Mobile Bookkeeping App for MSMEs in India

From daily expense tracking to GST-ready reporting, manage your business finances directly from your smartphone. Simple, fast, and designed for busy business owners who work on the move.

What is Mobile Bookkeeping App?

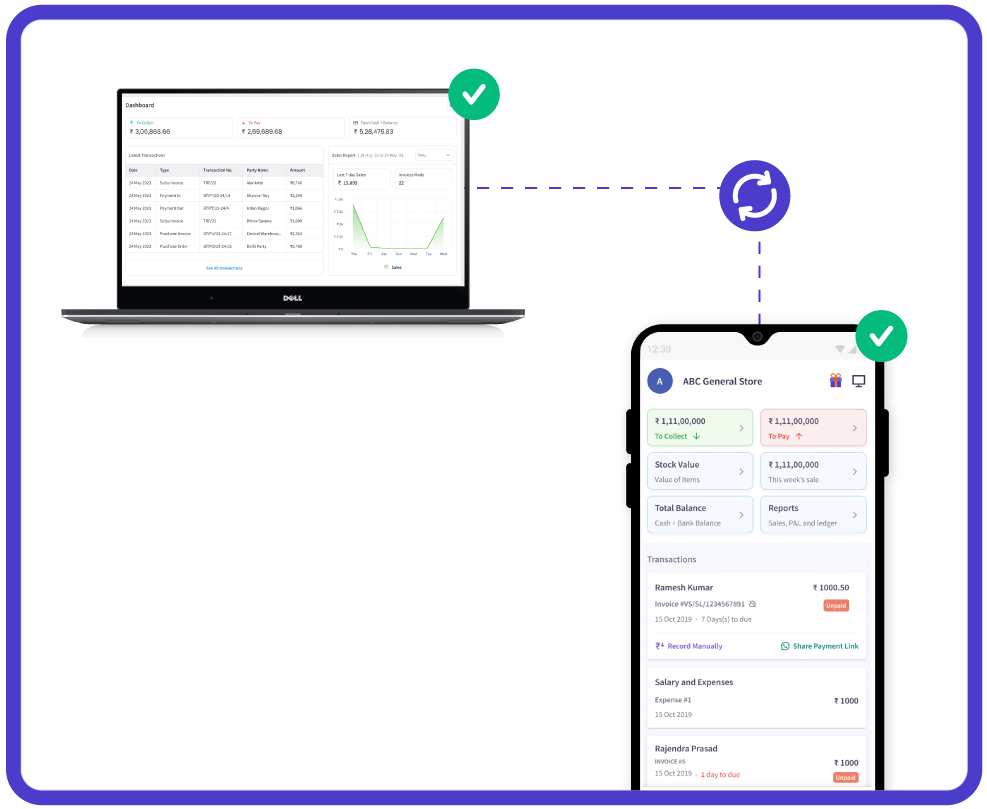

A mobile bookkeeping app is a tool that allows business owners to manage their financial records on the go. It helps track income and expenses, generate invoices, and maintain accurate financial records, all with just a smartphone or tablet. The app makes it easier to stay organised, reducing the need for manual data entry and minimising the risk of errors. Whether you’re handling cash transactions or digital payments, this app provides a convenient way to keep your financials up to date and accessible from anywhere.

Features That Bring Your Bookkeeping to Your Fingertips

Record Transactions on the Go

With the myBillBook mobile app, you can quickly record any expense, sale, or payment right when it happens—straight from your phone. There's no need to wait until the end of the day.

This way, you won’t forget anything. Whether it’s small cash payments, money from customers, or bills from suppliers, everything is logged immediately and accurately.

