e Invoice Limit | Applicability | Latest Notifications

If your business turnover is more than Rs. 5 Crore in any of the financial years from 2017-18, you must generate e-invoices for all your B2B transactions starting 1 August 2023.

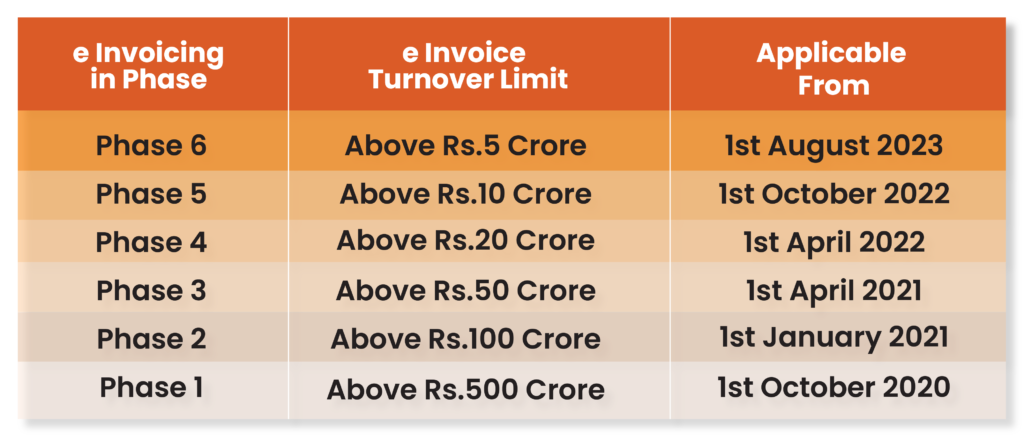

Implementing e-invoicing in India is a significant step towards curbing tax evasion and improving tax compliance. The system was first announced in July 2019 as a part of the GST reform. The introduction of e-invoicing was done in phases, starting with Phase 1 in October 2020 and the recent one being Phase 5, announced in May 2023.

Latest Notification on e Invoicing Limit: Businesses with more than Rs.5 Crore Turnover Should Generate e Invoices

As per the recent notification on e invoice limit released by GST Council on 10th May 2023, the business turnover limit to generate e invoices for B2B transactions has been reduced to Rs.5 Cr from the previous Rs.10 Crore. This means businesses with an annual aggregate turnover of more than Rs.5 Crore in any previous financial year from 2017-18 must generate e invoices. With this, more businesses are made to generate e invoices for B2B transactions. The new rule has come into effect from 1st August 2023. This means all your B2B transactions past this date need to have e-invoices in place of a regular invoice.

e-Invoicing in Phases

Here is a little back story of how the government has introduced e invoicing limits in phases.

Introduction of e-invoice Under GST

e-Invoicing was first announced in July 2019 as a part of the GST reform to curb tax evasion and improve tax compliance.

Phase 1: GST e-Invoice Limit for Businesses with Turnover Above Rs.500 Crore

In October 2020, the e-invoicing system was implemented on a voluntary basis for businesses with a turnover of more than Rs. 500 Crores in any previous financial year from 2017-18. This marked the initial phase of e-invoicing in India.

Phase 2: GST e-Invoice Limit for Businesses with Turnover Above Rs.100 Crore

In November 2020, the voluntary threshold was lowered for businesses with a turnover of more than Rs. 100 Crores in any previous financial year from 2017-18.

Phase 3: GST e-Invoice Limit for Businesses with Turnover Above Rs.50 Crore

In March 2021, the threshold was further reduced to include businesses with a turnover of more than Rs. 50 Crores in any previous financial year from 2017-18.

e-Invoicing Became Mandatory

Till Phase 3, generating e-invoices was a voluntary exercise for businesses with turnover above Rs.50 Crore, but from July 2021, e-invoicing was made mandatory for all businesses with a turnover of more than Rs. 50 Crores in any previous financial year from 2017-18.

Phase 4: Mandatory e-Invoicing for Businesses with Turnover Above Rs.20 Crore

In February 2022, the government extended e-invoicing to businesses with a turnover of more than Rs. 20 Crores in any previous financial year from 2017-18.

Phase 5: Mandatory e-Invoicing for Businesses with Turnover Above Rs.10 Crore

In August 2022, the threshold was further reduced to businesses with a turnover of more than Rs.10 Cr in any previous financial year from 2017-18.

Phase 6: Mandatory e-Invoicing for Businesses with Turnover Above Rs.5 Crore

In May 2023, the threshold was further reduced to businesses with a turnover of more than Rs.5 Cr in any previous financial year from 2017-18.

Example of Turnover Calculation for e-Invoicing

Now that it’s clear about the e invoice turnover limits, the next doubt that could come to your mind is – how is my turnover calculated and from which year e-invoicing is applicable. Here are the details about the same.

