Rent Receipt Format (Word, Excel, PDF)

Get professional, ready-to-use rent receipt templates—perfect for monthly payments, HRA claims, and legal proof.

Want to automate your rent tracking and receipt generation?

myBillBook billing software offers smart tools to generate, share, and store rent receipts digitally—ideal for landlords, tenants, and accountants.

Rent Receipt Format Templates- Download them for Free

Unlock Premium Rent Receipt Formats with myBillBook

Features of myBillBook Rent Receipt Format

Quick Monthly Rent Templates

Save tenant details and monthly rent amount once, then auto-generate receipts each month—perfect for landlords managing recurring payments with minimal manual work and consistent documentation.

PAN & Property Address Fields

Include landlord PAN and full property address using custom fields—helps tenants claim HRA and provides clarity in case of audits, disputes, or income tax verification requirements.

Multiple Payment Modes Supported

Record rent payments made through UPI, cash, cheque, or bank transfer—ensures all receipts reflect the exact mode of transaction for accurate financial records and tenant reimbursement claims.

Professional PDF & Excel Downloads

Download your receipts in printable PDF or fully editable Excel format—ideal for maintaining monthly records, sharing with employers, or storing proof of rent for legal and audit purposes.

Custom Notes & Fields

Add rental terms, duration, or agreement-specific remarks on each receipt—ensures mutual clarity and can be customized to suit unique rental agreements or special landlord-tenant arrangements.

Access Anytime via Mobile & Desktop

Generate, view, and share rent receipts anytime using the myBillBook app or website—manage rental documentation whether you’re in-office, remote, or on the move.

Rent Receipt Meaning

A rent receipt is an official document that confirms a tenant has paid rent to the landlord for a specific period, usually monthly. It includes key details like the amount paid, payment date, rental period, landlord’s name, tenant’s name, and property address.

For salaried individuals, rent receipts are essential while filing income tax returns, especially to claim House Rent Allowance (HRA) under Section 10(13A) of the Income Tax Act. Submitting valid rent receipts helps reduce taxable income and provides transparency in rental transactions. It also serves as legal proof of payment in case of disputes or audits.

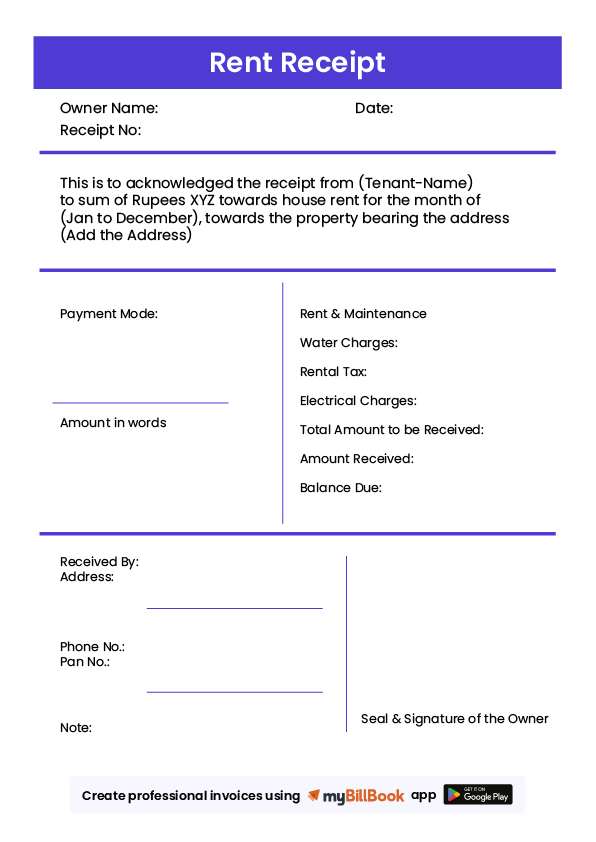

Rent Receipt Format

While there’s no officially mandated format for rent receipts, it’s important to include all necessary details to ensure validity for legal and financial purposes. A well-structured rent receipt format typically includes:

- Landlord and tenant details

- Rent amount and month paid for

- Property address

- Date of payment and payment mode

- Landlord’s PAN (if applicable)