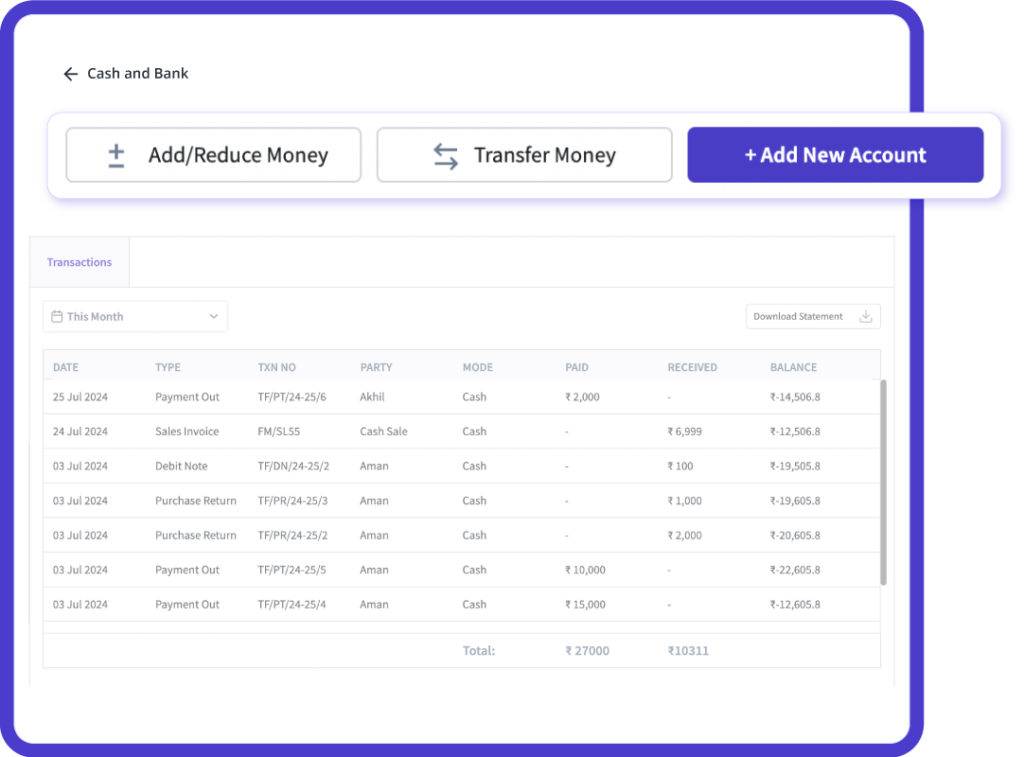

Real Time Financial Dashboard

Forget about dealing with complex spreadsheets or waiting for your accountant to provide updates. myBillBook gives you a real-time mobile dashboard where you can see your whole financial picture right on your phone.

You can easily check your income, expenses, profit, and cash flow in a simple layout that’s perfect for busy business owners.

