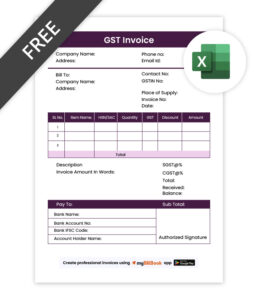

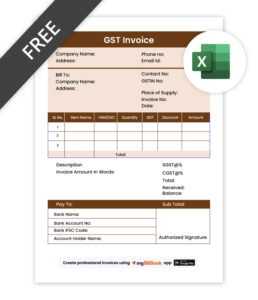

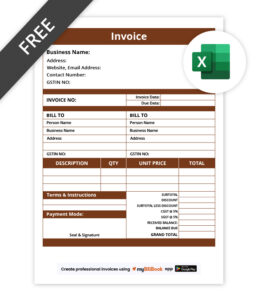

GST Invoice Format In Excel

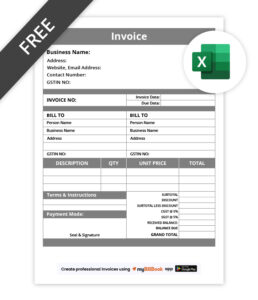

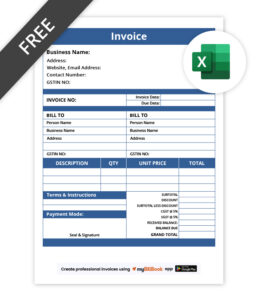

Download Ready-Made Invoice Formats in Excel – GST and Non-GST Templates for Every Business

Whether you need a GST invoice format in Excel for tax compliance or a simple invoice format in Excel for day-to-day billing, we’ve got you covered. Download, fill, and share in minutes — or switch to myBillBook billing software to create and manage all your invoices automatically, without manual effort.

Download Free Excel Templates for GST Invoices & Regular Invoices

Features of myBillBook GST Invoice Generator

Customisable Invoice Templates

The GST bill generator offers customisable invoice templates to create professional-looking invoices tailored to your brand identity.

Read more

From adding company logos to customising colours and fonts, you can personalise most aspects of the invoices. This flexibility ensures consistency in branding while providing a personalised touch to your GST invoices.

Automatic GST Calculation

Say goodbye to manual tax calculations with myBillBook’s automatic GST calculation feature. Our billing software accurately computes

Read more

GST amounts based on transaction details and ensures compliance with tax regulations. This feature eliminates the need for tedious calculations, reducing errors and saving valuable time for businesses.

Single Click e-Invoice Generation

Effortlessly generate e-invoices in a single click. Track the status of all your e-invoices, generated, failed, cancelled, and yet to be pushed,

Read more

all in one place. Initiate e-invoice cancellation directly from myBillBook. Simultaneously generate e-Way bills with auto-populated Part-A data.

Easy GSTR Filing

The billing software helps you to track input and output tax credits, reconcile transactions to prepare for GST return filing.

Read more

It offers seamless integration with the GSTN portal, to file GST returns directly from the platform with ease. With features like automated data validation and error checks, myBillBook helps minimize the risk of filing errors and penalties, making GST compliance a seamless experience.

GST-Compliant Invoices

With customisable templates designed specifically for GST compliance, you can easily generate invoices that include all the

Read more

details required by the GST law. This includes GSTIN numbers of both the supplier and recipient, HSN/SAC codes for goods/services, tax rates, and amounts for CGST, SGST/UTGST, and IGST. If required, you can also generate non-GST bills as well.

Automated Billing

Simplify your billing with Automated Billing feature which allows you to generate repeat invoices based on a schedule of your choice.

Read more

You can set up automated billing schedules for regular customers or subscription-based services. Also send automated payment reminders to your clients and get your payments on time. With automated billing, you can save time, reduce errors, and improve cash flow for your business.

GST Bill Format in Excel

A GST bill format contains fields of the invoice particulars as required by the GST law. The details include the list of goods or services provided, the price, quantity, tax rate, and the total amount payable.

