Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.

“Automated GST Reconciliation with this software has been a game-changer for our business. It effortlessly matches our purchase invoices with GSTR-2A and GSTR-2B, ensuring accurate Input Tax Credit claims. The advanced error detection feature has saved us from potential discrepancies, enhancing our compliance and reducing audit risks significantly.”

Dhanush S

Retailer, Hyderabad

Recommends myBillBook for:

Product Demo for GST Reconciliation software

“Superb customer service. Helped me set up my account as required”

myBillBook’s top features for GST Reconciliation Software

Automated GST Reconciliation

Automatically reconcile purchase invoices with GSTR-2A and GSTR-2B to ensure accurate Input Tax Credit claims. Match sales data with GSTR-1 to avoid discrepancies in outward supplies. Use advanced error detection to identify mismatches and discrepancies in real-time, enhancing compliance and minimizing audit risks.

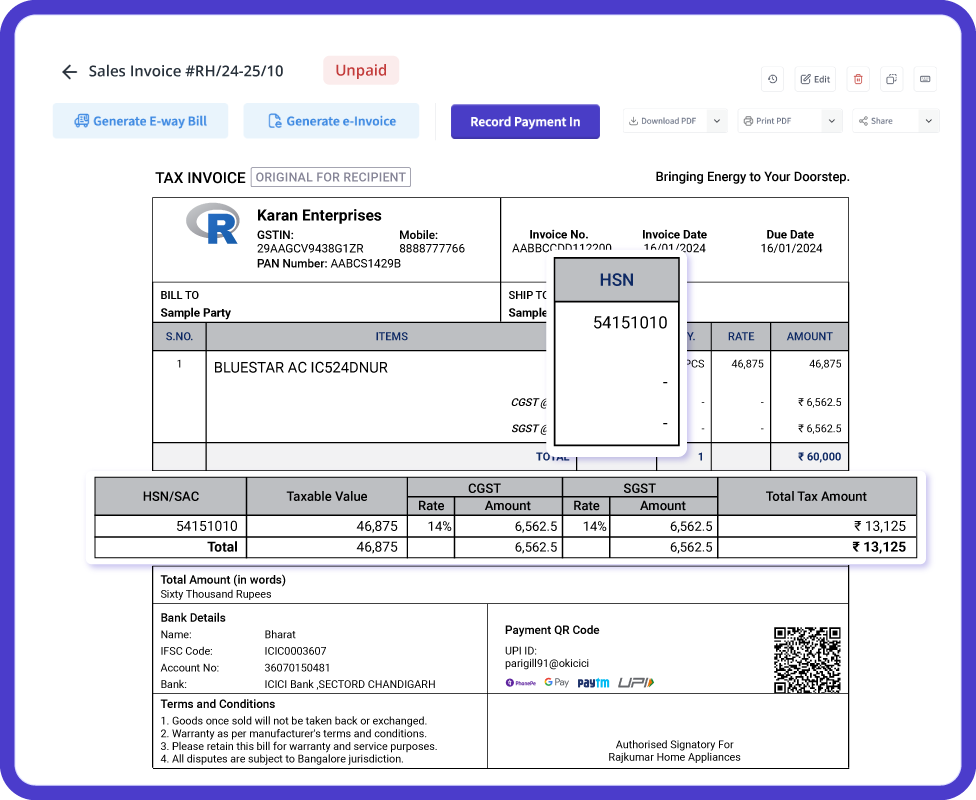

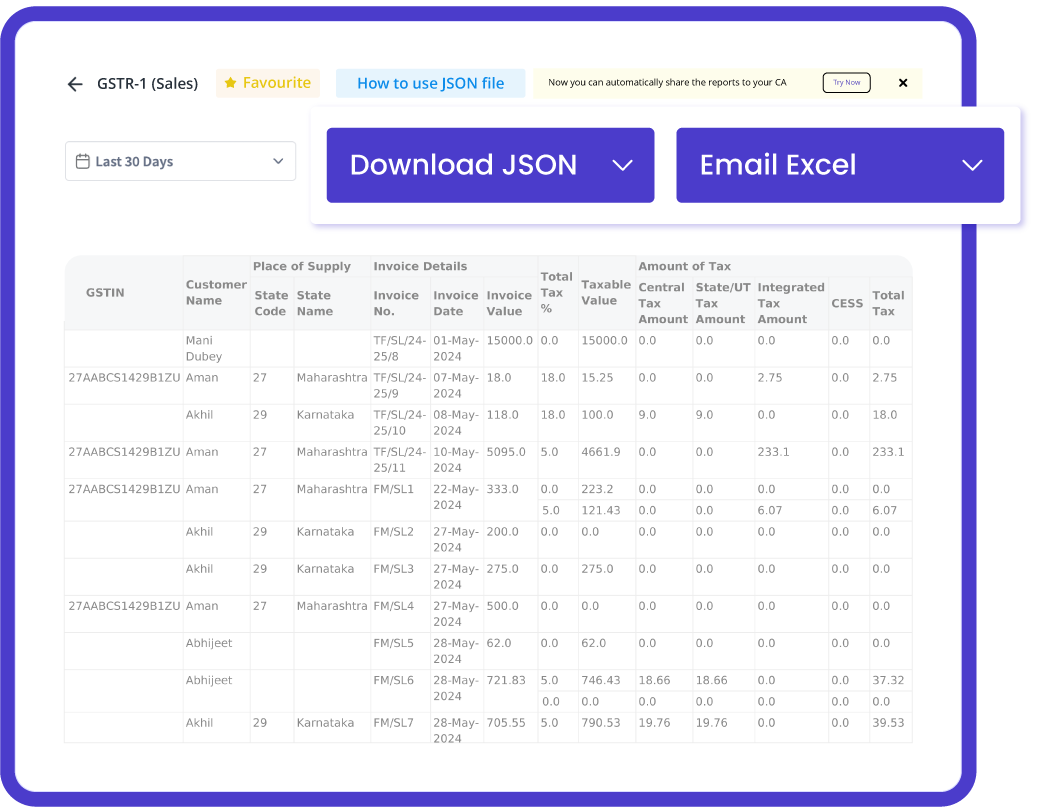

Seamless GST Return Filing

Automatically prepare GSTR-1 and GSTR-3B with pre-filled data from sales and purchase transactions. This feature ensures that all necessary fields, such as invoice details, HSN/SAC codes, and tax amounts, are populated accurately, reducing manual data entry errors.

