Affordable yet powerful solution to

manage & grow your business

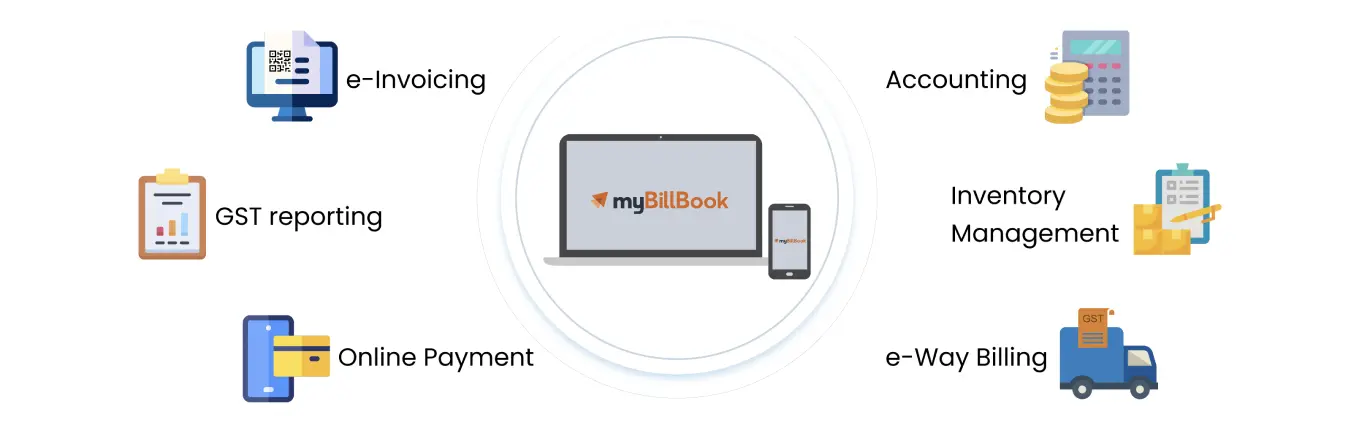

Why Use myBillBook e-Invoicing Software?

Convenience

Simplify tax compliance and filing with Invoicing, Accounting, and Reporting on the same platform.

Multiple business support

myBillBook’s e-Invoicing Billing software provides e-Invoicing enablement for all your GSTINs at once. It creates compliant e-Invoices in less than 20 seconds.

Remote Access to Multiple Users

Any number of users can create e-Invoices using our solution anywhere at any time.

Real time data back-up

Automatic cloud storage can help you store all your e-Invoices for easy and safe retrieval anytime in the future.

Customizable Invoice Formats

myBillBook’s e-Invoicing solution enables you to continue using your customised invoicing template and link it to e-Invoice through a QR code.

24/7 support

We provide 24/7 support via call, chat, and WhatsApp in multiple languages, and you can select your preferred language.

Benefits of Using myBillBook e-Invoicing Billing Software

Online store

Take your business online in just a few clicks. Set up your online store, create digital catalogs, generate e-Invoices, and expand your business by selling on WhatsApp and Facebook.

Take your business online in just a few clicks. Setup your online store, create digital catalogues and grow your business by selling via WhatsApp and Facebook. Take your first step towards e-commerce by creating an online store for your products and start selling online. You can also create categories and list products under each category. Also set delivery charges and no delivery charges rules. You can promote your online store by creating a customised link which can be shared on WhatsApp and SMS.

Delivery related documents

Create, download, and share e-Invoices and e-Way Bills for each customer or supplier. Perform multiple data validation checks to ensure data accuracy without manual intervention.

Create, download, and share e-Invoices and e-Way Bills for each customer or supplier. Perform multiple data validation checks to ensure data accuracy without manual intervention. Create tamper-proof delivery challans in seconds and get the consignor and the consignee to sign them and acknowledge the delivery of goods. A search tab allows you to find delivery challans quickly. Download, print/thermal print the challan, and share it via email, SMS, or Whatsapp.

POS billing

The myBillBook POS billing solution includes bar code scanning and keyboard shortcuts, ensuring quick and accurate billing and avoiding long customer lines at billing counters.

The myBillBook POS billing solution includes bar code scanning and keyboard shortcuts, ensuring quick and accurate billing and avoiding long customer lines at billing counters. Manage multiple counters and automatically update the related stock items when you generate an invoice using the retail POS billing platform. In addition, receive low stock alerts to help you avoid no-stock, preventing revenue losses and unnecessary expenses.

Inventory management

Start free trial to manage your company's inventory. Categorize your products, use a centralized dashboard view, and receive low-stock alerts. Generate reports to track overall inventory performance, view stock summaries, and sales and purchase totals.

Start free trial to manage your company's inventory. Categorize your products, use a centralized dashboard view, and receive low-stock alerts. Generate reports to track overall inventory performance, view stock summaries, and sales and purchase totals. Know your best-selling item and restock it on time to avoid out-of-stock situations. Finally, add all new items to the accounting software.

Staff Attendance & Payroll

Manage your employee attendance and payroll using the Staff Management feature.

Manage your employee attendance and payroll using the Staff Management feature. Streamline payroll processing for accurate payouts, improve employee discipline and achieve operational efficiency.

Intelligent reports

Convert your business data into 25 smart analytical reports for strategic business decisions. Create sales summary reports, party ledgers, profit and loss statements, GSTR sales/purchase reports, inventory reports, expense reports, and other documents.