Businesses can create GST tax invoice formats using different tools, including Word, Excel, and PDF. However, Excel is a popular tool to generate GST-compliant invoices.

Here is a detailed guide about the GST bill format in Excel, how to create one, and how myBillBook helps you generate GST-compliant invoices in seconds.

The GST law mandates registered taxpayers to issue GST invoices upon making a sale. Besides allowing the seller to collect the payments, the GST invoice enables them to avail input tax credit under the new tax regime. Hence, most GST-registered business owners must follow the GST bill format to generate bills.

Ever wonder why a GST bill format in Excel is so important?

The Excel template of the GST bill can be easily customised to fit the specific needs of a business, allowing for the easy addition of necessary information.

It’s a simple yet powerful document that keeps track of all the transactions made by your business.

The GST bill Excel sheet can be shared and accessed by multiple users, making it easier for teams to collaborate on GST billing.

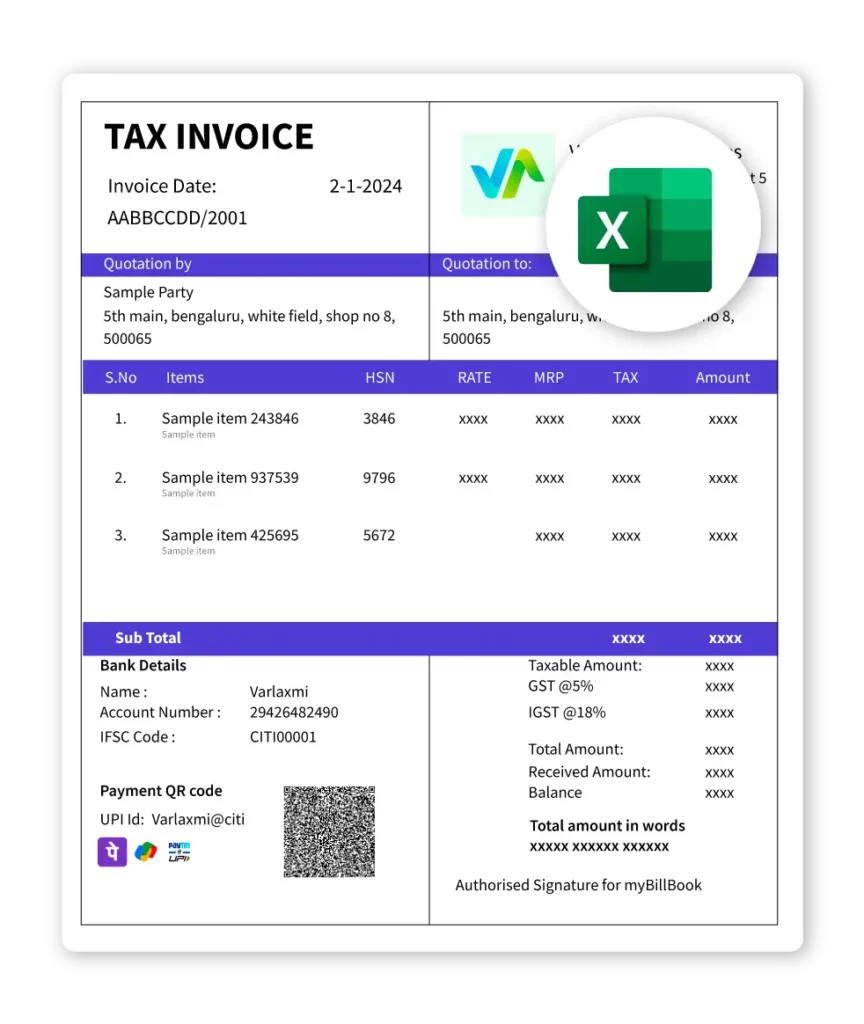

Details to Be Captured in the GST Invoice Format in Excel

The most important aspect of a GST Invoice format in Excel is the accuracy and precision of the details included for the customer’s review. The below-mentioned information ensures easy readability and convenience for the customer.

