Proforma Invoice Format

Proforma Invoice is a document that a seller issues before providing an actual invoice. The Proforma Invoice format helps businesses to create and issue proforma invoices at a faster pace. A proforma invoice template typically contains fields to mention the list of goods or services (yet to be delivered) and item prices.

Using a Proforma Invoice template simplifies the process of creating Proforma Invoices, ensuring businesses adhere to a consistent format. This consistency is important in business transactions as it helps both the seller and the buyer understand and agree on the terms and costs of a potential sale.

This page helps you understand what exactly is a proforma invoice format, essential elements to include, sample proforma invoice formats in Word and Excel, and other important information about proforma invoice formats.

What is Proforma Invoice Format or Proforma Invoice Template

A Proforma Invoice Template is a pre-designed and standardised format or layout used for creating Proforma Invoices. It serves as a ready-made document that businesses can use to generate Proforma Invoices easily, quickly and consistently. The template includes predefined sections and fields to enter the required information such as the seller’s details, buyer’s details, description of goods or services, quantities, prices, payment terms, etc.

Proforma Invoice templates can be customised to include specific company information, such as logos and colours while retaining the standard layout. They are commonly used in various industries, including international trade, to provide potential buyers with a clear estimate of costs and terms before finalising a transaction.

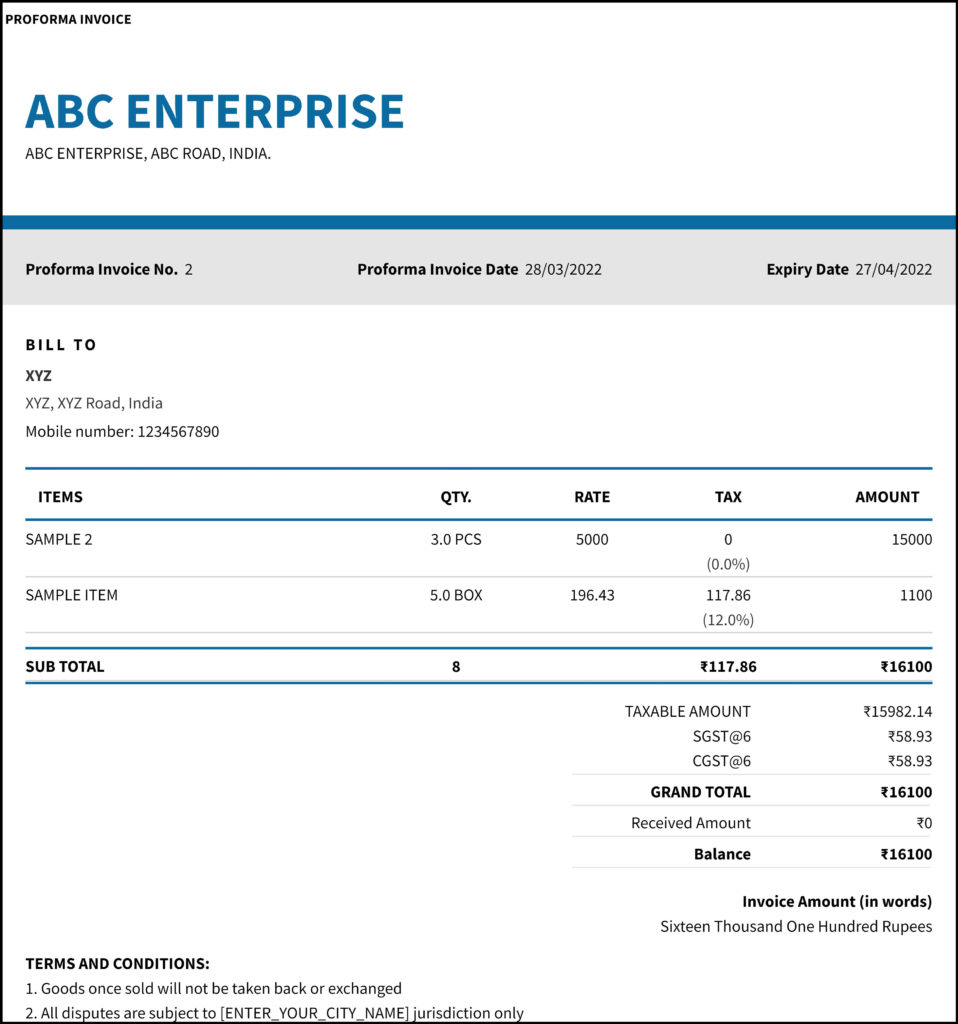

Sample Proforma Invoice Format

There’s no standard industry guideline dictating the proforma invoice format – it may even look like a sales invoice. However, businesses must have a standard proforma invoice format to make it consistent across all business transactions. Here is a sample proforma invoice format or template for your reference.

