Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing account receivables and payables was overwhelming for our retail chains on the cloud/online web with mutiple outlets. With myBillBook, we now view all account payables and receivables in real-time with 100% cloud access with real-time data sync across all devices. This has streamlined our accounting process and improved our cash flow management.”

Bhushan Sharma

Shopmore Mart, Hyderabad

Recommends myBillBook for:

Product Demo for Financial Accounting Software

“Superb customer service. Helped me set up my account as required”

Key Features of myBillBook Financial Accounting Software

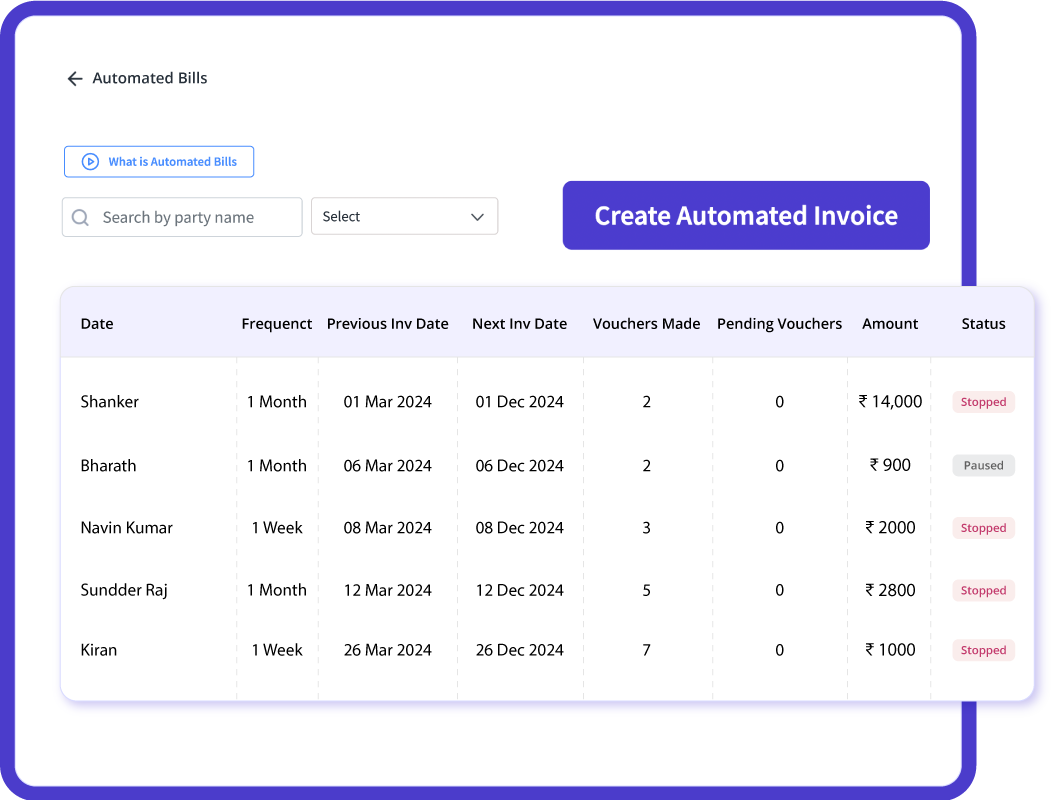

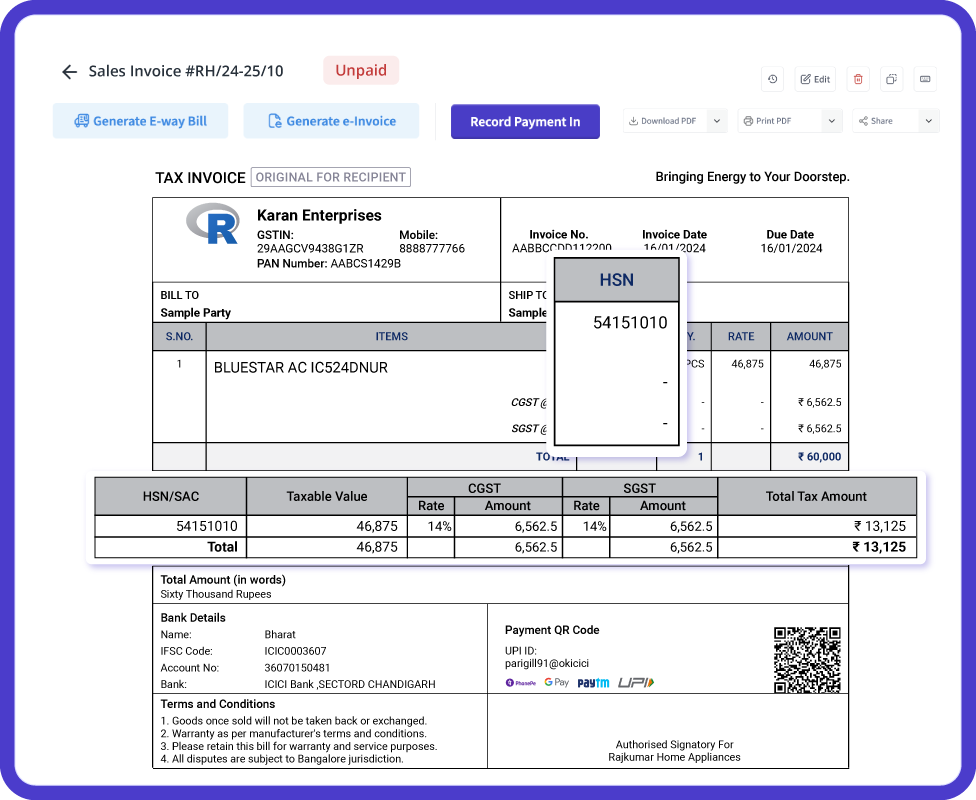

Automated Invoicing and Billing

Financial software enables businesses to generate invoices, track payments, and send automated reminders to clients. With features like GST-compliant invoices, businesses can ensure tax accuracy and compliance.

Expense Tracking and Management

Businesses can record, categorize, and analyze expenses efficiently. The software provides insights into spending patterns and helps reduce unnecessary costs.

