SIDBI Scheme: Features, Benefits and How to Apply for a SIDBI Loan

What is SIDBI?

The Small Industries Development Bank of India (SIDBI) was established in 1990 to promote, finance, and develop small-scale industries in India.

It provides refinance facilities and term loans to banks and financial institutions for on-lending to micro and small enterprises.

Objective of SIDBI

The main objective of SIDBI is to help the MSME sector grow. SIDBI offers loans and other financial services to millions of micro, small, and medium-sized enterprises and non-profit companies throughout the country’s vast ecosystem. Their policies provide India’s economic growth, innovation, international stature, and overall progress.

Benefits of SIDBI

SIDBI has played a pivotal role in the growth of the MSME sector, providing access to finance, facilitating technology and skill development, and promoting entrepreneurship.

Here are the benefits of SIDBI:

1. Access to Finance: SIDBI makes it possible for MSMEs to access financing for their establishment and expansion by customising loans to an enterprise’s needs.

2. Low-interest rates: SIDBI can obtain discounted interest rates due to its affiliations with numerous banks and foreign financial institutions. The alliances’ participants include the World Bank and the Japan International Cooperation Agency.

3. Promotes Entrepreneurship: Through a variety of programmes like Udyami Mitra, SIDBI encourages young people to become entrepreneurs.

4. Helps in the decision-making process: Relationship managers assist MSMEs by guiding them in making the best choice for the business and remain accessible throughout the loan application process.

5. No Collateral: Entrepreneurs are qualified for up to Rs. 100 lakhs without putting up collateral. To achieve this, a trust known as the Fund Trust for Micro and Small Enterprises was established (CGTMSE).

6. Equity and Venture Capital: SIDBI also provides equity and venture capital support to MSMEs through its investment arm, SIDBI Venture Capital Ltd.

7. No hidden charges: SIDBI schemes have a clearly defined structure and process. As a result, the applicant can trust the bank because there are no unexpected fees.

Functions of SIDBI

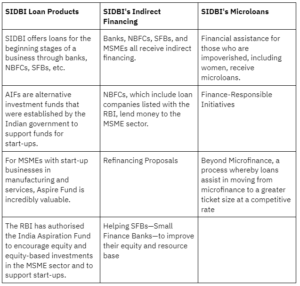

1. Indirect Lending

Indirect Lending is when SIDBI offers loans to banks, and then banks lend money to MSMEs. SIDBI does indirect Lending to banks, Non-Banking Financial Companies(NBFCs), Small Finance Banks(SFBs) and Micro Financial Institutions(MFIs).

2. Direct Lending

SIDBI also offers direct Lending, which means financial support is directly given to MSMEs in the form of soft loans, working capital and equipment finance. Recently, SIDBI assisted MSME through its Covid Emergency response programme.

3. Promotional and Development of MSME

SIDBI aims to help MSME, and for this SIDBI scheme has its initiatives, some of which are:

-

- Sampark(customer connect)

- It also arranges exposure visits to MSMEs for budding or emerging organisations.

- It also has an award system known as SIDBI-ET India MSE Award, which appreciates emerging MSMEs.

- SIDBI has an entrepreneurship awareness program and has partnerships with top institutes like IIM for entrepreneurship and leadership development.

- It also has a Women Entrepreneurship Program (WEP) in collaboration with Nitti Aayog.

4. Provides a platform to help MSMEs

Udyami Mitra is an aggregator platform to provide financial and non-financial services in one place.

5. Indirect funding

SIDBI gives venture capitalists (VCs) money, and these VCs, in turn, help new startups grow without having to worry about funding.

6. Contributes to the marketing sector

It helps SSI increase the networking channels to market its products and services.

7. Helps create employment opportunities

The SIDBI scheme expands employment opportunities by supporting industries focusing on employment, particularly in semi-urban areas.

SCHEMES offered by SIDBI

Direct Loan Schemes

The SIDBI’s direct loan programmes are listed below:

-

- Working Capital( Cash Credit)

- SIDBI Make in India Soft Loan Fund for MSME (SMILE)

- Smile Equipment Finance (SEF)

- Loans under a partnership with OEM (Original Equipment Manufacturer)

- SIDBI – Loan for Purchase of Equipment for Enterprise’s Development (SPEED)

- SIDBI ASSISTANCE TO HEALTHCARE SECTOR IN WAR AGAINST SECOND WAVE OF COVID19(SHWAS)

- SIDBI ASSISTANCE TO MSMES FOR RECOVERY & ORGANIC GROWTH DURING THE COVID19 PANDEMIC(AROG)

- TIMELY WORKING CAPITAL ASSISTANCE TO REVITALISE INDUSTRIES IN TIMES OF CORONA CRISIS (TWARIT)

- TOP-UP LOAN FOR IMMEDIATE PURPOSES (TULIP)

- SIDBI-Loan for Purchase of Equipment for Enterprise’s Development Plus (SPEED PLUS)

- SIDBI TERM-LOAN ASSISTANCE FOR ROOFTOP SOLAR PV PLANTS (STAR)

Indirect loans Schemes

SIDBI offers indirect loans to banks, NBFCs and other financial bodies. The categories of indirect loans that SIDBI has to offer are as follows:

1. Assisting NBFCs

Any company registered with the Reserve Bank of India and financing small and medium-sized companies can apply for a loan from SIDBI. The eligibility criteria will depend on the lender.

