Tyre Shop Billing Software

Easy GST Billing & Inventory Management for Tyre Shops

Trusted by 1 Crore+ Businesses Across India

What is Tyre Shop Billing Software?

Tyre shop billing software is a specialized tool designed to help tyre shops manage their billing, inventory, and sales processes efficiently. Similar to retail billing software, it allows tyre shop owners to generate GST-compliant invoices, track tyre inventory, and manage customer payments seamlessly. This software helps streamline daily operations by automating invoice generation, tracking sales data, and managing stock levels in real-time. With features like sales reporting, expense tracking, and payment reminders, billing software for tyre shops helps improve operational efficiency and ensures smooth financial management for tyre businesses.

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

myBillBook is perfect for tyre shops looking to streamline billing and boost profits

“Since using myBillBook, our tyre shop operations have become more efficient. Billing is faster, errors are reduced, and inventory management helps us track stock accurately—saving us both time and money.”

Rajesh Verma

Verma Tyre Centre, Pune, Maharashtra

Recommends myBillBook for:

Product Demo for Tyre Shop Billing Software

“Superb customer service. They are easily available on phone and Whatsapp.”

myBillBook’s Top Features for Tyre Shops

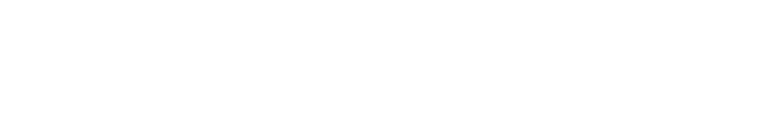

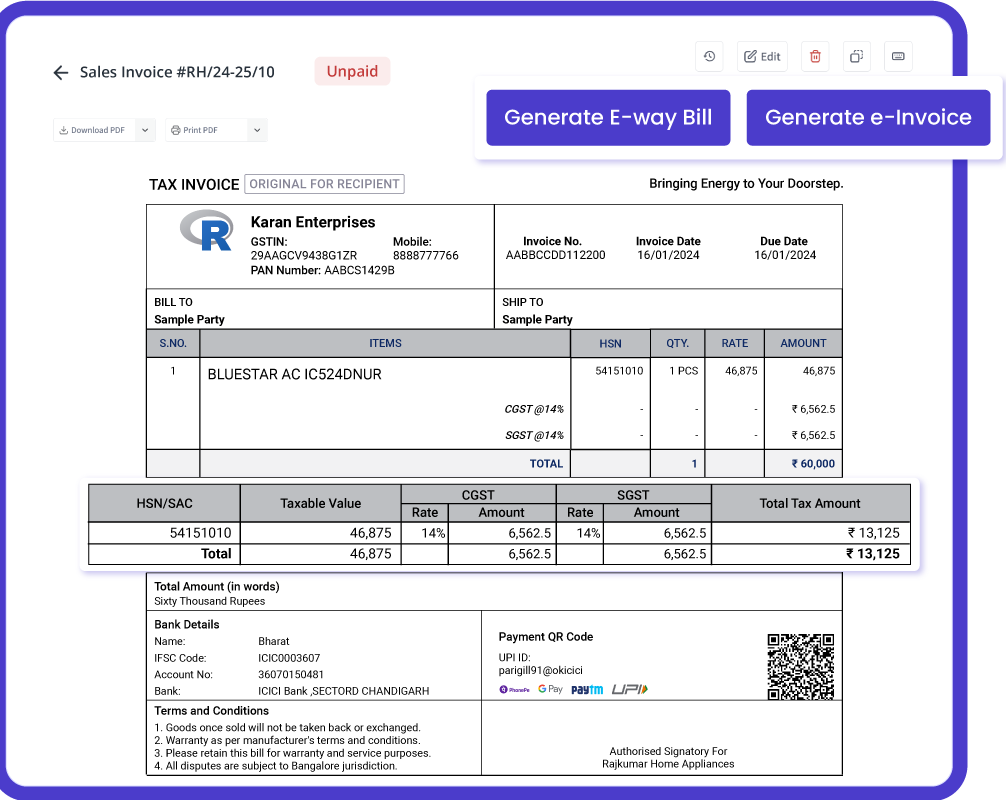

GST-Compliant & Customisable Tyre Shop Invoices

Generate both GST and non-GST invoices effortlessly. Customise invoices to match your Tyre Shop business needs and create them in seconds. Digitally sign invoices for enhanced authenticity. Also explore, invoice theme selection, and remove irrelevant fields to streamline your billing process.