Convert your business data into 25 smart analytical reports for strategic business decisions. Create sales summary reports, party ledgers, profit and loss statements, GSTR sales/purchase reports, inventory reports, expense reports, and other documents. You can access all reports and change business plans with a few clicks and share them with CAs, accountants, and clients directly via WhatsApp or email.

Your businesses will benefit from e-Invoicing in the following ways:

- Limited Errors: e-Invoicing in GST resolves and plugs a significant gap in GST data reconciliation and reduces errors. e-Invoices lessen the need for manual inputs and improve automation. It enables interoperability and minimises data entry errors compared to paper-based invoices.

- Easy Invoice Tracking: The e-Invoicing software determines the time of sending, viewing, and paying an invoice and thereby helps real-time invoice tracking.

- Reduced Tax Evasion: e-Invoicing software allows real-time access to invoice data and facilitates the availability of genuine input tax credit. Hence reduces the possibility of invoice manipulation.

- Data Integrity: e-Invoices certify the legitimacy of audits and surveys since the tax authorities can find the information needed at the transaction level.

e-Invoicing depicts the system in which business-to-business (B2B) creates invoices digitally, and the Goods and Services Tax Network (GSTN) verifies them.

The e-Invoicing system allows the IRP(Invoice Registration Portal), managed by the GSTN(GST Network), to assign an identification number to each invoice. The e-Invoice portal sends all invoice information to the GST and e-way bill portals in real time.

Yes, e-Invoicing is mandatory for service providers falling under the same turnover bracket as product companies.

First, go to the e-Invoice portal. On the search tab, select “e-Invoice status of the taxpayer”. Finally, fill in the GSTIN and captcha code and click on the “Go” button.

- Buy or Upgrade to Mybillbook’s Enterprise Plan

- You must either buy or upgrade the enterprise plan to utilise these services.

- Enable or Disable e-Invoicing on Mybillbook

- Login to your account and open the company settings from the page.

- Select “Yes” under “Are you GST Registered?”

- Enter the required details and switch on the toggle “Enable e-Invoicing.”

- Verify the Appearance of Your e-Invoicing Tab

- On viewing the conformation modal, click “Enable e-Invoicing.” and witness the “e-Invoicing” tab on the left navbar.

- Complete Your API Registration

- Select the “e-Invoice “ tab and click on “Generating e-Invoice”. Register Masters India as their API user on the Invoice Registration Portal if you do not have your GSP credentials.

- Download Your e-Invoice

- Once the generation is successful, the portal displays the success modal, which will contain:-

- Ack no. of the e-Invoice generated

- Download e-Invoice link

- Once the generation is successful, the portal displays the success modal, which will contain:-

Effective 1st August 2023, all GST-registered businesses with a turnover of above Rs. 5 Cr must generate e-Invoices for all B2B transactions.

Yes. e-Invoicing is mandatory for businesses with a turnover of more than Rs.5 Cr, effective from 1st August 2023.

If e-Invoice generation fails, users will receive an error message from the GSP. The error message thus recorded will help the user (and us) identify what went wrong and rectify it. After rectification, the user can try to generate the e-Invoice again.

The data on the IRP will be available for only 24 hours. However, once an invoice is registered and validated, it is uploaded into the relevant GST return. Also, it is available for the entire fiscal year.

No. According to Rule 48(5), any invoice issued by a person to whom the provisions of e-Invoicing apply that is not an e-Invoice is invalid.

You can pay your e-Invoice by credit or debit card. Some services also accept electronic checks or PayPal payments. For card payments, you can pay with almost any major credit card, including MasterCard, Visa, and Discover.

As per the new threshold on e-Invoicing for businesses by the government of India that goes into effect from August 1, the mandatory turnover threshold has been lowered to Rs.5 Crore from Rs.10 Crore. Hence, e-Invoicing will be mandatory for enterprises with an e-Invoice turnover limit of Rs.5 Crore. However, e-Invoicing does not apply to the following registered persons, regardless of turnover, as specified in CBIC Notification No.13/2020-Central Tax:

- An insurer or a financial institution, or a banking company (NBFC-included)

- A GTA(Goods Transport Agency)

- A registered person who supplies service for passenger transport

- A registered person who supplies services such as admission to the exhibition of cinematographic films in multiplex services

- An SEZ unit

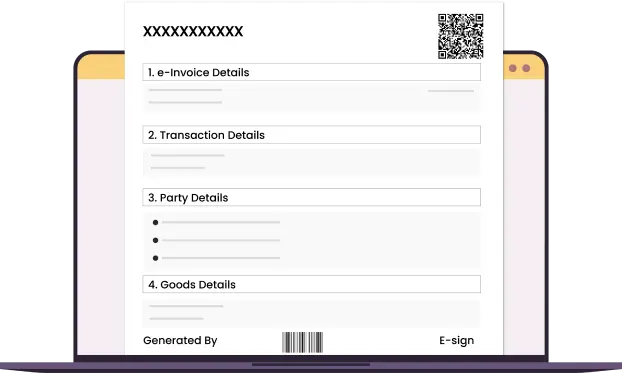

When you generate an e-Invoice:-

- You would receive a government-generated e-Invoice document that contains the following information -

- Acknowledgement no

- Acknowledgement date

- IRN no

- QR Code

- You would receive an e-Invoice login update on the GST portal.

- Your corresponding buyers get an update on their GSTR2A report on the portal.

You can fill up the form by clicking on this link, and our team will reach out to you for a free demo .