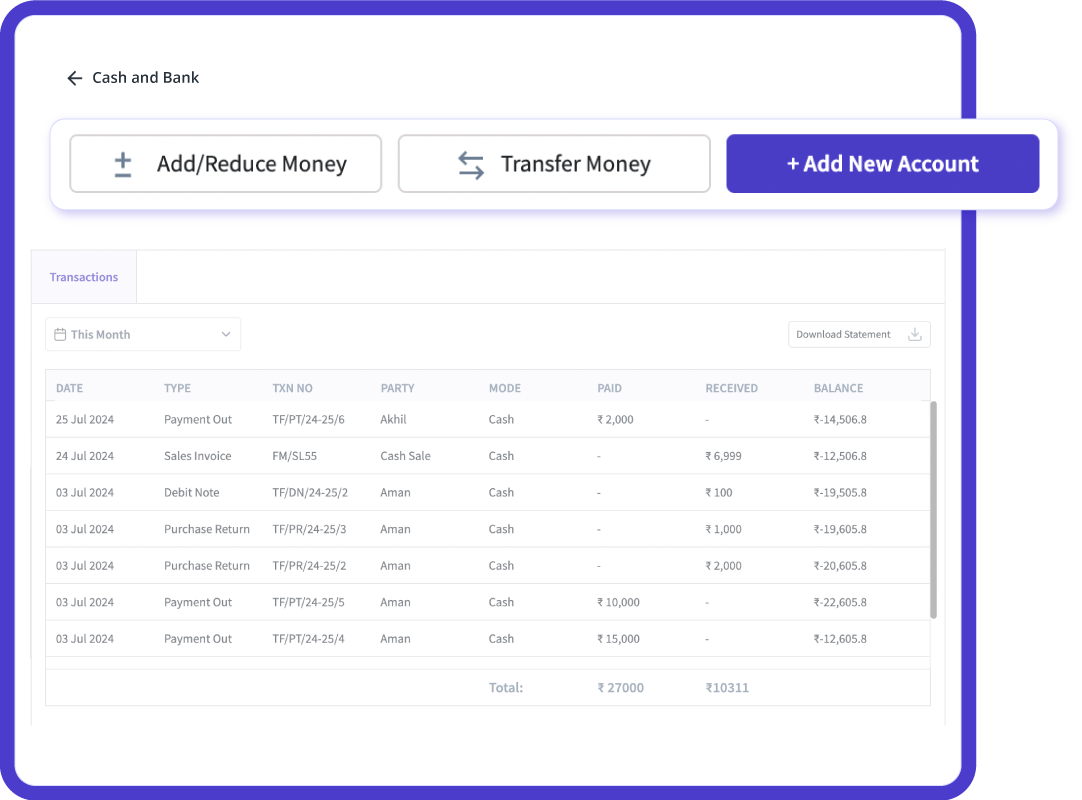

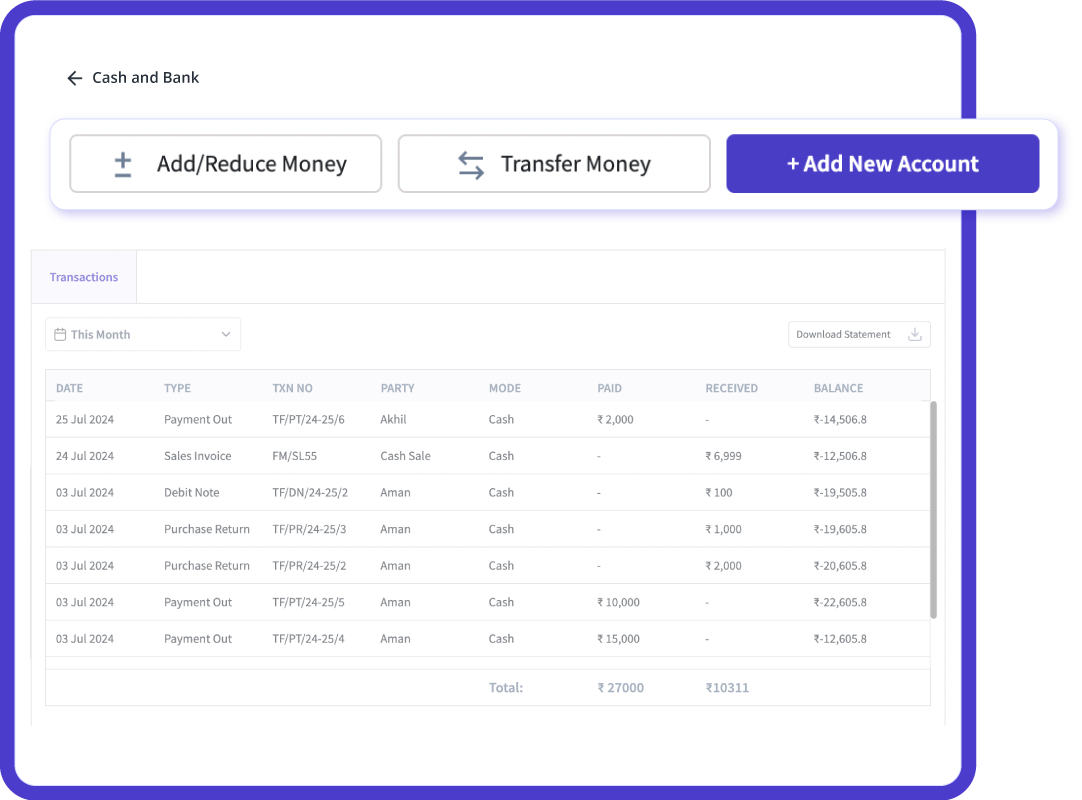

Bank Reconciliation

Sync your business bank accounts with the software to reconcile transactions seamlessly. Financial reporting software ensures that all financial records align with bank statements.