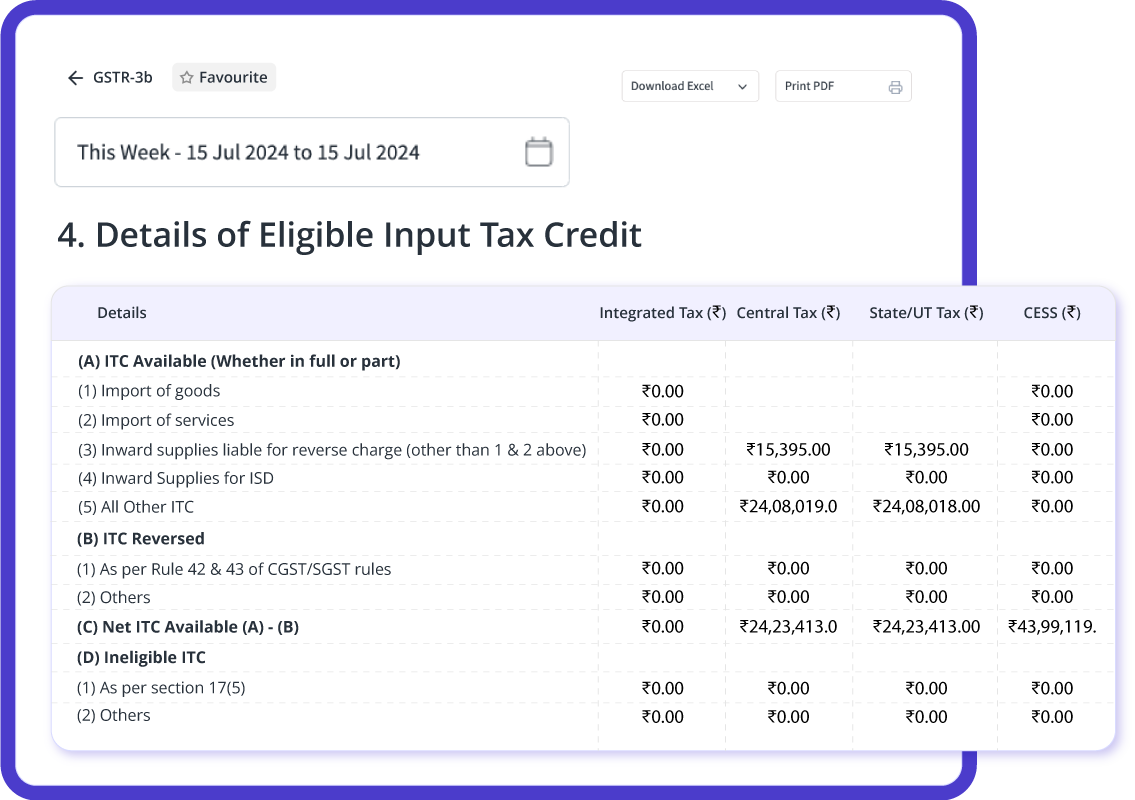

Optimize Input Tax Credit Claims

Automatically calculate eligible Input Tax Credit (ITC) based on purchase invoices and GST rates. This feature ensures precise ITC calculations, maximizing your tax benefits and minimizing errors.