2. Refinancing Plan

Under several refinancing plans, SIDBI will give scheduled banks financial support. Schedule banks with strong financial standing are eligible for SIDBI loans.

3. Financial support for small finance banks (SFBs)

SIDBI helps banks by offering equity investments for the capitalization of SFBs to narrow the equity gap.

Other kinds of Finance and Loan Option Schemes provided by SIDBI – Venture Capital:

| Loan Scheme | Loan’s Duration | Loan Amount | Criteria for Qualification |

|---|---|---|---|

| SIDBI Assistance to Facilitate Emergency Response Against Coronavirus (SAFE) | 5 years + a moratorium | Up to Rs.50 lakh | For new customers, a two-year cash profit history and an account that is not in the SMA1/2 category. For current clients, cash profits in the most recent audited balance sheet are not in the SMA1/2 category. |

| SIDBI Assistance to Facilitate Emergency Response Against Coronavirus Plus (SAFE PLUS) | 4-month cycle | Up to Rs.1 cr | For new customers, a two-year cash profit history and an account that is not in the SMA1/2 category. For current clients, cash profits in the most recent audited balance sheet are not in the SMA1/2 category. |

| SIDBI Make in India Soft Loan Fund for MSME (SMILE) | 10 years, in addition to a 3-year moratorium | Rs.10 lakh – Rs.25 lakh | Existing or new establishments |

| Small Equipment Finance (SEF) | 72 months | Min. Rs.10 lakh | Business experience of 3 years |

| Loans under a partnership with OEM (Original Equipment Manufacturer) | 5 years plus a moratorium | Rs.1 cr | Business experience of 3 years |

| Working Capital (Cash Credit) | As stated | Subject to the applicant | SIBDI and other banks’ clients |

| SIDBI Trader Finance Scheme (STFS) | 5 years plus a moratorium | Rs.10 lakh – Rs.1 cr | Business experience of 3 years |

| SIDBI – Loan for Purchase of Equipment for Enterprise’s Development (SPEED) | 5 years plus moratorium of 6 months | New customers: Rs.1 cr Existing customers: Rs.2 cr | Business experience of 3 years, with 2 years of profitability |

| SIDBI-Loan for Purchase of Equipment for Enterprise’s Development Plus (SPEED PLUS) | 5 years plus moratorium for 6 months | New customers: Rs.2 crExisting customers: Rs.3 cr | Business experience of 5 years, with 3 years of profitability |

| SIDBI – retail loan scheme for trade finance (RLS) | 5 years plus a 3-month moratorium | Rs.1 cr | Business experience of 3 years |

| Top up loan for immediate purposes (TULIP) | 5 years | Maximum of Rs.2 cr – | The applicant must have good financial standing and have used a SIDBI loan for a year. |

| SIDBI term-loan assistance for rooftop solar PV plants (STAR) | 5 years plus moratorium of 6 months | Rs.2.5 cr | 2 years of profitable operations and acceptable financial records |

| Funds of Funds for start-ups | Depending on the loan amount and the applicant’s financial situation | Subject to the applicant’s financial situation | Start-ups |

| Aspire, Fund, | 6 years | Depending on the applicant’s financial situation | SIDBI-accredited businesses that can assist AIF |

How to submit a loan application to SIDBI

To apply for a loan from SIDBI, applicants should follow the instructions listed below: Step 1: Go to SIBDI’s website – https://www.sidbi.in/ or https://www.udyamimitra.in/. Step 2: Select the tab labelled “Borrower’s Corner.” Select “Online Loan Application” from the menu. Step 3: Put in your login information, such as your username and password. Step 4: Once logged in, as an applicant, you need to enter the loan amount and select the scheme. Step 5: The form asks for personal information such as their name, username, email address, mobile number, company address, state, and district. Step 6: Once the details are filled in, click on Register to complete the application process. Step 7: The bank will send an email for account verification, and the applicant must confirm it to process the application.

FAQs about SIBDI

Yes, MUDRA loans are among the loan products provided by SIDBI. For the SIBDI direct loan, applicants must provide identification and address documentation, a PAN card, business documentation and other tax-related documents. No, the credit history of the individual or the partners is not considered SIDBI provides Micro Finance, Direct Finance, and Indirect Finance. No. It is not a division of the RBI. The Central Government of India and other organisations under its control or ownership own shares of SIDBI. SIDBI loans can be repaid over a maximum of 10 years for a maximum loan amount of Rs 2 crore. The Small Industries Development Bank of India (SIDBI) is the apex bank for promoting and financing micro, small and medium-scale enterprises (MSMEs) in India. It was established in 1990 under the Small Industries Development Bank of India Act, 1989. Are MUDRA loans made available by SIDBI?

What documents do I need to provide if I want to apply for a SIDBI direct loan?

When requesting a SIBDI loan, does the applicant's credit score come into play?

What types of financing does SIDBI provide?

Does SIBDI fall under the purview of the Reserve Bank of India?

How much money can you borrow at one time, and for how long can you make payments on a SIDBI loan?

What is SIDBI's full form, and when was it established?