Barcode Generation & Faster Scanning

Generate unique barcodes for each product in your inventory, including tyres, wheels, and spare parts. Print and attach the barcode to products, then simply scan during invoice creation. Ensure seamless stock updates and error-free billing and enhance efficiency of your tyre shop or automobile service centre.

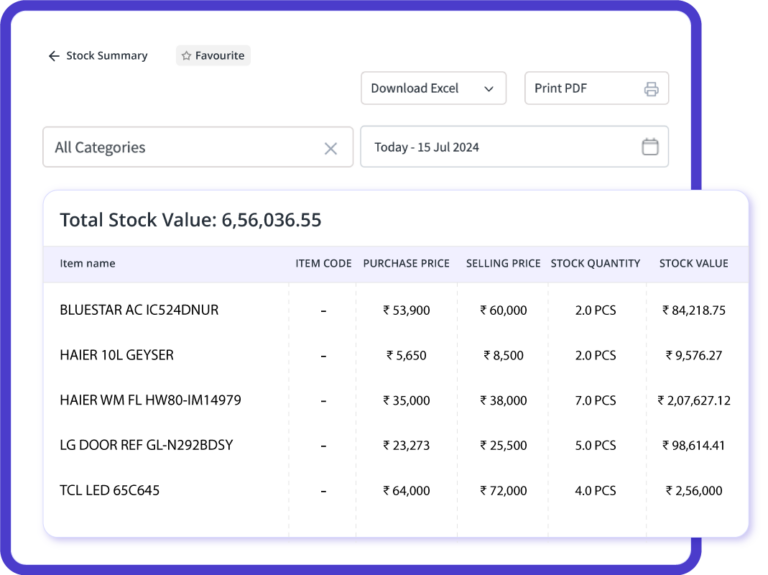

Track & Manage Tyre Shop Inventory

Keep a real-time track of your tyre inventory, spare parts, nuts, bolts, and accessories. Every sale automatically updates stock levels, and low-stock alerts help you restock in time. Download stock summary reports to analyse inventory trends and optimise your purchases.

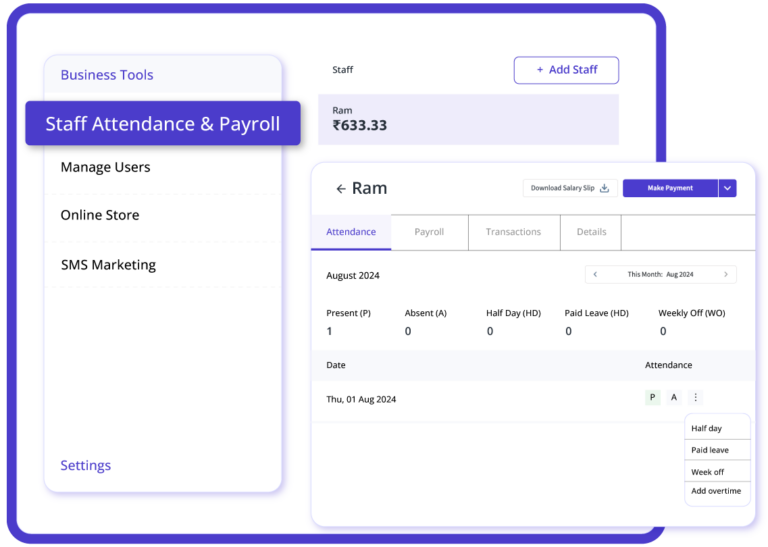

Manage Accounts & Staff Effortlessly

Monitor cash flow, track expenses, and reconcile ledger balances using automobile billing software. Manage staff attendance and payroll within the software and ensure streamlined operations for your tyre shop or automobile service centre.