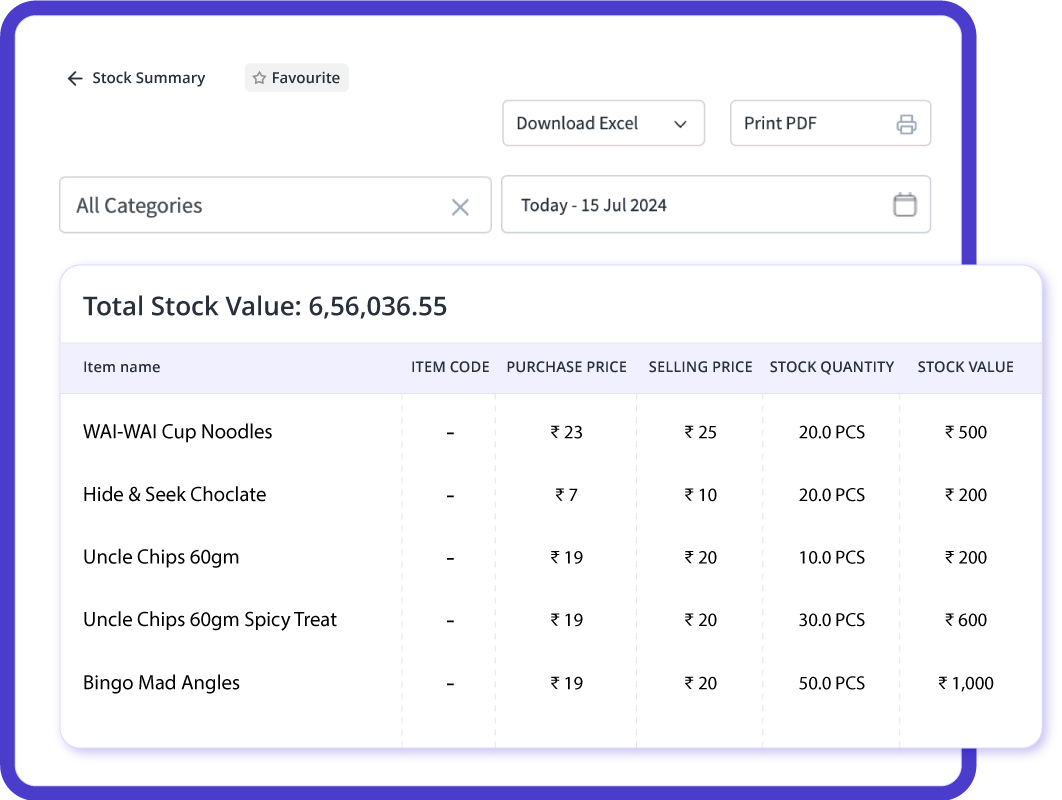

Inventory and Cash Flow Management

Track stock levels, manage purchases, and monitor cash flow efficiently with integrated inventory management features.

