can be created and customised using various online tools and software applications.

Frequently Asked Questions

What is a payment voucher?

A Payment Voucher is a critical document used for various types of payments, whether they are direct bank transactions, payments by cheque, cash transactions, or even pay orders and bank demand drafts (DDs). It serves as a record of payment and applies to a wide range of financial transactions.

Where is the GST payment voucher used and why?

The GST payment voucher covers RCM transactional payments between the GST taxpayer and the business' unregistered suppliers. Since unregistered taxpayers cannot issue a GST tax invoice, they must execute a GST payment voucher under the reverse charge mechanism.

Is the payment voucher same as the invoice?

Invoices and vouchers are two important documents used for recording business transactions. But unlike invoices, vouchers are made and utilised for internal business purposes. Even though they are sometimes used synonymously, they are not the same.

What is the difference between a voucher and a payment voucher?

The usage of vouchers allows the organisation's transactions to be readily managed and recorded. In contrast, a payment voucher is a document which proves that a monetary transaction has taken place and indicates that the company has paid its suppliers and other third parties.

Is the payment voucher a receipt?

A payment voucher is a request issued for the payment, while the receipt is the payment confirmation. A payment voucher was issued before the payment, while on the contrary, the receipt voucher was issued after the payment.

What type of transaction is a payment voucher?

Payment vouchers represent proof of monetary transactions, often used when a company makes vendor payments. Purchase Vouchers serves as documentation of payments made, indicating that the company has settled its financial obligations.

Is a GST payment voucher mandatory under Reverse Charge?

Yes. Under RCM, the registered recipient should issue a payment voucher to document payment to an unregistered supplier; also use it when paying RCM-liable advances.

What details should a GST payment voucher include?

Voucher number/date, supplier name/address, GSTIN (if any), amount (INR), mode/reference (UTR/cheque), narration, related invoice/PO, and authorised signature/stamp.

Can I record TDS/TCS in a payment voucher?

Yes. Note the TDS section, rate, and amount on the voucher, reflect net payable after TDS, and keep challan/proof attached for audit readiness.

Can a payment voucher be edited or cancelled?

If errors occur, cancel and re-issue (or pass a reversal/correction entry). Maintain an audit trail with reasons, references, and user/time stamps.

Know More About Bill Formats