Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing account receivables and payables was overwhelming for our business. With myBillBook, we now view all account payables and receivables in real-time with 100% cloud access with real-time data sync across all devices. This has streamlined our accounting process and improved our cash flow management.”

Mahesh J

Retailer, Hyderabad

Recommends myBillBook for:

Product Demo for ERP Accounting Software

“Superb customer service. Helped me set up my account as required”

myBillBook’s top features for ERP Accounting Software

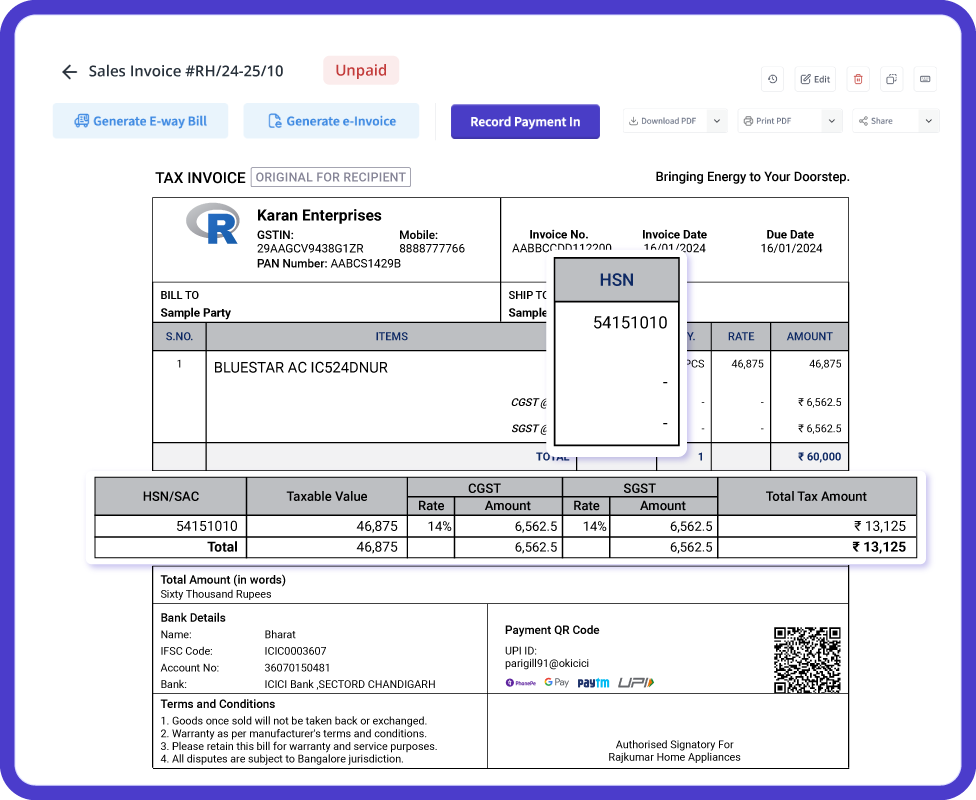

GST Compliant Invoices

Create customized and professional invoices complying with government mandates in seconds. Essential details like party GSTIN, HSN/SAC, and tax components are auto-populated from your inventory. Generate credit/debit notes, delivery challans, and sales/purchase returns easily.