- Company details: Name, Address, ZIP code, Phone number, and email

- Client details: Name, Address, and contact details

- Invoice number as per your records

- Goods/Services details: Description, Quantity, Cost, and Amount due

- Applicable GST tax and Total Amount at the end

- Bank details: Name, Account Number, and IFSC code

- Payment Terms and expected date for payment

It is important to ensure all the above details are accurate and precise for easy readability in a GST bill format. These details must be added before forwarding the invoice to the customer.

How to Create GST Invoice in Excel

Steps to follow to create GST bill using MS-Excel

Step:1 – Open Microsoft Excel. Select ‘File > New >Blank WorkBook’

Step:2 – Remove the gridlines by clicking on the ‘View’ tab and then unchecking ‘Gridlines’ in the ‘Show’ section.

Step:3 – Upload the company logo in the blank sheet by clicking on ‘Insert > Picture’.

Step:4 – Click on the ‘Header & Footer’ tab and give the header for the sheet as ‘Tax Invoice’.

Step:5 – In the next cell, enter your company details, including company name, address, email ID and GSTIN.

Step:6 – In the next cell, create an ‘Invoice To’ field to enter customer details like name, company name, address, email ID and GSTIN/UN.

Step:7 – To the right of the ‘Invoice To’ section, create fields like Invoice No., Date, Due Date, Terms, etc.

Step:8 – Right below the ‘Invoice To’ section, create the ‘Goods or services’ section to enter data, including name of the product/service, quantity, tax rate, discount, unit, total amount, etc., as per your business requirement.

Step:9 – At the bottom of the page, provide your bank details and other payment modes like UPI bar code, UPI ID, or UPI phone number.

You can also insert some excel formulas to auto-populate the cells when creating invoices. For instance, the ‘Date field’ can be auto-filled with the current day’s date using the formula =TODAY(). Similarly, you can use PRODUCT and SUM formulas to calculate the total price of the items and the total invoice amount.

For businesses in the jewellery industry, utilizing a jewellery billing software can streamline the invoicing process and ensure compliance with GST requirements, saving time and minimizing errors.

Is Excel Best Option to Create GST Invoices Bill?

MS-Excel is undoubtedly one of the best tools for calculations. For GST invoice generation, excel formulas help calculate the total price, tax amounts, discount calculations, etc. During the initial phases of the business, excel might help small and medium enterprises create invoices of their choice. However, once the business expands and when the billing and accounting requirements change, excel may not be a viable option.

Here are some of the limitations that excel poses for businesses.

- Increased time and effort: Invoice format in excel is like an online application in which the fields need to be filled with required details. When the business has limited products, the entry of each product in excel is easy. But when there are many products, imagine the time and effort required in creating one invoice in excel format.

- Not integrated with accounting: GST invoices created in excel can be used only to generate bills for the sake of customers. Businesses can have a copy of the same but may not use them directly for bookkeeping purposes. While accounting, they have to manually check and enter the bill details, which again is an additional task for the businesses.

- Excel is not a free source: Businesses need to have a valid purchase licence to use excel. Even when they have a readily available format, they may not make changes if required.

- Limited access to information: The invoices must be saved individually if the business wants to keep the billing information. Everything needs to be done from the same PC to have the entire data in one place. And finding a particular bill involves a lot of searches.

- Compromised data safety: As all the excel invoice sheets are saved on the same PC, any damage due to loss or theft puts the entire data at risk.

Hence, generating GST invoices in excel is not viable if the businesses look for a comprehensive billing and accounting solution.

myBillBook to Create Custom GST Invoices

If you are looking for a GST Bill format in Excel, you would definitely need a tool to generate GST invoices. myBillBook is one such online platform that provides a complete billing and accounting solution besides just generating GST invoices.

Let us see how to generate GST – compliant invoices using myBillBook software.

Generate GST invoice using myBillBook Web App

- Login to myBillBook web application

- Enter your business details to be displayed on the invoice, including business name, type, industry, address, logo, bank account details, signature, etc.