E-Invoicing Applicability

If your business turnover in any financial year starting 2017-18 meets the mentioned threshold e invoice turnover limit (currently above Rs.5 Crore), you must start generating e invoices from the applicable date (as mentioned in the above table).

e-Invoicing Turnover is Calculated at PAN Level not at GST Level

e-Invoicing is typically calculated at the PAN (Permanent Account Number) level. This means that all businesses registered under the same PAN number are treated as a single entity for e-invoicing purposes. As a result, the turnover considered for e-invoicing is the consolidated turnover of all businesses registered under the same PAN number, regardless of their individual turnovers. Therefore, if the combined turnover of these business entities exceeds the specified GST e invoice limit, all of them are required to generate e invoices and comply with e-invoicing regulations.

- Example 1: If you operate a business with multiple branches located in different cities across India, each branch will have its own unique GST number. However, all of these branches will be linked to the same PAN number, especially if you are the sole proprietor. In this scenario, if the combined turnover of all your branches surpasses the specified threshold GST e invoice limit, you must generate e-invoices at every branch, regardless of the individual turnover of each branch.

- Example 2: Suppose you are the owner of three distinct businesses, each registered with its own unique PAN and GST numbers. In such a scenario, it’s important to assess the turnover of each business independently. Identify the business for which the individual turnover exceeds the GST e invoice limit. For the other businesses whose turnover remains below the threshold e invoice limit, can continue their regular operations without the need for e invoicing compliance.

Which Businesses and Which Transactions are Eligible for e Invoicing Under GST

e-Invoicing under GST does not apply to all invoices and all business transactions. Here’s a breakdown of the eligibility criteria:

e-Invoicing Under GST is applicable only to invoices like

- Taxable Sales Invoices

- Credit Notes

- Debit Notes

- Invoice-cum-bill of supply

e-Invoicing Under GST is applicable only to transactions like

- Taxable B2B transactions involving sale of goods or services

- Business-to-Government (B2G) transactions involving sales of goods or services

- Export or SEZ Invoices

- Supplies made under Reverse Charge Mechanism (RCM)

e-Invoicing Under GST is applicable only to businesses

- Registered under GST

- With a turnover exceeding the threshold limit

- Conducting B2B transactions

e-Invoicing Exemptions Under GST

The scope of e-Invoicing does not encompass the following documents, transactions, and businesses:

- Exempted Supplies for which a bill of supply is issued

- Import-related transactions.

- Job work transactions

- Delivery challans

- Entities such as banks, financial institutions, and insurance companies

- The presentation of cinematographic films on multiplex screens

- Non-banking financial companies (NBFCs)

- Goods and passenger transportation agencies

- Business units operating within Special Economic Zones (SEZ

- Government departments

How does myBillBook help with Your e-Invoicing?

Here is a detailed video about how myBillBook helps businesses with their e-invoice generation process. With myBillBook, you can download invoices in JSON format and upload them directly to the e-invoice portal. Once the portal generates the e-invoice, the same gets reflected on the billing software. Further, while the generated e-invoices are available only for 24 hours on the government portal, myBillBook makes them available for a lifetime.

FAQs on E-invoice Limit

What is the turnover threshold for mandatory e-invoicing in India?

The turnover threshold for mandatory e-invoicing is currently Rs. 5 Cr for businesses to which e-invoicing is applicable.

How is turnover calculated for e-invoicing compliance?

Turnover is calculated on a PAN (Permanent Account Number) basis. If multiple businesses are registered under the same PAN, their combined turnover is considered.

Are there exemptions from e-invoicing based on business type or industry?

Yes, certain businesses and transactions, such as banks, financial institutions, and government departments, are exempt from e-invoicing requirements.

Is e-invoicing mandatory for businesses with a turnover of Rs. 5 Crores?

Yes, e-invoicing has become mandatory for businesses with a turnover of Rs. 5 Crores. Businesses falling within this turnover range are now required to generate e-invoices and comply with e-invoicing regulations.

What is the limit of e-invoicing in 2023?

In May 2023, the threshold for mandatory e-invoicing in India was further reduced to businesses with a turnover of more than Rs. 5 Crores in the previous financial year. This change indicates that businesses with a turnover exceeding Rs. 5 Crores are required to generate e-invoices and comply with e-invoicing regulations.

Is e-invoicing applicable to Rs.10 Crore turnover?

e-invoicing is applicable for businesses with a turnover of 10 crores. This came into effect from 1st August 2023.

Are there penalties for non-compliance with e-invoicing regulations?

Non-compliance with e-invoicing regulations may result in penalties, including financial penalties and legal consequences. Businesses must adhere to the relevant e-invoicing requirements.

What is the 7-day limit for e-invoice?

The 7-day limit for e-invoicing typically refers to the time frame within which businesses are required to generate and report their e invoices to the government's e-invoicing portal. In this context, businesses are expected to create and upload their e invoices within 7 days from the time of issuance.

What is the new GST e-invoice limit?

The latest GSt e-invoice limit, as announced in 2023, is businesses with more than Rs.5 Crore must generate e invoices for all B2B transactions.

Is e-invoicing applicable to Rs.20 Crore turnover?

e-invoicing is applicable for businesses with a turnover of 20 crores effective from 1st October 2021.