What is Cost Sheet?

A cost sheet is a statement that records all the costs a business incurs from production to sales. Using this information, a company can fix the price of its products and services. The main advantage of a cost sheet is that you can compare it with previous cost sheets to measure performance. You can then decide whether the cost of an item can be increased or decreased according to your costs.

You can prepare a cost sheet using previous cost sheets or current estimated costs. A previous cost sheet shows you the actual costs incurred for producing, storing, and selling a product. Using estimated values, you can produce a cost sheet just before the production begins. However, there may be several changes in the estimate and the final figures.

A cost sheet has to contain the following information:

- Cost per unit of a product

- Total cost

- The four main components of a cost sheet:

- Prime Cost

- Works Cost

- Cost of Production

- Total Cost or Cost of Sales

- Percentage incurred on every expense to the total cost

- If the cost sheet is prepared using historical cost sheets, record of discrepancies, if any

- If two cost sheets of any period are compared, record of discrepancies, if any

- Details about the management for cost control

- Summary of the total cost of the product

Components of a Cost Sheet

Let us see what the different costs mean on a cost sheet:

- Prime Costs

Under this header, you have to record all the expenses involved in the production process. This is also known as basic or first cost.

For example, if you have a textile store, your prime costs will be the costs of purchasing fabric from weavers, employee salaries, packaging, implements needed to measure and cut cloth, etc.

The formula for calculating prime costs is:

Prime Costs= Direct Labour + Direct Raw Material+Direct Expenses

- Works Cost

Works cost is the sum of prime costs and overhead costs including factory expenses. Overhead costs are those costs that are not directly related to the production of a product but are required nevertheless. For example, you need to pay electricity bills to keep your production going. Similarly, there are several other taxes and utility costs that fall under the overhead costs category.

- Cost of Production

Under this header, you should include all the expenses involved in business operations, including rents and work costs. The formula for calculating the cost of production is:

Cost of Production= (Work Costs)+(Administration Overhead Costs)-(Opening and Closing Stock of Finished Goods)

- Cost of Sales

Cost of sales or total cost contains the details of all the expenses involved in the production and other costs involved in selling and distribution. This value will help you understand how much you spend on a product according to the resources used for producing it. You can decide your selling price according to the cost of sales and know how much profit you will earn from it.

Different Types of Costs

Costs are of four types:

- Fixed costs

These costs are fixed, that is, they do not change according to the number of products. The price of your land or equipment are some examples of fixed costs.

- Variable costs

These costs vary according to the number of products. Raw material and labour are some examples of variable costs.

- Operating costs

Your business incurs these costs to maintain production daily. Utility costs, office supplies, travelling costs, etc. fall under this category.

- Direct costs

These costs are directly connected to production. For example, if a car company produces a car in four days, the raw materials and labour involved in the production form the direct cost of the car.

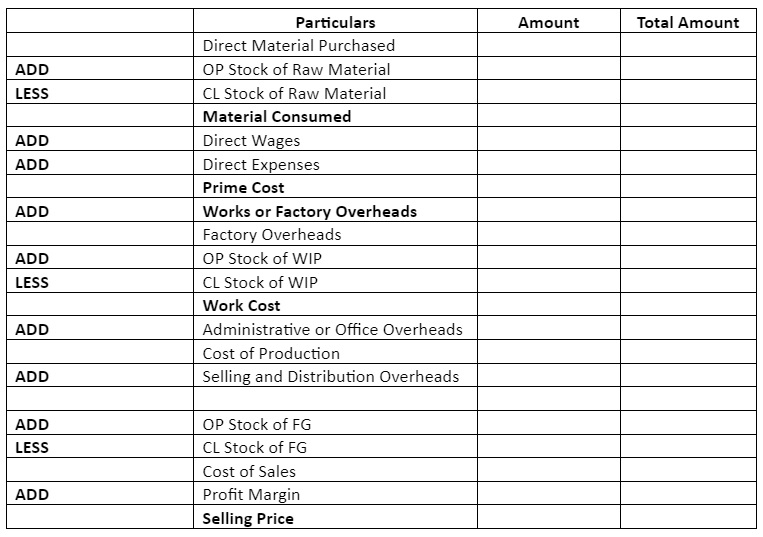

Cost Sheet Format

You must keep this format of cost sheet in mind for the correct preparation of cost sheet:

How to Prepare a Cost Sheet?