- Under ‘Sales’, click on ‘Sales Invoice > Create Sales Invoice’

- Click on ‘Add Party’ – Enter your customer details like party name, mobile number, address, and GSTIN

- Click on ‘Add Item > Create New Item’ – Enter details like item type, item name, sales prices, category, item code, etc.

- You can also add additional details like discount amount, delivery charges, terms and conditions, bank details, etc., to be displayed on the sales invoice.

- Click on ‘Save Sales Invoice’

- Once it is done, you can view the complete invoice.

- Find the options to ‘Print’ and ‘Download’ the invoice and share it with your customers.

Generate GST Invoice on myBillBook Mobile App

- Login to myBillBook mobile application

- Enter your business details to be displayed on the invoice, including business name, type, industry, address, logo, bank account details, signature, etc.

- Click on ‘Bill/Invoice > Add Party’ option

- Enter details like party name, mobile number, party type, address, GSTIN, etc.

- Click on ‘Add Item > Create New Item’ – Enter details like item type, item name, sales prices, category, item code, GST & Tax details, etc.

- You can also add additional details like discount amount, delivery charges, terms and conditions, bank details, etc., to be displayed on the sales invoice.

- Click on ‘Save & Generate Bill’

- Once it is done, you can preview the complete invoice.

- Find the options to ‘Print’, ‘Download’ and ‘Share’ the invoice.

Use myBillBook to generate GST-compliant invoices

myBillBook not only generates GST-compliant invoices but also makes tax filing easy. As the entire invoicing information is stored in the database, data retrieval is a matter of seconds. Further, as the billing software integrates with the accounting tool, inventory and cash flow management become a cakewalk. Business owners can evaluate the company’s performance by looking at the sales reports generated by the software at no additional cost.

If all these billing and accounting features come at a nominal cost, do you still think using excel to generate GST invoices is affordable and productive? With the changing billing and accounting needs of businesses, many tech-savvy invoicing and accounting tools have evolved. It’s time for the companies to upgrade their billing and bookkeeping practices to stay up to date in the present market.

Frequently Asked Questions

Are there any restrictions on the GST Invoice format in Excel?

A GST bill format in Excel should comply with your country's GST laws and regulations. It should include all the necessary information and calculations to generate GST-compliant invoices.

Is it necessary to use the GST bill format in the Excel template?

Using the GST bill format in an Excel template is not mandatory, but it is highly recommended, as it can ensure that your GST bills are formatted correctly.

Can I make changes to the GST tax Invoice format in the Excel template?

Yes, the GST bill format in the Excel template can be customised to fit the specific needs of your business. This can include adding or removing fields, changing the layout, or modifying the formulas used to calculate GST.

Is there a limit on the number of GST bills that can be created using the GST bill format in the Excel template?

No, there is no limit on the number of GST bills created using the GST Invoice format in the Excel template. It can create as many GST bills as needed for your business.

Is there any difference between the GST bill format in Excel and GST bill format in Word?

Both GST bill format in Excel and GST bill format in Word serve the same purpose: to create GST bills with specific format and details. The difference is in the software used to create the bills. Excel is spreadsheet software, while Word is word processing software.

What is an invoice format in Excel?

An invoice format in Excel is a pre-designed spreadsheet layout that allows businesses to enter billing details like product names, prices, taxes, and totals. It helps create professional-looking invoices quickly.

How do I make an invoice in Excel?

You can create an invoice in Excel by setting up columns for item name, quantity, rate, tax, and total. Or download a free Excel invoice template that includes automated calculations and fields.

Is there a standard Excel invoice template available?

Yes, there are several standard invoice templates available in Excel. These templates follow a professional structure and can be customized for GST, service billing, exports, and more. myBillBook offers free downloads.

Can I customize the invoice format in Excel?

Excel allows full customization — you can edit columns, add your logo, change currency, insert tax fields, or use conditional formatting to suit your business needs.

What are the key elements of a good Excel invoice?

A good Excel invoice format should include invoice number, date, customer details, itemized list of goods or services, tax breakdown, total amount, payment terms, and seller contact information