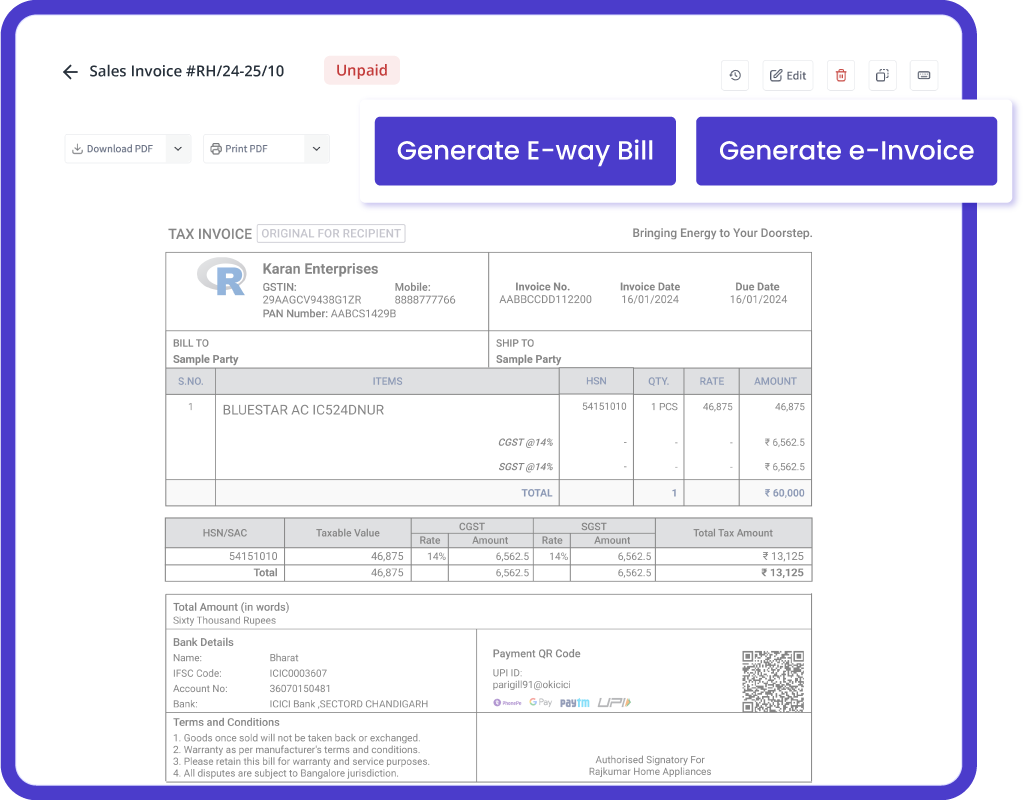

Effortless E-way Billing & E-Invoicing

Create e-way bills with a click for relevant transactions. myBillBook allows you to send authenticated e-Invoices for B2B transactions electronically via GSTN.

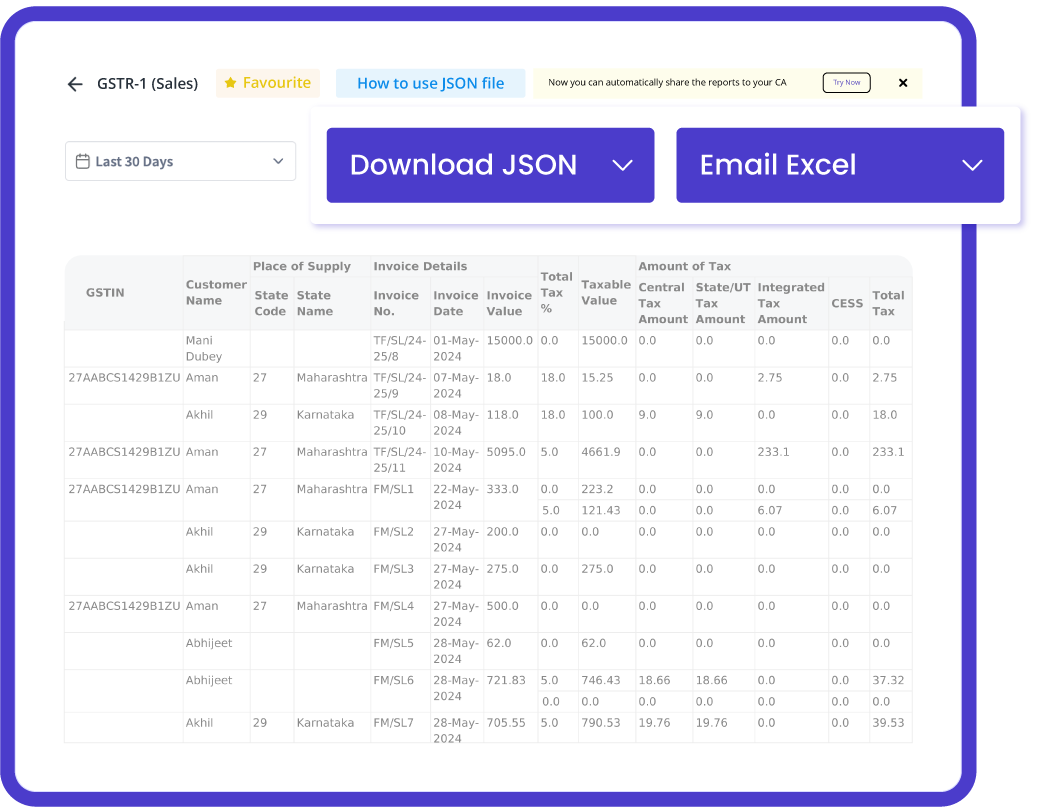

Easy GST Returns Filing

Generate and file error-free GST returns with GSTR-1, which details outward supplies of goods/services. Reconcile GSTR-2 for monthly purchases/inward supplies. GSTR-3b provides a consolidated summary of outward supplies, inward supplies, and ITC available.

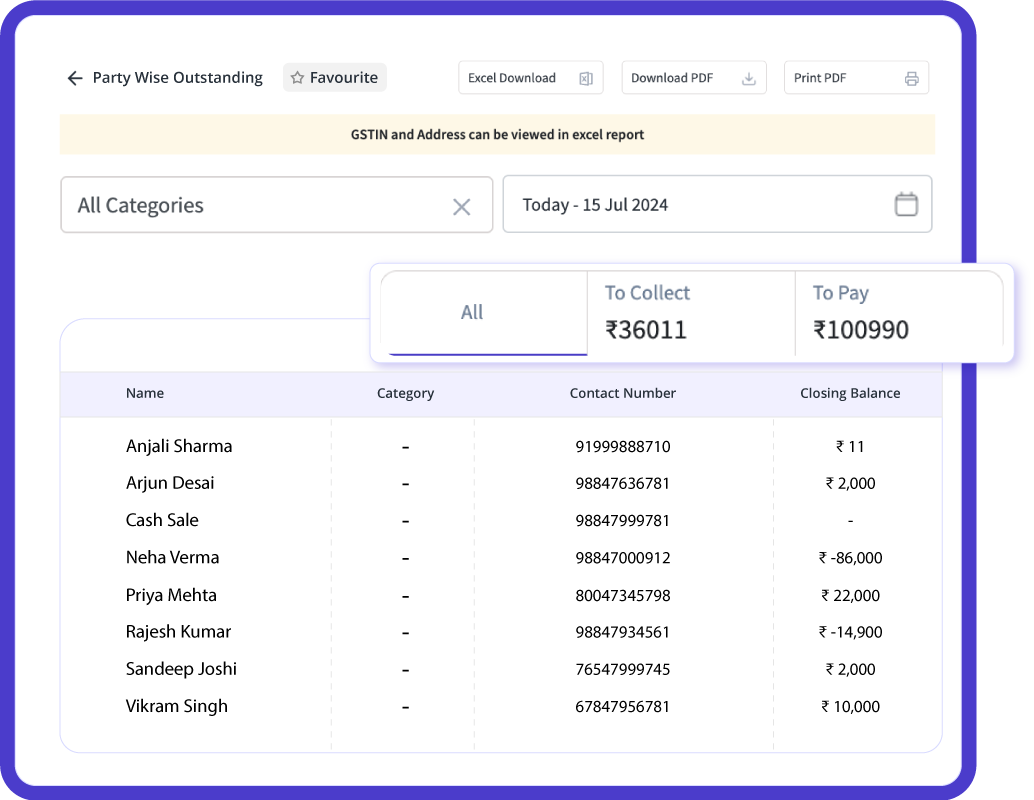

Track Account Receivables & Payables

View real-time account payables and receivables for customers and suppliers with party-wise outstanding reports. Track outstanding customer payments with the Receivable Ageing Report.

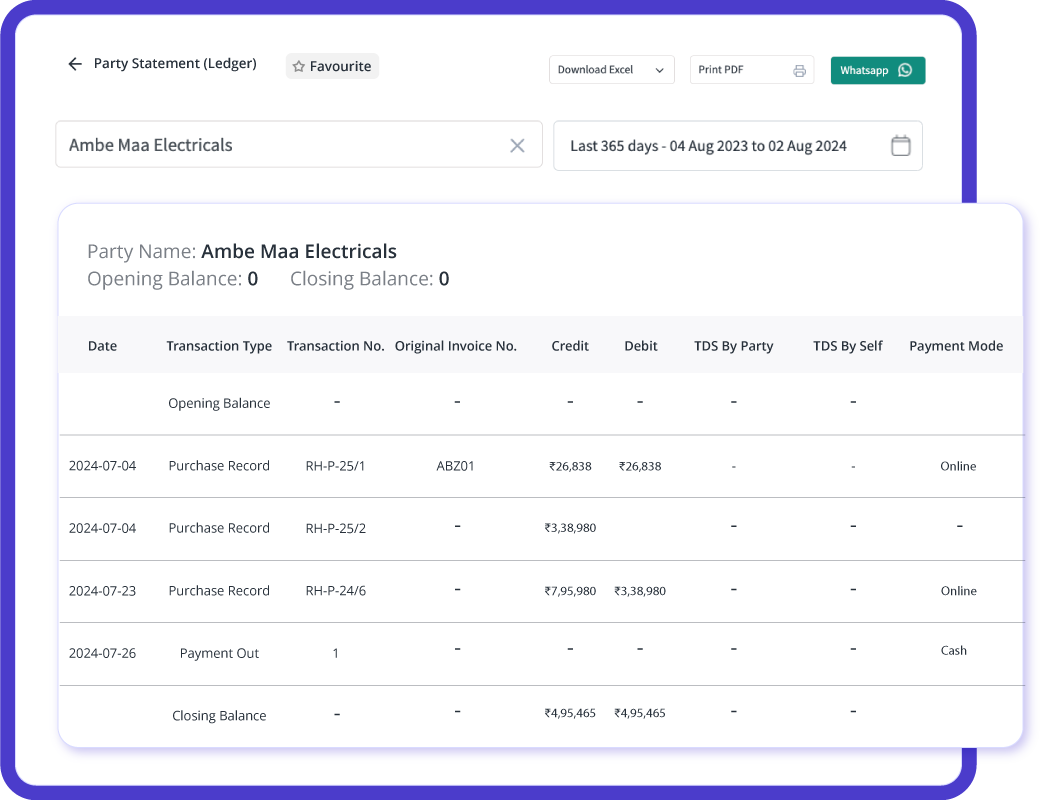

Ledger Management

Access detailed party statements and ledgers to monitor transaction histories with comprehensive ledger reports, ensuring smooth cash flow management.

