Donation Receipt Format

Acknowledge contributions with clean, professional donation receipts—clear donor details, amount in INR, payment mode, and authorization, presented in a consistent, audit-friendly layout.

myBillBook Billing Solution lets teams create, number, and share donation receipts in Word, Excel & PDF—capture donor information, payment references, and notes, then print, email, or WhatsApp instantly.

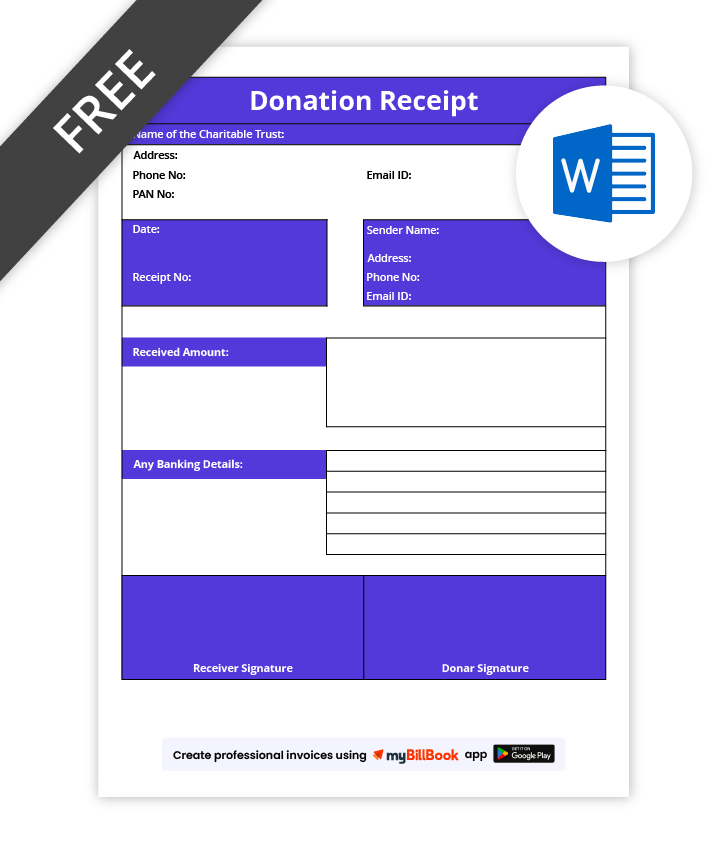

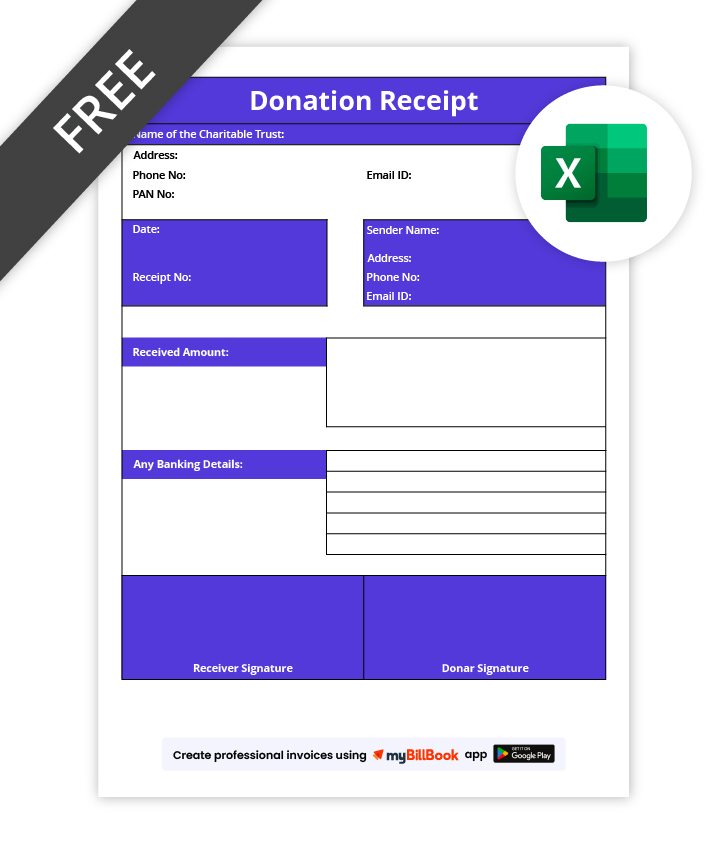

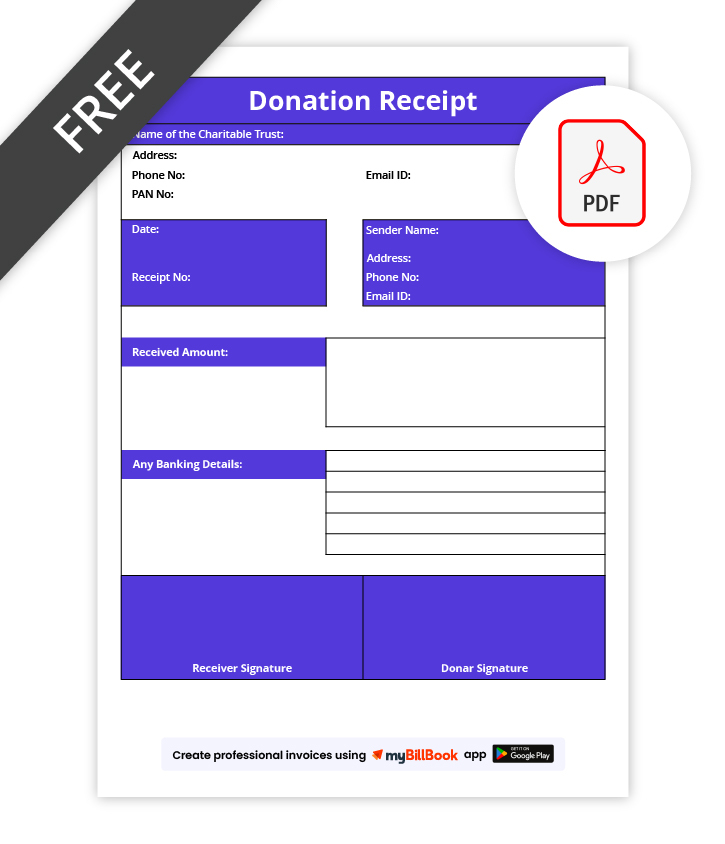

Download Free Donation Receipt Format Templates

Editable templates with numbered series, donor info, INR amounts, payment references, acknowledgement text, and sign-off blocks.

Unlock Luxury Donation Receipt Format

Features of myBillBook Donation Receipt Format

Custom Branding

Add logo, address, and receipt headers to every template. Keep branding consistent while presenting clear totals in INR and professional donor acknowledgements across all branches.

Serial Numbering

Define financial-year receipt series with prefixes and auto-increment. Maintain unique sequences per branch, improve traceability, and simplify reconciliations and audits.

Payment Modes

Capture payments by cash, bank transfer, UPI, or cheque with references. Reflect receipts, balances due, and notes, maintaining transparent records and accurate reconciliation for donations.

Donor Records

Store donor names, addresses, contacts, and receipt history in one place. Search quickly, avoid duplicates, and export lists for mailers, outreach campaigns, and periodic acknowledgements.

PDF Sharing

Export donation receipts to PDF for printing or email. Preserve layout, fonts, and margins so teams deliver consistent documents across devices, printers, branches, and audits.

WhatsApp Sharing

Share receipts via WhatsApp directly from myBillBook. Speed confirmations, reduce manual steps, and keep message histories traceable for support, reconciliations, and donor communications across teams.

What is the Donation Receipt Format?

A donation receipt format is a standardised template used by charities and non-profits to document donations. A standard receipt format for donation includes a statement acknowledging the gift and a charity representative’s signature.

Additionally, when making a donation and utilising an 80g donation receipt format, it’s important to note that under the Income Tax Act, deductions on donations made through Section 80G are limited to 10% of the taxpayer’s Adjusted Gross Total Income.