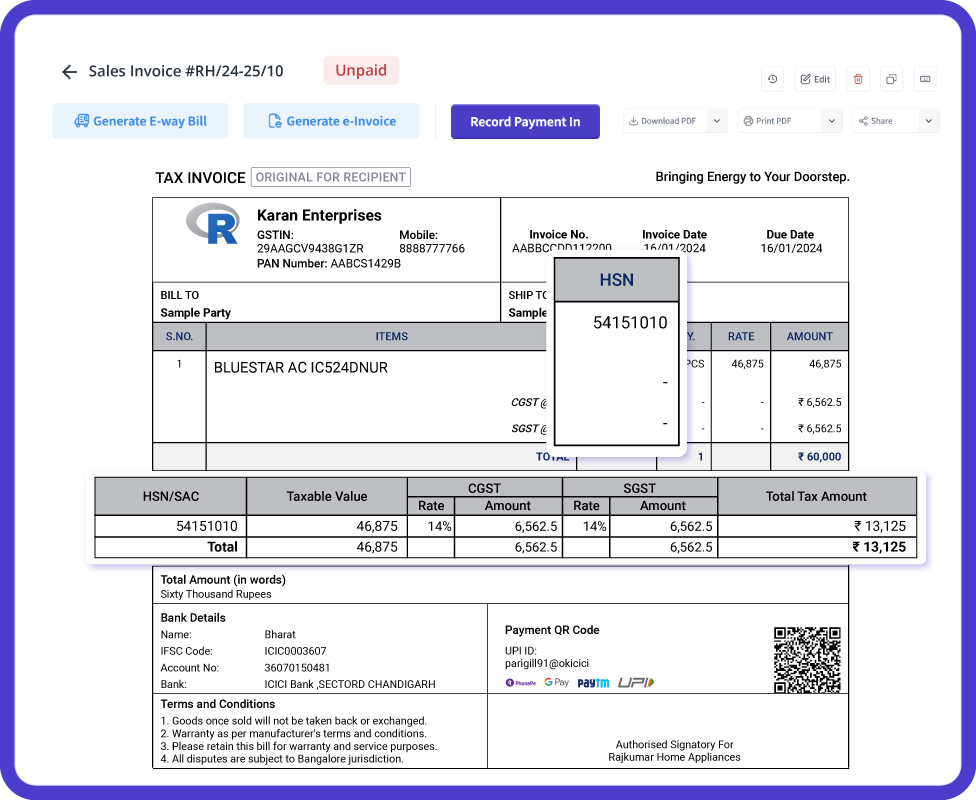

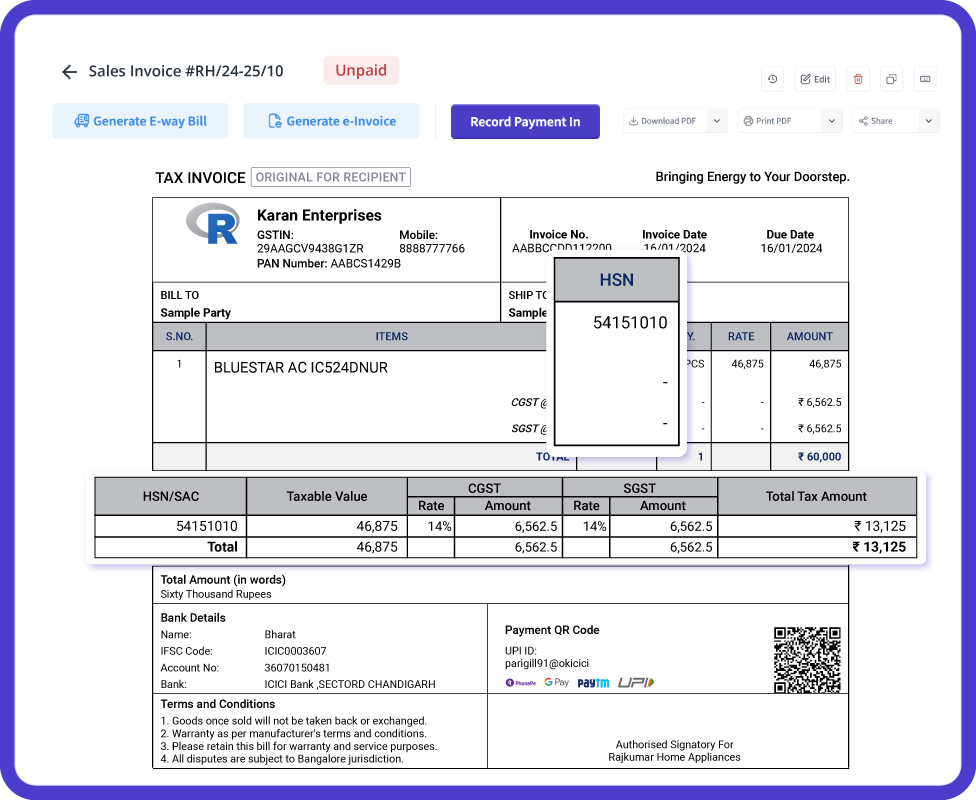

Instant Invoice Sync

Every invoice you generate through myBillBook is automatically added to your books—no double entry, no missed records.

Your mobile app syncs invoices instantly, so your financial dashboard always reflects real-time numbers. Even multiple team members can access updated data simultaneously.

Mobile Reminders & Notifications

Keeping track of your payments is a lot easier with reminders from your phone. The myBillBook app sends you alerts for due payments, collections, and unpaid invoices.

You won't need to remember to follow up or check payment dates yourself—the app takes care of that for you.

Mobile GST Compliance

Filing GST can seem complicated, but it doesn't have to be when you use automation. With myBillBook’s mobile app, you can easily calculate GST for every transaction as it happens.

You can keep an eye on the taxes you pay and collect, plus check out useful reports, all from your phone. No need for complicated Excel sheets or stressing over tax details.

Why Business Owners Prefer myBillBook’s Mobile Bookkeeping App?

Stay in control of your finances with live dashboards, smart notifications, and GST-ready reports — anytime, anywhere.

I no longer have to wait to reach the shop to update my accounts. I record every sale and expense on my phone. It’s so simple and quick to use, and now I can track everything in real time without missing a single entry.