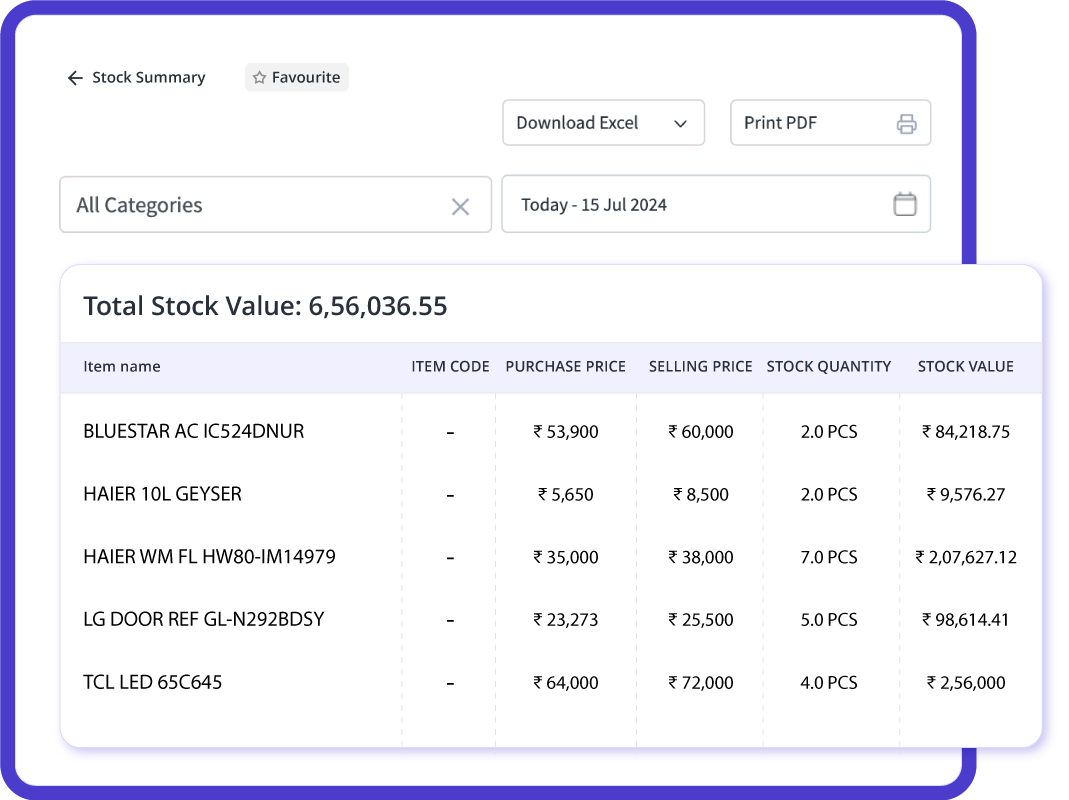

Inventory Management

Automatically track and update stock with each sales or purchase invoice. Quickly add items from a library of over 1 lakh products, edit items in bulk, and set low stock alerts.

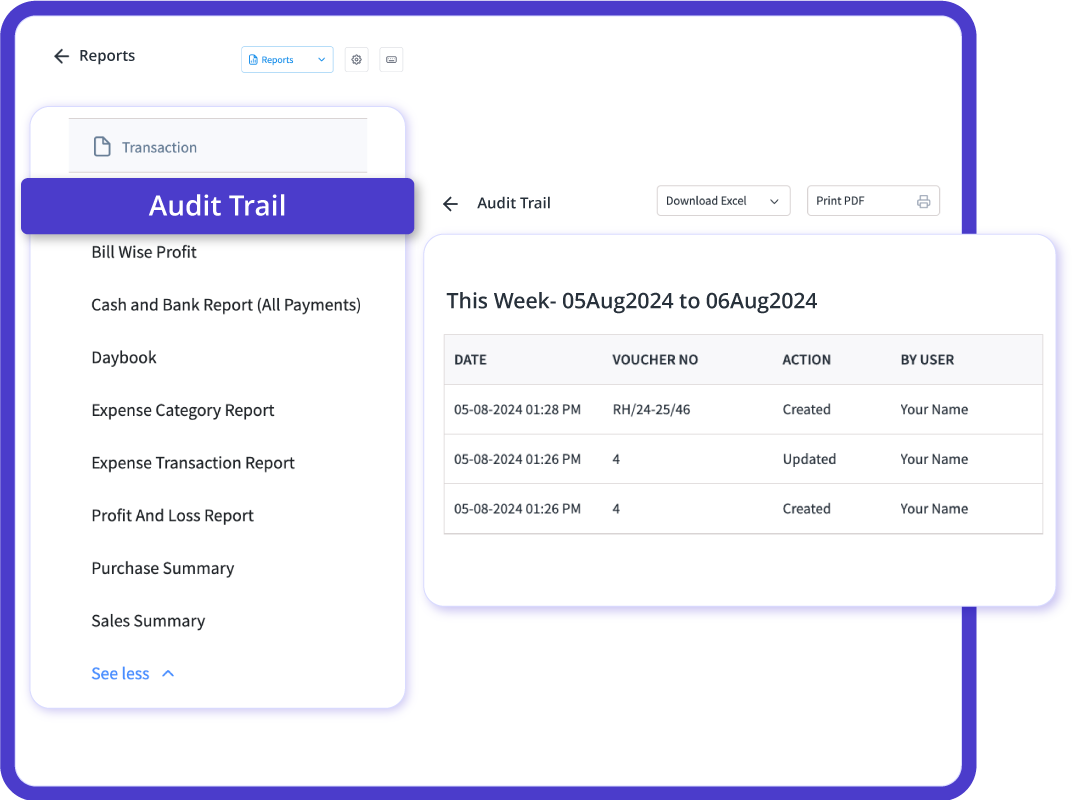

Audit and Compliance Assurance

Ensure seamless audit and compliance with built-in audit trails and comprehensive reports. Easily track all financial activities and maintain records that comply with legal standards and audit requirements.

myBillBook helps Business succeed

“myBillBook’s ledger management capabilities have revolutionized our transaction monitoring. Accessing detailed party statements and ledger reports is now seamless, enabling us to manage cash flow and take informed decisions with precision.”

Balram Jain,

Savi Hospital – Chennai

“myBillBook has made audit and compliance assurance seamless. The built-in audit trails and comprehensive reports provide us with the tools we need to stay compliant, ensuring our financial activities are tracked accurately and efficiently.”

