How to Cancel e-Way Bills

Information on ‘How to cancel an e-way bill’ is one of the most frequently asked questions by transporters, sellers, and buyers. Since generating e-way bills is a routine task for many, understanding the cancellation process is essential. This page provides a comprehensive guide on how to cancel an e-way bill on the e-way bill portal, the cancellation time window, how to cancel e-way bills after 24 hours, the procedure for rejecting e-way bills, and other key details related to e-way bill cancellation.

How to Cancel eWay Bill – Step-by-Step Guide

The only way to cancel an e-way bill is on the eway bill official portal. Here is a step-by-step guide to cancel your e-way bill on the eway bill portal.

Steps to Cancel e-Way Bill on e-Way Bill Portal

- Visit e-way bill website at www.ewaybillgst.gov.in

- Login to the portal using your username and password.

- From the left-side menu, click on ‘eWay Bill’ and select ‘Cancel’.

- You will be redirected to the ‘Cancel e-Way Bill’ page.

- Enter the e-way bill number you want to cancel and click on ‘Go’

- The e-way bill associated with that number will be displayed.

- Scroll down and select the ‘Reason for Cancellation.’

- Duplicate

- Order Cancelled

- Data Entry Mistakes or

- Others

- Enter related ‘Remarks’ in the next column

- Click on ‘Cancel’

- On successful cancellation, the screen will display the message ‘e-way Bill Cancelled Successfully.’

- Click on ‘OK’ to get a preview of the cancelled e-way bill.

The e-way bill with ‘Cancelled’ written across will be displayed on the screen.

When Can You Cancel an e-Way Bill

You can cancel an e-way bill if –

- Goods are not being transported

- The data entered is incorrect

- The order is cancelled

- Duplicate bill

Cancelling an e-Way Bill – Things to Remember

Irrespective of the reasons for cancelling an e-way bill, there are a few things you need to remember before cancelling it.

- You cannot delete an e-way bill once generated, but you can cancel it.

- Only the generator of the e-way bill can cancel it. Any other stakeholders involved in the delivery process, like the buyer or transporter, cannot cancel the e-way bill not generated by them.

- An e-way bill can be cancelled within 24 hours of its generation.

- You cannot cancel an e-way bill once any empowered officer verifies it.

- Once cancelled, you cannot use the same e-way bill during transportation.

e-Way Bill Cancellation Time

The e-way bill portal can store e-way bill data for a maximum of 24 hours. Therefore, any eway bill can be cancelled only within the first 24 hours of its generation. This means after the 24-hour window, the cancellation of an e-way is not possible.

How to Cancel an e-Way Bill After 24 Hours

As mentioned earlier, if an e-way bill is generated, but no goods have been moved, it can be cancelled within 24 hours of its generation. If this cancellation isn’t done within the first 24 hours, the generator, either the supplier or transporter, cannot cancel the e-way bill from his end.

However, there is a provision allowing the recipient of the consignment to reject the generated e-way bill within 72 hours of generating it. Once the recipient rejects the e-way bill, it gets cancelled.

How to Reject an e-Way Bill

Only the recipient of the consignment can reject an eway bill. The rejection window is within 72 hours from its generation or before its validity ends, whichever comes first. However, if a checking officer verifies an e-way bill during transit, it cannot be rejected even within the 72-hour timeframe.

Steps to Reject e-Way Bills | Steps to Cancel e-Way Bill After 24 Hours

- Visit e-way bill website at www.ewaybillgst.gov.in

- Login to the portal using your username and password.

- From the left-side menu, click on ‘eWay Bill’ and select ‘Reject’

- You will be redirected to the ‘Reject e-Way Bill Generated by Others’ page.

- Enter the date on which the e-way bill has been generated and click on ‘Submit’

- The list of e-way bills generated on that particular date will be displayed.

- Select the e-way bill you want to reject by checking the ‘Select for Reject’ box and clicking on ‘Reject’

- Upon successful rejection, the system will display ‘The number of e-way bills rejected’.

The generator of the e-way bill receives a message and mail on his registered mobile number and email address intimating that the e-way generated by him got rejected by the recipient.

.

How to Cancel an e-way Bill After 72 Hours

The cancellation time for an e-way bill stands on two conditions:

- Cancel before 24 hours from e-way bill generation or before it’s verified in transit.

