Best Auto Repair Shop Invoicing Software

Automate your billing and accounting

What is Billing Software for Auto Repair Shop?

Billing software for auto repair shop is a specialized tool designed to manage invoicing, payments, and service tracking for automotive repair businesses. Similar to retail billing software, it helps streamline the billing process by automatically generating invoices, tracking parts used, labor charges, and managing customer payments. With features like service history management, part inventory tracking, and customizable invoice templates, auto repair shop billing software improves operational efficiency, reduces errors, and ensures accurate financial records, making it an essential tool for auto repair shop owners looking to optimize their business.

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

myBillBook is designed for businesses to generate GST bills and automate their entire inventory management process.

“myBillBook’s invoicing software is simple to use and helps us stay organized. It’s been a great addition to our business.”

Anjali Desai,

Owner, Desai Garage

Recommends myBillBook for:

Product Demo for Auto Repair Shop Invoicing Software

“Superb customer service. Helped me set up my account as required”

myBillBook’s top features for Auto Repair Shop Invoicing Software

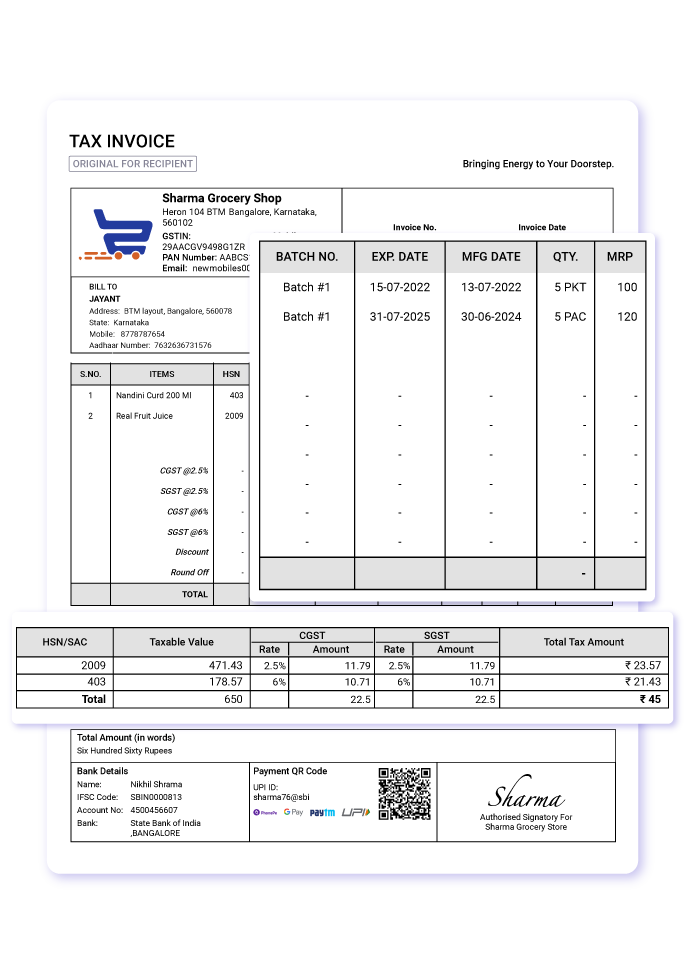

Instant Invoice Generation

It could be an auto repair order or a spare part sale, myBillBook generates professional invoices in seconds. Once you set the basic information, the app will automatically update the tax break-up, calculate the discounts and generate invoices swiftly. You can also pick up an invoice template that suits your auto shop image.