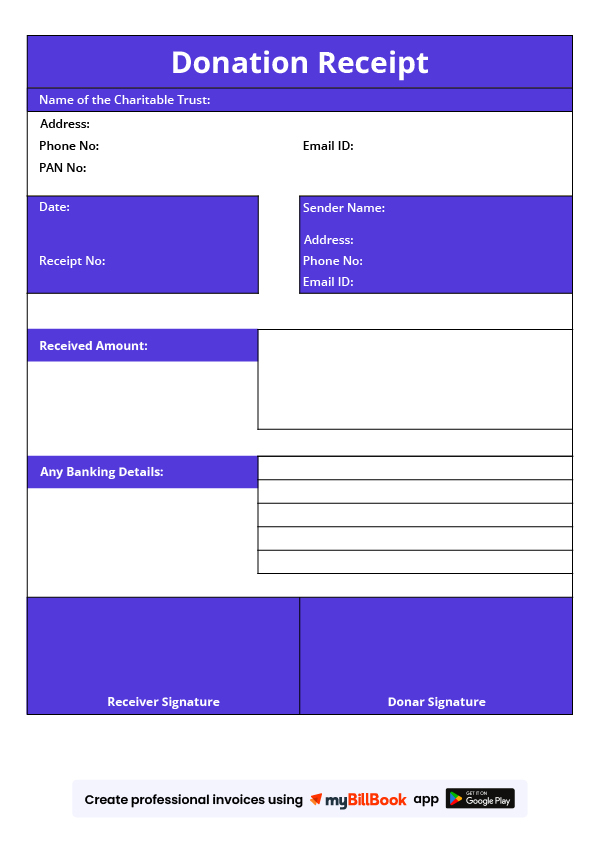

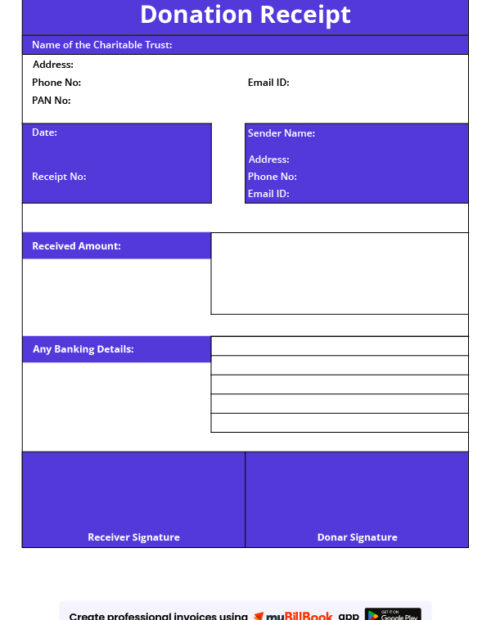

Sample Donation Receipt Format

A sample donation receipt format is attached below. It can help you understand the information that must be included in a donation receipt.

Donation Receipt Format: Details to be Included

When creating a donation receipt, it’s essential to include all the necessary donation receipt format details to make it valid. The receipt format for donation requirements is as follows:

- Donor Information: The name, address, and phone number of the donor

- Date of Donation: The date on which you donated

- Description of the Donation: A description of the type of donation (monetary or non-monetary)

- Value of the Donation: The value of the donation in monetary terms

- Charity Information: The name, address, and tax ID number of the charity

- Gift: A statement confirming that the donation is a gift and not a purchase or exchange

- Signature of a Representative from the Charity: The signature of a representative from the charity to acknowledge the receipt of the donation

Donation Receipt Format in Word

Word is great for branding and quick edits. Use styles for headings, keep a tidy table for donor/amount/mode/reference, and include a short thank-you message plus authorised signature. Add your logo, address, and contact in the header/footer for a professional look.

Leverage mail merge to generate many receipts from a donor list, track changes during review, and finalize. Once approved, convert to PDF for distribution so the layout remains intact.

Donation Receipt Format in Excel

An Excel-based receipt is perfect when you track many donations across campaigns or branches. Build a simple register with columns for receipt no./date, donor details, amount (INR) in figures/words, mode/reference (UTR/cheque/UPI), and notes.

Use data validation to create drop-downs for payment modes and campaigns, apply SUMIF/PIVOT to total by day or drive, and add conditional formatting to flag missing fields. Protect formulas, lock headers, and leave data cells editable. When ready, export to PDF for sharing or archival.

Donation Receipt Format in PDF

PDF gives a fixed, print-ready layout that looks identical on any device—ideal for acknowledgements sent by email or WhatsApp. Create the receipt in Word/Excel, then export to PDF with embedded fonts, A4 margins, and page numbers.

For security, enable password protection, restrict editing/printing, and add a digital signature or stamp. You can also use fillable PDF fields so operators can type details before locking the file. Compress when emailing multiple receipts.

Frequently Asked Questions

Is it necessary for a donation receipt to be in a specific format?

There is no specific receipt format for donation receipts. Still, it should include all the necessary information for the donor to claim a tax deduction and for the charity to keep a record of the donation.

Do all non-profit organisations provide donation receipts?

Most non-profit organisations provide a non-profit receipt format for donations. If a donor does not receive a receipt for their donation, they should request one from the charity.

Does the law require a donation receipt?

In most countries, a donation receipt is not required by law. Still, you must use a donation receipt as it serves as proof of the donation for tax purposes.

What are the benefits of using an 80G donation receipt format for tax purposes?

Deductions on donations made to eligible relief funds and charitable organisations are permitted under Section 80G of the Income Tax Act. Individuals, businesses, and other entities can claim this deduction.

Is it necessary to include the charity's tax ID number on a donation receipt?

Including the charity's tax ID number on a donation receipt is necessary. This information helps the donor claim a tax deduction for the donation.

How long should a charity keep a record of donation receipts?

A charity should record donation receipts for at least seven years so that the donor or the tax authorities can see the donation receipt for verification purposes.

What should be included in a donation receipt in India?

A donation receipt in India should include donor name, PAN (if available), receipt number, date, donation amount in INR, mode of payment, and organisation details.

Can I create a donation receipt in Excel for NGOs?

Yes, NGOs can use Excel templates to generate donation receipts with donor details, payment mode, and receipt number, making it easy to track and report donations.

Are digital donation receipts valid in India?

Yes, digital donation receipts (PDF or email receipts) are legally valid in India as long as they include all mandatory details like receipt number, donor information, and signature/authorization.

How can I download a free donation receipt format template?

You can download free donation receipt format templates in Word, Excel, or PDF from platforms like myBillBook, which provides ready-to-use, GST-compliant, and professional layouts.

Know More About Bill Formats