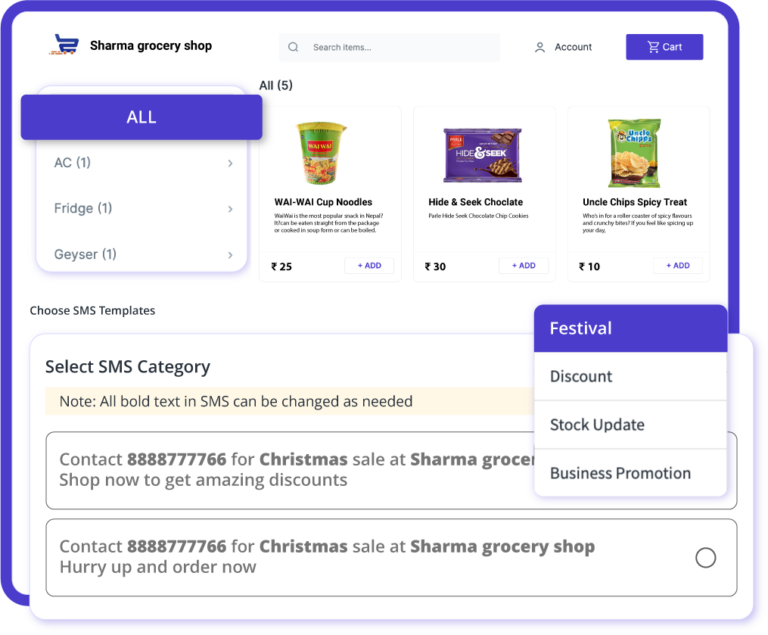

Take Your Tyre Business Online

List all your products with descriptions, prices, and images in your digital tyre store and share the link with customers for direct purchases. Simplify sales and enhance customer convenience with a professional online presence.

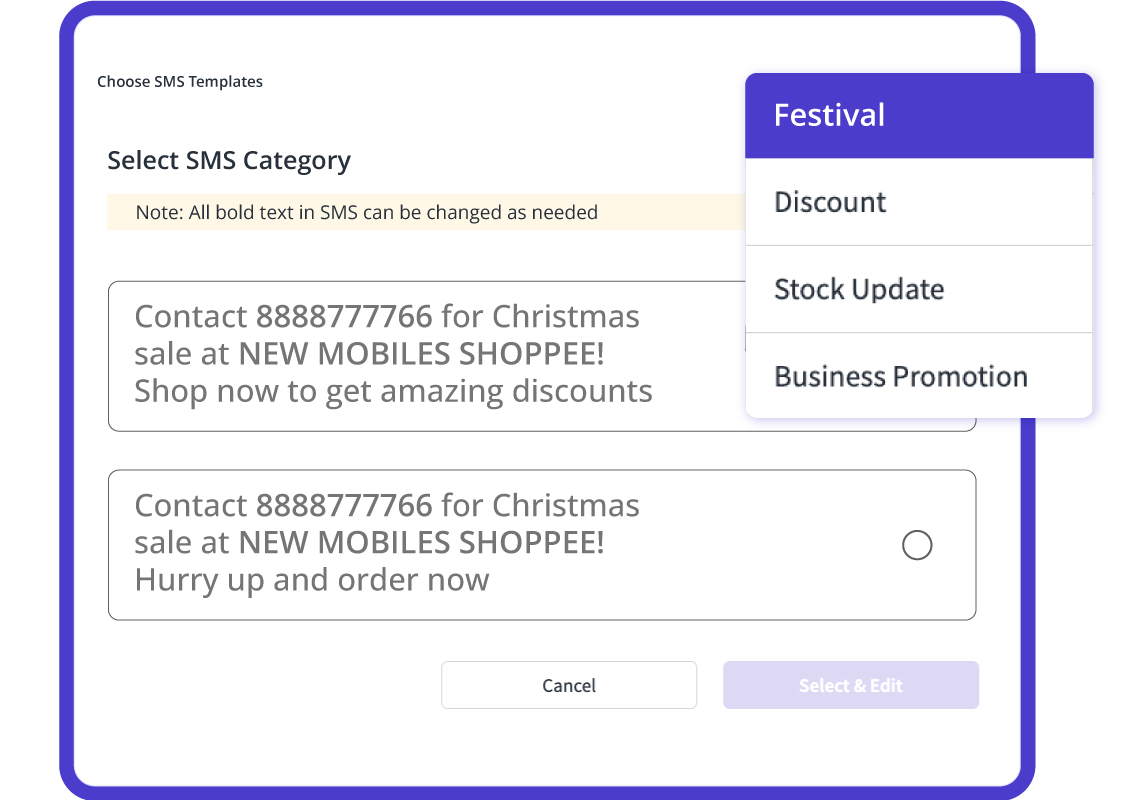

Enhance Customer Relationship Management

Strengthen customer engagement. Send automated payment reminders, promotional messages, and festive greetings via SMS and email. With customer details stored in the app, bulk messaging becomes effortless, helping you retain customers and drive repeat sales.