- Request the recipient to whom the e-way bill details were communicated to reject the generated e-way bill 72 hours before its creation.

If you wish to cancel an e-way bill beyond this time frame, which is after 72 hours it is not possible on the eway bill portal.

How to Modify eWay Bill – Vehicle Number Updation in Part-B

The Vehicle Number entry on an eway bill is optional when generating part-A of the e-way bill. However, an e-way bill must have a vehicle number to be valid for the transportation of goods.

You can update the vehicle number on the document using the e-way bill portal when the e-way bill is within its validity period in the following situations:

- When you did not enter the“Vehicle Number” on the e-Way Bill

- When you shift goods to another vehicle/conveyance during transit due to breakdown or transhipment

Note:

- You cannot edit any other details of the e-way bills.

- You can update vehicle details for multiple e-way bills in a single shot using the “Bulk update vehicle number” option on the e-way bill portal, where an excel template can be filled up and uploaded.

Vehicle Number Updation Process on eWay Bill

Here is a step-by-step Process to Update the Vehicle Number:

- Visit e-way bill official portal.

- Log in using username and password.

- From the left side menu, go to e-way bill and select “Update Vehicle No” option.

- Select “Re-generate” under “Consolidated EWB” to update vehicle details in your consolidated e-way bill. The next steps remain the same.

- Select either “e-Way Bill No” or “Generated Date” against “Show e-Way Bill By:”

- Enter the e-Way Bill No. or Date and Click “Go”.

- Select the relevant e-Way Bill you want to update the vehicle number

- Fill in the details:

- Vehicle number

- From Place

- Choose the reason for the change from the drop-down – Transhipment, Vehicle Break down or Not updated earlier remarks, if any.

- Click on the “Submit” button.

- If the mode of transportation is rail, air, or ship, enter the transporter document number instead of the vehicle number.

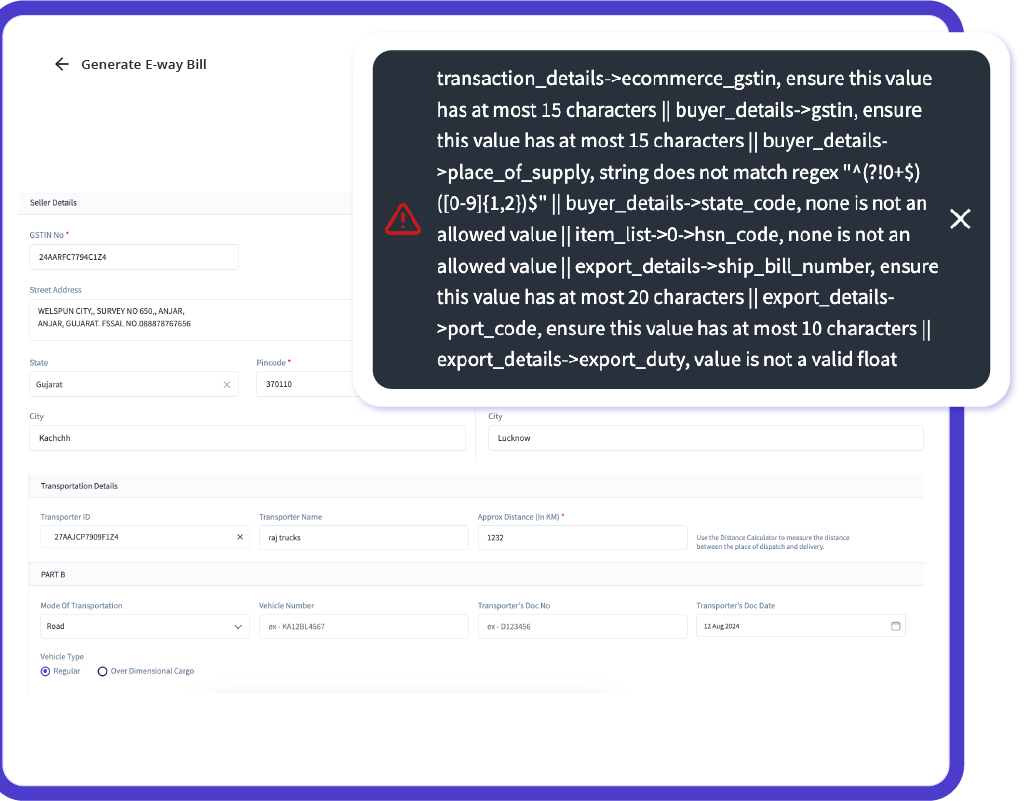

- Now, your e-way bill gets updated with new details instantly. However, if there are any errors, they will be displayed.

