You can get help from e-invoice customer care whenever you face a concern in the following ways.

- Read through these e-invoice helpline websites before reporting issues

- https://einv-apisandbox.nic.in (API integration and testing)

- https://einvoice1.gst.gov.in (registration, login and bulk generation)

- https://www.gstn.org.in/e-invoicing (legal procedures querying)

- Browse https://selfservice.gstsystem.in/ for self-service

- Contact support via toll-free e-invoice customer care number: 1800-103-4786

The personnel handling the portal for your e-invoice will help reduce your e-invoicing struggles forever.

[/vc_column_text]

Quick Resolutions

You must provide the following details concerning:

API Integration

- NIC Environment

- API name or NIC endpoint

- Header attribute values

- Payload (in plain text or encrypted in case of authentication-related issues)

- Actual response from NIC API

- Password

Generation of Irn in Bulk Mode Using the Offline Tool

Self-Help Service

To avail of the self-help, do the following:

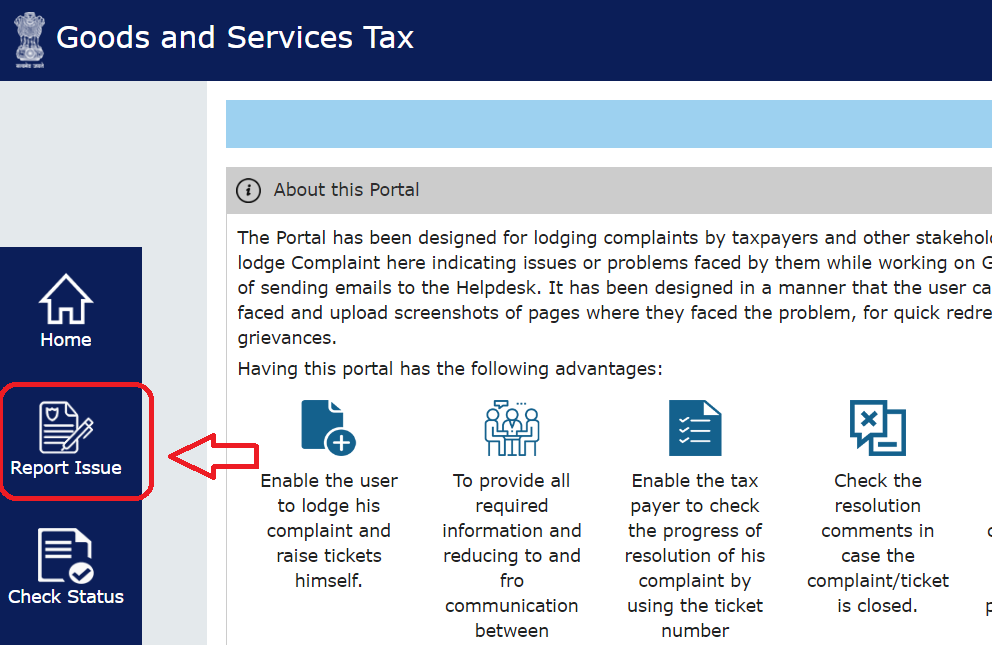

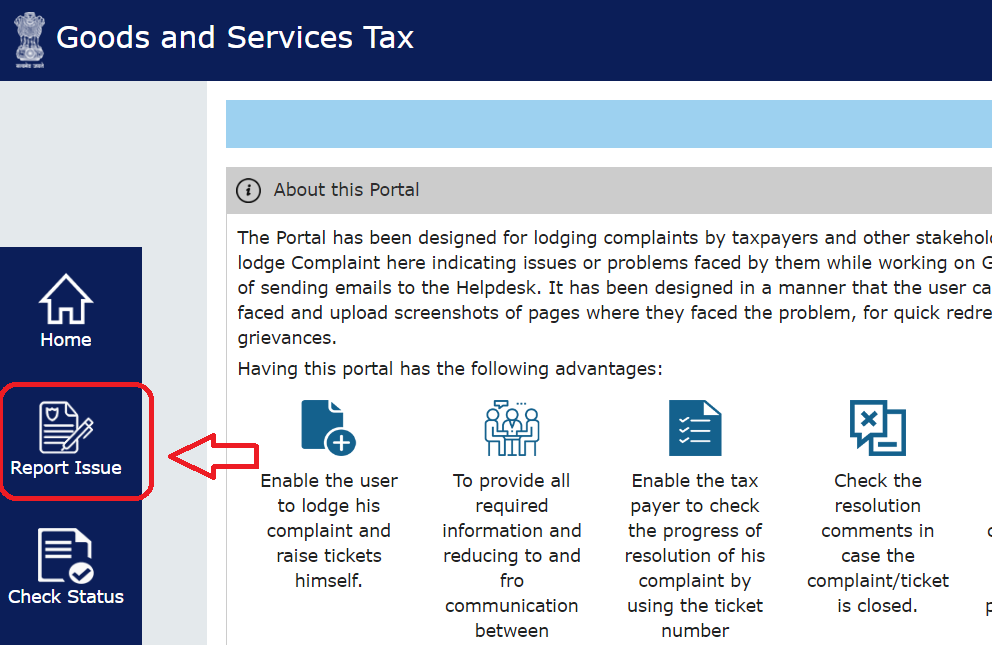