- Signature of the landlord or authorized person

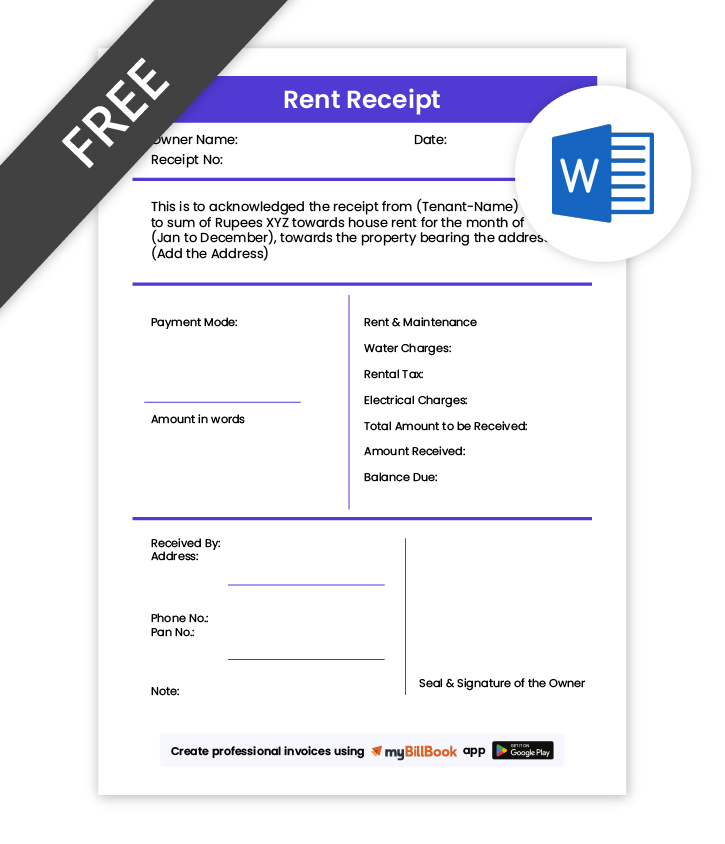

Rent Receipt Format in Word

If you have Microsoft Word installed on your computer, creating a rent receipt manually is simple and convenient. Just open a blank document, and format it using text fields like landlord name, tenant name, rent amount, rent month, and payment mode. You can refer to the sample format provided on this page for guidance. Once done, save and print the document. This printed version can then be signed by the landlord and submitted physically or uploaded to tax portals as proof for HRA claims or documentation.

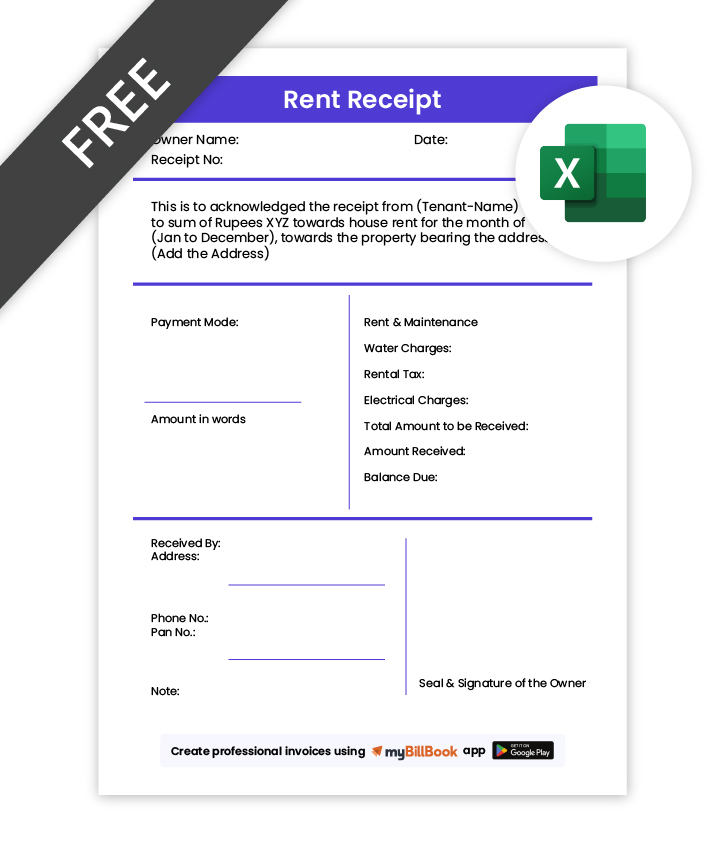

Rent Receipt Format in Excel

Microsoft Excel is ideal for creating rent receipts, especially if you want to maintain a monthly record in a tabular format. You can use pre-defined rows and columns to enter details such as rent amount, month, payment date, and landlord/tenant information. Excel also allows you to automate monthly calculations or create multiple receipts using a single template. This makes it an efficient tool for landlords managing several tenants or tenants maintaining personal rent records for tax filing.