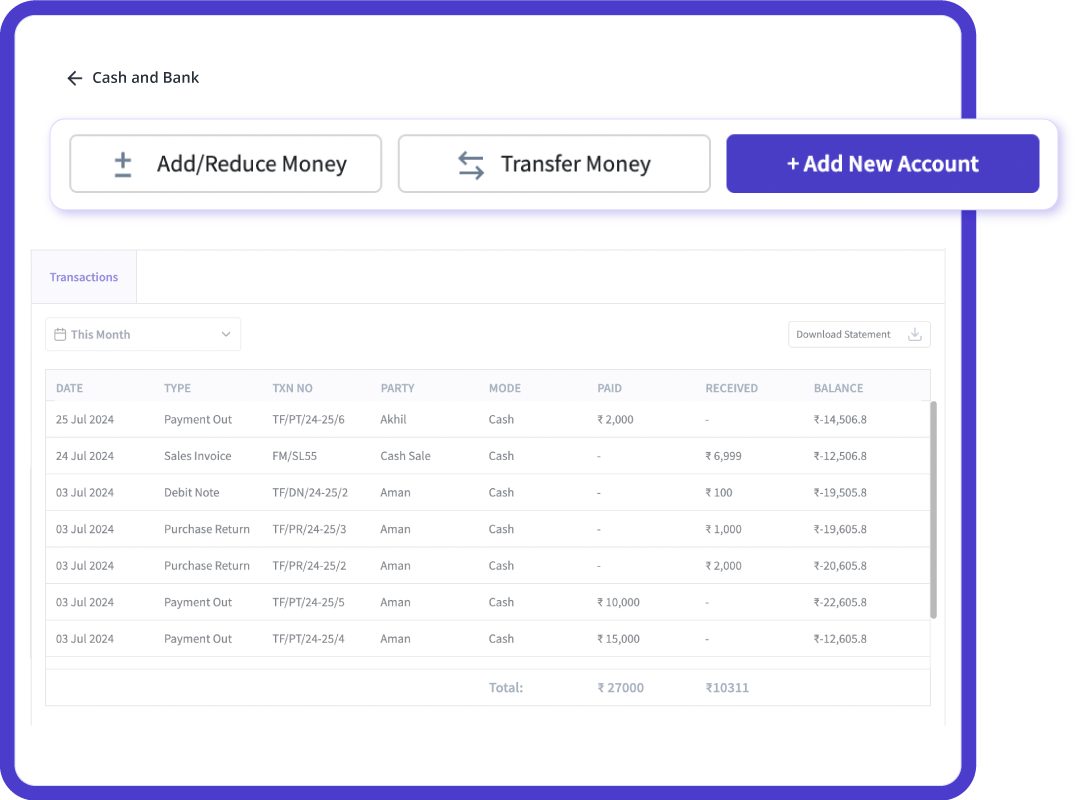

Cash Flow Management

Efficiently manage your business finances with real-time tracking of receivables and payables. Automate payment reminders and schedules to ensure timely collections and payments, improving liquidity and strengthening supplier relationships. Utilize comprehensive ledger reports for a complete financial overview to optimize working capital.

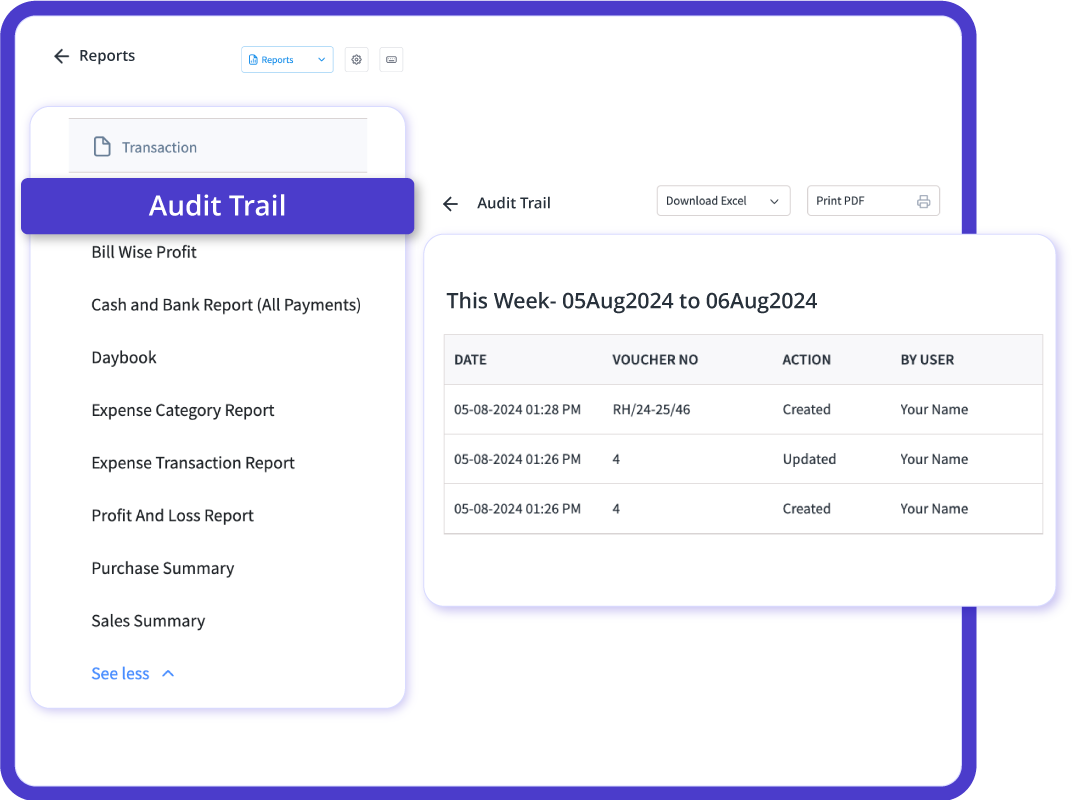

Audit and Compliance Assurance

Ensure seamless audit and compliance with built-in audit trails and comprehensive reports. Easily track all financial activities and maintain records that comply with legal standards and audit requirements.

myBillBook helps Business succeed

“This GST Reconciliation Software has made our reconciliation process incredibly efficient. It automatically aligns our sales data with GSTR-1, minimizing errors and discrepancies in outward supplies. The real-time error detection feature is a lifesaver, ensuring we remain compliant and audit-ready”

Pratham K

General Hospital – Chennai

“Filing GST returns has never been this smooth. The software automatically prepares GSTR-1 and GSTR-3B using pre-filled data from our transactions, eliminating manual errors. With accurate invoice details and tax amounts, we can file returns confidently, saving time and effort.”