Here is a step-by-step guide to preparing a cost sheet:

Step 1:

Prime Cost = Direct Material Consumed + Direct Wages + Direct Expenses

Direct Material Consumed = Direct Material Purchased + OP Stock of Raw Material – CL Stock of Raw Material

Step 2:

Works Cost = Prime Cost + Factory Overheads + OP Stock Work in Progress – CL Stock Work in Progress

Step 3:

Cost of Production = Works Cost + Office and Administration Overhead + OP Stock of Finished Goods – CL Stock Finished Goods

Step 4:

Total Cost = Cost of Production + Selling and Distribution Overheads

Profit: Sales – Total Cost

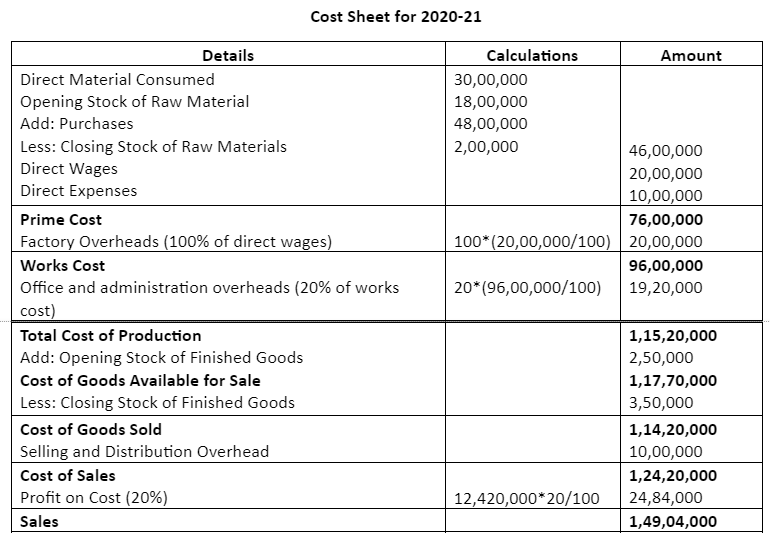

Cost Sheet Example

Suppose you are preparing a cost sheet for an automobile company for the year 2020-21. You have to consider the following information to prepare a cost sheet:

- Direct material consumed – INR 30,00,000

- Opening stock of raw materials – INR 18,00,000

- Closing stock of raw materials – INR 2,00,000

- Direct wages – INR 20,00,000

- Direct expenses – INR 10,00,000

- Factory overhead – 100% of direct wages

- Office and administration overhead – 20% of works

- Selling and distribution overhead – INR 10,00,000

- Cost of opening stock for finished goods – INR 2,50,000

- Cost of closing stock for finished goods – INR 3,50,000

- Profit on cost – 20%

Importance of Cost Sheet

Cost sheets are extremely important in the following ways:

- They help determine the final cost

The main aim of preparing a cost sheet for your business is that it helps you determine the accurate cost of the product. You can use cost sheets to calculate the total cost as well as the cost per unit of a product.

- They help in calculating the cost break up for each product

Using a cost sheet, you can understand how the costs for a product are broken up. For example, you can get the actual material costs, tax costs, and so on.

- They help in deciding the selling price

You can use a cost sheet to calculate the selling price of a product according to the materials and resources you have invested in the product.

- They help in comparing costs

You can compare the costs of products from previous years with the costs of the current year. If you can take any action to reduce the current year’s costs, you can take it by studying cost sheets.

- They help control costs

A cost sheet gives you a perspective on the costs incurred by your business to produce and sell a product. You can monitor and control production and marketing costs. An estimated cost sheet will give you an idea of individual costs at each step of production.

- They help in decision-making

Cost sheets are one of the first documents you need to prepare and study to ensure that your production takes place smoothly. A cost sheet can guide you to make correct business decisions.

- They help in budgeting

Using cost sheets, you can prepare a robust budget that will help your business run smoothly. You can prepare a budget using historical data or estimated data.

FAQs

Is a cost sheet a financial statement?

A cost sheet is not a financial statement. It helps calculate the costs the business will incur over a certain period.

Is cost sheet similar to profit and loss statement?

A cost sheet shows the per unit price and total cost of a product while a profit and loss statement is used to measure the profit or loss a company has incurred.

What is the benefit of cost sheet?

There are many benefits of a cost sheet but a major benefit is that you can decide the selling price of the product according to the production cost.

Can a cost sheet measure different costs?

Yes, a cost sheet is used to measure four major costs – prime costs, works costs, production costs, and costs of sales.

How do we collect data for creating cost sheets?

You can create cost sheets using historical data. i.e., data from previous cost sheets or using estimated data, i.e., data of the current year.

Read more: