How to Cancel e-Invoices in GST Portal

‘How to Cancel e-Invoice’ is one of the most frequently asked questions on e-invoicing. This page takes you through the cancellation process and also provides other e-invoice cancellation-related information. Before knowing the process of e-invoice cancellation, let us know when you can cancel an e-invoice (reasons).

Reasons to Cancel an e-Invoice

You can cancel the generated e-invoice for multiple reasons, some of which include –

- Cancelled order

- Return of sale

- Data entry errors

- Errors in e-invoice

- Duplicate invoices and so on.

How to Cancel e-Invoice: Step-by-Step Guide

There are multiple ways to generate an e-invoice, including API-based integration, using the GePP tool, etc. Irrespective of the modes of generating an e-invoice, the only way to cancel it is through the e-invoice official portal. The portal offers two different ways to cancel the e-invoice. One is to cancel a single e-invoice, and the other is to cancel them in bulk. Let’s look at the step-by-step guide to cancel an e-invoice on the GST e-invoice portal.

Steps to Cancel a Single e-Invoice

Step 1: Log in to the e-Invoice portal.

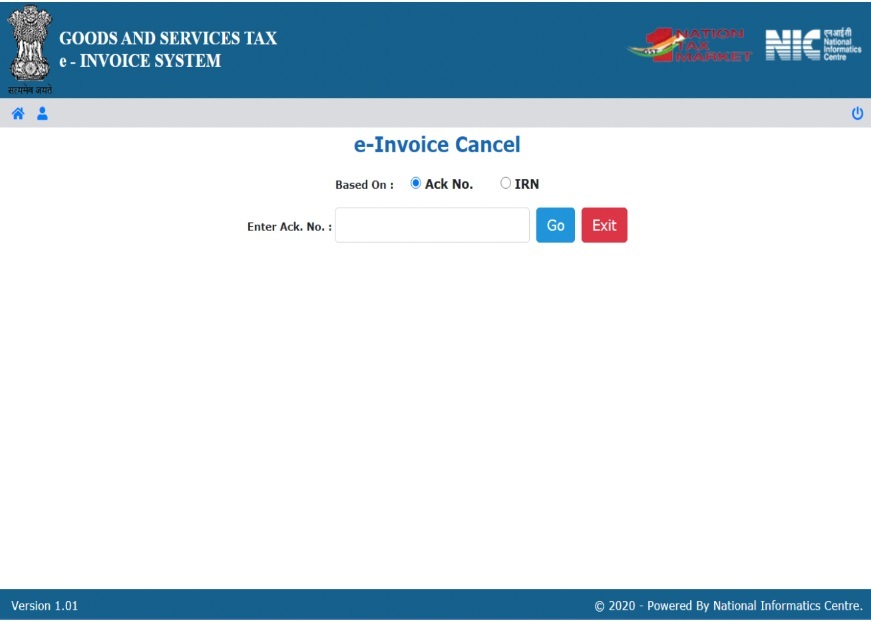

Step 2: From the left side menu, click on ‘e-Invoice’ and select ‘Cancel’

Step 3: Choose either the ‘Acknowledgement number’ or the ‘IRN’ to enter. (You can find both of them on the e-invoice you wanted to cancel)

Step 4: According to the selection, enter the respective number in the field and press ‘Go’

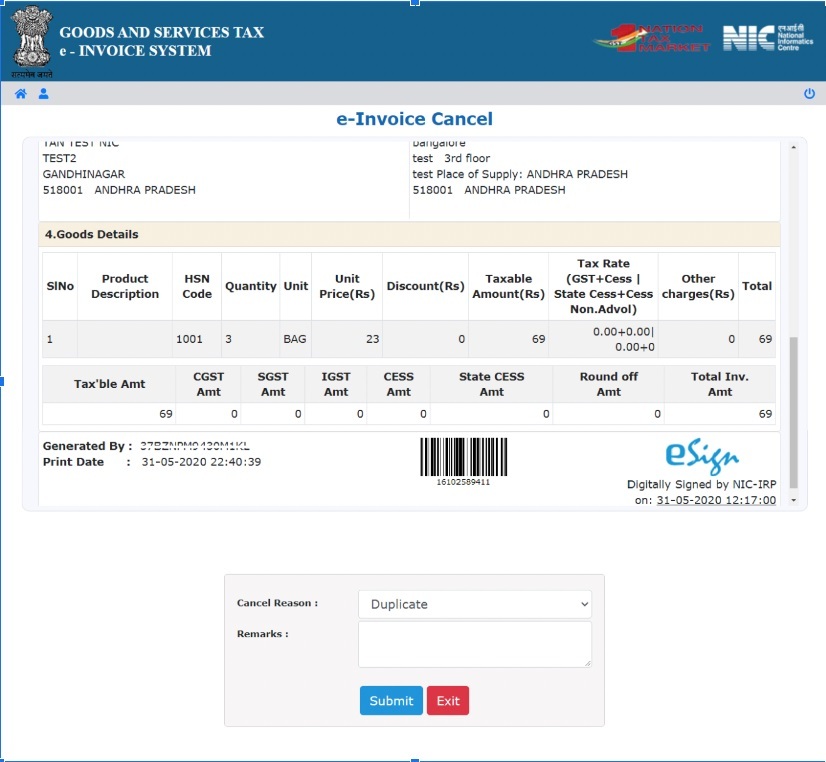

Step 5: The screen will display the generated e-invoice.

Step 6: Scroll down to choose cancel reason and to enter remarks.

Step 7: Under ‘Cancel Reason’, you will find two options – 1.Duplicate and 2.Data Entry Mistake

Step 8: Choose anyone based on your reason (In most cases, it would be ‘Data Entry Mistake’ because there is no chance of duplication in the e-invoicing framework)

Step 9: In the ‘Remarks’ column, name the information that was entered incorrectly. Example unit change, item change, price change, etc.

Step 10: Click ‘Submit’.

Step 11: On successful submission, the cancellation request gets updated automatically and you can see the e-invoice with ‘Cancelled’ marked across it.

Steps to Cancel Bulk eInvoices

If you want to cancel more than a single e-invoice, you can use the ‘Bulk IRN Cancellation’ option provided by the e-Invoice portal. As mentioned earlier, the cancellation window of 24 hours remains the same even for this option. Here are the steps to cancel e-invoices in bulk.

Step 1: Visit the einvoice official website at einvoice1.gst.gov.in

Step 2: From the main menu, go to ‘Help > Tools > Bulk Generation Tools’.

Step 3: You will be redirected to ‘Bulk IRN Generation’ page

Step 4: Scroll down to see the ‘Bulk IRN Cancel’ option.

Step 5: Click on the ‘E-Invoice Cancel by IRN – JSON Preparation’ to download the tool to your PC.

Step 6: It is an Excel-based tool and requires MS Office 2010 and higher versions on your PC to access it.

Step 7: Once downloaded, open the tool and fill in the required details on the ‘Bulk E-Invoice Cancel’ sheet

Step 8: Add the IR number of the e-invoice which you wish to cancel, the reason for cancellation, either duplicate entry or data entry mistake, and Cancel Remark.

Step 9: Once all the details are entered, click on the ‘Validate’ option for the tool to validate the data entered.

Step 10: Next, click on ‘Prepare JSON’ to download the JSON file to your system.

Step 11: Once the JSON File is downloaded, log in to the einvoice portal.

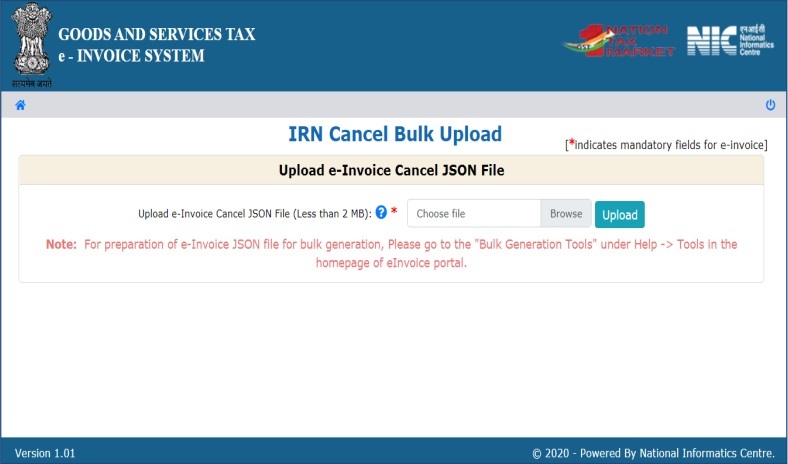

Step 12: From the left-side menu, click on ‘e-Invoice’ and select ‘Bulk IRN Cancel’.