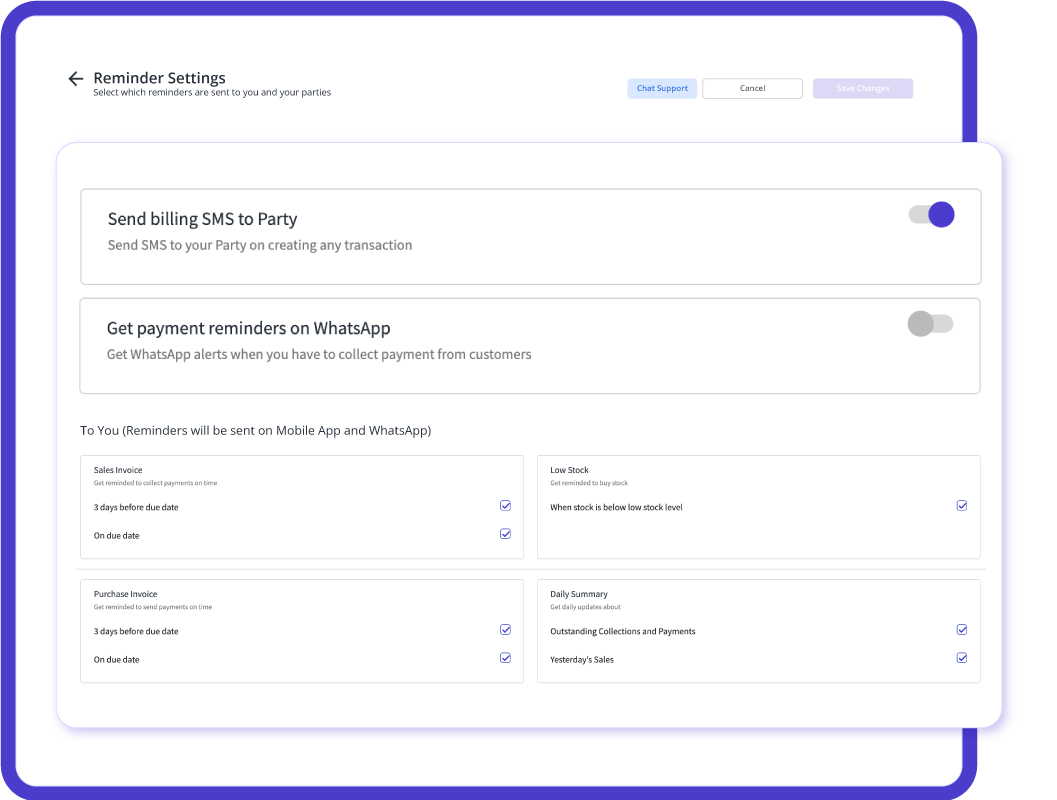

Set Auto Reminders

May it be a payment reminder or a service due, you can gently remind your auto repair shop clients through the payment reminder feature available on myBillBook. You can either set auto reminders or send them manually through Whatsapp, e-mail or as a normal message.

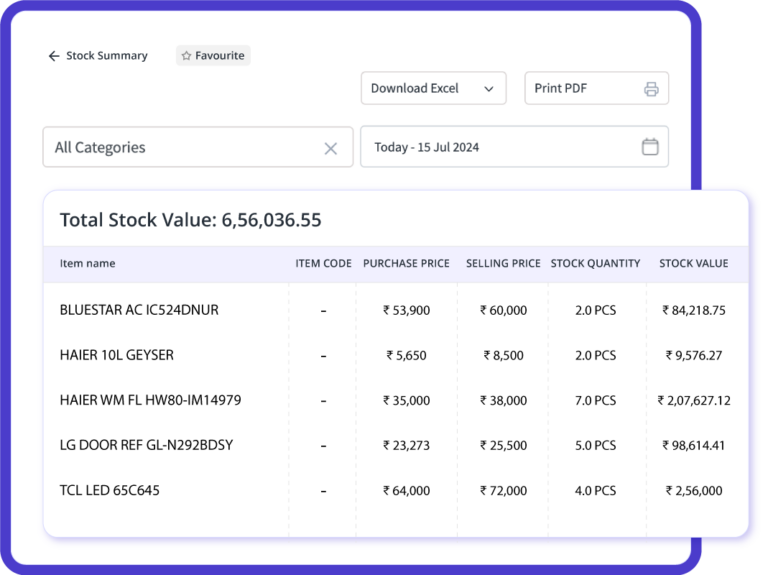

Better Inventory Management

Auto repair shops often deal with many spare parts and equipment. Keeping track of them without proper bookkeeping is a difficult task. myBillBook’s inventory management feature helps you track your inventory quite efficiently. You can also send purchase orders to the suppliers and sync them with the app.

Efficient Expense Tracking

Enter all your business expenses, including bills, purchase invoices and others – the app will automatically update your finances. In case of recurring expenses, the billing software will also remind your about the due dates so that you would never miss a payment.

myBillBook helps Business succeed

“myBillBook has made invoicing so much faster and easier. Our customers love the clear and detailed bills.”

Rohan Patel,

Owner, Patel Auto Repair

“Tracking repairs and payments is now seamless with myBillBook. It’s a huge time-saver for our shop.”

Sunil Gupta,

Manager, Gupta Auto Services

“The software has streamlined our billing process, reducing errors and improving cash flow. Highly effective!”

Vikram Singh,

Proprietor, Singh Auto Works

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

You take care of your customer’s cars, and our auto repair shop invoicing software will make sure your billing and accounting tasks are running smoothly. myBillBook auto repair shop invoicing software takes care of all your billing requirements enabling you to focus on your business efficiently. You don’t need any accounting knowledge to use the auto repair shop billing application.

myBillBook’s auto repair shop billing software helps you create invoices in seconds, send professional quotes, convert estimates into invoices, manage your expenses, gain insights about your repair shop, and much more with a single app.

myBillBook is a cloud-based invoicing and accounting software that is available as a mobile and desktop application. You can also access the billing software through its website. Let’s look at the features offered by myBillBook that would help you upgrade your auto repair business.

Additional Features of Auto Repair Shop Invoicing Software

Set Auto Reminders:

May it be a payment reminder or a service due, you can gently remind your auto repair shop clients through the payment reminder feature available on myBillBook. You can either set auto reminders or send them manually through Whatsapp, e-mail or as a normal message.

Accept Online Payments:

The billing app is integrated with more than five payment gateways to enable online payments.

Maintain Better Customer Relations:

Save customer details, including their vehicle details, service dates, repairs made, etc. Schedule follow-ups using the app and remind your customers about the service dues. You can also wish and greet your customers on their special dates.

FAQs on Auto Repairing Invoicing Software

Can I try auto repair shop invoicing software before buying?

Yes, myBillBook auto repair shop offers a free trial period of 14 days, during which you can experience the app in real-time.

Can I create non-GST invoices using the auto mechanic shop software?

Yes, the software is designed to generate both GST and non-GST invoices. You need to select the option before creating an invoice.

Can multiple users use myBillBook repair shop invoice software simultaneously?

Yes, multiple users can login to the billing app using the same credentials. You can also login through various mobile, PC, and web devices using the same login details. The data gets synced automatically across the devices.

Can I customise the invoice format using the myBillBook application?

You can choose from eight invoice themes and colour options in the myBillBook application. Further, you can also customise the information on the invoice by selecting the fields to display, adding an invoice prefix and sequence number, and adding custom fields to your auto repair invoices.