Horizontal Balance Sheet Format

Create audit-friendly horizontal balance sheets for Indian companies—readable INR figures, current/non-current splits, and cross-referenced notes that speed reviews.

A standard Balance Sheet Format helps structure assets, liabilities, and equity clearly for accurate review and reporting.

Horizontal Balance Sheet Format – Download Free Templates

Get side-by-side comparatives, proper classifications, and note numbers—optimised for Indian GAAP/Schedule III presentations.

Explore Preminum Horizontal Sheet Format

Features of myBillBook Horizontal Balance Sheet Format

Comparative Columns

Show current and previous year figures side by side in horizontal view. Highlight variances and trends to speed reviews and support clear, and gives board-ready analysis.

Group Mapping

Map ledger accounts to Schedule III headings once and reuse monthly. Ensure consistent classification, quickly locate unmapped balances, and maintain accuracy across branches.

Ledger Drilldown

Click balances to open supporting ledgers and vouchers. Verify postings, resolve classification issues quickly, and shorten month-end close without leaving the statement.

Notes Linkage

Attach note numbers beside line items and maintain disclosures on a notes schedule. Keep cross-references aligned and simplify auditor queries during reviews.

Rounding Units

Present amounts in rupees, lakhs, or crores consistently. Improve readability of board packs and external presentations without manual reformatting every period.

PDF Export

Export horizontal balance sheets to PDF with headers, footers, and page numbers. Preserve fonts and margins for consistent, print-ready statements across teams.

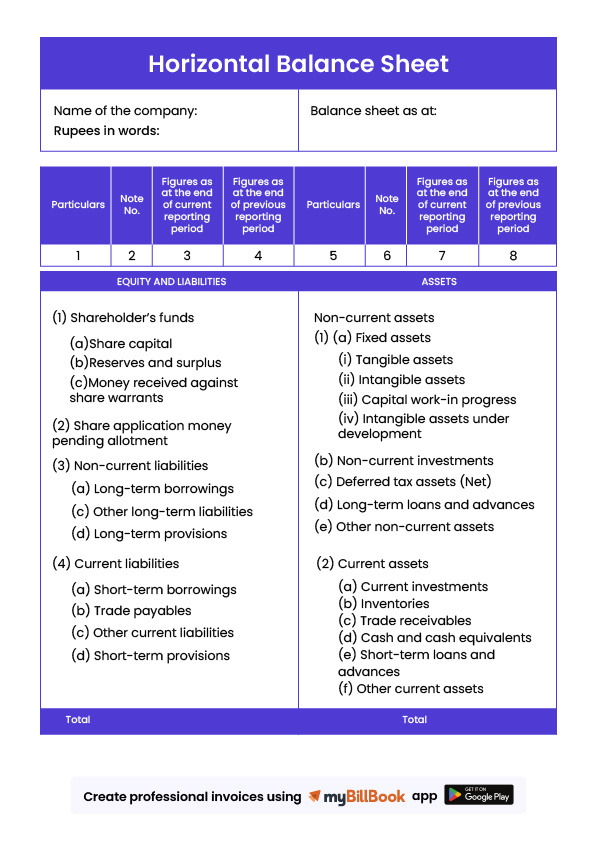

What is the Horizontal Balance Sheet Format?

A horizontal balance sheet format presents each line item with side-by-side comparatives (e.g., Current Year vs Previous Year) on the same page. In India, it typically follows Schedule III headings with current/non-current splits, note numbers cross-referenced to a notes schedule, and rounding shown in ₹/lakhs/crores. This layout makes trend and variance review faster because movements are visible line-by-line, aiding board discussions and audits. It’s commonly shared as Word, Excel, or PDF for clean, presentation-ready packs. By contrast, a vertical format shows one period top-to-bottom, with comparatives referenced elsewhere.