Sandesh Gupta,

GM Jewels – Banglore

“Filing GST returns has never been easier than with myBillBook. It provides error-free GSTR-1 and GSTR-3b reports, and the reconciliation of GSTR-2 is seamless, ensuring we stay compliant and focus more on growing our business.”

Mahesh Rao,

Kaya Wholesale shop owner – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

ERP is the world’s most outstanding enterprise resource planning software utilized by many businesses to run their daily operations.

In the 1960s, the Garner Group invented ERP software. ERP full form in accounting stands for Enterprise Resource Planning. There are various modules that the ERP accounting system and company administrator utilize. It enables you to organize, track, and utilize all of your company’s business resources. You can run your organization more effectively using an ERP system by reporting on, collecting, and categorizing all business activity.

Why Use myBillBook?

Generate GST & non-GST invoices

Create customised GST & non-GST invoices, quote, estimate, and purchase orders for your clients

Manage your inventory

Track & manage all your inventory, get low stock reminders and makes sure that you are never out of stock

Analyse Business Reports

Make data-driven business decisions based on reports & insights like GST reports, P&L, stock summary, etc.

What Is ERP Accounting?

In accounting, ERP is a database package that covers all processes and transactional activities of a company, such as production, marketing, financial management, and human resources. In other ways, the objective of ERP is to create a unified strategy for the entire business.

Integrating a business’s records from all departments, procedures, and operations necessitates a very effective ERP system. This involves a significant investment in developing, training, and deploying an ERP system.

What Is ERP Accounting Software?

Several ERP software systems are available to manage your accounting requirements. The best one, on the other hand, simplifies and resolves all complex accounting jobs. Before purchasing ERP software, every organization should look for an economical ERP solution. The ERP accounting system should be developed to meet buyers’ needs and those who lack accounting expertise but can still manage it.

A good ERP implementation involves the use of robust accounting software. By offering a single ERP solution built natively on the business platform, ERP accounting software overcomes any barriers between separate departments.

What is ERP accounting software? ERP is the industry-leading enterprise resource planning software that integrates your clients, employees, and goods into a single system, providing a unified view of your customer’s whole journey. In contrast to conventional ERP systems, these software applications are designed to be flexible, easily adaptable, and customizable.

Why Use myBillBook ERP Accounting Software

Tracking functionality

ERP enhances financial operations, like payment options for customers, credit analysis, and revenues monitoring. For example, an ERP system may track revenues generated by the company, billing, financial analysis, and budgeting.

Financial and statistical information of the highest quality

Accounting departments benefit from simple access to data due to ERP technology. Businesses have well-organized systems and resources, which enables them to maintain sound financial management. Financial information is equally protected, and you have the option of co-authoring, managing, and editing when you have access to it.

Companies have independent accounting and financial systems and must manually analyze information. An integrated ERP accounting system transfers data automatically. So you can manage data more efficiently, accurately, and consistently.

Automated collection of data

Businesses using automated systems can expand their operations since they have the freedom to focus only on their core activities. For example, an ERP system automates your bookkeeping.

It streamlines accounts payable and receivable procedures and also cash flow management issues. In addition, by creating and compiling data, it becomes significantly easier to handle the entire organization.

ERP accounting systems assist you in gathering financial data from multiple departments to generate accounting reports. It is why the software is so valuable; it simplifies the operations.

Reduced number of errors

There is always a possibility that a person will make an error while manually collecting data. By losing attention and overlooking critical entries, you might create havoc with your accounting ERP. In addition, inaccurate financial information will have a negative impact on the accuracy of financial reports.

Due to the automated nature of an ERP system for accounting, such errors are prevented. This provides you with reliable information about your company’s financial status.

Significance of ERP Accounting System for Small Businesses

Transparency

Through the use of an ERP system, all necessary information can be shared and available in a matter of seconds. This minimizes the need to export data, reducing errors. It enhanced your company’s productivity and eliminated your HR costs.

Fast decision-making

The real-time data offered by the ERP system managing risk, marketing, and accountancy by enabling your firm to make critical choices on time, hence reducing deadline failures. Teams can identify any potential difficulties that could have an impact on the level of production. A comprehensive business report enables business leaders to make a convenient, effective choice and promptly respond to a dynamic business environment.