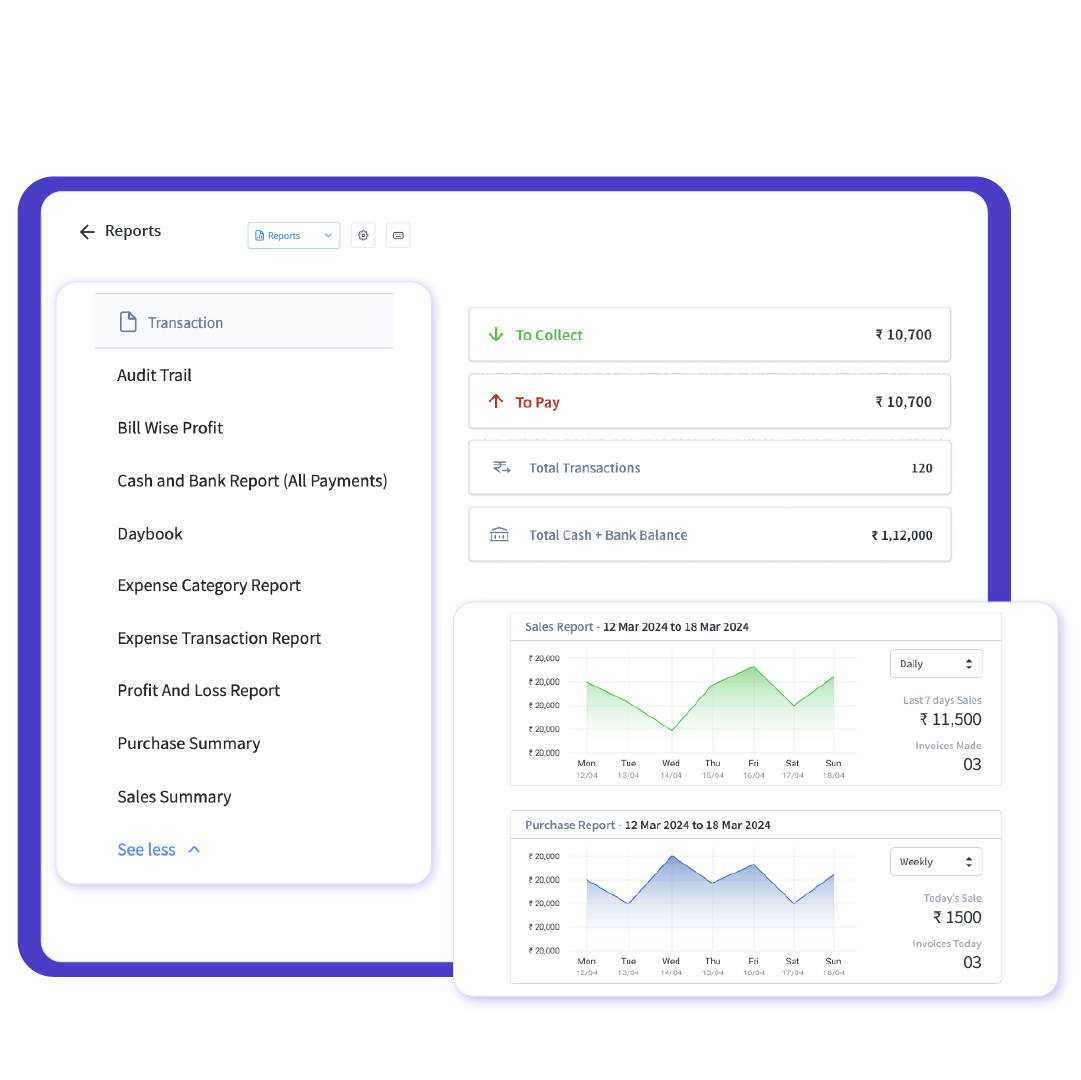

Financial Reporting and Analytics

Generate detailed financial reports, including profit & loss statements, balance sheets, and cash flow statements. Financial reporting software provides valuable insights into business performance.

GST and Tax Compliance

The software helps businesses generate GST-compliant invoices, file tax returns, and maintain accurate tax records, reducing the risk of penalties and audits.

myBillBook helps Business succeed

“Creating customized, professional invoices that comply with government mandates has never been easier. With myBillBook’s 100% cloud support and real-time data sync across both mobile and laptop, we can auto-populate essential details and generate credit/debit notes, delivery challans, and returns effortlessly on iOS and Android.”

Palak Jain,

Grocery Store owner – Chennai

“Generating e-way bills and e-invoices used to be tedious and time-consuming earlier while using the government portal. With myBillBook’s cloud support, we create e-way bills and send authenticated e-invoices electronically via GSTN for B2B transactions, managed in real-time from both mobile devices and laptops on iOS and Android.”

Mallik j,

Stationery Owner – Banglore

“Keeping track of cash at the counter and multiple bank accounts was difficult to manage with manual registers. With myBillBook’s cloud support, we manage cash registers, record payments, transfer money between accounts, and track payments across different modes, all with real-time data sync across mobile devices and laptops on iOS and Android.”

Rudresh Rane,

Clothing Retailer – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

Choosing the Right Financial Accounting Software

Managing finances efficiently is crucial for any business, especially small and medium enterprises (SMEs). Financial accounting software helps businesses streamline bookkeeping, track expenses, generate invoices, and prepare financial reports seamlessly. The right financial software simplifies compliance, improves cash flow management, and ensures accurate financial reporting.