Kiran Gupta,

Laya Jewels – Banglore

“Optimizing Input Tax Credit claims is effortless with this software. It accurately calculates eligible ITC from purchase invoices, ensuring we maximize our tax benefits. This feature not only saves us money but also ensures compliance with GST regulations, boosting our financial efficiency.”

Suresh Jain,

Tribe Hotel – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

GST Reconciliation Software is software that ensures the crucial processes for taxpayers for not paying the same taxes multiple times. In fact, it assists in estimating the most accurate amount of ITC that can be claimed by a registered taxpayer, and it thereby affects the business on a monetary level.

Why Use GST Reconciliation Software?

GSTR 2A reconciliation software has been designed to include a huge spectrum of features that enable easy and quick GST filing of your business. myBillBook is the most popular and recommendable GST filing software that is mostly used across various types of businesses and industries. Let us check out the interesting features of myBillBook GST filing software, which are as follows:

Highly Compliant

myBillBook GST software can be used for all of your GST needs comprising tax liability, ITC, GSTR 1, GSTR 2, and GSTR 3. This software follows the GST laws and assists your business in remaining GST compliant.

Auto Calculation

myBillBook software has the ability to calculate the ITC and tax liability automatically for your business. It saves your valuable resources and time by decreasing manual efforts.

Timely Notifications

This GST filing software would always notify you whenever a deadline of GSTR approaches. It keeps you updated about your pending transactions.

Auto-updated Bank Feeds

The feature of auto-updated bank feeds in the software grabs the essential data from your bank statements and eases the process. It is even connected to safe payment gateways.

Secure Filing

As a matter of fact, all the transactions you have done are encrypted on the software. It keeps your data completely safe by rendering a quick backup of your data.

Comprehensible Reports

This GST filing tool maintains a real-time record of the available input tax credit, the tax you have paid, and many more things. It offers you an in-depth report of all the important updated matters regarding your taxes.

Easy Export and Import of Data

myBillBook GST filing software facilitates your filing of GST by supporting easy export and import of data. In short, you can enjoy a seamless process with instant transfer of data irrespective of its size.

Multiple Businesses and Users

When it comes to myBillBook GST software, it enables you to list your business as well as add multiple users. It lets you handle all your transactions of GST in one place.

Significance of GST Reconciliation Tools for Small Businesses

When it is about the importance of GST reconciliation tools, it brings a lot into the brightness of the light. It is essential for the taxpayers to reconcile sales data regularly with that of the vendors to receive the eligible ITC (Input Tax Credit). The process of reconciliation just includes five steps that offer you a lot of benefits which are as follows:

- The process of GST reconciliation for the fiscal year needs you to mandatorily file the GST returns on a regular basis. In case if you are missing the due date for GST returns filing, you should file it by paying the applicable late fees. GST filing plays an important role because it is the very first step to the GST reconciliation process. According to that, you should align the tax returns and update the account books regularly.

- Once you are done with the GST return filing, the actual procedure of reconciliation and matching begins. You must recheck the details to identify any missed entries or mismatches in the accounts, and then you have to amend the fault entries if you find them for the next GST return filing period. You are allowed to make the changes in the upcoming and current tax returns filed but not for the previous periods.

- Once the above step is done, you have to match the purchase register with GSTR 3B. You can track it easily as it is uploaded month-wise. Then you have to match it with the details of GSTR 2A that are uploaded by suppliers. You should keep your account book well maintained. You should identify the mistakes in the relevant sales and purchases to avoid paying extra taxes and loss in ITC claims.

