MahaGST – Portal For Maharashtra GST

What is the MahaGST Portal?

For business owners operating in the state of Maharashtra, the Maharashtra Goods and Service Portal is a portal designed to administer and execute taxes that must be paid under the GST regime. The site was created to make payments quick, straightforward, and hassle-free.

Maha GST Portal Services

The website’s objective is to simplify the GST rules and regulations for all business owners. It aims to simplify complex business procedures with just a few clicks or intuitive techniques.

The following are a few of the services offered on the MahaGST Portal:

- GST Registration

- GST Rules and Regulations

- Tracking GSTIN

- GST Verification

- GST Dealer Services

- E-Payments

- GST’s latest news and updates

MahaGST Tax Forms

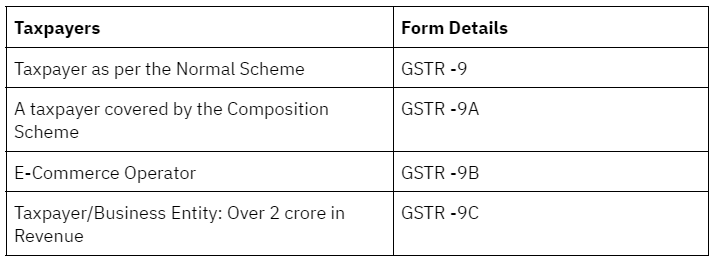

There are several forms available for various types of taxpayers, but you only need to fill out the form for the category you fall under.

There are four different annual return types under GST Rule 80.

Maha GST registration login process

The processes for creating a new dealer registration on the Mahagst login website are listed below:

- Visit www.mahagst.gov.in to get started.

- Click “Other Acts Registration” after navigating to the bottom of the page.

- Then, select “New Dealer Registration.”

- Afterward, select New Registration under various Acts.

- Continue to scroll down until you see the “Next” button. Now As indicated below, click Next.

- To continue, select New Dealer.

- The next screen will walk you through the registration procedure.

Return filing process on MahaGSTportal

There are two distinct categories for the return filing process for MVAT and CST, namely:

- Prior period returns (For the durations up to March 31, 2016)

- New automation return (For periods beginning on April 1, 2016)

- The TIN-wise annexures J1 and J2 must be submitted with the return during the prior period. However, the invoice-level Sales and Purchases annexure must be submitted during the new automation return filing process.

- The present Trade Circular aims to clarify the procedures for downloading and filing returns for prior period returns and SAP new automation returns on the MGSTD website, mahagst.gov.in.

- Profile Creation – A profile must be created and a password obtained before using the Mahagst portal to file returns or access other e-services. The user guide to creating the profile is available under-

- Click here: mahagst.gov.in/en

- To access the menu, use the “Menu” button on the homepage.

- Then click “Dealer Services” with the mouse.

- Press the “Manuals and Procedures” button.

- Scroll under the header “Maha Gst Portal” and Select “User Guide for SAP Legacy Dealer Profile Creation.”

Return filing through the Maha Gst portal

1. Returns (for the periods to March 31, 2016):

The following describes the stages involved in the preparation of returns for the period ending on March 31, 2016:

- A profile will be generated for dealers who have not yet registered a profile on the Maha Gst portal.

- Download the return template from the MGSTD website at mahagst.gov.in

- Construct the J1 and J2 Sales and Purchases Annexure

- Validate the annexures

- Validate the annexures; manually revert

- Verify Excel and produce an a.txt file for upload

- Visit the Login Page- Enter your login ID and password

- Upload the .txt file – Submit the return

- Before turning in the return, any overdue payment must be made.

2. New automation returns (effective for periods beginning on April 1, 2016):

The process flow of the actions necessary to prepare a return for the period beginning on April 1, 2016, is as below:

- A profile can be made for dealers who haven’t set up an account on the Mahagst site.

- Visit the MGSTD website at mahagst.gov.in to download the Annexure Template.

- Prepare invoices based on. Annexure for Sales and Purchases.

- Certify the annexures.

- Make an entry in Excel Return; check Excel and produce an a.txt file for upload.

- Go to the Login Page, and enter your login ID and password.

- Submit the return by uploading the.txt file.

- Pay your debt, if any.

How do I use www.mahagst.gov.in to make e-payments?

Here are the steps to make an e-payment:

- Log onto www.mahagst.gov.in, the official website

- Select the “e-payments” button.

- Choose your option:

Returns for e-Payment

Order/Return Fees

Assessment Order PTEC OTPT

- Complete the next window’s online instructions by inputting the information.

FAQs on MahaGST

What is the website for the Maharashtra GST?

The official website of the Maharashtra State government is www.mahagst.gov.in.

How do I pay on Maha GST's website?

Visit www.mahagst.gov.in and click on "E-payments." choose your preferred payment method.

What is the Maha GST portal's help desk number?

Contact number: 1800 225 900. You can also go to the website's "About Us" section. Select "Contact us."

What to do if the activation link for the Maha GST profile is not received or is inaccessible?

All emails from MGSTD have a sent status. You'll be sent the URL. Click on the URL you received in the letter if the original link is broken. A different option is to copy the entire link accurately and then paste it into the web browser. This will fix the difficulty.

I get a message saying, "Profile already exists in the system" on the Maha GST portal.

No need to create a profile again if you receive the problem above. Instead, utilise your current user name and password. However, you can use the password-resetting feature if you've forgotten yours.