Suresh

Kirana Store Owner, Pune

Recommends myBillBook for:

Features That Power India’s Growing Businesses

Product Demo for Mobile Bookkeeping App

“Superb customer service. Helped me set up my account as required”

Real Experiences from Businesses Using myBillBook’s Mobile Bookkeeping App

This app has made bookkeeping much less stressful. I can check cash flow, income, and GST right on my mobile—even when I’m travelling between clients

Mahesh

Freelance Service Provider, Kochi

The best part is the instant invoice sync. I create an invoice, and it’s updated in my books immediately. No paperwork. And no double entry.

Ravi

Distributor, Hyderabad

The mobile reminders are a game-changer. I get alerts for payments due, so I never miss a follow-up. It’s like having an accountant in my pocket.

Neha

Pharmacy Owner, Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Mobile Bookkeeping App?

A mobile bookkeeping app is a simple digital tool that allows small businesses to record income, expenses, invoices, and taxes directly from their smartphones — without depending on spreadsheets or desktop accounting software.

With a mobile bookkeeping billing software, you can manage your entire business finances on the go. Whether it’s creating invoices, tracking daily cash flow, or viewing reports, everything happens at the palm of your hand.

For Indian MSMEs, kirana shops, wholesalers, pharmacies, and service providers, this means more control, less paperwork, and faster decision-making — without hiring an accountant

Who Should Use a Mobile Bookkeeping App?

- Kirana & Retail Stores – Record daily sales and expenses right from the counter.

- Wholesalers & Traders – Keep your accounts updated while managing multiple orders.

- Pharmacies & Distributors – Track invoices, collections, and GST in real time.

- Freelancers & Service Providers – Manage finances anywhere, even while working remotely.

- Startups & MSMEs – Run your entire business bookkeeping without hiring extra staff.

- Owners On the Move – Perfect for business owners who aren’t tied to a desk.

Benefits of Using a Mobile Bookkeeping App

- Access Anytime, Anywhere — Manage your accounts even when you’re not in the store.

- Real-Time Updates — Transactions, invoices, and expenses sync instantly.

- GST Compliance Made Easy — Automatic tax calculations on every entry.

- Paperless Record-Keeping — No files, no ledgers, no stress.

- Smart Insights — Real-time reports to help you make faster, smarter business decisions.

- Timely Reminders — Get mobile alerts for payments and due invoices.

- Team Collaboration — Allow your team or accountant to access and update records securely.

Step-by-Step Guide: How to Use the Mobile Bookkeeping App

- Download the App from the Play Store or App Store.

- Sign up or Log In with your business details.

- Add Your Business Information, such as name, GSTIN, and contact details.

- Record Transactions Instantly as they happen — sales, purchases, or payments.

- Create & Sync Invoices that automatically update your books.

- View Reports & Track GST from the mobile dashboard.

- Set Reminders for collections, payments, or follow-ups.

- Collaborate securely by adding your accountant or staff.

Why Use myBillBook Mobile Bookkeeping App

On-the-go billing

Invoicing has traditionally been a desktop activity, but finding the time to sit down and do it can be challenging. Clients may send invoices straight from their phone or tablet, whether they are on the job site, in a vehicle, or at a lunch stop. The sooner they invoice, the sooner they will be paid.

Recovering past-due

When an invoice is paid or when it is past due, your clients will be notified via the mobile accounting app. This simplifies the management of accounts receivable.

Maintaining bank reconciliations

Accounting software can get a direct feed from your client’s bank account, allowing them to monitor transactions daily. Instead of letting it pile up over a month, quarter, or year, they may now conduct a few minutes of bank reconciliation each morning.

Photographs, as well as store receipts and invoices

Remove the weight of paper records from your clients’ shoulders. They may use their phone to take pictures of receipts and bills, and a mobile bookkeeping app will send these to the company’s accounting software.

Monitor your cash flow at any moment.

You may create a dashboard that lets clients track money coming in and going out of their accounts.

More involved clientele

Clients who have access to their company account 24×7 become significantly more interested in the figures. They’ll monitor data daily and become more involved in the company’s future. This eventually develops into a stronger bond with their accountant.

Quick victories

A mobile bookkeeping app might be the single most important solution for some clients’ cash flow. Business owners who used to spend one day a month at home pounding out invoices on a desktop computer may now do so from anywhere. They might suddenly submit invoices as soon as jobs are completed. In a single move, you may significantly enhance their monetary situation.

Purchase cleaner books

For client bookkeeping, mobile accounting software combined with daily bank feeds works well. Bank reconciliation is far more likely to be up to date because companies may examine and code transactions on their phone every day. This allows you to track and advise on business success, making the conclusion of the fiscal year considerably less stressful.