Transporter ID on e-Way Bills

Initially assigned Transporter/seller who generated e-way bills can change/ re-assign the Transporter ID, thereby replacing the existing transporter with a new one. However, if the initially assigned transporter assigns another transporter by changing the “TransID,” then the seller cannot make any changes. Further, you can edit only Part-B details.

Here is a step-by-step re-assignment of another transporter:

- Select “Update EWB Transporter” under the “e-way bill” option on the dashboard’s left-hand side panel.

Note: You can enter “Transporter GSTIN” or “Transporter enrolment ID.”

- Enter the new/changed “Transporter ID” and Click “Submit.”

- You can view the updated e-way bill and click on “Print” to print the e-way bill.

Note: The e-way bill number will remain the same if you change the transporter details.

Top Features of myBillBook e-Way Bill Software

Fast and Accurate e-Way Bill Generation

Create error-free e-way bills in less than 30 seconds with automatic population of key details such as GSTIN, vehicle number, and transporter ID. Benefit from over 25 intelligent error checks that ensure compliance, minimize penalties, and enhance your logistics workflow.

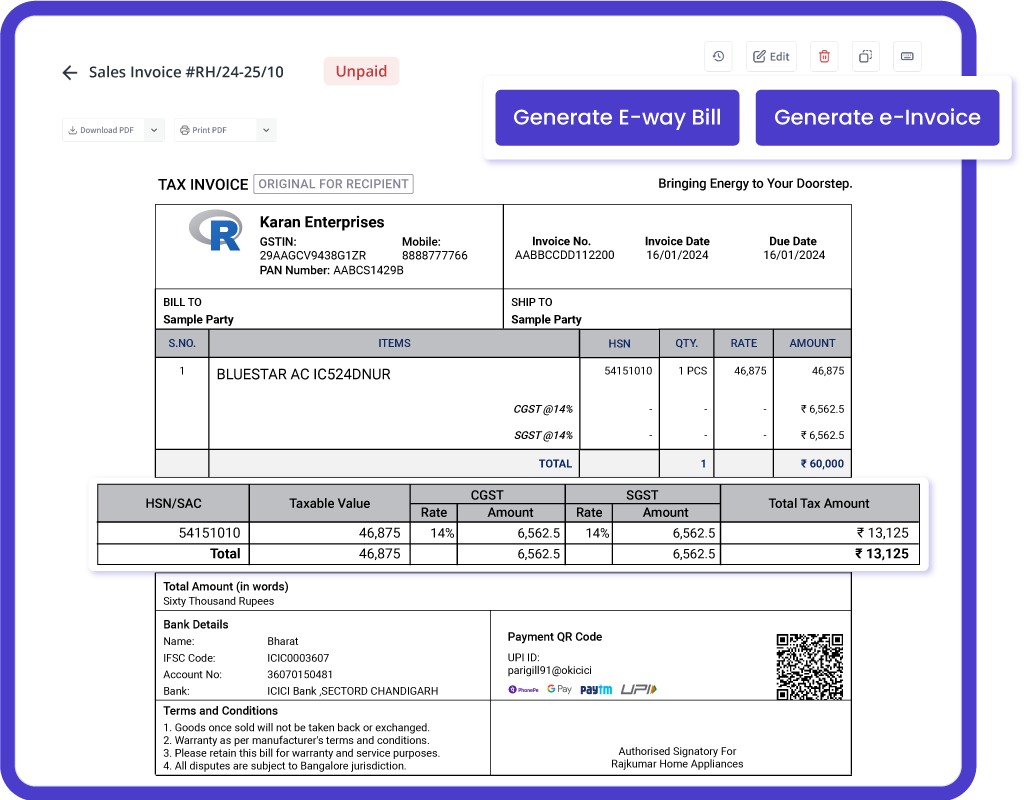

Smooth Integration with GST and e-Invoicing

Seamlessly connect with GST billing and e-invoicing systems. Generate and share e-way bills directly from your invoices with no manual effort, ensuring a cohesive and efficient compliance process.