Horizontal Balance Sheet Format: Details to be Included

When creating a horizontal balance sheet format, several details must be included to represent a company’s financial position accurately. Some key elements should be included:

| S.No | Details |

| 1 | Company name and date of the balance sheet |

| 2 | Assets such as cash, investments, property, and equipment |

| 3 | Liabilities such as loans accounts payable. Taxes owed |

| 4 | Shareholders’ equity, including common stock and retained earnings |

| 5 | Totals for each category and the overall balance sheet |

| 6 | Comparisons with previous periods show trends and company financial position changes |

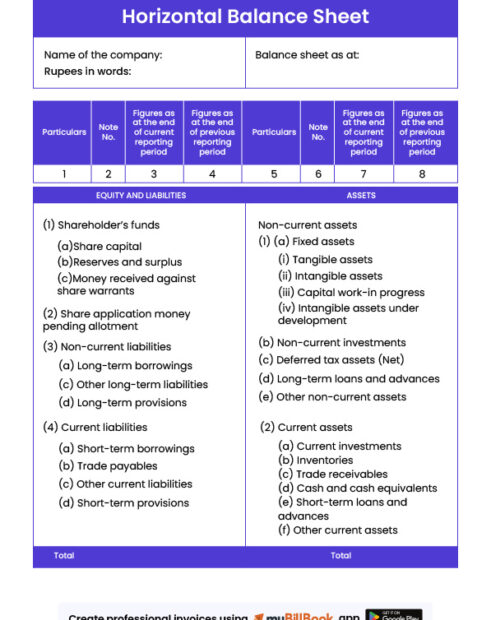

Sample Horizontal Balance Sheet Format

A sample horizontal balance sheet format provides a template that can be customized to suit a company’s needs. Here is an example of a sample. You can review the sample to understand the data that should be included and how it should be arranged.

Horizontal Balance Sheet Format in PDF

A PDF gives you a fixed, print-ready layout that looks identical on any device. It’s ideal for board packs and audit submissions because you can lock editing, embed fonts, watermark pages, and include headers/footers with page numbers and sign-off blocks. Export from Word/Excel once final, ensure ₹/L/Cr rounding is consistent, add notes references (e.g., “Note 3”), and compress the file for email. Best for circulation and archival.

Horizontal Balance Sheet Format in Word

A Word template is perfect when you need styling, annotations, and quick edits. Use styles for headings, keep CY vs PY tables aligned, and add notes cross-references and an appendix for detailed disclosures. Track changes and comments during reviews; insert branded headers, page numbers, and prepared/reviewed/approved sign-offs. Once approved, convert to PDF for distribution. Best for drafting and stakeholder markup.

Horizontal Balance Sheet Format in Excel

Excel excels at comparatives, formulas, and variance analysis. Keep a mapping tab to link ledgers to Schedule III heads, calculate subtotals automatically, and apply conditional formatting to highlight movements. Freeze panes for readability, set A4 print areas, and protect formulas with a password while leaving input cells open. Add a small trend chart or ratio block if needed, then export to PDF for the board. Best for finance preparation and analysis.

Frequently Asked Questions

Can a customizable horizontal balance sheet format be created in Excel?

Excel's horizontal balance sheet format offers calculation and graphing capabilities with easy editing and sharing options.

How can a horizontal balance sheet format be shared securely?

A customizable horizontal balance sheet format in PDF can be password-protected to secure financial information, and PDF files are easily shareable and printable on any device.

How does a horizontal balance sheet format differ from a vertical one?

A horizontal balance sheet presents financial data in a side-by-side layout, while a vertical balance sheet presents data in a top-to-bottom format.

What are the mistakes to avoid when creating a horizontal balance sheet?

Common mistakes include incomplete information, poor formatting, and unbalanced total assets and liabilities.

How often should a company prepare a horizontal balance sheet?

A company should prepare a balance sheet at the end of each accounting period, such as annually, quarterly, or monthly, depending on the company's needs and reporting requirements.

Can a horizontal balance sheet be used for personal finance?

Yes, horizontal balance sheets can track personal finances and help people evaluate their financial health, spot areas for improvement, and make better budgeting and investment decisions.

Is a horizontal format permitted under Schedule III in India?

Yes—layout is a presentation choice. Ensure Schedule III headings, current/non-current splits, comparative figures, and cross-referenced Notes to Accounts are properly shown.

How do I classify current vs non-current items?

Classify as current if expected to be realized/settled within 12 months (or operating cycle); otherwise non-current. Apply the policy consistently and disclose in notes.

What rounding unit should I use—₹, lakhs, or crores?

Choose based on materiality and audience. Use one unit consistently across the statement and disclose the rounding convention on the cover or notes.

How do I handle reclassifications or prior-period adjustments in comparatives?

Restate the previous year for comparability where practical and disclose the reason and impact in Notes to Accounts, including any limitations or estimates used.

Know More About Bill Formats