Proforma Invoice Format in Word

You can create a proforma invoice format using Microsoft Word, as it allows flexibility in design and customisation while maintaining a consistent structure. Using proforma invoice format in Word, businesses can include their branding elements, adjust fonts and colours, and add specific information to tailor the proforma invoice to their needs. Ultimately, a proforma invoice template in Word simplifies the process of generating proforma invoices and ensures that they are presented in a clear and professional manner.

For detailed information on proforma invoices in Word, how to create one, and a sample proforma invoice template in Word, refer to this page on Proforma Invoice Format in Word

Proforma Invoice Format in Excel

Excel is another powerful tool to create proforma invoices with ease. A proforma invoice format in Excel comes with an add-on advantage of calculation capabilities. This means, you can add formulas to the proforma invoice format and Excel will automatically calculate the totals or add dates to the invoice. Businesses can create proforma invoice formats in Excel for efficient organization and easy updating of proforma invoices.

For detailed information on proforma invoices in Excel, how to create one, and sample proforma invoice format in Excel, refer to this page on Proforma Invoice Format in Excel.

Proforma Invoice Template Under GST

A proforma invoice format is not a legal document. GST does not consider it a valid sale document; hence, it is not required to be reported under any returns. Neither the seller nor the buyer is required to pay GST on proforma invoices.

Since the proforma invoice format is not an actual invoice, there is no need to add it to the accounting books of either the buyer or the seller. However, after the introduction of GST, there are a few changes to the proforma invoice format. Compared to the previous version, the current proforma invoice contains the GST number instead of the VAT/Sales Tax numbers. It also displays the HSN code of the product or the SAC code of service. It also includes the CGST, SGST, and IGST, if necessary.

Is Proforma Invoice Mandatory

A Proforma invoice is not mandated by the law and is purely offered to establish good faith between the buyer and seller. Businesses can create proforma invoice formats in Word, proforma invoice formats in Excel, and proforma invoice formats in Google docs on their own. They can also download proforma invoice format directly from the internet from reliable sources like myBillBook and others.

If you wish to create a proforma invoice format on your own, make sure all the contents listed above are included in the document. Another important thing to remember is a proforma invoice must be marked as ‘Proforma Invoice’ to indicate that this is not the final sale invoice. Also, include the phrase ‘This is not a GST invoice’ to avoid any confusion on the part of the customer. If it is marked as a ‘Sales Invoice’ by mistake, it becomes a legal document and is liable for GST returns.

Using myBillBook to Create Proforma Invoice

Businesses can opt for one reliable, risk-free option to create proforma invoices. myBillBook is one such billing software offering an array of billing solutions for small and medium enterprises at a minimal cost. All you need to do is download either the mobile application or the desktop application, and you’re all set to take your billing and accounting tasks online.

Also Check:

| Bill Book format | Delivery Challan Format | Cost Sheet Format |

| Credit Note Format | Debit Note Format | Cash Memo Format |

Features of myBillBook that Help Businesses Create Compelling Proforma Invoices

- Create Proforma Invoices in Seconds: myBillBook is a complete billing solution that allows users to create sales invoices, quotations, delivery challans, and proforma invoices in just a few clicks. The app provides pre-defined formats for all kinds of invoices, and all you need to do is simply choose the kind of invoice you want to generate, enter the details, and your invoice will be ready in seconds.

- Invoice themes: You don’t have to stick to the same standard proforma invoice format that every other business uses. myBillBook offers personalised invoice formats in various themes. You can choose from 7 different themes and 8 colour options while creating the proforma invoice. The customisation feature allows you to create GST and non-GST invoices in your preferred colours and styles.

- Add and remove fields: Users can add and delete fields and make the invoice as per their business requirements. Some pre-defined fields can be added by simply enabling them in the settings, and any other custom fields can be included by using the ‘Add Custom Field’ button.

- Convert Proformas into sales invoices: Another interesting feature offered by myBillBook is that once the deal gets confirmed, you can simply convert the proforma into a sales invoice using a single click. The ‘Convert to Invoice’ option allows users to convert proforma invoices into sales invoices in just seconds. No more hassle of entering the information all again to create an invoice.

- Download, Print or Share: Once the proforma invoice is created and saved, you have multiple options to send it to your customers. You can either download and share it through e-mail, directly print and hand it over, send it as an SMS or share it through Whatsapp. All these options are readily available on the app. You can also edit the invoice whenever required, create a duplicate of it or simply save it for later use.

- Safe and secure platform: myBillBook is an ISO-certified application that provides 100% data security to its users. All the information entered on the platform is end-to-end encrypted to prevent malware and virus attacks. Only authorised users have access to the information, thus making it completely safe and secure. The application also takes timely data backups to prevent data loss and to provide multi-device access.

When you subscribe to myBillBook billing software, you’re not just receiving a proforma invoice generator tool; but an end-to-end billing and accounting software that would do much more than you can imagine.