A completely paperless office

It saves you time when your clients enter expense data into their accounting software by collecting receipts. As a result of the paperless mobile bookkeeping report, you won’t receive a deluge of papers at the end of the fiscal year, and tax season will be significantly more organised & accurate.

Improved expenditure tracking

As soon as a purchase is completed, clients may utilise mobile applications to connect expenditures to jobs. This makes determining the real cost and profitability of certain tasks much easier.

Significance of Mobile Bookkeeping App for Small Business

Sustainable Mobile Computing for Database Requirements

Financial institutions must handle tens of thousands of contacts, which may include clients, investors, and partners. The mobile accounting software has database options to assist businesses in establishing and maintaining their CRM.

Banks and financial organisations are progressively recognising the need to embrace cloud technology and establish significant cloud footprints. Hosting databases ensures that the internal storage space is not exploited for other purposes. To ensure compliance with database standards, download the Mobile bookkeeping app to your phone and laptop.

Information technology infrastructure cost savings

Some financial institutions might struggle to meet the criteria for IT infrastructure and software. Migration to the cloud greatly reduces the number of IT infrastructures required and eliminates the need to acquire hardware.

There is no need to make substantial investments in in-house computers and networks to protect accounting data. When using mobile accounting software, IT infrastructure costs are significantly lowered. Save money by installing the app from the store on your IT infrastructure.

Top Security Parameter

Businesses that use cloud computing have better security than those that use traditional methods. Cloud solutions provide banks with data management and transaction visibility. Accessing account details using the Mobile accounting app is the most secure method of data access.

Banks can respond to threats and protect consumer information thanks to cloud-based technology. The cloud providers ensure built-in malware protection, compliance retention, email encryption, and virus protection. Data saved using the Smartphone bookkeeping mobile app is immediately stored in the cloud.

Low Operating Expenses

Bank infrastructure costs are decreased when files are maintained on-site. In addition, the expense of day-to-day maintenance is greatly reduced. Cloud finance solutions eliminate the costs associated with server development and maintenance. Installing the Mobile accounting app on your mobile device requires ZERO upkeep.

The expense of IT infrastructure upkeep might be too high at times. The equipment required to keep technology up to date is considerably reduced with cloud banking solutions. For new updates to the mobile app, the app must be updated after some time.

Enhancement of Operational Efficiency

One of the most essential advantages of shifting to the cloud for banks is increased operational efficiency. With a multi-user facility, information may be viewed remotely from any device. With the aid of mobile bookkeeping applications, the operational efficiency of the firm is increased to a new level.

Cloud technologies help banks’ overburdened IT departments operate more efficiently. By bringing vendors and buyers together on a single platform, the efficiency of online payments is improved. Businesses may manage accounting issues more effectively with the mobile accounting app.

Frequently Asked Questions

What is a mobile bookkeeping app?

A mobile bookkeeping app is a simple tool that helps you record transactions, track income and expenses, and manage GST directly from your phone.

Is a mobile bookkeeping app free to use?

Yes. Many apps like myBillBook offer free versions with core bookkeeping features such as transaction recording, reports, GST calculation, and invoice sync.

How fast can I set up a mobile bookkeeping app?

You can download the app, sign up, add business details, and start recording transactions in just a few minutes—no accounting knowledge needed

Can I track payments and reminders with a mobile bookkeeping app?

Yes. Most apps send alerts for pending invoices, upcoming due dates, and collections—helping you follow up faster and maintain better cash flow.

Can I export financial reports from a mobile bookkeeping app?

Yes. You can easily export invoices, sales data, GST summaries, and transaction reports in PDF or Excel formats for record-keeping or accountants.

How secure is my data on a mobile bookkeeping app?

Top apps use encrypted cloud storage, so even if your device is lost, your records remain secure and recoverable anytime.

Can multiple users access the same mobile bookkeeping account?

Yes. You can give team members or accountants permission to view or update records securely, without losing control over your data

Does a mobile bookkeeping app calculate GST automatically?

Yes. Most apps calculate GST on each transaction and create ready-to-use tax reports, making compliance simple for Indian MSMEs

Is a mobile bookkeeping app suitable for small businesses?

Yes. It’s designed especially for kirana stores, traders, freelancers, and small business owners who want simple bookkeeping without complicated software.