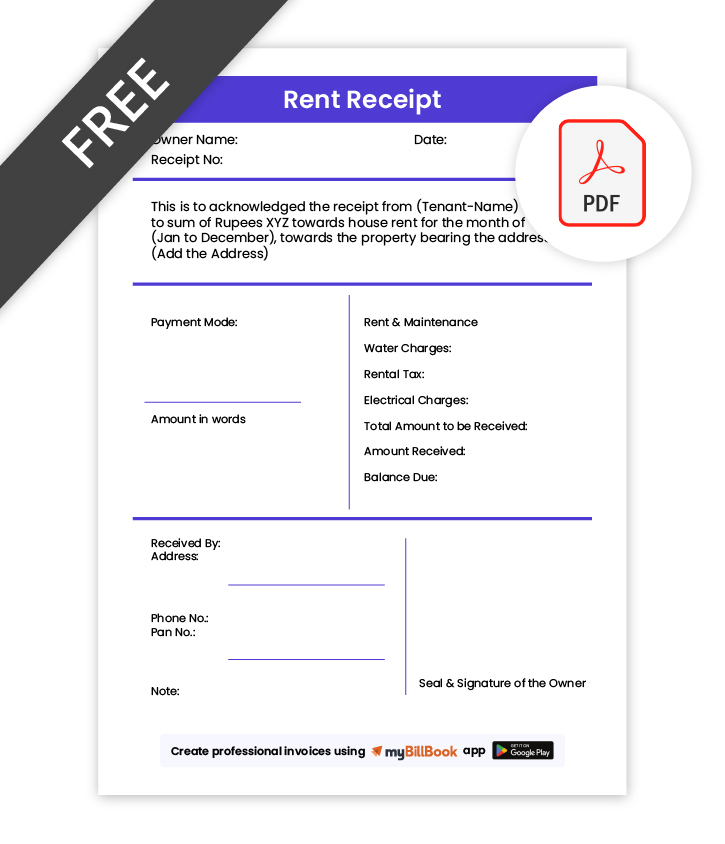

Rent Receipt Format in PDF

PDF rent receipt formats are perfect when you need a clean, professional, and non-editable document. You can download the pre-filled format from this page, print it directly, or use a PDF editor to fill out the fields digitally. PDF receipts are widely accepted by employers and tax departments when claiming HRA or submitting rental proofs. They also maintain formatting across devices, making them a reliable choice for sharing or storage.

Frequently Asked Questions

Is there a specific format for creating rent receipts?

No, there isn’t any. However, you need to include all the necessary information for it to become legit.

Do I need to add my PAN number to my rent receipt?

If your annual rent is less than Rs.1 lakh, PAN number is not required on the rent receipt.

Is a revenue stamp required on a rent receipt?

If the rent is paid in cash and is more than Rs.5,000 per month, you need to affix a revenue stamp on a rent receipt. However, if the revenue stamp on a rent receipt is not required e rent is paid through online transfer or cheque.

Is rent receipt submission mandatory?

If your income is more than Rs.3 lakhs and HRA or house rent allowance is more than Rs.3,000, you must submit rent receipts to claim HRA.

Is the landlord’s PAN number required to claim HRA?

If the monthly rent exceeds Rs.8,333, the landlord’s PAN number is required to claim HRA.

Can landlords issue rent receipts digitally?

Yes, landlords can issue digital rent receipts using billing or documentation software. As long as the receipt contains all required fields, it’s legally valid even in digital form.

Is a rent receipt required for every month?

Yes, ideally a rent receipt should be issued for every month’s payment. This ensures a clear payment trail and protects both landlord and tenant in case of disputes.

Can I use rent receipts for income tax filing?

Yes, rent receipts are valid proof of rental payment and can be submitted while filing income tax to support your HRA claim or rent deduction under Section 80GG.

How do I generate rent receipts for HRA claim?

You can generate rent receipts manually or use billing software like myBillBook to create and download professional rent receipts with all required fields for HRA claims.

Are handwritten rent receipts acceptable?

Yes, handwritten receipts are legally valid if they include correct details and are signed by the landlord. However, printed or digital receipts are more professional and easier to maintain.

Know More About Bill Formats