Top Benefits of Financial Software for Small Businesses

- Time-Saving Automation: Automates repetitive financial tasks, freeing up time for business growth.

- Error-Free Transactions: Reduces manual errors and ensures data accuracy.

- Cost-Effective Management: Helps businesses save costs on accounting services.

- Regulatory Compliance: Ensures compliance with financial regulations and tax laws.

- Enhanced Decision-Making: Provides real-time insights into business finances.

- Increased Efficiency: Automates financial processes, reducing manual workload and improving operational efficiency.

- Better Financial Accuracy: Minimizes errors in bookkeeping, invoicing, and financial reporting.

- Improved Decision-Making: Real-time financial insights help businesses make informed financial decisions.

- Scalability: Adaptable to business growth, allowing seamless financial management as operations expand.

- Security: Cloud-based solutions with encryption protect sensitive financial data.

Common Challenges in Financial Accounting & How Software Helps

- Manual Errors & Data Entry Mistakes: Financial software automates processes, reducing human errors.

- Regulatory Compliance Issues: Built-in tax and GST compliance features simplify legal obligations.

- Time-Consuming Bookkeeping: Automated transactions and reconciliations save time.

- Difficulty in Financial Forecasting: Real-time reporting and analytics assist in planning future finances.

- Security Concerns: Cloud-based solutions with encryption ensure data safety and restricted access.

How to Select the Best Financial Software for Your Business

Choosing the best financial accounting software depends on several factors, including:

- Business Size & Needs: Ensure the software supports your company’s scale and industry-specific requirements.

- Ease of Use: Look for an intuitive interface that requires minimal training.

- Integration Capabilities: The software should integrate seamlessly with other business tools like payroll and CRM systems.

- Cost & Scalability: Choose a solution that fits your budget and can scale as your business grows.

- Customer Support & Security: Opt for software with reliable support and robust security features.

Trends in Financial Accounting Software

- AI & Machine Learning Integration: Automates financial predictions and anomaly detection.

- Cloud-Based Accounting: Enables remote accessibility and real-time collaboration.

- Blockchain for Secure Transactions: Enhances transparency and security in financial transactions.

- Mobile-Friendly Solutions: Allows businesses to manage finances on-the-go.

- Customizable Reporting: Tailored reports help businesses analyze financial health effectively.

How myBillBook Helps with Financial Accounting

myBillBook is a comprehensive financial accounting software designed for small businesses. It offers:

- GST-Compliant Invoices: Generate professional invoices with auto-filled tax details.

- E-Way Billing & E-Invoicing: Seamlessly generate and authenticate invoices for B2B transactions.

- Easy GST Returns Filing: File GSTR-1, GSTR-2, and GSTR-3B effortlessly.

- Receivables & Payables Tracking: View outstanding balances with real-time reports.

- Cash & Bank Account Management: Track payments, manage bank transactions, and reconcile accounts.

- Automated Billing & Inventory Management: Keep track of inventory and generate recurring invoices automatically.

Conclusion:

Financial accounting software is essential for small businesses looking to streamline operations, enhance compliance, and make data-driven financial decisions. myBillBook offers a robust solution tailored to meet the unique financial needs of small enterprises.

FAQs on Financial Accounting Software

1. What is financial accounting software?

Financial accounting software is a digital tool that helps businesses manage their financial transactions, track expenses, generate invoices, and prepare financial reports.

2. How does financial software help small businesses?

It automates bookkeeping, improves financial accuracy, ensures tax compliance, and provides real-time financial insights, allowing small businesses to make informed decisions.

3. Is financial software secure for businesses?

Yes, most financial software solutions use encryption and cloud security to protect sensitive financial data.

4. Can I use financial software for tax filing?

Yes, many financial accounting software solutions, including myBillBook, help businesses file GST returns and maintain tax compliance.

5. Does myBillBook support multi-user access?

Yes, myBillBook allows businesses to grant access to multiple users with role-based permissions for secure financial management.