1. Navigate to https://selfservice.gstsystem.in and click on “Report Issue”

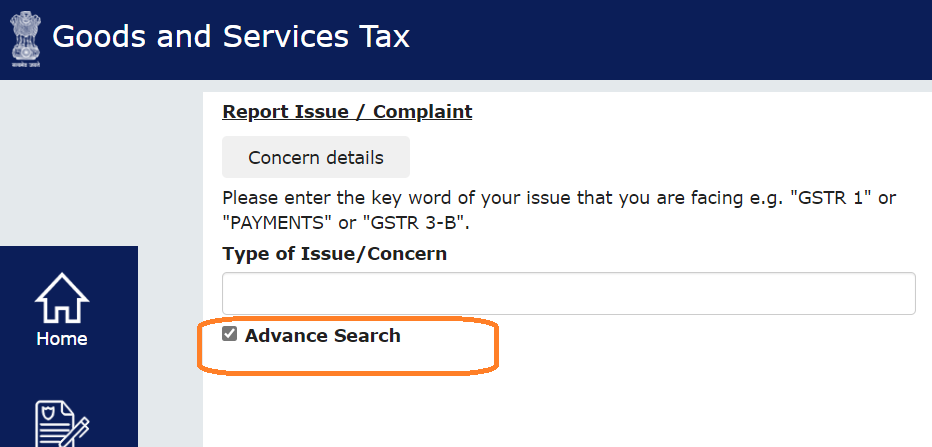

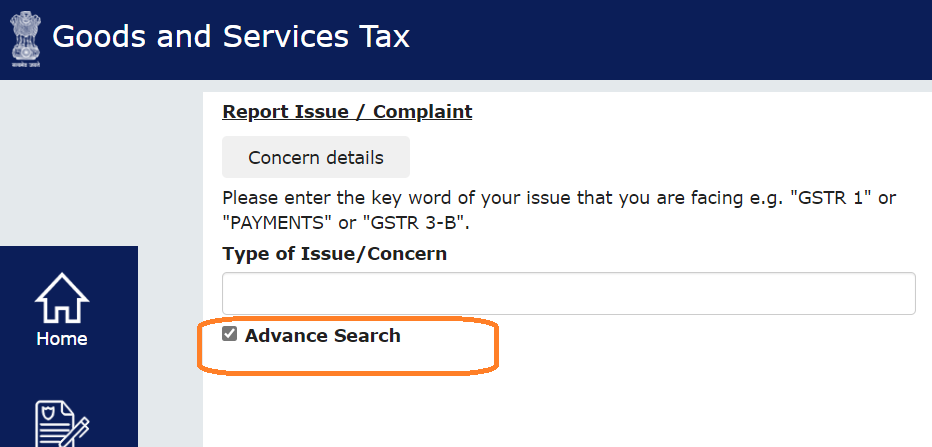

2. Select “Advance Search”.

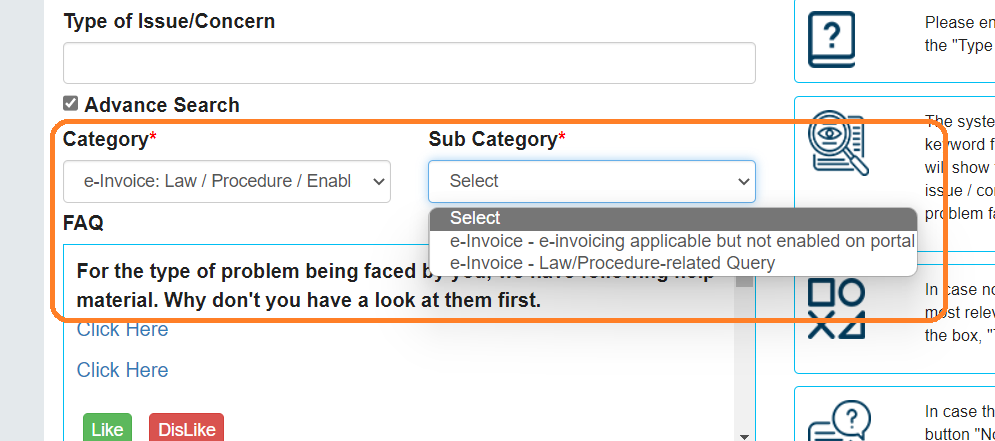

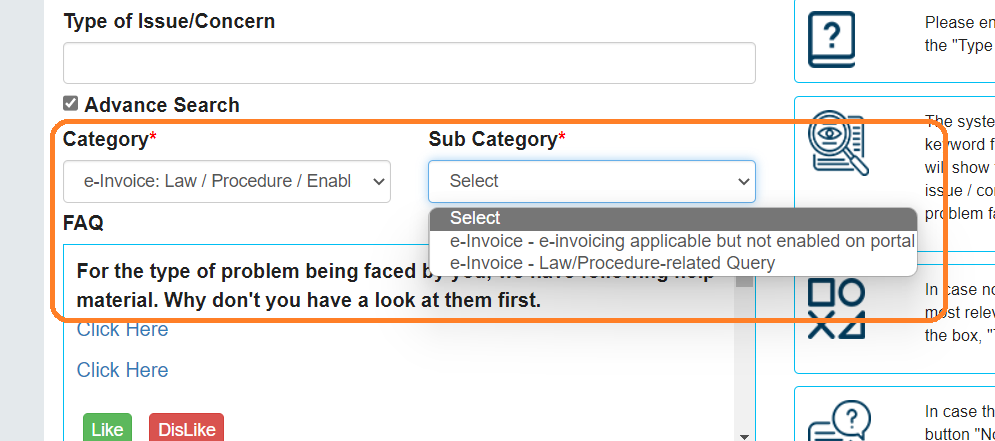

3. Under the “Category” dropdown list, select “E-Invoice” and the relevant subcategory under “Sub Category”.

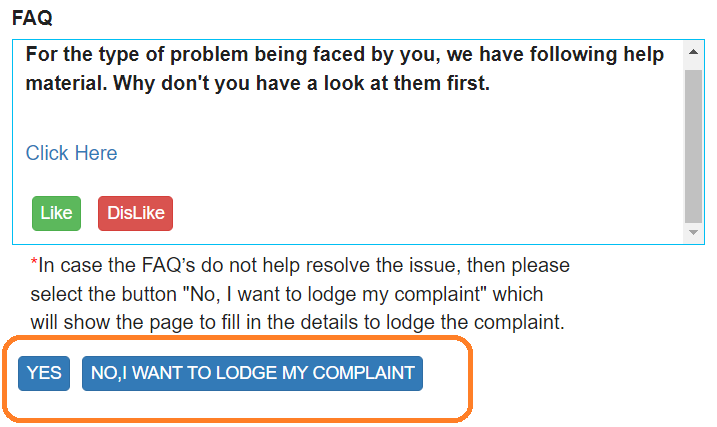

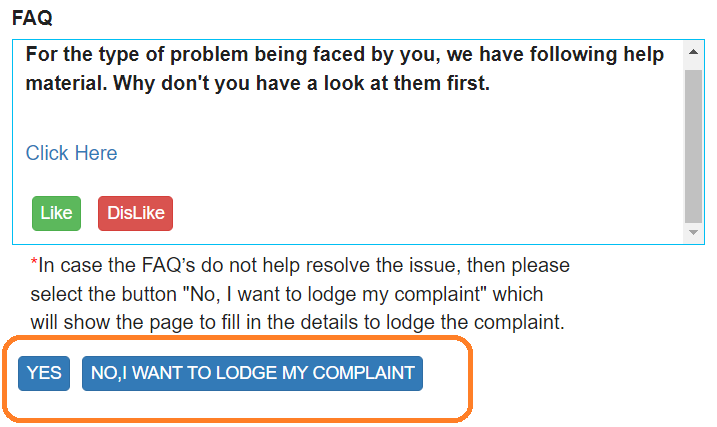

4. Use the links provided to select the issue type, fetch the information and resolve the issue. Otherwise, click “NO, I WANT TO LODGE MY COMPLAINT.”