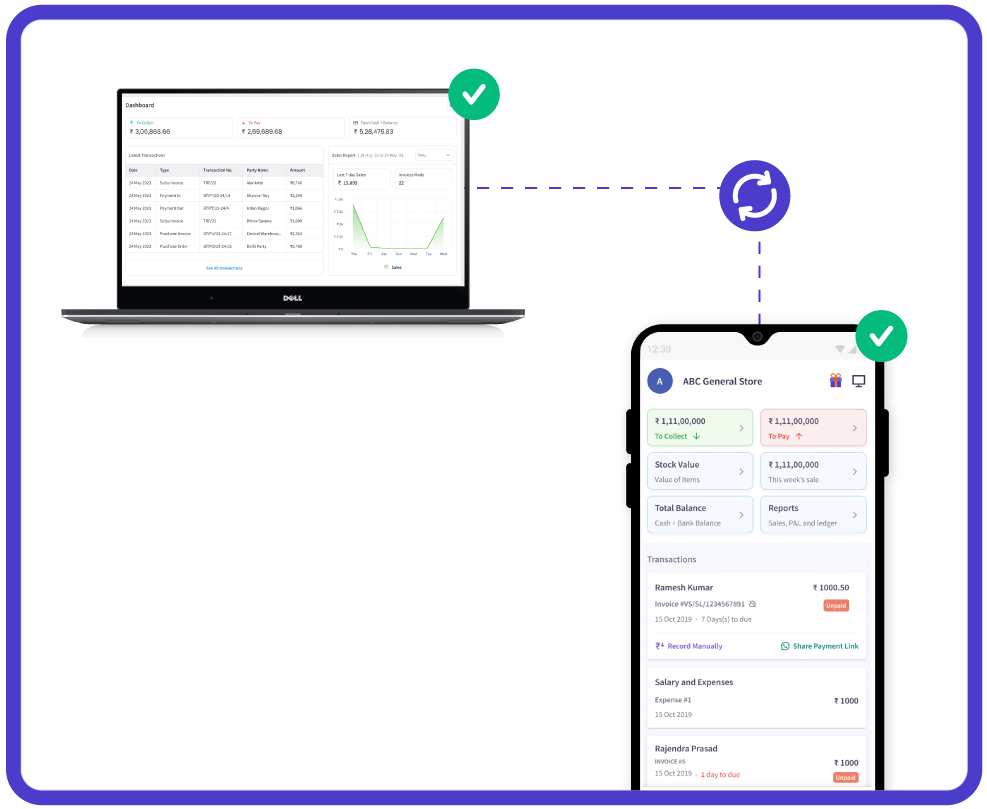

Multi-Device Access with Real-Time Sync

Manage your e-way billing transactions securely from any location with myBillBook’s cloud solution. Use multiple devices (phone, tablet, computer) simultaneously and benefit from real-time data synchronization, keeping all your devices up-to-date.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

FAQs on Cancelling eWay Bills

How do I cancel an already-generated e-way bill?

Once generated, the e-way bill cannot be deleted. However, the generator can cancel it within 24 hours of its generation by logging into the official eway bill portal. However, if a specific EWB has been verified by the proper officer, it is not possible to cancel it.

What is the time limit for the cancellation of an e-way bill?

The e-Way bill must be cancelled within 24 hours of being generated. Only the person who generates the e-Way bill can cancel it. It is against the law to use a cancelled e-Way bill.

What is the penalty for not cancelling the e way bill?

The fine for not cancelling an eway bill or travelling without an invalid eway bill or no eway bill is INR 10,000 or the tax sought to be evaded (whichever is greater). If the transporter denies to pay the penalty, the vehicle will be seized and to get it released a minimum of half the consignment value needs to be paid.

Is there any validity period for eWay bill?

The e-way bill’s validity is determined by the distance the goods will travel. If the distance is less than 100 km, the e-way bill will be valid for one day from the relevant date. For each additional 100 km, the validity will be extended by one day from the relevant date.