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Per month. Billed annually. Excl. GST @18%

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

The Ultimate Guide for Tyre Shop Owners

How to Grow & Manage Your Tyre Shop Business Efficiently

Running a tyre shop successfully requires more than just selling tyres. From managing inventory and pricing to offering excellent customer service, tyre shop owners need to focus on multiple aspects of their business. In this guide, we will explore key strategies to streamline operations, boost sales, and grow your tyre business efficiently.

1. Understanding Your Market

Before you expand or optimize your tyre shop, it’s important to understand your customers’ needs. Identify the types of tyres in high demand, whether for cars, motorcycles, trucks, or specialty vehicles. Keep track of seasonal trends, as demand may vary depending on weather conditions and road usage patterns.

2. Building a Strong Supplier Network

Having reliable suppliers ensures that you always have the right stock at competitive prices. Negotiate with manufacturers and wholesalers for better rates and discounts. Maintaining good relationships with multiple suppliers also helps in avoiding stock shortages and unexpected price hikes.

3. Inventory Management for Tyre Shops

Overstocking or understocking can hurt your business. Keep track of stock levels and ensure you have a variety of tyre sizes and brands available. Implement a stock rotation system where older tyres are sold first to prevent damage due to aging.

4. Pricing Strategies to Maximize Profits

Competitive pricing is crucial for attracting customers. Research the market and set prices based on factors such as brand reputation, quality, and customer demand. Consider offering bundled services like tyre installation, wheel balancing, and alignment to increase revenue per customer.

5. Offering Additional Services

Beyond selling tyres, offering related services can enhance customer satisfaction and boost your revenue. Services like puncture repair, wheel alignment, balancing, and nitrogen filling make your shop a one-stop solution for tyre-related needs.

6. Digital Marketing for Tyre Shops

Leverage digital marketing to reach more customers. Create a website or list your business on Google My Business to improve local search visibility. Engage with customers through social media platforms and use targeted ads to attract nearby vehicle owners.

7. Customer Service & Retention Strategies

Happy customers are more likely to return and recommend your business. Offer warranties on tyres, maintain clear communication about pricing and services, and provide excellent after-sales support. Sending service reminders and follow-ups can also help in customer retention.

8. Financial Management & Expense Tracking

Proper financial planning ensures steady business growth. Keep track of daily sales, expenses, and profits. Monitor cash flow and reinvest in marketing or inventory as needed. Maintain transparency in transactions to build customer trust.

9. Adapting to Industry Trends

Stay updated with the latest developments in the tyre industry. Look for new tyre technologies, eco-friendly options, and market trends that may impact customer buying behavior. Adapting to industry changes can help you stay ahead of competitors.

10. Using Technology to Automate Business Operations

Automation can simplify various aspects of running a tyre shop, from managing invoices to tracking inventory. With digital solutions, you can reduce manual errors and save time spent on administrative tasks.

Boost Your Tyre Shop’s Efficiency with myBillBook

Managing a tyre shop becomes effortless with myBillBook, the best billing software for tyre shops. Generate professional GST-compliant invoices, track inventory in real time, manage accounts, and improve customer relationships – all in one place. Upgrade your tyre shop today with myBillBook and take your business to the next level!

FAQs on Tyre Shop Invoicing & Billing Software

How can myBillBook help my tyre shop with billing and invoicing?

myBillBook allows you to generate GST and non-GST invoices quickly and professionally. You can customize invoices with your shop’s details, add branding, and digitally sign them. The software also supports barcode scanning for faster billing and automated stock updates.

Can I track my tyre shop inventory using myBillBook?

Yes! myBillBook helps you manage your tyre stock, spare parts, nuts, bolts, and accessories in real-time. The software alerts you when stock is low, allowing you to restock on time and prevent lost sales.

Does myBillBook support multiple payment modes?

myBillBook allows you to accept payments via cash, UPI, bank transfers, and digital wallets. It also tracks pending payments and sends automated reminders to customers for outstanding dues.

Can I manage customer details and send reminders using myBillBook?

Yes, myBillBook has a built-in Customer Relationship Management (CRM) system. You can store customer details, send service reminders, payment alerts, and promotional messages via SMS or WhatsApp to enhance customer retention.

Is myBillBook suitable for multi-branch tyre shop businesses?

Yes, myBillBook supports multi-store management, allowing you to track sales, stock, and financial records across different tyre shop locations from a single dashboard.