5. Provide the required details by attaching the screenshots using the “Attachment” option.

In addition, you can use the “Self-help” e-invoice portal customer care to

- check the progress/status of the issue

- Fetch links to relevant information

Otherwise, you can always get help from the e-invoice helpdesk number.

FAQs

I currently use regular invoicing software, which has a long turnaround time. Can e-invoicing help me tackle this?

Yes. The e-invoicing platform handles all your accounts. Hence you can use your team’s valuable time for more productive jobs rather than repetitive and time-consuming ones with the platform. And thus increase your productivity.

Does e-invoicing support B2C invoices?

No. It does not support B2C invoices since there is no ITC involved.

What is e-invoicing under GST?

An e-invoice is a Tax Invoice usually issued by every registered taxpayer. Still, it contains some additional information in the form of a QR Code.

Can e-invoicing help me, a tax inspector, spot fraudulent invoices?

Yes. E-invoicing ensures you a legitimate ITC application so that you quickly spot any fraudulent invoice if there is one.

How does e-invoicing minimise errors?

E-invoicing allows you to have minimal manual input. The automation offered helps you improve the process and limit all errors.

Read more about GST e-Invoicing

E-invoice Customer Care, Support

You can get help from e-invoice customer care whenever you face a concern in the following ways.

- Read through these e-invoice helpline websites before reporting issues

- https://einv-apisandbox.nic.in (API integration and testing)

- https://einvoice1.gst.gov.in (registration, login and bulk generation)

- https://www.gstn.org.in/e-invoicing (legal procedures querying)

- Browse https://selfservice.gstsystem.in/ for self-service

- Contact support via toll-free e-invoice customer care number: 1800-103-4786

The personnel handling the portal for your e-invoice will help reduce your e-invoicing struggles forever.

Quick Resolutions

You must provide the following details concerning:

API Integration

- NIC Environment

- API name or NIC endpoint

- Header attribute values

- Payload (in plain text or encrypted in case of authentication-related issues)

- Actual response from NIC API

- Password

Generation of Irn in Bulk Mode Using the Offline Tool

Self-Help Service

To avail of the self-help, do the following:

1. Navigate to https://selfservice.gstsystem.in and click on “Report Issue”

2. Select “Advance Search”.

3. Under the “Category” dropdown list, select “E-Invoice” and the relevant subcategory under “Sub Category”.

4. Use the links provided to select the issue type, fetch the information and resolve the issue. Otherwise, click “NO, I WANT TO LODGE MY COMPLAINT.”

5. Provide the required details by attaching the screenshots using the “Attachment” option.

In addition, you can use the “Self-help” e-invoice portal customer care to

- check the progress/status of the issue

- Fetch links to relevant information

Otherwise, you can always get help from the e-invoice helpdesk number.

FAQs

I currently use regular invoicing software, which has a long turnaround time. Can e-invoicing help me tackle this?

Yes. The e-invoicing platform handles all your accounts. Hence you can use your team’s valuable time for more productive jobs rather than repetitive and time-consuming ones with the platform. And thus increase your productivity.

Does e-invoicing support B2C invoices?

No. It does not support B2C invoices since there is no ITC involved.

What is e-invoicing under GST?

An e-invoice is a Tax Invoice usually issued by every registered taxpayer. Still, it contains some additional information in the form of a QR Code.

Can e-invoicing help me, a tax inspector, spot fraudulent invoices?

Yes. E-invoicing ensures you a legitimate ITC application so that you quickly spot any fraudulent invoice if there is one.

How does e-invoicing minimise errors?

E-invoicing allows you to have minimal manual input. The automation offered helps you improve the process and limit all errors.