Step 13: You will be redirected to the ‘IRN Cancel Bulk Upload’ page.

Step 14: Click the ‘Browse’ option to choose the JSON file and click on ‘Upload’ to upload the file.

Step 15: If the cancellation is made successfully, the system displays the cancelled einvoices with the IRN number, cancel reason, cancel remark, cancel date, and status.

Step 16: If the e-invoice is not eligible for cancellation, then the system will provide the appropriate error message in the status column.

Step 17: The ‘Download Result Excel’ option would let you download the cancelled e-invoices.

e Invoice Cancellation Time Limit

The e-invoice portal can store e-invoice data for a maximum of 24 hours. Therefore, any e-invoice can be cancelled only within the first 24 hours of its generation. This means after the 24-hour window, the cancellation of an e-invoice is not possible.

Important Points to Note About e-Invoice Cancellation

e Invoice Amendment/Modification

Amendment, modification or editing of generated e-invoices is not possible on the e-invoice portal. However, the same can be done on the GST portal while filing GSTR-1. The ‘Amend Record Details’ option available during GSTR-1 filing allows you to make changes in the generated e-invoices.

Cancel e-Invoice After the 24 Hours of Generation

As mentioned above, cancellation of e-invoices can be done only within 24 hours of generating the e-invoice. After 24 hours, if you wish to cancel an e-invoice, you need to generate a credit note in case the reason for cancellation is a sales return. For any other reasons, you cannot cancel an e-invoice except to edit it in the GST portal while filing GSTR-1.

e-Invoice with Active e-Way Bill

e-Invoices with active or valid e-way bills cannot be cancelled within the 24-hour time frame. In order to cancel such an e-invoice, you first need to cancel the e-way bill and then cancel the e-invoice, provided the cancellation period is within 24 hours.

Same Invoice Number

Once you cancel an e-invoice, you cannot use the same invoice number to generate another e-invoice. If you use the same number, it will be rejected when uploaded on the e-invoice portal. This is because IRN is a unique string based on the supplier’s GST number, document number, document type and financial year. Therefore, you must create a new invoice with a unique document number and report the same for e-invoice generation.

Partial Cancellation

Partial cancellation of e-invoices is also not possible. You can only fully cancel the e-invoice within 24 hours from the time of generation.

FAQs on ‘How to Cancel e-Invoice’

Can an e-invoice be cancelled?

Yes, an e-invoice can be cancelled within 24 hours from the time of generation.

Is it OK to cancel an invoice?

It's acceptable to cancel an invoice in certain cases where errors or discrepancies are found in the original invoice.

In which case can the invoice generated be cancelled?

In situations like incorrect data entry, duplicate invoices, or when there's a need to rectify details, you can cancel the generated invoice.

How do I cancel an invoice in GSTR-1?

In GSTR-1, you must amend or modify the invoice details to reflect the cancellation.

How do I cancel an e-invoice after 3 days?

An e-invoice cannot be cancelled after 3 days of its generation. However, you can either create a credit note for the same invoice or make the changes while filing GSTR-1 returns.

How do I cancel an e-invoice after 1 month?

An e-invoice cannot be cancelled after 1 month of generating it. However, you can make the changes while filing GSTR-1 returns.

What is a cancelled invoice called?

A cancelled invoice is often referred to as a ‘Cancelled Invoice’. You can find the term ‘Cancelled’ printed across the invoice on the cancelled invoice.

How do I cancel my e-way bill and e-invoice?

An e-invoice cannot be cancelled if an e-way bill has been generated. If your e-way bill was generated in the last 24 hours, you can first cancel the e-way bill before cancelling the e-invoice. Once the e-way is cancelled, you can cancel the e-invoice within 24 hours of generation by following the above process.

How do I cancel an e-invoice on the GST portal after 24 hours?

You can edit the information on your e-invoice while filing GSTR-1 on the GST portal.