Increase Productivity

For small companies, one of the huge advantages of ERP is continuous improvement, which is vital to every company’s bottom line. Employees can concentrate their efforts on managing more significant company volumes due to increased transparency brought about by smooth business processes. This assists in transforming many aspects of your organization and overcoming obstacles to growth.

Data Flow Simplified

Switching to ERP software streamlines data flow. This is particularly true for rapidly growing organizations, which may encounter difficulties when data is treated differently in various departments. For instance, the inventory section may have difficulty accessing financial data. With ERP software, all information is centrally located and accessible to all departments.

Having significant collaboration

Implementing an ERP accounting system for small businesses can make a significant difference in terms of collaboration issues. Communication gaps and lack of teamwork are typically the results of individuals not having timely access to data. In addition, collaboration is improved when all users have access to all financial records, allowing them to have the “strategic vision”.

Reduce operating expenses

Most importantly, an ERP system decreases total operating costs. By consolidating data into one software system, you may save money on various software and monitoring solutions for each department.

ERP vs Accounting Software:

| ERP Software | Accounting Software |

| 1. ERP software provides significantly more functionality than accounting software. An ERP system performs a wide variety of duties. It emphasizes both financial and non-financial issues. | 1. Accounting software securely and quickly controls cash flows and responds to real-time market movements. |

| 2. An enterprise resource planning system (ERP) combines all a business’s operations that provide a 360-degree view of the organization’s health and productivity. Numerous lego blocks are assembled to form a whole house. | 2. Essentially, a dedicated accounting system is a single lego block. It provides information on financial performance, although it is limited to simple financial reporting. |

| 3. An ERP system can be implemented and configured to meet the unique requirements of your industry. | 3. Accounting software is only partially capable of meeting industry-specific needs. |

| 4. An ERP will allow for significantly more seamless integration of business activities. | 4. You may only need accounting software to record and report basic financial data. |

| 5. Manufacturing ERP enables proactive inventory management, which reduces stock carrying costs, helps faster and more reliable decision-making, and lowers operation costs. | 5. Accounting software does not have capabilities for production management. |

Features of myBillBook ERP Accounting Software

ERP invoicing module integration

ERP accounting software packages can manage your inventory, invoicing, and billing procedures. In addition, by utilizing an integrated system, you can minimize the need to purchase separate software for data migration.

Safety

It’s a well-known fact that accounting software gathers massive amounts of data and must handle a significant number of sensitive corporate data. So you need a system that ensures safe work computation and data sharing. Before investing, check out the security measures. Then, select an ERP vendor who specializes in it and has extensive experience with it.

Customisation

Its set of regulations and criteria governs each business’s finance operations. As a result, the software must be adaptable to your business strategy. As well as being able to expand in coordination with your company.

User-friendly interface

Accounting activities and calculations are difficult to perform. Thus, a user-friendly approach will facilitate workers in completing all of these complex duties. As such, it should operate in an intuitive setting. With an intuitive interface, you can complete procedures quickly.

Mobile ready application

Today’s era is mobile technology due to the simplicity of moving while utilizing an app. Mobile accounting software is fast gaining popularity. Therefore, consider software that is likewise mobile-friendly. Utilize mobile-enabled ERP software to have quick access to the information you require. All major and popular manufacturers offer native ERP applications for Android and iOS that function identically to the pc version of the software. For an example of mobile-friendly software, you can explore our transportation billing software.

Reminders for Making Payments

Automatic payment reminders assist clients in being notified of upcoming and also past outstanding payments, where applicable. Reminders can be sent by email texts that you can configure. Additionally, you can automate your reminders. You can send gratitude and appreciation emails to your clients after collecting payments along with reminders.

FAQs – ERP Accounting Software

What functionality do you require from the accounting software packages?

With the use of account payable and accounts receivables functionalities, ERP Software can help track your company’s cash flow. The accounting system can also automatically link to bank accounts, credit cards, and download transactions.

What is the most excellent option for you: ERP vs Accounting Software?

It varies according to the nature of the business. For example, accounting software is ideal for businesses that create bills for clients regularly. However, if you merely need business management software to streamline processes, you can rely on accounting ERP software.

Which accounting software is the simplest to use?

ERP accounting software is often regarded as one of the simplest accounting applications of tracking various accounting Performance metrics and tracking and recording all transactions. In addition, ERP software helps secure critical data and information stored in the cloud, decreasing the risk of computer failures.