- The fourth step is that you have to ensure that you keep congruity between the GST returns and the books of accounts, as it is very crucial when you claim ITC. Moreover, you should perceive that the reverse charge mechanism is the only method for an individual to get the benefit of credit of tax paid if the services or goods are utilized. The key factor is to maintain proper coordination as it assists in reporting of details in the GST returns. One can also make use of advanced reconciliation software to decrease the communication gap between the recipients and the suppliers.

- Finally, you should involve in reporting all the corrected purchase or sales transactions done between a financial year for the returns of September. You should do it with the applicable late fees even if you miss the due date as it is very important to receive ITC. If you have not claimed ITC in the previous months, you can avail the same in few months, but it should not be after tiling the annual returns, i.e., GST returns or GSTR-9 for the September month of the financial year.

Free Plans Offered by GST Reconciliation Software

When it comes to the free plans provided by GST Reconciliation Software, it include a lot of features that make your accounting much easier. It includes features like contacts, bills and expenses, inventory and e-way bills, GST invoicing, reporting and GST filing, and banking, as well as main features. Apart from these primary features, it offers you many more features like estimates, multi-user collaboration, recurring invoices, payment reminders, client portal, mobile apps, online payments, direct vendor payments, accountant module, template customization, delivery challans, purchase orders, free customer support, sales orders, integrated platform, GST returns approval, template customization, vendor credits, credit notes, and auto-scan

Features of GST Reconciliation Software

Have a look at some of the crucial features of GST Reconciliation Software which are given below:

Multi-Platform Adaptability

Invoice matching is very important to make sure that every taxpayer in the value chain files his or her GST returns on time which would affect the business’s compliance rating directly. Therefore, to keep up with these requirements of compliance, your GST software should be enabled on multiple platforms by being accessible from mobile phones, tablets, or desktops at any point in time. It further facilitates the online filing of returns.

Flexibility

Various huge companies are making use of GST software to manage the operations of their business smoothly. Even medium and small businesses use accounting tools for book-keeping. The software gives flexibility to their business operations so that they can have a seamless experience.

User Interface and Reporting

One of the beautiful features of the software is the user interface. It provides informative reports and informative dashboards to make your accounting operations easy and enable quick decision-making. Moreover, this feature helps you to save on working capital by avoiding over or under-stocking.

Cognizance

A normally registered taxpayer in one state has to file 25 returns during a fiscal year as per the GST regime. GST software that you use should have the ability to communicate with the users about the possible coming events. This would further ensure that your business remains up without missing any deadline of the company.

Security

Above all, the GST software offers security in today’s digital world, which is one of the most important assurances. It keeps your business data confidential and avoids the threat to your business. As in today’s world, a lot of hackers play their game to hack the confidential information of the individual or business; this feature makes the software reliable and trustworthy.

To further enhance your financial operations on the go, explore our mobile accounting software that complements GST compliance with ease.

FAQs – GST Reconciliation Software

How do I do GST reconciliation in Excel?

You have to fill the data in the excel sheet as per the requirement of the master data sheeting. Then you have to enter portal data on the left side of the sheet and books data on the right side. After that, you can check all the essential data in the master sheet by clicking on the summary.

How do you do GST reconciliation?

You have to simply go to Gateway of Tally and then Display and then Statutory Reports and then GST and lastly click U: Status Reconciliation.

How can I download GSTR 2A software for free?

At first, you have to log in to your GST portal with your login credentials, and on the dashboard, you have to click on the Return dashboard. There you have to choose the financial month and year for which you require to download GSTR-2A.

What is 2A in GST?

GSTR 2A is a purchase-associated dynamic tax return that is generated automatically by the GST portal for every business

Can I get GSTR 2A for a full year?

Of course, you can download GSTR 2A data of different months or for a full year in the GST software as it has an in-built feature of advanced reconciliation.